Jose Cayasso

More posts from Jose Cayasso

My team and I go through 250 to 300 investor decks every single month. Even though a small group of founders has started exploring Notion memos to replace pitch decks, the reality is that most investors will still expect a good old slide presentation.

The following are slides that we constantly see founders struggle to solve. The most common reasons why these slides don’t work?

- Founders haven’t really solved that aspect of their businesses.

- The founder doesn’t understand what the slide means or what it needs to answer for the investor.

Go-to-market slide

What it needs to answer: How will you triple your revenue year over year?

For most decks and most company stages, the go-to-market slide is the most critical in the presentation. Most companies are pitching investors when they have a bit of traction, so it’s safe to assume most of the capital will go toward accelerating growth.

Also, depending on the company stage, “go-to-market” ought to be considered a section rather than an individual slide. As a general rule, the later stage the company is, the longer and more detailed this section becomes. We worked on the pitch deck that raised UpKeep’s Series B round, and the go-to-market section was about seven slides long.

If you are structuring your pitch deck cohesively, the go-to-market will probably be the first slide investors will encounter that details how the company intends to use its funding. We usually put go-to-market slides after the business model slide but before the market size slide; that way, you can dive into expansion after the investor already understands how you make money (and before touching on the market potential).

One of my favorite go-to-market slides comes from Airbnb’s 2009 pitch deck (the one they used for YC Demo Day):

Notice how at this point (seed stage), Airbnb had identified three critical go-to-market tactics:

- “Targeting festivals and events” shows a good understanding of the audience willing to “experiment” with their offering.

- “Partnerships with existing booking providers,” a source of growth that is still used today.

- Its “dual posting feature” on Craigslist. At the time, Airbnb had developed a simple bot that automatically cross-posted all new Airbnb listings to Craigslist. All posts had a link back to their website.

Some of the most common mistakes I see on go-to-market slides:

- Being too generic about growth tactics: Founders just make a list of five to six growth channels they intend to experiment on without going into detail about what they are doing there and what they are doing differently from their competitors.

- Talking about the same channels everyone else is using: SEO, influencer marketing, social media marketing are pretty standard these days. Stating that you’ll be focusing on those outlets does not constitute a proper go-to-market strategy.

- Wasting slide space in “obvious” channels: Most companies need a social media presence, an optimized website and an intuitive user experience. Those do not set you apart from competitors. All companies should be doing that.

A good go-to-market slide must show the company understands why it’s growing and what it needs to do to continue. It should also highlight tactics, strategies and unique channels the company has discovered that competitors have yet to figure out.

Instead of approaching this slide as a list of ideas for growth, investors would much rather see:

- The one or two channels that are already driving most of the customers for the company and could quickly scale if they had additional capital.

- One or two additional channels the company is starting to explore that could unlock a new source of customers soon.

Suppose you touched on a critical marketing/growth strategy as your go-to-market overview slide. The next step is doubling down on your hypothesis with numbers and key performance indicators: cost of acquisition, retention rate, customer lifetime value, repayment time and average contract size all belong in this section.

Proving your understanding of those numbers is a must if you intend to sell your capacity to pour the capital from this round of funding into fueling growth for the next 18 to 24 months. In other words, show the investor where your customers are coming from and convince them that you can double or triple your growth using their capital.

