Bill Binch

More posts from Bill Binch

As a revenue leader at large and small technology companies, I’ve spent the last 15 years attending a lot of quarterly board meetings.

These meetings take countless hours to prepare for and can create a lot of stress. The prep and the practice can be draining, and, more importantly, distracting from your daily grind.

This is all necessary because the board meeting is such a high-stakes event. As a wise mentor once told me, no one ever gets a promotion from a board meeting, but people sure do get fired afterward.

So if you’re responsible for driving revenue growth at your company, how do you make your portion of these meetings as engaging and impactful as possible? I’ve got some hard-earned advice on that front, as well as suggestions for five must-have board slides — customized for leaders at B2B, software-as-a-service companies — that will help you give a great presentation and preserve your sanity.

Size matters — and so does consistency

I’ve been part of company board meetings where the deck was 30 slides, and I’ve also been in meetings where decks would be more than 150 slides. You’ll need to gauge what level of detail is right for your organization, but my general rule is to cut your slides until it hurts the narrative of the deck.

You should also strive for consistency. You’ll want to deliver the same sets of metrics and details in each quarterly meeting so that directors and executives can make apples-to-apples comparisons of key data.

One caveat: The world is evolving and the idea of “cohort data” is thriving. As businesses evolve and new models like consumption- or payment-based pricing become more common, you may need to adjust certain metrics over time, particularly if you are a B2B SaaS company.

Deliver the goods

From the delivery point of view, I’ll share a couple of ideas.

The first is fairly well known: Don’t present slides; present the story. Board members are skilled at thin slicing through data and composing their questions ahead of time. Don’t feel the need to present every nuance around your data — get to the point.

The other piece of advice here is to look ahead. First-time attendees at board meetings often lean toward giving a look at the past, which is probably not where you should be focusing most of your energy. Read through your presentation and see how much focuses on the future versus the past.

The majority of your deck should paint a picture of what you’re going to do, not what’s happened. The board has received a board flash from the CEO right after the quarter closed and has now read the deck. What you’re here to do is share the adjustments you’re making to lead the business forward.

Finally: Create an appendix. This allows your content — new initiatives, changes to go-to-market strategies and product topics — to stay front-and-center and not get bogged down by too much data. But having an appendix still allows the board to view more detailed, quarter-over-quarter changes.

Focus on these five, must-have slides

I traditionally build my “talk time” around five revenue-focused slides during a board presentation. Some versions of these slides have been in my board decks for the past decade. These are data-rich slides, so again, prepare to discuss the story they’re telling and not the data.

For example, your board members will notice if your sales velocity is speeding up and your average selling price is trending down. They can see that in your numbers, so you need to explain why that is happening.

