If you bring up bad news about the price of technology stocks on Twitter, very helpful people will send you multi-year charts that put recent declines into historical context. Yes, thank you; I was not aware you could zoom out.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The instinctual need to proclaim that selloffs of tech stocks don’t matter is either a bad-faith argument or poorly disguised fear. More on that in a moment. Regardless, the recent negative price movement of tech stocks — and software shares in particular — matters.

Why? Because we are not only seeing software stocks flirt with bear-market territory in technical terms, but also a pretty notable pullback in the value of even the fastest-growing technology companies. This means that public valuation multiples — key indicators for yet-private unicorns and younger startups — are shrinking.

Have valuations shifted enough to slow the current venture capital bonanza? Probably not. But we could be closer to that tipping point than you’d think.

Have valuations shifted enough to slow the current venture capital bonanza? Probably not. But we could be closer to that tipping point than you’d think.

Declines

The Bessemer Cloud Index is trackable on the public markets thanks to the WisdomTree Cloud Computing Fund, which is essentially a trading version of the company set.

After reaching a 52-week high of $65.51 last month, the market value of the basket of software companies slipped to $53.00 as of this morning. That’s a decline of 19.1%, or 90 basis points under the 20% required for a particular asset, or asset collection, to reach technical bear-market territory.

We’re close, in other words.

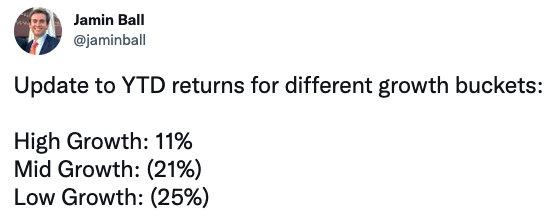

The pain is not evenly spread, however. As investor Jamin Ball noted this morning, it’s only most software companies that are in negative territory for the year:

Still, those numbers were 39%, -9%, and -17% as recently as November 19, so we’ve seen a dramatic decline in the value of high-growth software companies, even as their slower-growing siblings continued to deflate.

It’s not hard to find evidence of the carnage. A taste, not inclusive of this morning’s trading as the markets have been open for about 10 minutes as I write to you:

- Okta closed yesterday’s trading worth $198.08 per share, off highs of $294.00.

- Atlassian closed yesterday’s trading worth $357.21, off highs of $483.13.

- UiPath closed yesterday’s trading worth $43.93, off highs of $90.00.

After some pre-market chop, tech shares are up today, but not enough to make a dent in recent declines. A small bounce doesn’t make a drop any less painful if concrete is the interval between down and up.

Given the high value that investors have appointed to startups from their earliest stages through unicorn rounds and pre-IPO investments, and even into public liquidity cycles, these declines matter. Why? Because a bunch of private-market investors are betting that their startup investments will eventually convert to IPOs at strong revenue multiples; if public tech stocks, however, decline, and compress revenue multiples for startup comps, those yet-private companies could struggle to price their next round in an attractive fashion, either slowing their fundraising — and, therefore, growth — or halting it altogether.

Alarmist? It feels like it, given just how long we’ve been in this particular bull market. But at some point a pullback won’t simply snap back into shape, providing the market with another few quarters’ worth of rich-multiple security.

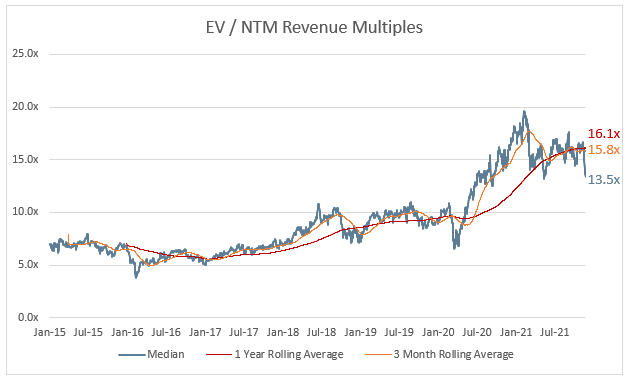

Before this week’s declines, things had already changed. Ball’s blog included the following regarding the November 26, 2021, trading week:

Now imagine that final little downward drop with a bit more poison in it. We’re probably somewhere near the bottom of 2021’s median SaaS revenue multiple now. Any further declines and we’ll start eating into the huge value appreciation that was built during the 2020 pandemic trading.

At which point, at least some of the logic behind venture capitalists investing in startups at three-figure revenue multiples will begin to unravel. Surely some of today’s insane prices are predicated on the idea that SaaS valuations have reached a new, higher plateau. Maybe, but also, it appears, maybe not?

We’ve written about the logic behind today’s rising software company prices. And the risks thereof. But we’re on the cusp of seeing investing hypotheses backed by hundreds of billions in capital being tested. Not quite yet, but so very close. Watch the markets.

Comment