Of all the startup markets in the world, fintech in Latin America is one of the hottest. Capital is flowing into the region’s financial technology companies at a slicing pace, leading to a wave of startups that are building private-market value at a simply astounding rate.

The sheer volume of capital flowing into LatAm fintech startups may appear overheated, but several reasons explain why the flood makes sense. This isn’t to say that every deal and every resulting valuation markup is logical. But there are several factors in play that make the booming venture capital totals these companies are raising more reasonable than they might initially appear.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Regulatory tailwinds in select markets are helping build momentum for fintech products. Also, several startups — we’ll speak to Pomelo and Belvo below; Swap is another example — are working to build infrastructure that should help bring more financial services to market.

And finally, the Latin American fintech market is seeing exit volume pick up, not only implying that capital can be returned to investors who bid up the region’s startups, but also that funds previously preserved in private-market amber and recently made liquid can be reinvested in startups, creating a virtuous circle.

Let’s quickly chew on just how much more money fintech startups in Latin America are raising this year before turning to discuss the logic behind the influx.

A rising tide of capital

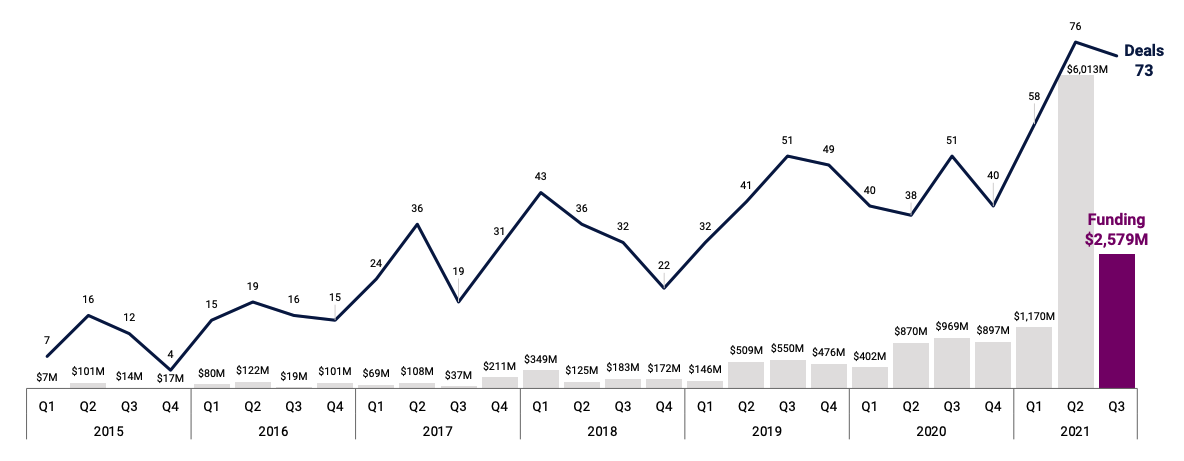

CB Insights data indicates that despite rapid growth from 2015 to 2020, when Latin American fintechs raised $138 million and $3.14 billion, respectively, 2021 stands apart from other years in terms of growth.

It’s proved somewhat common to see rising dollar volume for any particular venture capital market or startup category reach new highs in recent quarters. But we’ve seen such records come often with flat, or perhaps even lower, deal volume. That is not the case with LatAm fintech; both dollars and deals in the region are going to smash through 2020 and 2019’s superlatives, and indeed have already done so.

The dollar result will wind up more impressive than the deal figure, but both are set to crush prior totals.

Narrowing our vision to quarter tallies over yearly and year-to-date results, Latin American fintech startups just had the second best quarter on record. The startup cohort’s Q3 2021 period was only beaten by Q2 2021; if we excise the second quarter, for reference, Q3 2021 itself is more than a double of any prior quarterly record.

So while Q2 2021 was supreme, Q3’s numbers are spectacular on their own merit. For perspective, the $2.58 billion that financial technology startups in the region raised in the second quarter was more than any preceding year’s tally for the same collection of corporations, excepting 2020. For a single quarter, that’s extraordinary.

Happily for founders, the funding did not merely land in a single stage of startup life. Instead, 68% of deals thus far in 2021 for LatAm fintech startups were early stage, 14% midstage and 12% late stage. The final group is a bit overweighted compared to what we’d anticipate, but the pipeline of new projects appears to be very strong.

What’s driving the dollars, deals and early-stage startups forward? A few things.

Tailwinds, for better or worse

When we think about Latin American fintech, Brazil is perhaps the country that first springs to mind. It’s where mega neobank Nubank got its start, and we’re tracking lots of activity in the country.

Per CB Insights, two out of Q3’s 10 largest Series B fintech rounds worldwide went to Brazilian companies — MercadoBitcoin and Cora. And in a turn of events that would have been unexpected a few years ago, the quarter’s eighth-biggest global IPO exit by valuation was TC’s, formerly Traders Club, which listed on Brazilian stock exchange B3.

It does help that Brazil is gathering fruit from recent regulatory rollouts such as nationwide electronic payment scheme Pix and the Open Banking initiative. A general partner at ONEVC co-leading the firm’s efforts in Brazil, Bruno Yoshimura commented on this environment: “The Central Bank has been doing a tremendous job, and Pix is one of the most relevant structural changes. [ … ] It is fascinating that they already have 105 million people registered in such a small period of time. Both Open Banking and Pix will level the playfield for new challenges and we expect to see a lot of innovation around them,” he predicted.

