Despite an impressive growth run on its way to the public markets, when Robinhood did finally price its IPO, the result was a bit slack. The consumer-friendly trading platform priced at the lower end of its IPO range and traded lower in its opening session.

For a company that rode a boom in consumer saving and investing activity, it was a sort of odd final entry in its private life.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Now public, Robinhood is writing a new book, adding a first chapter last evening when it reported its Q3 2021 earnings. The results were lackluster, leading to the company trading sharply lower this morning.

Robinhood greatly missed expectations, and its guidance was far from inspiring. What happened to the company that once posted sequential revenue gains that raised eyebrows and popped eyeballs? It’s worth a little time to understand.

After all, Coinbase also makes the bulk of its monies from trading fees. And Robinhood and Coinbase are hardly alone in doing so. There are other richly valued equities-and-cryptos trading platforms out there, including WeBull and FTX. Could they face similar issues? It will serve us well to pay attention to what Robinhood’s Q3 performance may be able to tell us.

After all, Coinbase also makes the bulk of its monies from trading fees. And Robinhood and Coinbase are hardly alone in doing so. There are other richly valued equities-and-cryptos trading platforms out there, including WeBull and FTX. Could they face similar issues? It will serve us well to pay attention to what Robinhood’s Q3 performance may be able to tell us.

Into the numbers!

Q3 by the numbers

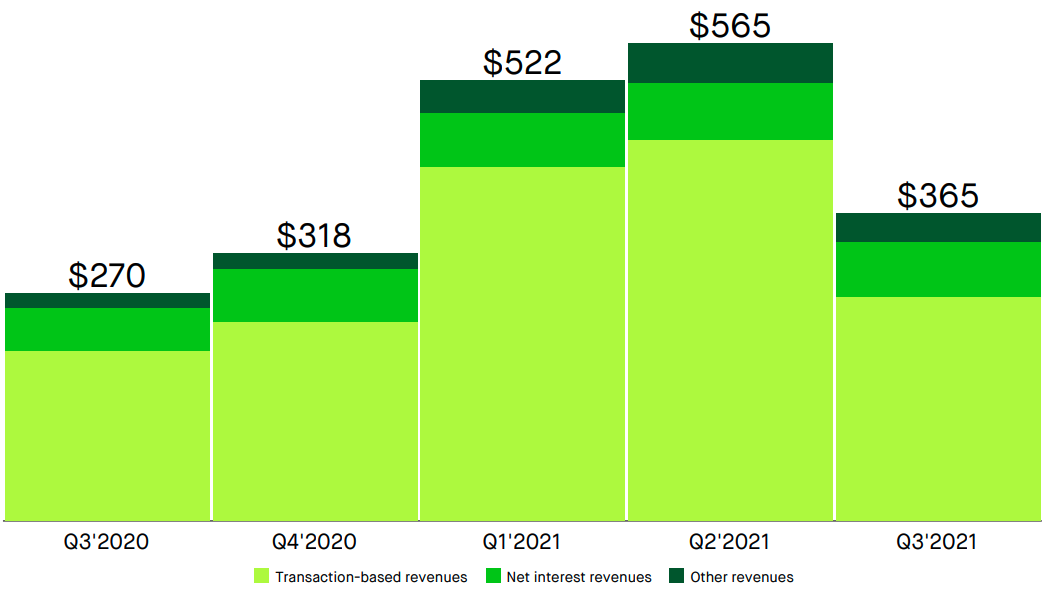

Before we get into the why, let’s talk raw figures. In the three months concluding September 30, 2021, Robinhood generated $365 million in revenue, up 35% from its year-ago quarter. The company generated options-related transaction revenues of $164 million (+29% YoY), cryptocurrencies-related revenues of $51 million (+860% YoY) and equities transaction top line worth $50 million (-27% YoY).

Robinhood’s net loss came to $1.32 billion, though seeing companies take huge losses in the quarter following their IPO is not uncommon. In adjusted EBITDA terms, Robinhood turned in -$84 million worth of the stuff in Q3, off sharply from a year-ago $59 million adjusted profit.

Robinhood expects to post yet another quarter of sequential revenue declines in Q4, noting that it will have revenues of less than $325 million. That’s not good. Especially for a company that posted revenues of $565 million in Q2 2021, or given that analysts expect Robinhood to generate $497.99 million in Q4 revenue.

How did it all get so weird so fast?

Down, to the right

In simple terms, Robinhood saw its user base, crypto trading revenues and revenue per user metrics fall. The combined whack to its overall revenue led to the company’s profitability picture taking a beating.