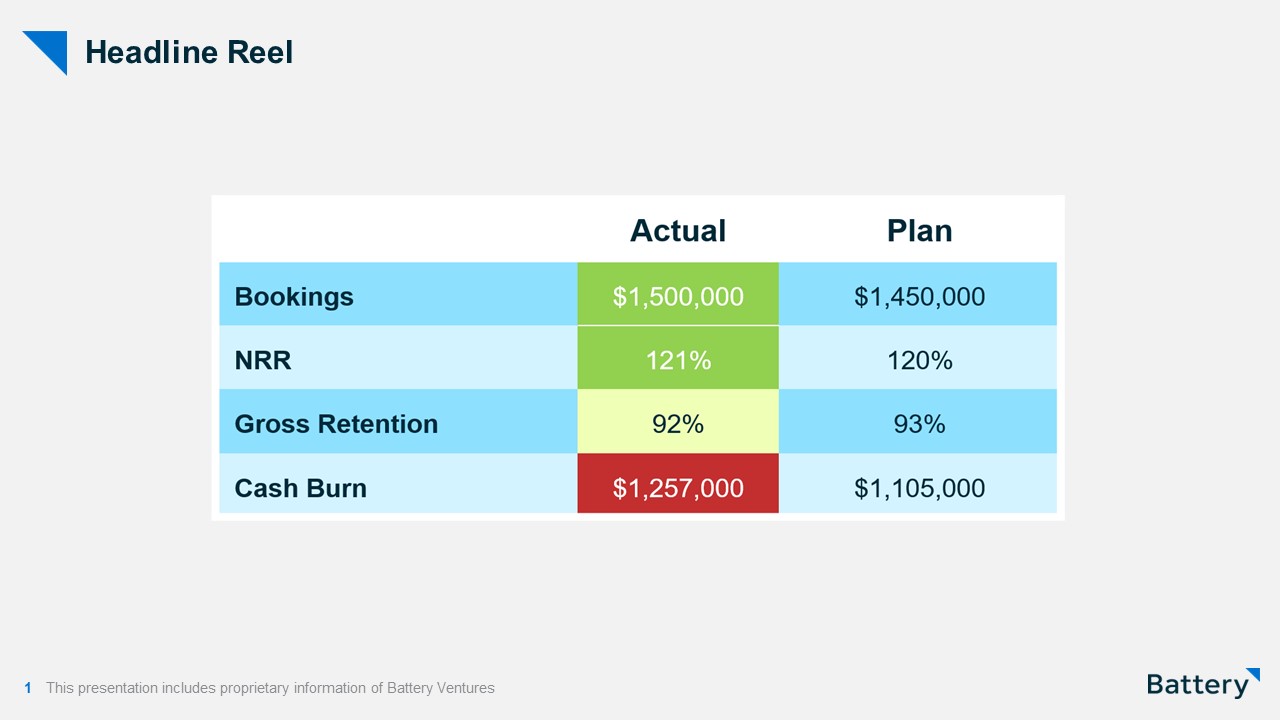

Slide #1: Headline reel

After the cover page and agenda, I think every deck should start with the headline reel: the key results of what you achieved last quarter. Regardless of whether your quarter was good or bad, don’t make the board search through the deck to find the details.

Your key metrics may vary, but for most SaaS companies, these four key areas should always make the front page: bookings, net-revenue retention (NRR), gross retention and cash burn. The board is looking to learn if the business is trending up, is flat or down, so strive to present this picture clearly.

Bookings are self-explanatory: How did we do against the plan? In the example below, I used a simple color-coding system to highlight the results and give more “tone” to the slide on how we performed. As you might expect, green is good, yellow is a warning sign and red spells trouble.

NRR and churn are next, and in my experience, the board likes to see these side by side. Did you exceed NRR because you booked a huge expansion deal, or did you do it steadily? Seeing these two metrics together can address that quickly.

Last is the cash position. We all like to see how efficiently we’re operating, so adding this metric provides a high-level view of the quarterly results.

Obviously, you can add other items that are critical to your company, like OKR performance and NPS. But I find the four mentioned above are the cornerstone elements of the opening slide.

