The early 2022 IPO cohort is beginning to take shape. Recall that Reddit recently filed to go public, albeit privately. That’s going to be a huge debut.

With Samsara closing out 2021 and Reddit set to ensure fireworks, we might be content. But there are more offerings coming, including Justworks: The HR software company filed late last week, so we’re going to tear into its S-1 to see just what the company has built.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

TechCrunch has covered Justworks several times during its startup life, including when it raised a $40 million round back in 2018. The former startup also closed a $50 million round as 2020 kicked off, bringing its total known capital raised to just over $140 million. In addition, Justworks CEO Isaac Oates sat down with one of his investors and TechCrunch earlier this year to go over that 2018 Series B pitch deck. You can find our notes here.

We’ve also reported on the Justworks category more broadly, for example, when startup Blink raised $20 million at a $100 million valuation. At the time, our own Ingrid Lunden noted that HR software aimed at non-tech companies was having a moment.

We’ve also reported on the Justworks category more broadly, for example, when startup Blink raised $20 million at a $100 million valuation. At the time, our own Ingrid Lunden noted that HR software aimed at non-tech companies was having a moment.

Today, we’ll dig into Justworks’ business, its economic performance and what it might be worth. Let’s have a little IPO fun one last time this year!

What’s a ‘Justworks’?

Justworks’ software helps small businesses keep things running. What’s on offer? Things like payroll, vendor payments, payroll tax filings, unemployment insurance, accounting software and e-signature support.

A grab bag of tooling that, even at lower price tiers, allows SMBs to actually do the core work of being in business. The tech company also has more expensive plans that include access to health insurance products.

All told, Justworks sells its software on a per-employee, per-month basis, with set costs for companies up to 175 employees; past that, the company wants you to call them.

So, SMB-focused, HR-themed SaaS. That classification of Justworks helps us know what questions to ask:

- Is Justworks a pure software company, or does its product require more human inputs that lower its gross-margin profile? (In simpler terms, how high-quality is its revenue?)

- Does the company have churn under control? (In simpler terms, are SMB customers as churn-heavy as we’ve been historically warned by venture capitalists?)

- Finally, does Justworks have attractive net retention metrics? (In simpler terms, how far can you upsell customers with limited employee footprints if you charge per worker?)

Let’s explore.

Is it a good business?

Yes? It’s certainly not a traditional software IPO, however.

The company’s revenue mix contains software income and a huge chunk of low-margin insurance and benefits coverage. And Justworks has a history of profitability that we don’t see often.

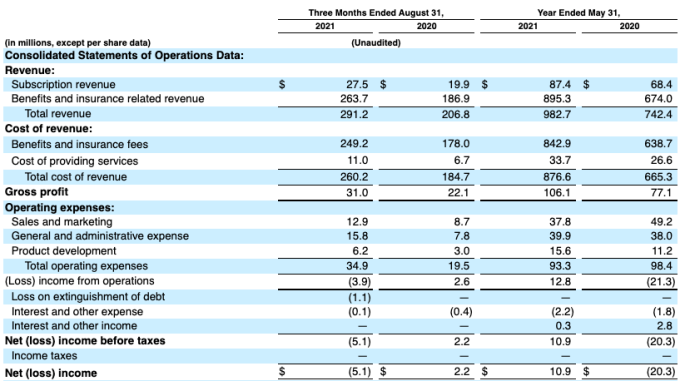

Let’s start with the company’s income statement through its August 31, 2021, quarter. Justworks’ S-1 includes space for it to update with data from its November quarter, but we’ll have to wait for those numbers. Here’s what we have today:

As you can see, the company’s growth rate from its May 2020 to May 2021 year was medium at just 32.4% across both of its revenue categories. Just looking at its software (subscription) incomes, we can see even slower growth of 27.8%.

But to the company’s credit, it posted growth and a simply huge gain in profitability over the fiscal year. Indeed, during its fiscal year concluding in May 2021, Justworks saw a more than $30 million swing in net income to $10.9 million. I don’t get to say this often given that most tech companies going public are bleeding red ink like they recently took up wrestling barbed wire fences for fun, so: fuck yeah, profitability.

More recently, the company swung back to losses, but did its move to negative net income in the quarter ended August 2021 come with faster growth?

