Fintech Farm, a newly launched fintech startup based in the U.K. that creates digital banks in emerging markets, confirmed to TechCrunch today that it has raised $7.4 million in seed funding.

The company said it plans to use the investment to launch neobanks in eight countries over the next 24 months. Flyer One Ventures and Solid led the seed round. TA Ventures, Jiji, u.ventures and AVentures Capital also participated.

Digital banks, neobanks, challenger banks or whatever you may call them, are among the biggest recipients of VC investments in fintech. Globally, hundreds have sprung forth the past few years to challenge incumbents in their respective markets.

In Eastern Europe, for instance, Ukrainian neobank Monobank, in just the years of operations, has amassed over 4.5 million customers and more than $100 million in operating income, as claimed by the company last year.

After helping to scale Monobank in Europe, Dmytro Dubilet, one of its co-founders, aims to do the same in emerging markets via his new company. He started Fintech Farm with Nick Bezkrovnyy, a former director at KPMG U.K. and Middleware founder and CEO Alexander Vityaz.

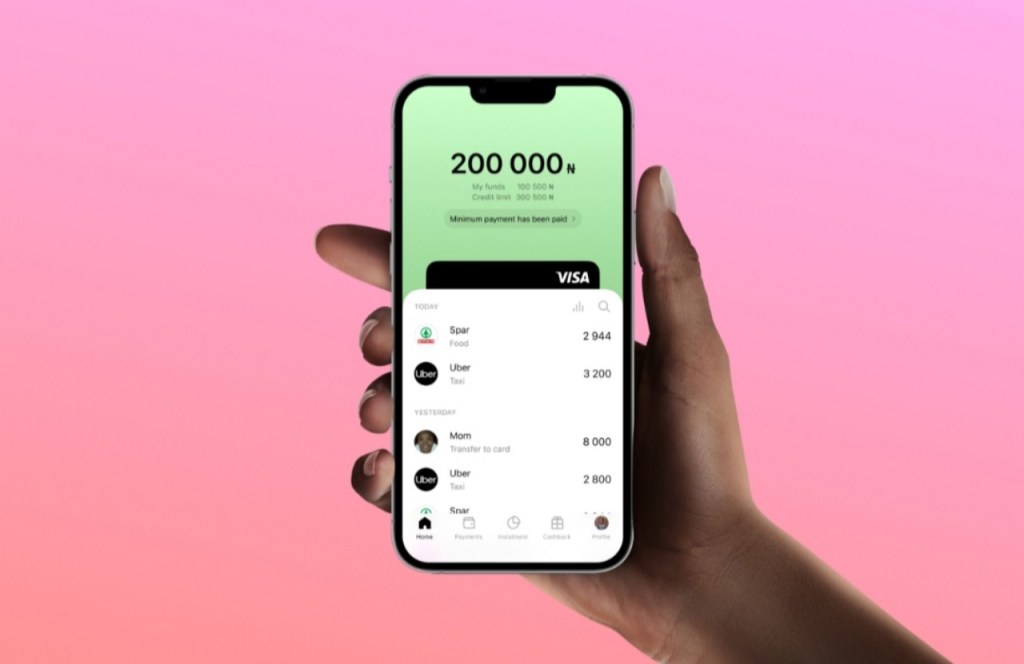

In November 2021, Fintech Farm launched in its first market, Azerbaijan. It took a credit-led neobank approach by providing loans to customers with thin credit histories via cards and a mobile app.

On a call with TechCrunch, Dubilet said Fintech Farm’s operational model in Azerbaijan and prospective markets is to launch its app via partnerships with local banks.

“Usually, it’s 50-50 partnership with a local bank,” he remarked when asked how this partnership works. According to him, Fintech Farm is responsible for the business side of things — the app and credit decision making processes. The partner bank holds local knowledge, license and capital as both parties co-invest in the business equally.

As a U.K.-based fintech, Fintech Farm takes a different approach from the conventional model used by neobanks in the country (Monzo, Starling Bank, Revolut) who prefer to hold their banking license and offer the full range of financial services themselves.

But considering its operational approach, that is, providing financial services to emerging markets, it makes sense to have a different business model. Fintech Farm uses a different name in each country it launches, but the same design and mascot — a funny-looking lion with a lilac mane.

Three months into its launch in Azerbaijan as Leobank, Fintech Farm has issued over 100,000 cards; by the end of the year, it hopes to get this number up to a million.

And in the next two years, Fintech Farm plans to enter eight emerging markets spread across Africa and Asia, the first of which is Nigeria.

“We have a plan to launch similar businesses in around eight other markets that are slightly bigger than Azerbaijan, of course,” said Dubilet. “Our next market is going to be Nigeria, we have visited Nigeria a couple of times already and it is one of our favourite countries,” said Dubilet, adding that the launch will likely take place in the first quarter of 2022.

Meanwhile, despite its original plan to use partner banks, Fintech Farm has done the opposite in Nigeria so far. Right now, the company says it has gotten a “co-operative license.” Should Fintech Farm acquire up to 200,000 customers, the founders said it would partner with a bank to scale further.

According to Bezkrovnyy, a determining factor for choosing a partner bank, asides from licensing and infrastructural support, will be how fast they can move to capture millions of customers and issue hundreds of millions (dollars) in loans.

Fintech Farm’s key product is a card that functions as a debit card where users can withdraw funds from deposits and a credit card with a loan facility attached in the customer’s name. A savings account, deposits and transfers are some of the app’s features.

Nigeria’s population is hungry for credit. Fintech Farm’s credit-led approach will serve to meet the demand (most of its revenues comes from offering loans) companies such as FairMoney and Carbon have done for years. However, unlike these indigenous neobanks, Fintech Farm wants to use credit cards to provide cheaper and more accessible credit.

“In terms of the credit product, we see an opportunity for a “mass credit card” in Nigeria. Currently, credit cards issued by traditional banks are limited to the upper-middle class,” Bezkrovnyy said in a statement. “At the same time, APRs of credit offerings from neobanks and alternative lenders may well be over 100%. We are going to fill this gap and accept those customers neglected by traditional banks and offer them fair interest rates.”

Unlike most developed countries, the West African nation lacks an advanced credit bureau system to detail people’s credit histories, so there’s some scepticism to how Fintech Farm will use credit cards to operate. But Dubilet is pretty confident; he cites the company’s data science teams which he describes “as one of the best in the world”, to work some magic.

As part of this financing round, Vladimir Mnogoletniy, co-founder of Genesis, the parent company of African online classifieds platform Jiji, will join Fintech Farm’s board. He is also a partner at co-lead investor Flyer One.

The founders believe the expertise and understanding of Mnogoletniy and his Jiji team will be pivotal to Fintech Farm’s growth.

In a statement, Mnogoletniy said Jiji, having built one of the largest e-commerce platforms on a GMV basis, was looking for the right partner to enter the neobanking space. Investing in Fintech Farm was a strategic investment to that end.

As Fintech Farm carries out its expansion plans, it also intends to spend heavily on marketing and hiring talent, especially engineers and data scientists.

Comment