Christmas has come early this year in the form of a new SPAC deal. InfiniteWorld announced yesterday it will merge with Aries I Acquisition Corporation in a deal that will value the startup at around $700 million, per company calculations.

Another day, another SPAC deal. We know. But this time we’re talking metaverse, so we have no choice but to take a look.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

In the wake of Facebook deciding that its original product remit was too narrow, something solved by declaring itself a metaverse company, the phrase has been inescapable. The metaverse might be a somewhat squidgy term — it’s something involving digital, community, commerce and having a second online existence — but it’s hot around the tech world.

That makes it unsurprising that a company working on the theme has found a blank-check company willing to merge.

What’s InfiniteWorld and what does it do? A grand question; I had no idea. Happily, the company’s investor deck helps a bit.

What’s InfiniteWorld and what does it do? A grand question; I had no idea. Happily, the company’s investor deck helps a bit.

Let’s look at the deal, what the metaverse company sells, and then discuss its somewhat humorous financial projections. To say that InfiniteWorld is a nascent commercial enterprise is an understatement, and in a world where many crypto companies are scaling to huge revenues, it stands out as a low-income concern.

To date, that is. InfiniteWorld has huge projections. Let’s talk about it.

The deal

Infinite Assets, Inc., better known as InfiniteWorld, is merging with Aries I Acquisition Corporation. Aries I is listed on the Nasdaq under the ticker symbol “RAM.” As of this morning, the company is trading at roughly $10 per share, having regained modest lost ground since its midyear IPO.

The deal will take InfiniteWorld public with a “pro forma equity value of approximately $700 million,” the companies said in a statement. That figure does not include possible redemptions, which means that it could change. So too could the expectation of InfiniteWorld having $171 million in cash after the deal closes, including $145 million from Aries I — again, assuming no redemptions — and cash that the startup has on hand today.

InfiniteWorld also has “cryptocurrencies valued at approximately $93 million based on recent prices on Coinbase,” the statement said.

What do we need to take away from the above? That Aries I is going to bring low nine figures worth of cash to InfiniteWorld, pushing its equity value up toward the $1 billion mark.

What’s an InfiniteWorld?

What’s a metaverse company? According to the InfiniteWorld presentation, it’s a collection of traditional and blockchain-related efforts that could be used to support crypto work by customer brands.

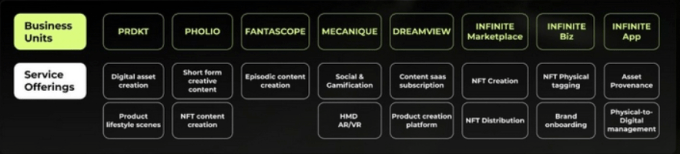

A quick peruse of the above will detail thematic overlap between different InfiniteWorld products. PRDKT, Pholio, the Infinite Marketplace, Infinite Biz and Infinite App all have some play in the NFT space, for example. There’s other metaverse-y stuff in there, including noted AR and VR work via the Mecanique sub-brand.

In more detail, InfiniteWorld says that PRDKT will help bring brands into the digital realm, Pholio sells “short-form creative solutions,” and Fantascope sells longer animated clips, for example. Perhaps more importantly, InfiniteWorld plans to sell NFT marketplace tech to others via a white-label setup.

The aggregate is a mix of things, but if a brand wanted to go from its traditional form into the digital realm, it appears that there is a good chance that InfiniteWorld has something to sell it. The company is a grab-bag for the metaverse, if you will.

How does all that translate to revenues?

Financial optimism

InfiniteWorld has little business track record but big aspirations. Observe the following, via its somewhat low-res SPAC deck:

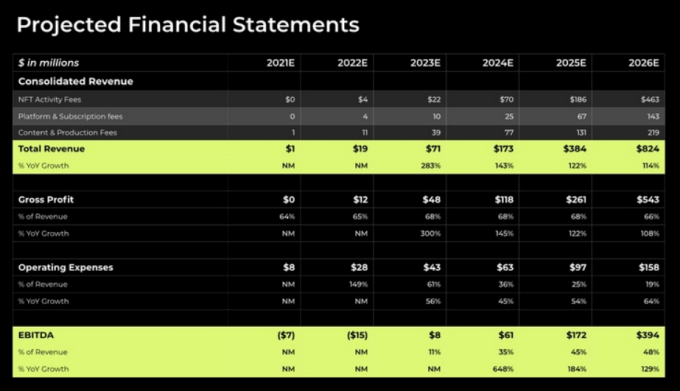

From a high level, InfiniteWorld anticipates 2021 revenues of around $1 million. That figure scales mightily to $19 million in 2022 and $71 million in 2023, according to company estimates. That means that the company won’t reach traditional IPO scale until into 2024 on a run-rate basis, according to TechCrunch calculations.

Simply put, InfiniteWorld is telling investors that it’s about to start a simply massive revenue ramp from effectively de minimis top line this year to nine figures in the next three years. Few companies manage such a quick jump, but the company is playing in hot markets where other players have managed to generate huge incomes.

OpenSea, for example, has made a mint taking a 2.5% cut of NFT sales on its platform. As you can see in the above, NFTs figure prominently in the InfiniteWorld revenue ramp. Here’s how the company describes that particular revenue source, along with its other two key sources of income:

NFT activity fees should be high-margin incomes, given that they involve the sale of digital items for traditional currency. Platform and subscription incomes appear to be software-like, so they should also generate strong gross margins. The final bucket, given its implied higher human input costs, should generate lower-quality revenues given historical norms for service-based work compared to software sales.

Still, the collection blends to anticipated gross margins in the high 60s% over time, the company said. That’s fine, if not exceptional, for a company playing in a high-tech space.

InfiniteWorld is an interesting company, albeit one that appears rather incipient for a public offering. Still, one argument in favor of SPACs is that it helps younger companies list. Consider this a more extreme example.

For investors, the pitch is obvious, I think: There’s a chance that IniniteWorld will tap a metaverse gusher. If that happens, its $700 million enterprise value will appear small in the rearview mirror. On the other hand, the company’s business history is all but nil. So, the risks are high, even if the rewards may be great.

Let’s see how it eventually trades.

Comment