Use case/audience slide

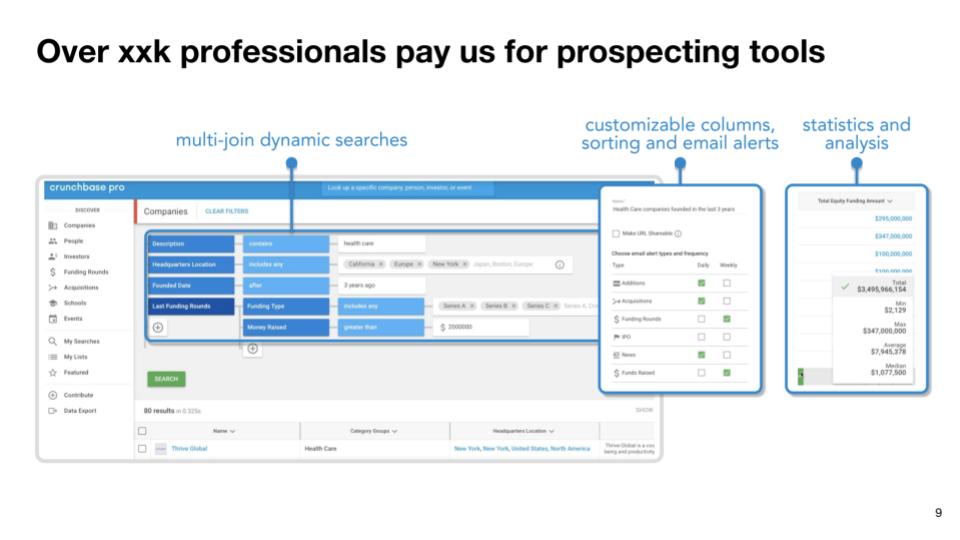

It’s often tough to get a grip on the ideal product use without a contextual example. Take a look at the slide from Crunchbase’s Series C deck.

While this slide does an excellent job of showcasing product features, it’s still unclear how Crunchbase’s customers are using the platform. None of the slides on the deck (at least in the public version) provided a more profound example of platform usage inside one of the organizations that use them.

Startup nirvana (aka product-market fit) essentially depends on your ability to understand these use cases and make sure they are replicated across your customer base. For earlier-stage companies, a good case study can help prove that you are beginning to understand this fit for earlier-stage companies.

Think of this case study as a short tale about a company using your product successfully.

Explaining that case study not only serves the purpose of bringing your product or service down to Earth but can be used to show your understanding of the sales funnel, the decision-makers that have to be brought in and the type of company that you target.

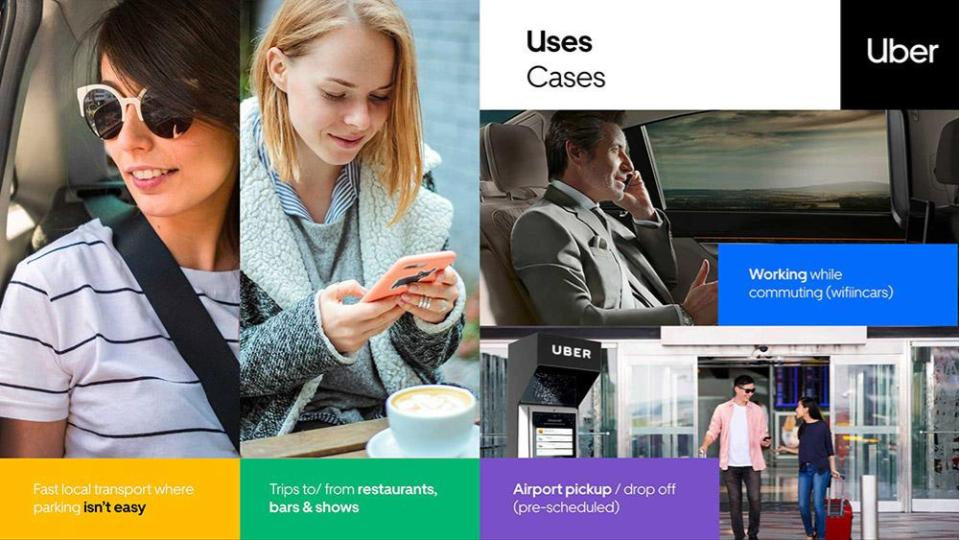

There are two ways to approach this slide:

- Paint a picture of a customer persona: age, gender, income, location, work position, interests. Tell us why they would use your service. Ideally, you should have been in touch with hundreds of these personas before you see an investor.

- Write a short case study of ideal platform use: Please make sure you mention who the decision-maker was, who inside the organization uses the tool more intensely and what results they see after adopting you.

The case study should come from a real customer, providing credibility about the business, the product and the team’s ability to sell.

TAM

The total addressable market (TAM) slide generates the most confusion among founders and is therefore the slide with the most inconsistent results.

This section of the deck should answer a single question: How big does your company get?

What most founders will do is Google some stat on the size of their industry and simplify their conclusion by assuming that all they need is 1% of the market to become a $1 billion company. That’s the wrong approach.

A startup’s total addressable market can’t be determined with a top-down approach (1% of X market or industry). It’s also not the size of the problem (how much money is wasted because of the lack of current solutions).

Therefore, you can calculate TAM by multiplying annual revenue per customer by the total potential customers available.

