In the wake of Coinbase’s direct listing earlier this year, other crypto companies may be looking to go public sooner than later. That appears to be the case with Circle, a Boston-based technology company that provides API-delivered financial services and a stablecoin.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Circle will not direct list or pursue a traditional IPO. Instead, the company is combining with Concord Acquisition Corp., a SPAC, or blank-check company. The transaction values the crypto shop at an enterprise value of $4.5 billion and an equity value of around $5.4 billion.

The offering marks an interesting moment for the crypto market. Unlike Coinbase, which operates a trading platform and generates fees in a manner that is widely understood by public-market investors, Circle’s offerings are a bit more exotic.

The offering marks an interesting moment for the crypto market. Unlike Coinbase, which operates a trading platform and generates fees in a manner that is widely understood by public-market investors, Circle’s offerings are a bit more exotic.

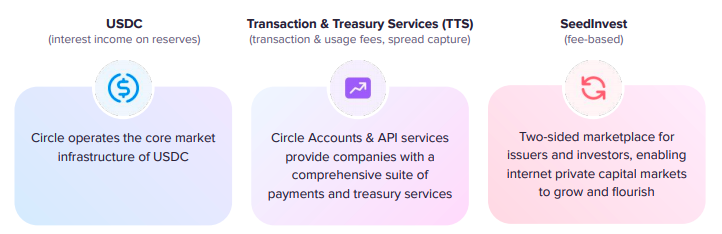

Circle’s SPAC presentation details a company whose core business deals with a stablecoin — a crypto asset pegged to an external currency, in this case, the U.S. dollar — and a set of APIs that provide crypto-powered financial services to other companies. It also owns SeedInvest, an equity crowdfunding platform, though Circle appears to generate the bulk of its anticipated revenues from its other businesses.

For more on the deal itself, TechCrunch’s Romain Dillet has a piece focused on the transaction. Here, we’ll dig into the company’s investor presentation, talk about its business model, and riff on its historical and anticipated results and valuation multiples.

In short, we get to have a little fun. Let’s begin.

How Circle’s business works

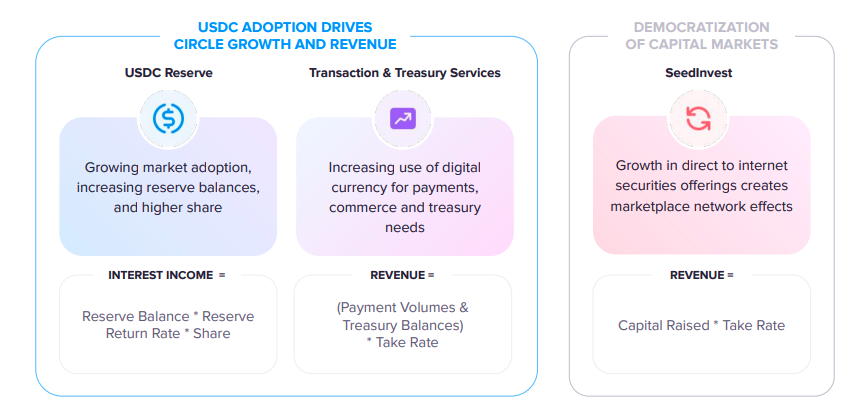

As noted above, Circle has three main business operations. Here’s how it describes them in its deck:

Let’s consider each one, starting with USDC.

Stablecoins have become popular in recent quarters. Because they are pegged to an external currency, they operate as an interesting form of cash inside the crypto world. If you want to have on-chain buying power, but don’t want to have all your value stored in more volatile, and tax-inducing, cryptos that you might have to sell to buy anything else, stablecoins can operate as a more stable sort of liquid currency. They can combine the stability of the U.S. dollar, say, and the crypto world’s interesting financial web.

Per Circle, its USDC stablecoin is both “compatible with U.S. Federal and State regulations and guidelines for digital currency” and built atop popular chains such as Ethereum. What’s Circle’s relationship to USDC? Here’s the company in a release from earlier this year:

Circle is also a principal developer of USD Coin (USDC), which together with Coinbase and the Centre Consortium oversees the standards and protocol for what has become the fastest-growing, regulated, fully reserved dollar digital currency.

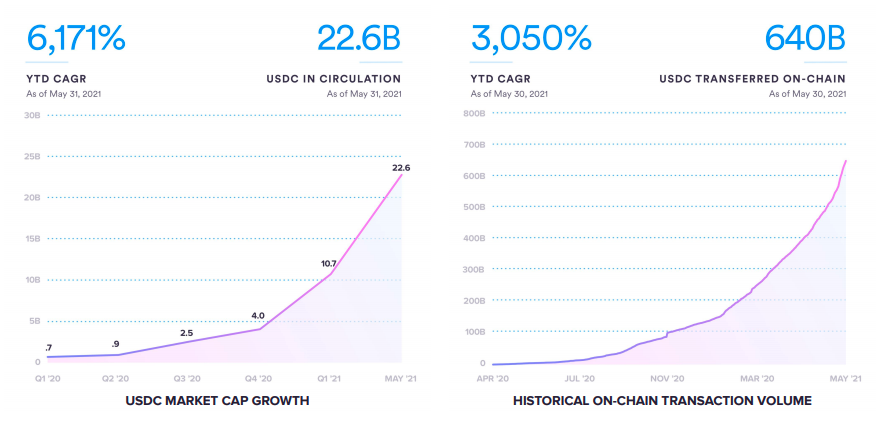

USDC has seen rapid historical growth. Here’s the company’s data run on historical usage of USDC since early 2020:

