David Teten

More posts from David Teten

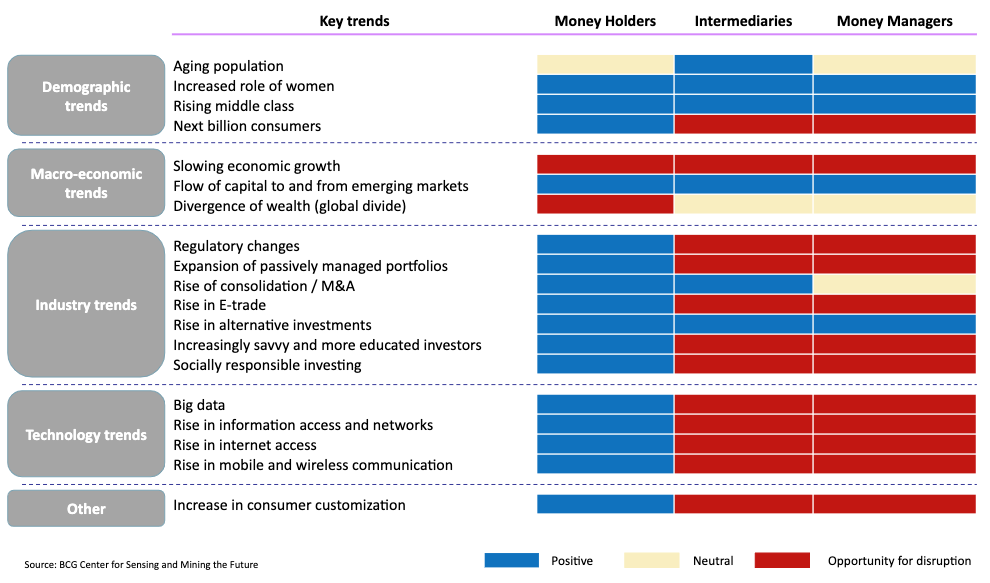

Power in the investment management industry is shifting to the money holders from money managers, driven by several major economic, social and political trends.

Collectively, these are irresistible forces meeting a moveable object: the traditional asset management industry structure. Below are five key trends impacting the investment management industry.

A new group of underserved customers

Women in the U.S. are expected to control as much as $30 trillion in assets over the next three to five years, and millennials $20 trillion by 2030. The new decision-makers will expect the industry to reflect better gender balance and be more accessible.

Women and millennials tend to invest differently than the past generation of older men. Millennials are both more risk averse and more socially conscious when selecting investments. In addition, because they came of age during the financial crisis, millennials have a negative perception of some of the traditionally dominant financial services companies. The change in the values of the investor base helps explains the popularity of ESG investing.

Additionally, allocators are becoming a lot less tolerant and unwilling to turn a blind eye toward toxic cultures of sexual harassment and discrimination, which have been tolerated at some largely male-led investment managers for years. Our view is that as the culture and preferences of allocators change, so will their investment criteria and the tolerance for bad behavior.

Millennials are, “inherently distrustful of authority so the traditional financial adviser model is not going to work for them,” said Suzanne Ley, formerly head of financial institutions at Westpac.

“They demand complete transparency in all aspects of their life, so hidden/opaque fees structures are not going to be tolerated. They also have a high propensity to move jobs more frequently than past generations, so the portability of financial assets is going to be very important going forward,” she added.

Read More

Geopolitical risk leads to capital flight

Political volatility is not good for savers and allocators, as it tends to destroy asset value. The new cold war between the U.S. and China is ideological in part, but it is also in large part about technology dominance and cybersecurity.

The new cold war has only increased the movement of capital to regions of relative stability. The fear of totalitarian regimes or anarchy in China, Russia, the Middle East and South America has millions of well-educated and wealthy citizens looking to protect themselves and their nest eggs. We are seeing the first net private capital outflows in emerging markets due to “risk-off” sentiment and risk of rising rates in the U.S. and Europe. Even though the economic outlook in the U.S. is negative and the COVID-19 response inadequate, the country remains relatively stable. Together with places like Switzerland, Singapore and the U.K., the U.S. remains an attractive safe haven.