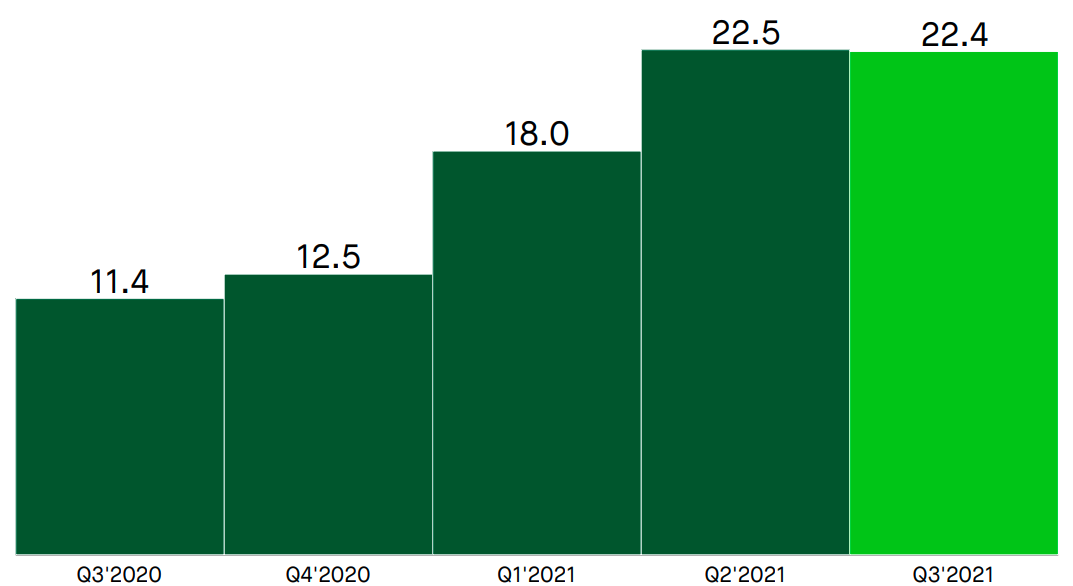

Pulling from its investor deck, here’s how Robinhood’s user base (“net funded accounts”) has grown over time (note the recent decline):

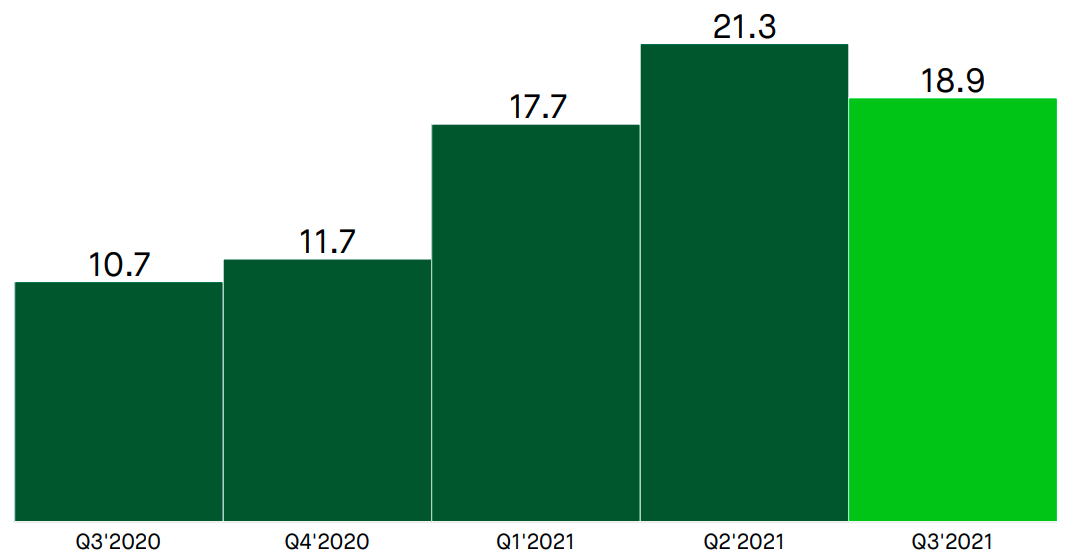

What led to the end of Robinhood’s upward user trajectory? A hint can be found in its reported monthly active user (MAU) count, which fell:

Falling MAUs and a modest decline in net-funded accounts fit together neatly; usage fell, leading to more account churn against lower sign-ups.

