Justworks released an updated IPO filing today, providing fresh financial results and a look at what the company may be worth when it debuts.

For those of you in search of a single number, using a simple share count, Justworks could be worth more than $2 billion at the top end of its current range.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

But that’s hardly enough information. So this morning, The Exchange is going to calculate the company’s various simple and fully diluted valuation marks, run multiples using its most recent quarter’s results, and compare all the data to the firm’s final known private valuation.

I had wanted to write up a 2022 IPO primer this morning, discussing the upcoming Reddit and Via IPOs, but that will have to wait a day. The Justworks S-1/A filing is here, if you want to follow along. Let’s talk SMB-focused HR software!

I had wanted to write up a 2022 IPO primer this morning, discussing the upcoming Reddit and Via IPOs, but that will have to wait a day. The Justworks S-1/A filing is here, if you want to follow along. Let’s talk SMB-focused HR software!

Justworks’ recent financial performance

If you missed our first look into the Justworks story, let’s catch you up: The company has two core business lines. The first, called subscription, is what Justworks charges for access to its service — things like “HR expertise, employment and benefit law compliance services, and other HR-related services,” per its filing.

The other, larger component of its top line is called “benefits and insurance-related revenue.” The former is pretty high margin, the latter less so.

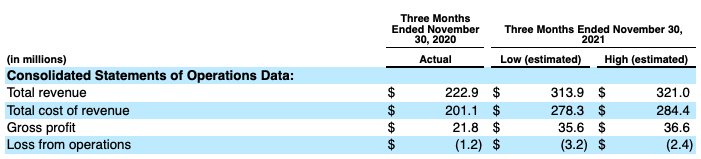

Here’s how the company did on an aggregated basis in its November 31, 2021, quarter:

As you can see, Justworks posted fairly material growth on a year-over-year basis and even better gains in terms of gross profit. If you are surprised that the company’s resulting gross profit is so small compared to its revenues, recall that Justworks is not merely a software company; its revenues include lots of that lower-margin “benefits and insurance-related revenue” that we noted above.

More simply, the company is in the SMB HR space, so its software unlocks customer activity that will not generate SaaS-like margins. Still, the company’s aggregate results detail growth and very limited losses. So we can note that the company’s revenue mix is different than what we see from most software companies while also not being rude about that fact.

Per the company’s math, here’s how the growth percentages work out for its most recent quarter:

- Revenue growth of 42.4%.

- Cost of revenue growth of 39.9%.

- Gross profit growth of 65.6%.

These numbers are related, of course. The company managed to post faster revenue growth than it did cost of revenue growth, so we’d expect an outsized impact to gross profit. Which we see in its growth rate coming in the highest of the three numbers listed above.

On a blended basis, the company’s gross margin should land between 11.3% and 11.4%, rather similar numbers between the two estimates.

Justworks posted faster revenue growth in its November quarter than it did in its August quarter, and with greatly improved gross profit, it should be able to keep its losses to a minimum as it continues to scale. I dub its most recent quarter to be quite good.

What’s that worth?

Well, we have a good idea now that the company has dropped an IPO price range, so let’s talk about it.

Justworks anticipates selling stock in its IPO at between $29 and $32 per share. When the IPO as it is currently constructed is complete, Justworks will have 62,427,380 shares outstanding. At that share count, the company is worth $1.81 billion to $2.00 billion. Throw in the 1,050,000 shares reserved for the company’s underwriters, and those numbers rise to $1.84 billion and $2.03 billion.

Justworks will become a double unicorn in its IPO. And its upcoming valuation is even higher if you include shares that have been earned but not exercised — vested options, warrants and the like. Renaissance Capital calculates that the company’s fully diluted valuation at the midpoint of its proposed range is $2.2 billion. At $32 per share, that figure rises to around $2.3 billion.

Are those numbers good? Yeah, they are. Why? Because Justworks’ last private valuation was $590 million (post-money) in January 2020, per PitchBook data. So the company is going to roughly 4x its final private valuation in its IPO. That’s what investors love to see — huge gains attached to small time periods.

For the sake of the company, I hope that its bankers don’t underprice its shares in its upcoming transaction as much as Justworks’ venture investors appear to have in its 2020 Series E.

Do those numbers make sense?

At first blush, no. With up to $321 million in revenue for its most recent quarter, Justworks’ maximum revenue multiple is around 1.9x, if we convert the top end of its recent quarterly result into a run-rate figure. That’s low!

But unfair? Perhaps not, and that’s why we spent an extra second on the company’s two-part model above; if we didn’t know that Justworks had a larger, lower-margin business and a smaller, higher-margin business, the company’s IPO valuation would appear to be highway robbery. But considering how the company’s top line is in fact made up, the numbers make some sense.

We’ll learn a lot more about the Justworks IPO range if the company raises it, of course. And we’ll learn more when the company sets a final price. And then we’ll keep on learning when it floats. But for today, at least Justworks can rest content that it’s on track to multiply its valuation in its upcoming debut. That’s never a bad sign.

Comment