Yes, somewhat. In the August 202 quarter, compared to its year-ago equivalent, Justworks’ aggregate revenue growth expanded to 40.8%, while its software incomes rose a much-improved 38.2%. However, those gains came at the cost of expanded sales and marketing costs and a boosted general and administrative line item; the latter of which, we’re sure, included IPO-related preparatory expenses.

All that is somewhat simple. Now, the gross margin question. We wanted to know:

- Is Justworks a pure software company, or does its product require more human inputs that lower its gross-margin profile? (In simpler terms, how high-quality is its revenue?)

The answer is that Justworks has a two-part business. Its subscription revenues are software incomes along with “fees charged” to “access … HR expertise, employment and benefit law compliance services, and other HR-related services.” Essentially, the company’s per-employee, per-month charges are recorded there. Then there’s the company’s main revenue result, its “benefits and insurance related revenue.”

Update: In the first iteration of this story, I applied the company’s “benefits and insurance fees” cost of revenue to its “benefits and insurance related revenue,” and the company’s “cost of providing services” exclusively to its subscription revenues to generate two different gross margin numbers for its two core business lines. The company noted after publication, however, that some costs from providing services stem from its benefits and insurance revenues.

The result of our overly-loose calculation of per-business line gross margins was that we understated the precise gross margin of the company’s subscription revenue, and overstated the gross margin resulting from benefits and insurance fees revenues.

Given that we have two revenue categories, and two cost of revenue categories that don’t line up precisely, it’s tricky to calculate the company’s non-insurance/benefits gross margin. But we can say that it’s north of the 60% that our initial, overly-conservative figure indicated.

In aggregate, the company’s gross margin for the August 31, 2021 quarter was 10.6%.

None of this is a diss, mind; you don’t have to build a 100% pure SaaS company to create value. But it’s also fair to say that Justworks’ business generates a lot of low-margin revenue and far less higher-margin top line.

Next up from our question list:

- Does the company have churn under control? (In simpler terms, are SMB customers as churn-heavy as we’ve been historically warned by venture capitalists?)

We can only tell by dint of our following question regarding net retention because Justworks’ filing is pretty thin from what we can see on customer churn. However, its net retention metrics include that number, so let’s move on to our third query:

- Does Justworks have attractive net retention metrics? (In simpler terms, how far can you upsell customers with limited employee footprints if you charge per worker?)

To answer that question, we need to know how Justworks defines the term. From its filing (emphasis added):

We calculate our subscription revenue net retention rate by taking (i) subscription revenue from the previous fiscal year, adding upsells and expansion less contraction and cancellations during the current fiscal year, excluding subscription revenue from new customers, and dividing by (ii) subscription revenue from the previous fiscal year.

This seems to be a nice, robust definition of net retention. So, when Justworks says that its net retention worked out to “119% for the twelve months ended August 31, 2021,” we can infer that churn wasn’t so big an issue that the company is unable to post pretty good sales growth from existing customers.

Add all that up for me

Justworks is a software and services company that sells HR tooling and human help to small business customers. It has two key revenue lines, the smaller of which has stronger gross margins. Historically, it has posted modest growth, though its top-line expansion recently accelerated. And Justworks has shown that it can generate profit in the past, even if it has recently dipped back into the red.

So what is the company worth? I have precisely zero idea. If you value the company on its total revenues, its low blended gross margins would lead you toward a decidedly non-SaaS multiple. And Justworks wants to be considered a software company, as that demarcation is the land of milk and honey, from a market cap perspective.

Per PitchBook data, Justworks was valued at $590 million (post-money) after it raised $50 million back in early 2020. Given that the company had subscription incomes of $27.5 million in its August 31, 2021, quarter, that valuation works out to around 5.4x its current subscription run rate. That’s low. Throw in the fact that it does generate some margin on its bigger revenue category, and it seems like the company should be able to crush that final private mark.

By how much? I do not know. We’ll know more when we get updated financials from Justworks and some early pricing information.

Union Square, Firstmark, Bain Capital Ventures, Redpoint and Thrive Capital all led rounds for the company during its private life. We’ll know soon enough what sort of returns they can expect.

Comment