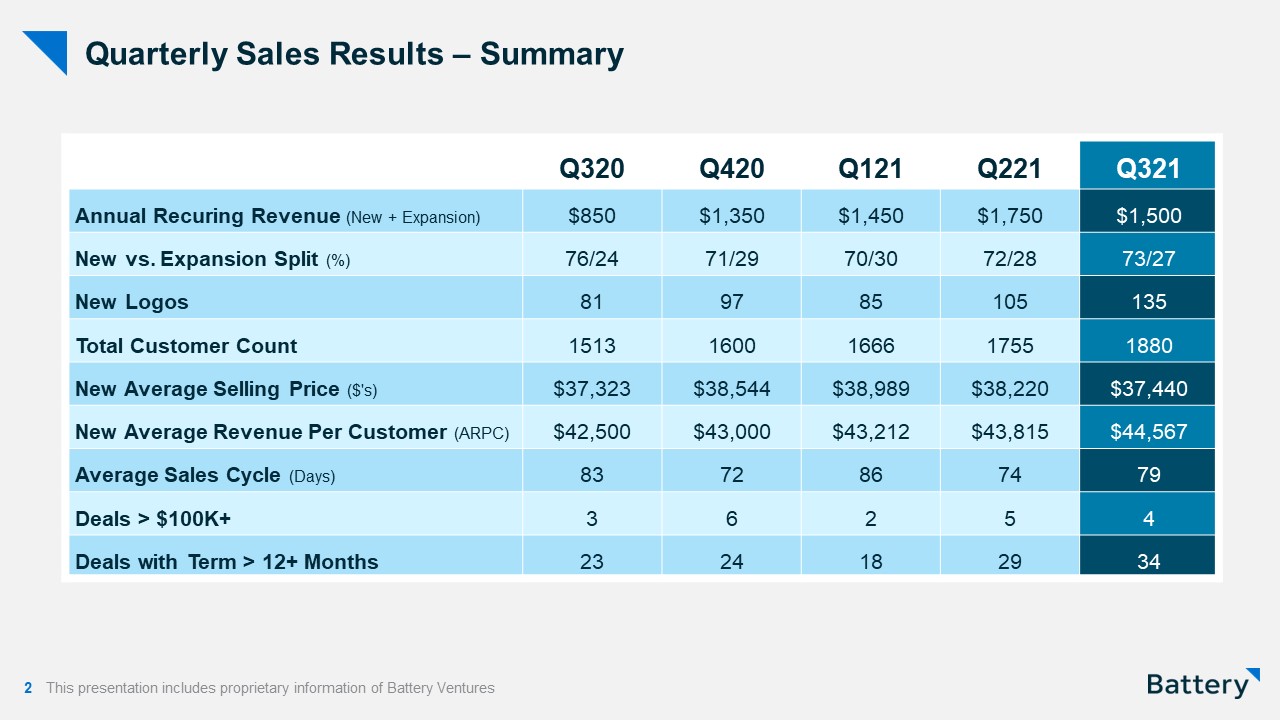

Slide #2: The detailed, five-quarter view

The next few slides provide increasingly deeper levels of detail. I’ve found that boards like it when I’m consistent with what’s presented each meeting, and when I answer questions before they are asked.

In my opinion, this second slide is the most critical. It gives a deeper look at your results than the highlight reel and shows it over a five-quarter view. Why five quarters? Because that time frame gives you a view of year-over-year results from the same quarter, plus a look at how the last three quarters have progressed.

A few additional comments:

The ARR line of your chart can be expanded to display a detailed look into your different buckets of revenue, such as new, cross-sell and upsell. I think displaying the split between new sales versus expansion sales is critical, especially if you start releasing subsequent products into the market. This helps you see how that product adoption is going.

Logos and customer count are next. These two lines allow the reader to understand the gross number of customers added in the quarter, as well as the total customer count (and obviously, lets you do quick math on how many customers churned).

The average sale price (ASP), or average revenue per customer, and the average sales cycle come next. These give a sense of the velocity of the business. Did deal volume pick up, but ASP fall? Can I see that the cycles are moving faster? Could that be indicative of higher competitive pressure forcing higher discounts? Simply put, these three data points provide an idea of what’s happening at the deal level.

Finally, I like to track deals over $100,000 (after some time, this metric may move up to $250,000, $500,000, etc.). Also worth reporting are deals with terms longer than 12 months. As you push toward more enterprise selling, the number of these long-term contracts you’re signing form a good metric of success.

