Happy Friday! The TechCrunch crew is still in a modest period of repose thanks to the Thanksgiving holiday, but we wanted you to have numbers to chew on all the same. So, this morning, we’re taking a brief look at Samsara’s IPO filing.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

You may have heard of Samsara. Founded in 2015, it’s raised more than $900 million during its life as a private company, per Crunchbase data, including a simply massive $700 million round in 2020 that valued Samsara at $5.4 billion.

Big bucks for a young company, yes, but does it have the results to back them up?

We’ll find out. But first, we have to talk about what Samsara actually does. And for that, we have to start with a phrase that you haven’t read as much about lately: IoT.

We’ll find out. But first, we have to talk about what Samsara actually does. And for that, we have to start with a phrase that you haven’t read as much about lately: IoT.

What does Samsara do?

If you are new to a company, reading its IPO filing is always good fun. You get to play a very diverting game — Can the Company Actually Explain What It Does? Most companies cannot.

It seems, in many cases, that after seventy-eleven rounds of edits between lawyers, bankers, comms staff, PR pros and executives, how most companies talk about themselves when they go public has been reduced to a lukewarm stew of corporate gibberish.

Thankfully, this is not the case with Samsara. Its business is actually pretty easy to understand.

From a high level, many more pieces of the physical world are connected to the internet today than before. This generates data of all sorts, which is useful in myriad ways. You could even call the connected pieces of hardware an internet of things if you wanted. Maybe IoT for short?

You recall the IoT craze from a few years ago. CES was overflowing with the stuff for what felt like an age. But as with many technologies that reach the public consciousness only later to fade from the conversation, IoT work appears to have found a real home in the business world, even if it didn’t wind up being the consumer phenom that some expected.

So, IoT. What does Samsara do with the technology niche? It collects lots of data from IoT devices (first- and third-party). That data is then processed inside software hosted remotely (cloud), after which it is served up via different applications (SaaS). Or as Samsara puts it:

We provide an end-to-end solution for operations: Our solution connects physical operations data to our Connected Operations Cloud, which consists of our Data Platform and Applications. Our Data Platform ingests, aggregates and enriches data from our IoT devices and a growing ecosystem of connected assets and third-party systems, and makes the data actionable for use cases through our Applications.

That’s about as clear as S-1s get.

The company’s business model is subscription-based, but notably isn’t pure SaaS. The company also provides hardware (IoT devices) as part of its service packages. As the company explains (emphasis added):

A subscription to our Connected Operations Cloud includes IoT data collection, which comes from a Samsara IoT device, such as an Internet gateway, camera or sensor, or at times from a third-party solution; cellular connectivity for our IoT devices; access to our cloud Applications, APIs and the Samsara App Marketplace; customer support; and warranty coverage.

The hardware costs are baked into revenue costs in the form of “amortization of IoT device[s],” the company adds. So, Samsara is a mostly software company, but not one that is afraid of doing some hardware work as well. Sadly, the company’s revenues are presented as a single block, so we can’t get too fancy.

Summing: Samsara is a software provider that ingests, processes and presents real-world data collected from first- and third-party IoT hardware. It sells its service as just that, taking recurring fees in recompense for providing hardware and managed code. It sells to other companies.

All that in hand, let’s talk results!

Is all that a good business?

Yeah, but it was stupid expensive to build.