Pension funds and wealth management funds have a big opportunity in growing their footprint geographically. While traditional markets in Europe, the U.S. and Japan are saturated, India, for example, provides the perfect environment for the growth of a new wealth management industry. A combination of a strong middle and upper-middle class, well-educated professional class, a free-market economy and expansion of disposable wealth will drive demand for wealth management products, both in the institutional and retail spaces.

The recession effect

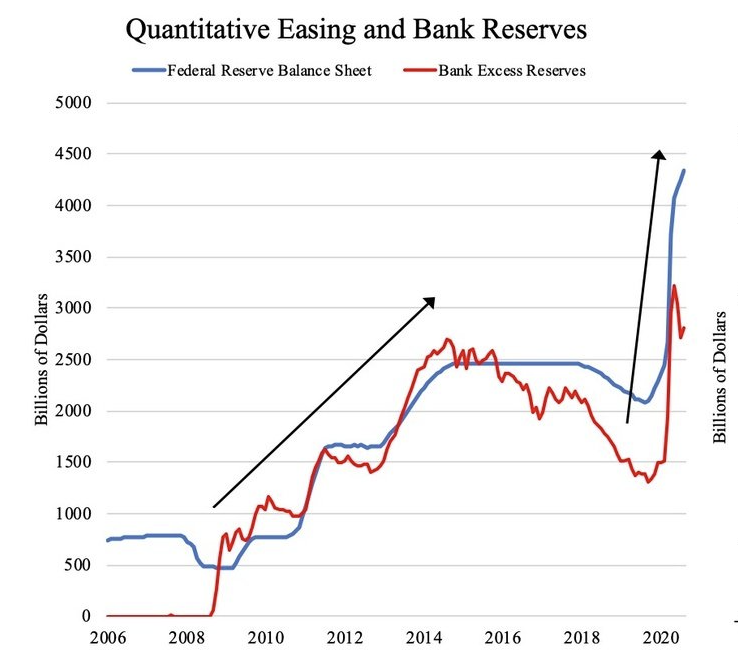

The 2020 recession had a short-term negative impact for many investors, but it had a surprisingly modest effect for many people. The initial impact was largely cushioned by aggressive government intervention with unemployment subsidies, small business association and disaster recovery loans, eviction protections and massive buying of many market assets.

However, the underlying problem is not necessarily demand-driven, as in previous economic recessions — it’s a massive lifestyle change due to a health crisis, which will lead to the permanent disruption of many traditional businesses and the creation of new business models. Most market observers expect increased debt levels and an expanding gap between the rich and the poor, both in developed economies and emerging markets. The likely trade-off is either far greater accountability for the wealthy (including investment managers) or greater social unrest.

The modern investor is aware of most risks

COVID-19 taught the world to take the pandemic risk seriously.

Eric Kohlmann, venture partner at Arc Ventures, is concerned about increased systemic concentration risk:

Many quant funds rely on very similar factor models, often with the exact same factors. We have already experienced “quant quakes,” where factors suddenly move by six to seven standard deviations. With investing moving substantially into passive strategies, ETF flows and quantitative trading models could trigger a huge sell-off with certain triggers. Such a “resonance disaster,” where overly similar models interact to trigger substantial sell-offs, is increasingly likely to happen.

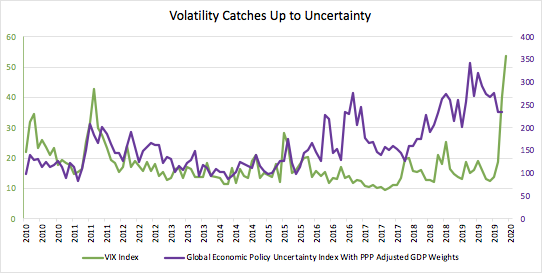

Overcrowding in similar investment models creates a major gap between volatility and uncertainty. Historically, volatility and uncertainty have moved in unison when market forces drove market prices. However, market prices have been departing from fundamental drivers for a number of years now, because of excessive stimulus by central banks. As a result, market uncertainty and volatility diverged, creating structural risk in market prices.

