Venture investors are betting that AI-focused startups are ready for the public markets, making more, larger, earlier bets on such companies.

It’s a great time to raise capital if your startup is building with — or on top of — artificial intelligence, regardless of how far along you are toward an exit. While many startup niches have seen their funding tallies rise in 2021, AI startups appear to be enjoying strong gains across younger and older cohorts, implying a broad base of customer demand.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

New data from CB Insights details a global AI funding market replete with activity, sharply divided by geography.

This morning, we’re making sense of the numbers with help from Sapphire Ventures partner Jai Das and Glasswing Venture partners Rudina Seseri, two of our regular check-ins when it comes to AI investing.

First, we’ll dig into the data to understand where capital is flowing today in the AI startup market. Then we’ll talk about why both early- and late-stage bets on AI startups are so very popular today.

First, we’ll dig into the data to understand where capital is flowing today in the AI startup market. Then we’ll talk about why both early- and late-stage bets on AI startups are so very popular today.

Record venture demand

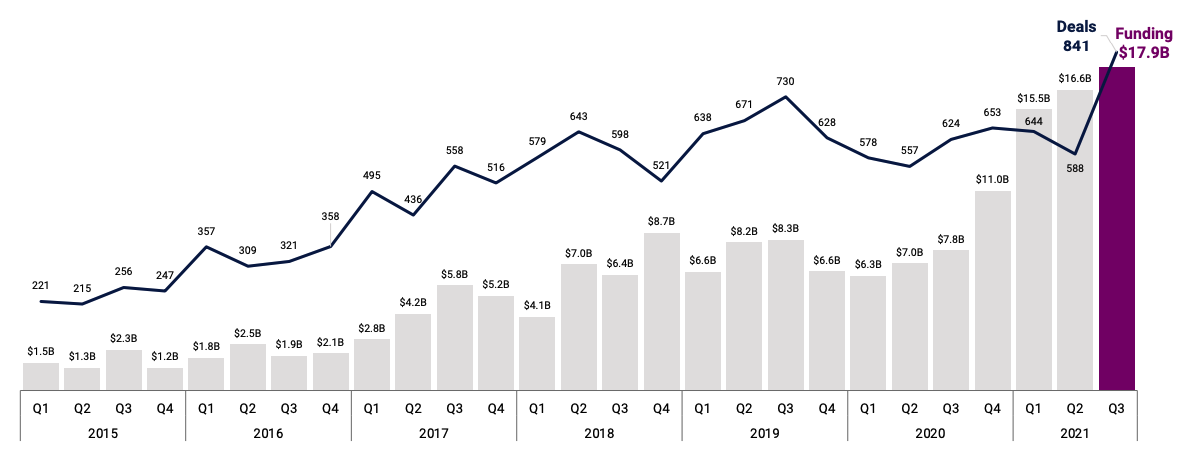

In the third quarter of 2021, investors poured $17.9 billion into global AI startups, CB Insights reports. The amount of money raised by the cohort of companies has risen every quarter since Q1 2020, when AI startups raised a local minimum of $6.3 billion.

But what makes Q3 2021 more than just another quarter of strong fundraising results from AI startups is a dramatic rise in deal volume.

Observe:

Record deals and record deal volume caught our eye. What’s going on?

Many startup sectors are seeing their venture capital totals rise on the back of more, larger mega-rounds, or investments of $100 million or more. The AI startup market is no different. In the third quarter of 2021, AI startups raised 45 mega-rounds, the third quarter in a row in which a tally of 45 or greater was reached, after posting 47 and 46 deals worth $100 million or more in Q1 and Q2 2021, respectively.

It’s worth noting just how different today’s AI startup mega-round pace is from prior years. In 2020, an average of 19.75 mega-deals were raised per quarter, according to CB Insights data and TechCrunch math. That number was just 13.5 per quarter in 2019, 12.25 in 2018 and six in 2017.

Notably, early-stage deal volume as a fraction of overall AI startup deal share is drifting lower as time passes and as midstage investments grow. In 2020, for example, early-stage AI investments were 65% of total deals, while midstage deals took up 20%. Thus far in 2021, the numbers are 61% and 22%.

But when we consider that there were 2,412 total AI rounds in 2020 and 2,073 through Q3 in an accelerating trend, it’s not a stretch to expect total deal volume in 2021 to rise, dragging absolute early- and midstage deal volume to new heights in the year, comparative deal share be damned. (Indeed, mega-round dollar share among AI startup rounds has fallen from a peak of 70% in Q1 2021 to 57% by Q3.)

And the early- and middle-stage AI startup deals are getting larger. Average deal size for AI startups has risen from $18 million in 2020 to $33 million thus far this year. But as average tallies can be skewed by a few large deals, we care more about median deal size. That is also accelerating, from $5 million in 2020 to $7 million thus far in 2021, a gain of around 40%.