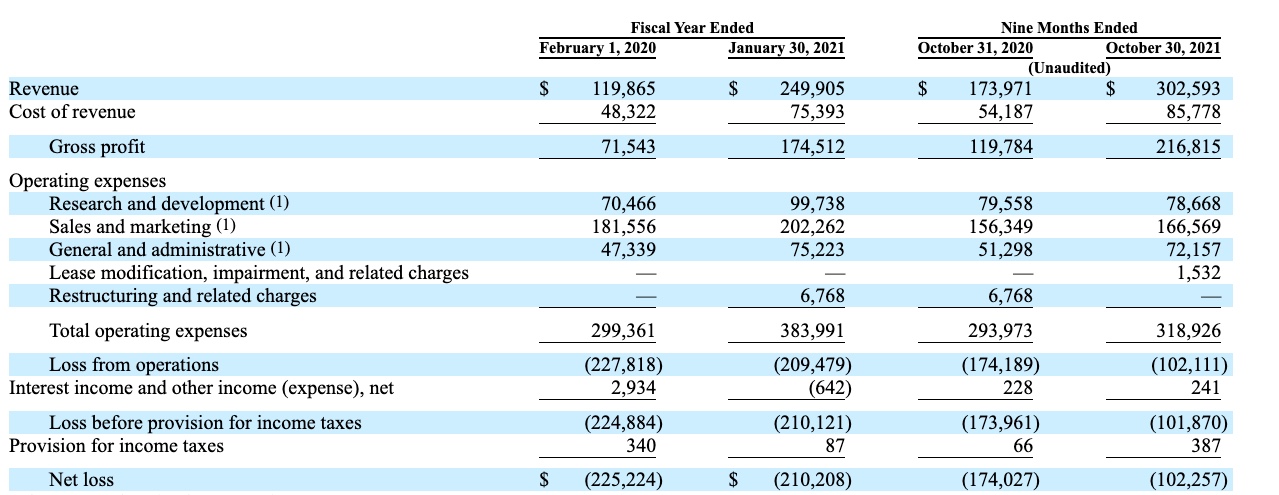

Samsara’s business results have lots to like. As we can see in its income statement, there’s plenty of growth to cite, for example:

From its fiscal years ending in early 2020 to early 2021, Samsara posted 108.5% growth. In the nine months concluding in October of the same years, the company grew 74%. Samsara’s growth rate is decelerating but remains strong for a company going public.

And its gross margins improved over the same time periods, including from 60% to 70% in its last two full fiscal years. More recently, in the three quarters concluding in October of 2020 and 2021, Samsara’s gross margin ticked up from 69% to 72%.

What we can tell from the above numbers is that Samsara is a quickly growing company with strong gross margins. That means it’s worth quite a lot in today’s market.

But! The company is comically unprofitable.

In the nine months concluding October 31, 2020, Samsara managed to post operating expenses of $294.0 million against gross profit of just $119.8 million. Thus, the company’s operating loss for the nine-month period was $174.2 million, very similar to its revenue for the period.

Things got better this year. In the same nine-month period of 2021, Samsara’s gross profit was a far greater percentage of its operating costs — $216.8 million of $318.9 million, or about 68% — leading to a far-slimmer operating loss of $102.1 million for the period. The company’s operating deficits fell even more sharply in percent-of-revenue terms than they did in raw dollar figures thanks to top-line expansion.

So, yes, Samsara can say that it is losing less money as time goes along and that it is still posting top-tier growth. Huzzah. I remain in awe of the company’s spending over time, however; dropping $156.3 million in sales and marketing costs against $119.8 million in three quarters of calendar 2020 is just bold.

But it appears to be working out, with the company’s revenue expanding nicely while growth in sales and marketing spend has moderated. Still, with a negative operating cash flow of $123.2 million in the nine months concluding October 2021, Samsara is miles from breakeven.

What’s it worth?

Recall that Samsara was valued at $5.4 billion back in May 2020. Will it be able to meet that valuation mark in its IPO?

- Samsara October 30, 2021, quarterly revenue: $113.8 million.

- Implied run rate from its most recent quarter: $455.3 million.

- Samsara October 30, 2021, growth rate (YoY): 72%.

Samsara would have to command a revenue multiple of just under 12x to meet its final private price. Will it manage that? Er, yes. Yes, it will.

We can say that with confidence because there are two public SaaS companies with revenue growth rates in the 70s, Datadog and Asana. And they are both worth around 50x their current annualized revenue, per Bessemer data. Even if Samsara manages half that multiple, it is worth more than $11 billion.

From this, we have to wonder why Samsara sold its shares so cheaply in its final private round. At the time, perhaps it felt like it was getting a good deal, but in reality, its private backers slapped a comically low valuation on the company and are about to get paid like bandits.

More when we get a price, but this is going to be a big, fun IPO to watch.

Comment