The problem is that most hedge fund investors, both quantitative and discretionary, use volatility to estimate how much leverage they should include in their portfolio. This has occurred more in recent years as markets have soared amid a massive GDP contraction. When volatility and uncertainty diverge, it creates an environment for sudden and massive price corrections.

Rob Li, partner and managing director of Stone Forest Capital, observed that during the first two weeks of the COVID-19 market meltdown, many high-quality supermarkets, such as Costco, plunged hard due to massive sell pressure from quant trading. In retrospect, we know supermarkets actually benefited from COVID-19, and Costco’s sales actually tripled thanks to a COVID-driven nationwide lockdown.

Yet, machines chose to sell those supermarket “winners” because even the best algorithm has a fundamental Achilles’ heel: They need large amounts of historical hard data to make a decision to buy or sell. Since COVID-19 was an unprecedented global event, machines had no historical reference points to evaluate the situation and had to resort to a crude, “dumb” strategy: Follow the market. This irrational algorithm-driven selloff hence, according to Li, created a golden opportunity for long-term, fundamental investors.

Innovation in tech brings opportunity

Rapid innovation in technology is generally positive for most money holders and will provide intermediaries and money managers an opportunity to differentiate themselves. We’re likely to see the greatest rate of change in the private markets.

Investing in public markets has already been massively impacted by technology and analytics. The next wave is going to hit the tech stack of the private markets. Quantitative, technology-enabled investing in private companies makes sense but is structurally very difficult and will become a more common strategy at a much slower rate.

In venture capital, early-stage companies often operate in frontier industries, where the rules are unpredictable, and conventional analytic frameworks may be misleading. Even for later-stage companies with somewhat predictable financials, Trilliam Jeong, CEO of WealthBlock.ai, observed that data availability, data standardization and distribution are all major hurdles. However, there is a lot of room to use technology to make the investing process more efficient.

Private equity and venture capital investors are now copying the hedge fund world in trying to automate more of the job. VCs tout our industry as frontier technology investors, but many of us are using the same infrastructure tools we have used for the past 20+ years: Excel and recent college grads searching Google.

We’ve seen some modest progress in people upgrading from Excel to Google Sheets, use of CRM and cloud-based storage services. “Structured, accurate and accessible data never really existed before for the private markets at scale,” Sebastian Soler, founder at Techfor.VC, said. “Advances in machine learning, specifically natural language processing, have made generating these baselines, aggregate datasets possible, at scale, with high accuracy. Sources like Crunchbase, AngelList and SeedInvest even give this data away for free or very low cost. The problem that faces startup investors now is how to mine this new data layer efficiently to increase returns.”

Disclosures:

Katina Stefanova is an investor in AcordIQ and Long Game and is a former Bridgewater Senior Executive.

David Teten is an investor in numerous investment tech companies, including Addepar, Asaak, Clarity (sold to Goldman Sachs), Drop Technologies (Cardify), Earnest Research, Indiegogo, Republic, Stratifi, Wonder, and Xperiti. He is an advisor to Bullet Point Network.

Contributors:

The first version of this paper was co-written with Brent Beardsley, formerly a Partner with Boston Consulting Group. This study would not have been possible without the collaboration and support from Brent and from the Boston Consulting Group. We also want to thank the research, technology, and editorial team who supported us during this study: Greg Durst, Jen McPhillips, Jenny Wong, Charles McLaughlin, Michael Rose, and James Ebert, plus more recently Ariel Cohen, Caleb Nuttle, Spencer Haik, and Cormac Ryan of Bullet Point Network.

These disclosures were added to this article after it was published.

Comment