Update: Things didn’t go that well.

Grab, the Southeast Asian super app, announced last night that it completed its business combination with special purpose acquisition company (SPAC) Altimeter Growth. The result? Grab will begin trading today on the Nasdaq under the ticker symbol “GRAB.”

And it raised a pile of money in the process. Billions, in fact.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The Grab SPAC failed to, ahem, grab our attention during the recent IPO rush, so it’s the right time to sit back and catch up. This morning, we’re going to refresh our memory of the Grab-SPAC deal, check in on the company’s Q3 2021 performance, and yammer about the company’s early trading. Which, spoiler, is looking good.

Grab’s SPAC deal

Grab’s SPAC deal

One issue that many SPAC-led deals endured lately is redemptions. In essence, SPAC backers can opt to get their money back ahead of a business combination (more here). This has led to some blank-check deals not bringing as much capital to bear as initially expected.

In the case of Grab, redemptions were not a problem. As the company recently reported: “Shareholder redemptions were effectively 0%, at 0.02%.”

So, we should expect that the Grab SPAC deal did in fact raise the money we anticipated for the super app. Indeed, as Grab wrote last night, the “transaction raised gross proceeds of US$4.5 billion in the largest-ever U.S. public market debut by a Southeast Asian company.”

That’s about half the reason we care about the blank-check-led debut of Grab; it’s not just a big deal for a big company, it’s the biggest deal for its region, and it’s heading into its first trading session having received a huge vote of confidence from its SPAC backers.

And while it is early to say this with confidence, the company’s trading post-combination is doing just fine. Shares of Grab are up 2.6% this morning to $11.30 per share. There was some indication that they could open higher this morning, but we don’t entirely trust first-day, pre-market trading data.

What are investors seeing in the company to make them confident enough to drop billions into its accounts and bid its shares higher? Let’s find out.

Grab’s Q3

We love an IPO here at TechCrunch because they are essentially a drawing-back of the curtain. Private companies love to flex their private status, telling the public rather little. A mistake, I think, but that’s beside the point. Because Grab was in the process of going public, it dropped regular reports for us to digest. So let’s talk about its Q3 2021 numbers.

It was a mixed period for the company, with gross merchandise value rising to a new high, but revenue falling due to what the company described as “a decline in mobility [revenue] due to the severe lockdowns in Vietnam.”

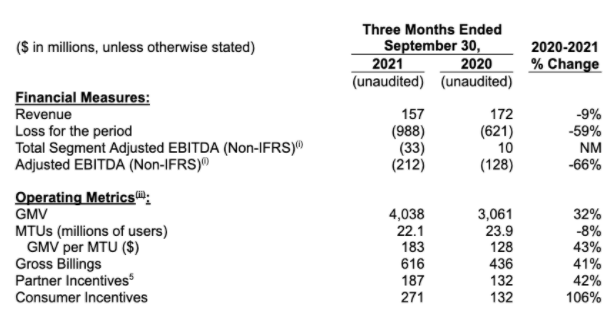

That sentence should give you an idea of both Grab’s business and its geographical footprint. Here’s how the company’s delivery, mobility and financial services business performed in aggregate in the third quarter:

This says most of what we need. First, the company’s revenue decline was not immaterial in the third quarter. A nearly 10% drop matters a lot in a business — growth-oriented technology companies — where the pace of revenue expansion is critical to worth; to see negative numbers is more than notable, regardless of the reasons behind the declines.

The company’s losses are also up massively compared to the year-ago period. Grab is not a company at risk of making money for some time.

And yet, there are some very positive things to highlight as well. The company’s GMV growth feels solid, especially from a falling user base (MTU result). If you can see a post-COVID future where lockdowns are no longer an issue, it isn’t impossible to see growth and improved profitability in Grab’s future. Just, not yet.

All this is my attempt to understand the market enthusiasm for Grab shares. The above numbers are, presently, Not Good: Grab’s third quarter showed rising losses and falling revenues. That’s bad! And, yet, investors are pouring billions into the business and bidding up its shares this morning.

Despite a recent selloff in the value of tech companies, Grab is showing that there is still room for optimism on the public markets.

Segments, etc.

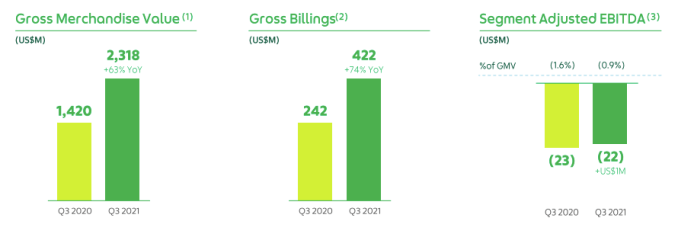

Something notable about Grab is that it reminds me of Uber. Not simply because they both offer on-demand food delivery and rides, but also their profitability makeup. For example, Grab’s delivery business loses money:

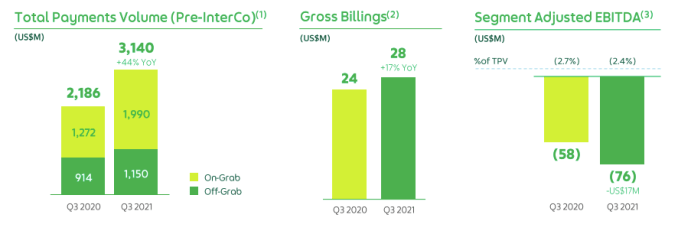

As does its financial services business:

While, in contrast, its mobility business generated $64 million worth of positive, segment-adjusted EBITDA. In human terms, the company’s rides business managed to return profits to the main company, while its other key divisions returned losses. Mobility was not enough of a profit source to save the company’s aggregate profitability, but much like Uber, moving people around can now generate healthy results, despite overall unprofitability.

Why investors are far more enthused about Grab than Uber is a puzzle I leave to you. We’ll keep tabs on the company’s first few earnings periods before letting it go.

Comment