Now, finding the “total potential customers available” figure is easier said than done. It requires, once again, a deep understanding of the target persona or the target company size. It requires you to find how many individuals or companies match that profile and would be willing to pay for your product.

Understanding annual revenue per customer is also a complex exercise. It requires you to have a level of confidence in your business model and to be realistic about how much your future customers will pay you. (You should have covered the business model by the time you get to the TAM slide).

You should also consider competitors, their market share, and, realistically, what percentage of that market share you can convert into your product.

Possible outcomes

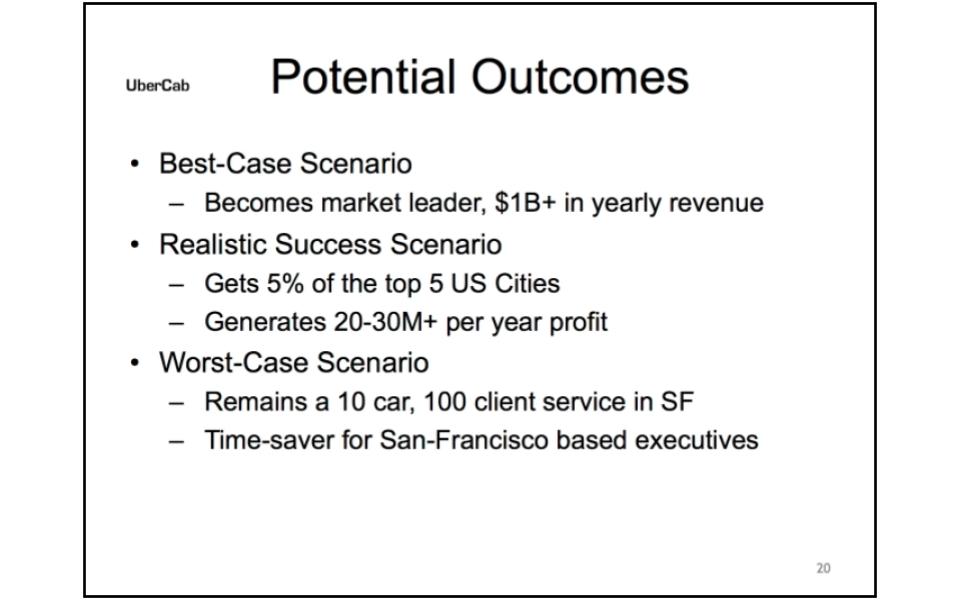

I first saw this slide in use on Uber’s pitch deck. This is the original slide:

The slide essentially lays out three expected outcomes the business could have. In the case of Uber, the reality today probably exceeds its “best-case scenario” at the time.

“Possible outcomes” is not a slide that we often see in pitch decks. Still, it can serve the beneficial purpose of lining up founder and investor expectations: Uber was ambitious enough to expect more than $1 billion in revenue, but its realistic expectation was very down to Earth.

Team

This slide is not supposed to be about everyone in the company or about your advisory board. This slide is about the team that will make or break this business: the founders — and perhaps one or two key employees.

The founding team needs to encompass the complete set of skills to get a company off the ground.

In a hardware startup, “getting off the ground” is probably the ability to build that functional prototype; this means that the team slide on the deck should have engineers, industrial designers, individuals familiar with the complications of manufacturing products at scale and someone who can sell the product.

In a software company, “off the ground” means developing the product, launching it and getting the first few customers through the door. This means you’ll need engineers, UX designers and, again, someone who can sell or market the product.

You can recruit people to help with those tasks at the early stage, but those will likely be more junior employees. Recruiting an expert growth hacker or an experienced CTO as a non-founding employee is near impossible.

Having $1 million in the bank as your seed round doesn’t solve the problem of finding a CTO or a crucial senior employee. They can probably take a better-paying job without the risk of doing a startup with a 12-month runway. Those key employees must join the company because they believe in it. They need to be willing to take a below-market salary for years because they can envision the company’s long-term potential (and the equity they will own).

The team slide is about demonstrating that all the skills needed to “get the business off the ground” are already recruited.

Sometimes it’s good to zoom out on your work and ask yourself if the slides fulfill that purpose. We have a pitch deck structure that we use with most of our clients:

Remember, a pitch deck needs to achieve two things: tell your company story and convince the investor that they can make money with this.

Comment