What can we tell from these charts? That there is a growing market for stablecoins in the crypto market, and that USDC is taking on a reasonably sized chunk of the market. CoinMarketCap data backs up the market-share point; USDC in-market value has risen to $25.9 billion as of this morning, making it the second-largest stablecoin after Tether.

USDC is not a side project for Circle. Instead, it’s part of the company’s business engine.

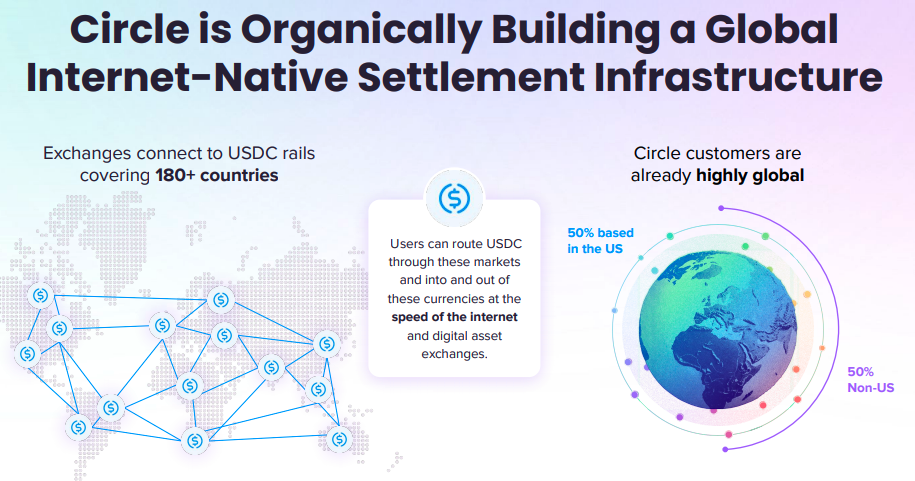

Observe the following slide:

Underpinning Circle’s infrastructure, then, is USDC. Or perhaps more accurately, Circle’s infra is predicated on USDC and its affiliated account system.

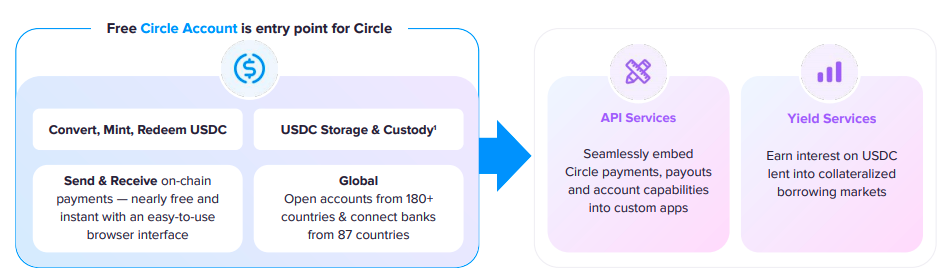

One more slide excerpt helps make this clear:

Circle accounts allow its customers to interact with USDC, and, in tandem, access its API tools and yield-generating offerings. On the API side, Circle’s developer hooks offer accounts, payments, payouts and yield services. The company calls its API services “transaction and treasury services,” which is illustrative.

Here’s how each of the company’s three businesses generates revenue:

Regarding reserve-related incomes (far left of the image), recall that stablecoins are pegged to an external currency and are backed by the same. So, if lots of folks buy USDC from Circle, it will sit on a mountain of reserved cash. It can generate interest on those sums. Those revenues would likely expand as interest rates rose. So, if you are bullish on central-bank tightening in the United States, you may be bullish on Circle’s USDC reserve-related incomes.

The middle piece of the slide is somewhat the culmination of what we’ve read through so far. The company’s API-delivered services generate fee income based on usage. This should be familiar ground for anyone in the tech world, crypto-focused or not.