More specifically, median angel AI startup funding events are now worth $6 million through Q3 2021, up from $4 million in 2020.

The data appears to paint the picture of a startup sector busy attacking a host of problems. Glasswing’s Seseri backed up this perspective, telling The Exchange in an email that while “enterprise interest” in startup AI products has “become much broader in recent years,” both AI and machine learning products more broadly “have become more robust across a variety of sectors,” helping drive market demand in markets from sales and marketing to cybersecurity.

A broader customer base and a wide application imply a huge remit for startups to build into.

Considering all of our data-focused work, we can draw a few conclusions:

- The accelerating pace of mega-deals for AI startups implies that the startup cohort is generating more IPO candidates than ever before. If you raise $100 million total, let alone in a single shot, investors are betting on an exit north of $1 billion, and hopefully much larger. Most of those companies will need to power their own exit instead of looking for a soft corporate landing.

- Rising median deal value and rising deal volume imply a robust early-stage fundraising market for AI startups. And expanding midstage deal share should keep the late-stage investing game well stocked. This should keep AI startup IPO expectations on the rise for the foreseeable future.

Just don’t expect all the AI startups you read about to be exciting. In fact, we could see a great many startups in the AI game working on problems that are far from headline-generating.

AI everywhere

As much as we like to think about futuristic technology and cutting-edge AI, many of these companies are tackling much more mundane tasks, but that doesn’t tame VC enthusiasm for them. On the contrary, Das’ Sapphire Ventures is bullish about “boring AI” – AI applied to solve simple problems. He gave the example of Sapphire-backed company Verbit, an AI-supported transcription and captioning service that aims for maximal accuracy with a “human touch.”

Indeed, Sapphire’s pragmatic take on AI means it doesn’t frown upon having humans in the loop, whether it is at Verbit or at a healthcare company it recently backed.

“AI is not going to replace humans [but] make humans better at what they do,” Das predicted. His take? That AI is in the process of cropping up across all sectors. “In general, I think any company that is building software … will have AI built into it,” he told TechCrunch.

If AI is becoming so ubiquitous, it is in part because it has never been easier to launch an AI-enabled startup. “The barrier to market entry has significantly been lowered in the past few years,” Seseri said, noting that “AI/ML is no longer a pure deep tech play requiring two or three years to realize commercial viability.” She explained this by “the proliferation of off-the-shelf models (OpenAI’s language generator GPT-3), templates, and robust open source communities that startups can use to generate innovative new solutions.”

At the same time, Seseri added, AI-enabled offerings are now in higher demand because their value add has become more obvious. “Companies, specifically enterprises, have invested increasing amounts of money into their data infrastructure and practices and they can now extract significant value from the technology. Providers of cutting-edge, high-value frontier tech can demand increased prices as value to the bottom line becomes more tangible.”

If we were to use the demand and supply resonance map theorized by VC firm pi Ventures, AI has significantly moved on both axes: toward more supply as tech became simpler and toward more demand as needs that were previously latent are now apparent.

From a VC perspective, the consequence is clear: “More founders can break into the space, prove initial traction and drive more capital from investors,” Seseri said. But if you are a founder, don’t expect investor interest to be fairly distributed. At least not yet.

The geography quandary

When we drill more deeply into just where the AI dollars are flowing in more granular geographical terms, it gets a bit choppier.

The United States, for example, saw $10.4 billion worth of AI startup investment in Q3 2021 across 324 deals. Asia saw just $4.8 billion worth of funding across a similar 321 deals. From there, the list drops off sharply, with Europe seeing $1.6 billion worth of AI startup capital from 142 deals.

Latin America saw just $500 million worth of transactions from 12 deals. Indeed, Canada by itself nearly matched all of Latin America’s AI venture activity in the third quarter, posting $400 million worth of dollar flow against 24 rounds.

For a startup to raise late-stage AI capital, then, is to exist in North America, Asia or perhaps Europe. Nowhere else is really active, though that could change if early-stage deals lead to attractive candidates in smaller AI markets for larger checks.

Thinking out loud, we may be seeing something akin to a generational differential in various startup markets. North America, Asia and Europe may be further ahead in certain areas like fintech, leading to startups tackling other, less solved issues. In contrast, more developing startup markets like Latin America and Africa are seeing huge fintech investments in recent years, perhaps due to a less developed economic environment on average and a less disrupted financial ecosystem.

If our read of the market holds, we should see comparative tallies of AI startup fundraising pick up in Latin America and Africa in coming years, as their fintech work gets sorted to the same degree that it has been in larger startup markets.

Yes, even our caveat is bullish on the longer-term trend of AI startup fundraising. Such is the state of things as we head into the final months of the year.

Comment