But as we have pointed out in the past, there are also opportunities for startups in more challenging environments. For instance, when the CEO of Argentine fintech Exactly, Gabriel Gruber, joked on Twitter that Argentina was unrivaled in adopting public policies to boost crypto adoption, he wasn’t referring to doing it on purpose like El Salvador did. Instead, he was taking a jab at foreign exchange restrictions and the government’s controversial monetary policy — all of which fuel appetite for alternatives. “Crypto use cases make a lot of sense in markets with weak currencies and/or high inflation,” Irigoyen concurred.

Work ahead

Offering fintech services in LatAm is still harder than in other regions, especially cross-border, but Belvo, Pomelo, Swap and others are all working on making this easier. “It currently takes about 18 months to launch a fintech in any given [Latin American] market,” Argentine entrepreneur Gaston Irigoyen told TechCrunch. “Our goal at Pomelo is to fix that, to make LatAm look like Europe in terms of helping companies unlock multiple markets almost simultaneously.”

Similarly, fintech API startup Belvo is tackling the infrastructure layer, but its co-CEO Pablo Viguera acknowledges that this is fairly new. “Until recently,” he said, “being able to offer many of the fintech services and products that are now attracting funding took too long and required a large investment of resources and technological development, which prevented companies from achieving their goals.” And while this “has changed dramatically” (his words), there is still room for growth before it comes to parity with Europe, let alone the U.S.

However, LatAm has an advantage over more developed regions: It has more unmet needs, and therefore presents more opportunities for startups. “Roughly half of the population remains unbanked,” Pomelo’s Irigoyen noted, “so fintechs have been modernizing and democratizing financial services for a few years and their products are now robust and mainstream.”

This also echoes the market presentation that Nubank included in its F-1 IPO prospectus, in which it highlighted that the market where it operates “remains significantly underpenetrated with respect to financial services compared to developed economies.” Culprits, Nubank argues, include “prohibitively high costs for financial services,” as “the banking sector in Latin America is highly concentrated.”

“While this concentration has enabled the large incumbent banks to maintain their status quo,” the document goes on, “we [at Nubank] believe it also creates a very fertile environment for disruption from new entrants who can use advanced technology, data and customer service to level the playing field.”

And while this was long coming, there’s another factor to take into account, Irigoyen said: The pandemic, which has “fast-tracked both financial inclusion and the adoption of digital payment methods.”

Lots of capital, but lots of competition

While COVID-19 has helped drive adoption of digital products and services, it has also changed the labor market. And not always for the better, when it comes to startups. Flush with new capital, LatAm fintechs are not shy about putting funding to work, which means rapid hiring. But they are running into both their local peer set and larger international companies more comfortable with remote hiring in the pandemic’s wake.

Viguera told The Exchange that “finding the right people is always a challenge and generally, the demand is high.” That is not a surprise, but the executive added that thanks to “COVID-19, more international companies are increasingly hiring in Latin America because there’s an enormous talent pool in the region.” That’s good news for regional talent looking to trade their labor for more dollars, and more shares. But less good for local startups now competing with not just the startup down the street, but also with global tech majors with bigger brands, and deeper pockets.

There are other wrinkles in the Latin American venture capital market for fintech startups. ONEVC’s Yoshimura notes that his firm’s “average investment pace is at 2.2x right now versus last year and 50% of the deals we’ve done this year are fintech.” Those data points imply that not only are regional fintech startups raising rapidly — boosting internecine hiring competition — but also that there are just a lot of startups in the sector. Which, again boosts the talent market wars.

The capital flows are also bolstering competition between startups for market penetration. We asked Belvo whether the regional capital influx was making its market more competitive. Viguera said that Belvo has “some competitors at a regional level,” before arguing that his company’s broader, “truly pan-Latin American” service sets it apart.

That said, the co-CEO did allow that his company’s market is “a space that is growing and we believe that’s good news for the sector, as more players realize the potential of APIs to transform financial services across the region.”

There’s likely plenty of room for a number of fintech success stories in Latin America, but the huge capital inflows will keep their talent market tight and the competitive landscape cutthroat until consolidation shakes out smaller players.

What startups and venture investors are chasing

If a more competitive product and talent market would give you pause at adding more bets to the LatAm fintech space, you aren’t thinking like a venture investor. Why? Because they chase the truly outsized results, the sorts of investments that return whole funds. And so long as Latin America can produce such winners, it will continue to attract outsized venture capital.

Yes, we’re talking about Nubank, which has a simply huge IPO coming. (The Exchange looked into its financial results here, if you’d like a tour.)

Yoshimura told The Exchange that “Nubank will set a new bar of what is possible in LatAm.” Why? In his view, because before the company’s breakout success, “there weren’t great examples of major VC-backed B2C companies with such a two-digit market share in a massive industry.”

Nubank’s impending IPO shows that you can build not just unicorns in the Latin American region, but you can build decacorns in the area, while also taking on a regulated industry replete with incumbents.

“Nubank is setting the bar of how big can a business get on an IPO and will make VCs think more thoroughly about how big can a business get if everything [goes] right,” the investor added.

To some degree then, Nubank’s IPO will be a tone-setting event. Generally expected to do well, if Nubank prices strongly and soars, expect the money gusher that LatAm fintech has enjoyed to continue. A neutral IPO probably wouldn’t be enough of a negative signal to slow capital. But a very negative result might give pause.

The Exchange will cover the Nubank IPO in detail.

Comment