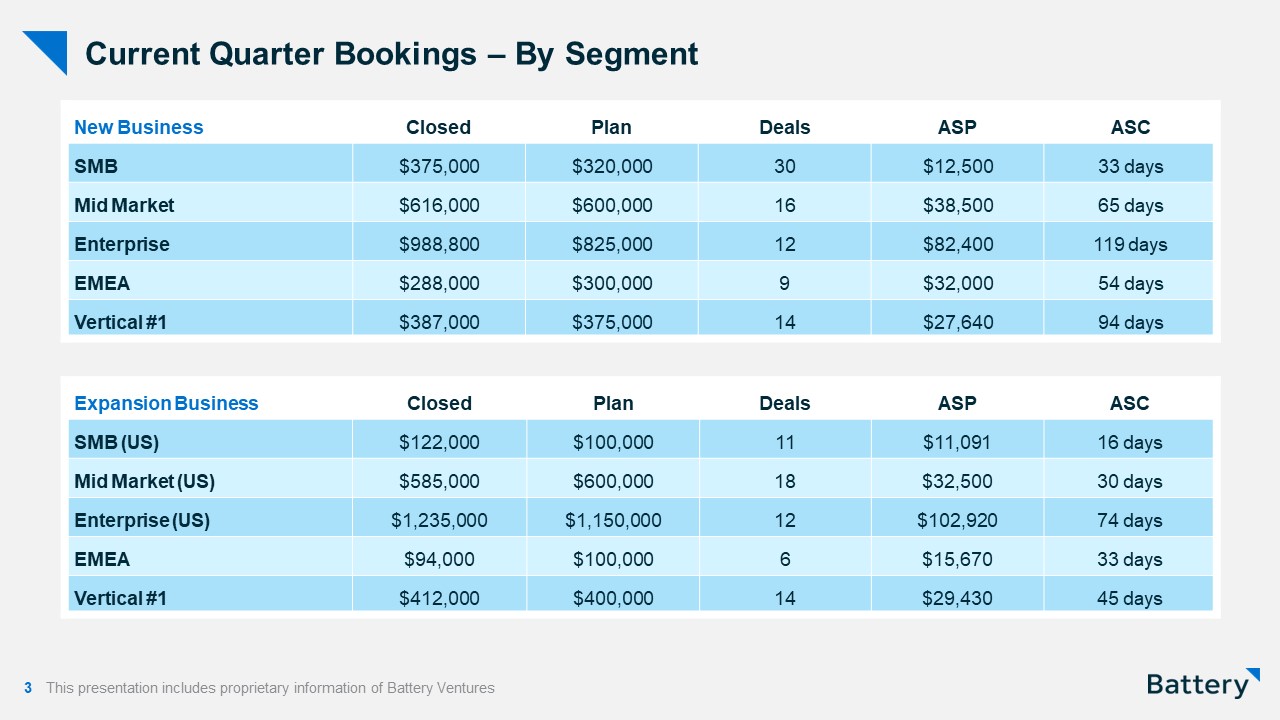

Slide #3: Segments, geographies and verticals

This is the sales detail slide. It breaks down your segments, geographies or verticals, and lets you evaluate how they performed.

Bookings versus the plan is the opening act here, followed by the number of deals, the segment ASP and the sales cycle length. I’d suggest you split this between new business and expansion business so you can have visibility on how both performed, especially if you have account executives selling to both new and expansion channels — this way you can see where you’re winning and what needs attention.

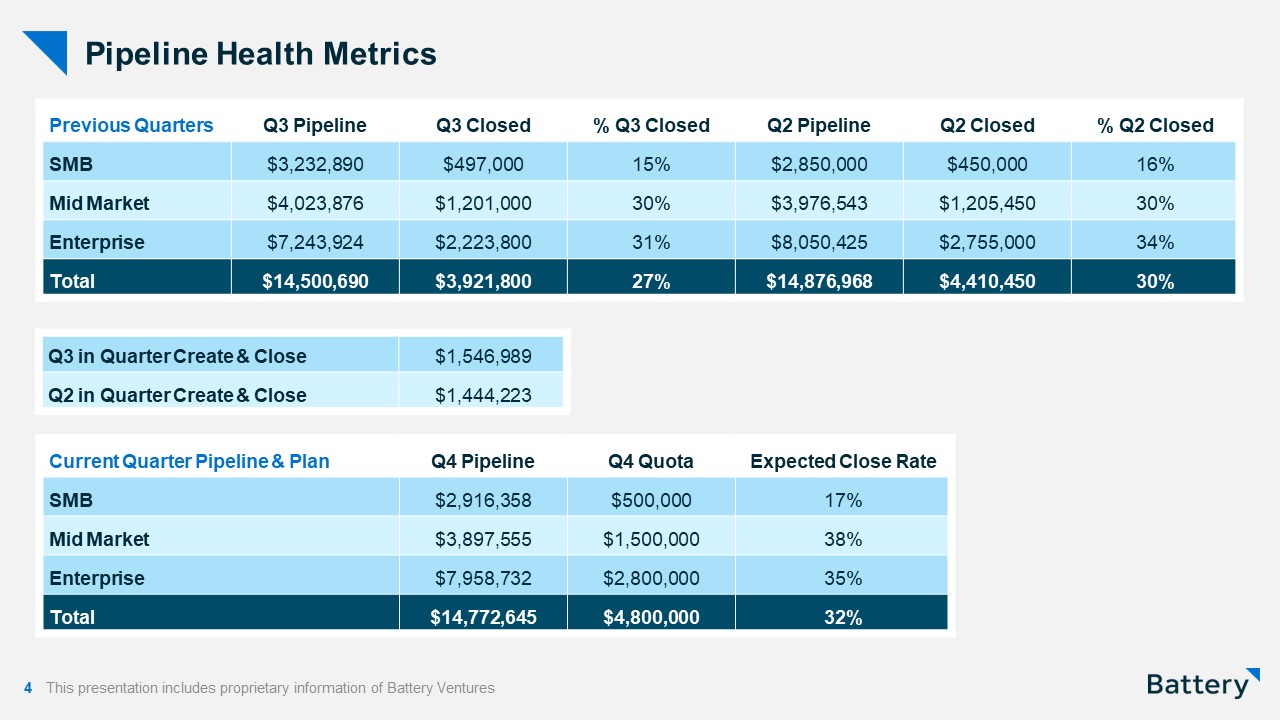

Slide 4: Pipeline

No board presentation can be complete without a sales pipeline slide. You should provide a look back at the quarter and focus on your conversion rates. Adding in these results from the quarter before is useful, too, as it lets you start spotting trends.

Specifically for companies that sell to SMB markets or have cycles that close in less than 90 days, the in-quarter, create-and-close stat is a useful metric. This data point helps you see how many deals are opened and closed within the 90-day quarter.