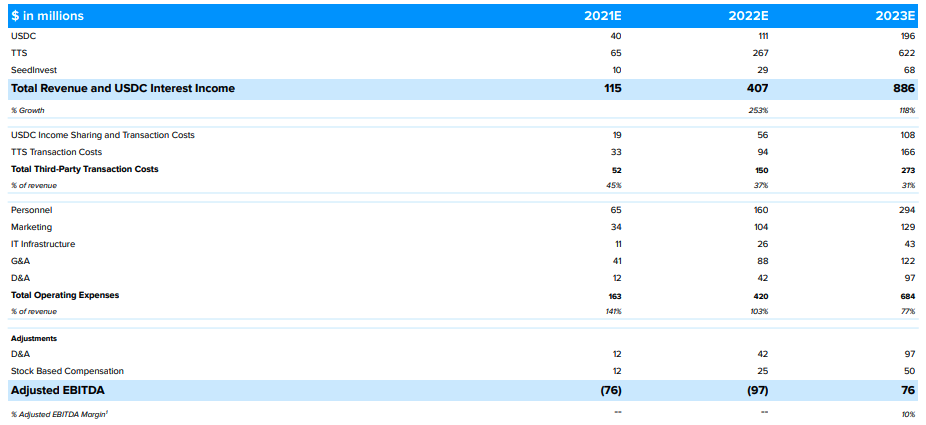

How do the three business groups generate revenue in comparison to one another? We do not know the answer, in historical terms at least. Circle does provide, however, forward-looking results for its business units:

Starting in the 2021 column, Circle anticipates USDC-related revenues to total $40 million, and its API-delivered services to generate $65 million. SeedInvest, what feels now to be a wholly distinct business after reading the company’s deck, will generate less than 10% of its anticipated 2021 top line.

Circle anticipates simply staggering growth in 2022 and 2023. The company forecasts a 253% gain in revenue during 2022 and 118% the following year. That’s enough to scale the company from $115 million in 2021 revenue to $886 million in 2023.

The second part of the company’s table is essentially cost of revenues. The firm expects to see its “gross margins” expand from 55% in 2021 to 69% in 2023. That’s very good — if the company can pull it off.

The result of its anticipated revenue growth and improving margins get the company to adjusted profitability in 2023; the company would still generate net losses in the year, as its operating expenses as a percentage of revenue are higher than its gross margin.

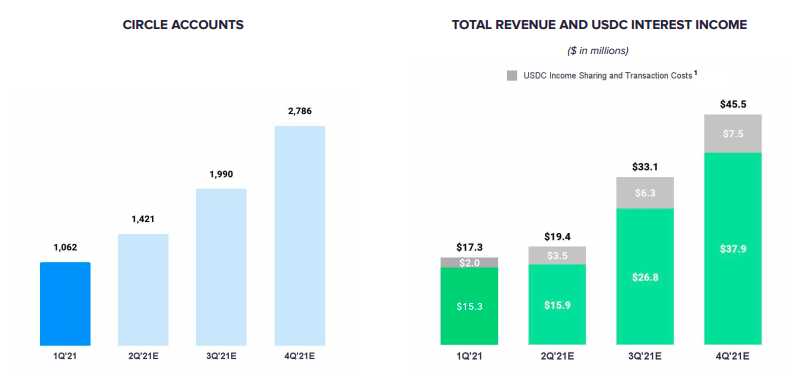

What about historical data? Well, we have a single quarter’s worth. Here it is:

So, the company had just over 1,000 circle accounts — customers, I think — at the end of March and generated $17.3 million in first-quarter revenue. The company anticipates that figure increasing to $19.4 million in the second quarter.

Note, however, that the company is breaking out income-sharing and transaction costs relating to USDC activity. Perhaps it’s signaling that those costs are contra-revenue; if so, the company’s top-line projections might need some closer inspection. Regardless, the company is telling investors that its revenue growth is about to take off in Q3.

We are deep in SPAC territory here. The company is combining and debuting with scant shared historical results. Perhaps due to a history of business-model pivots, it doesn’t appear to be excited about sharing historical results. All right, fine, that appears to be legal, but it does make my hair stand up a bit.

This is the sort of business that is correct for a SPAC-led debut. It could not go public in a traditional manner in its current state of maturity. But a SPAC can get it a huge slug of cash at a price that it has locked in, allowing it to complete its growth into corporate adulthood while public. A gamble, sure, but one that will be very fun to watch.

The company expects the transaction to close in Q4 2021, so we should get more data from Circle before it begins to trade.

When The Exchange last checked, there were no new SEC filings from the SPAC entity that might have included more in-depth, GAAP-friendly numbers. So, we’re stuck with projections for now.

On that point, valuation: With an equity valuation of $5.4 billion, Circle is betting that it can grow quickly before the combination is enacted, effectively shrinking its revenue multiple before it begins to trade.

Here’s the company’s revenue run rate multiple at its Q1 (actual) and Q4 (estimated) revenue results, inclusive of revenue demarcated as “income sharing and transaction costs:”

- Q1 run rate multiple: 78x

- Q4 run rate multiple: 29.7x

See the difference? On one hand, Circle is massively expensive at its current scale. But in the quarter that the deal should be consummated, it’s far more reasonably priced.

I don’t know what the market’s appetite is for shares in this company, but it has found plenty of capital ready to back its vision and model. Let’s see what we can learn from its Q2 2021 and Q3 2021 results when they come out.

Comment