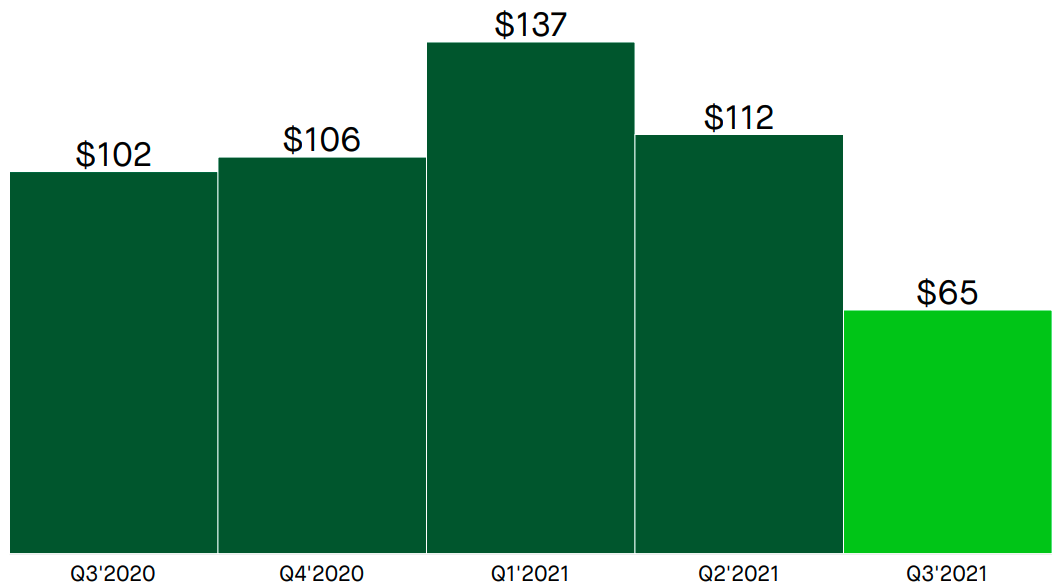

Robinhood’s falling MAU tally was coupled to falling average revenue per user (ARPU). Observe:

Falling users multiplied by declining ARPU leads to what? Yep, declining revenues:

Recall that Robinhood expects “that total revenue will be less than $325 million” in Q4, and you can see that the downward slope to the chart is pretty sharp. Robinhood may post precisely zero revenue growth when comparing Q4 2020 to Q4 2021.

Which is flat wild. The company was growing by leaps and bounds! What happened?

Blame it on Doge

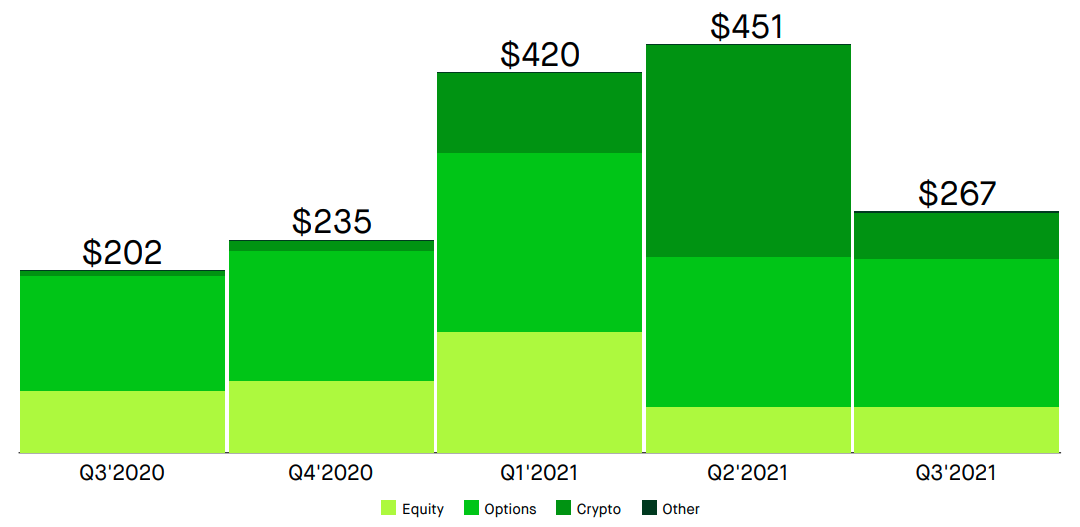

The above chart aggregates Robinhood’s transaction revenues into a single bucket. By doing so, we can’t see its changing transaction-based revenue mix. Happily, there’s a chart for that:

Notably, in Q3 2021, when compared to Q2 2021, equity and options incomes were pretty much flat. But crypto revenues dropped like a stone. They are responsible for Robinhood’s revenue declines from Q2. And that matters quite a lot for other companies.

Recall that Robinhood did warn us that its crypto revenues would fall.

Coinbase also generates revenues from transactions — and just those in the crypto space. If it has seen even a fraction of the downturn that Robinhood has experienced in terms of crypto transaction incomes, it could have a tough quarter. The same logic applies to FTX and other exchanges: Are we seeing volumes fall in terms of crypto trading?

The somewhat OK news for Robinhood competitors with more of an equities focus is that Robinhood’s numbers are less bad. Sure, flat revenues are not good, but they are better than implied declines, right?

All told, it appears that Robinhood nailed its IPO timing and raised what could be considered the maximum that it could. Not that that will be any comfort to those who bought into its shares at their 52-week high — $85.00, per Yahoo Finance — only to see them worth just $35.56 today.

Comment