You don’t want to leave out the current quarter, as your board will want to see how the pipe looks to get a sense of this quarter. For bonus points, some CROs put their top deals on this slide, creating an ask for connections, intros and other help.

Slide 5: Sales team health

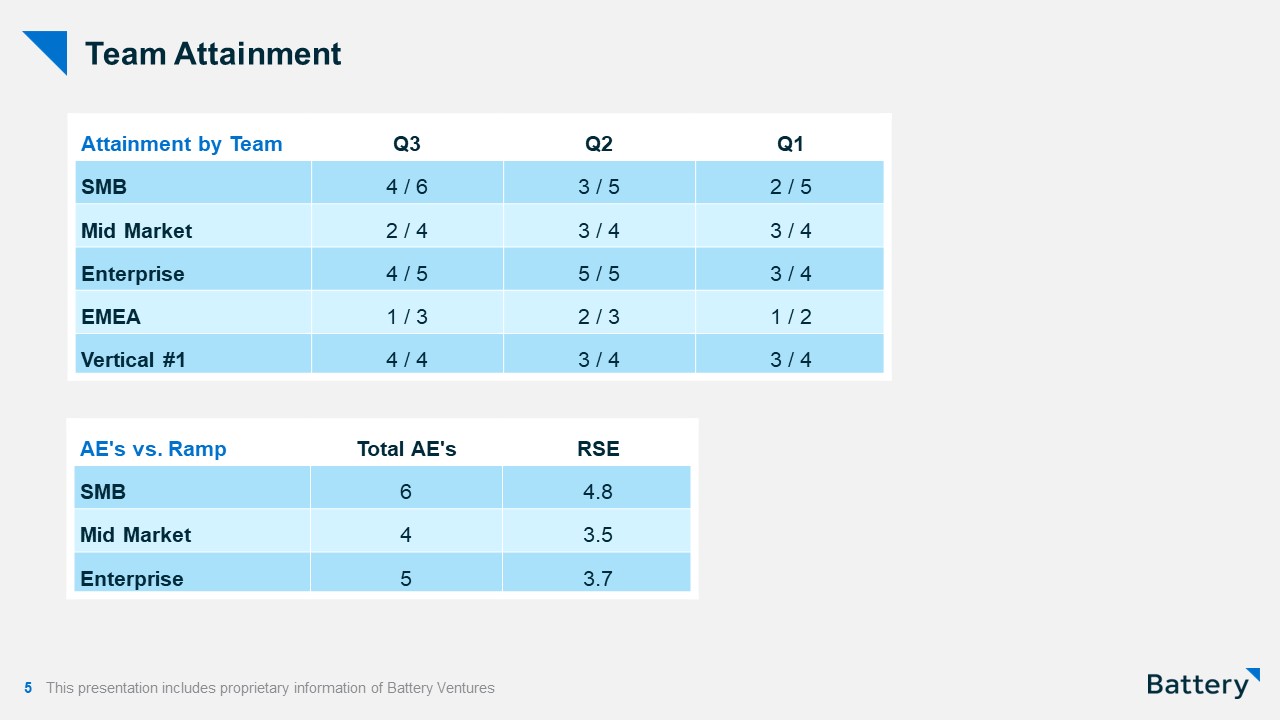

The last critical slide concerns team attainment. This is your “sales health” slide, comprising two critical elements: (1) What percentage of account executives are reaching their quotas? and (2) How are we hiring versus the plan?

The success of account executives is the barometer for company psychology in terms of whether you have a winning team or a losing team. I have a saying: Winning is infectious. Not only does the sales organization celebrate, but the whole company knows when sales is beating quota. This vibe travels fast. When over 50% of your sales team is meeting quotas, then the culture is winning.

But that’s only true in context of the hiring plan. If your entire sales team is above quota but you’ve only hired 50% of your planned headcount, it probably means you don’t have enough quota on the street. So while the sales team is succeeding, the company is likely missing quota. This is not good for CRO job security.

It’s worth considering if you should show your hired headcount versus the planned headcount.

In my experience, I’ve unfortunately been behind the amount of quota at the street level versus what the plan is, so this slide keeps me honest. If you see a company that is substantially behind its hiring plan, that’s a company missing its targets.

Finally, some of you may notice what’s noticeably absent from these slides: CAC, magic number, lifetime value and Rule-of-40 type metrics. These could be included here, but I consider this data to be more financially focused and less sales related.

Comment