Good news, everyone: The Q4 IPO cycle is now well and truly underway.

For those of us who prefer to read IPO filings to funding announcements, new S-1 documents from Udemy, Rent the Runway and others just touched down. But we care the most about those two, as they are listings from venture-backed companies that we’ve covered here at TechCrunch over the years.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

This morning, we’re going to dig into the core business results of each company, discussing how they make money and the state of their recent results. This entry will dive into Rent the Runway; afterward, we’ll dig into Udemy. Today is a rare two-Exchange day. You are welcome.

Off the top, I’m incredibly curious what impact the pandemic had on Rent the Runway’s numbers — after all, no one needed a loaner gown for months and months — and how strong its gross margins have proved over time. I also want to understand how expensive it is to buy all the clothing items that the company needs to operate, and how those costs are accounted for in its reporting.

While private, Rent the Runway raised hundreds of millions of dollars in equity funding and the odd debt round. The company’s most recent major investment was a $125 million Series F announced in March 2019. The company was valued at a flat $1.0 billion after that transaction, Crunchbase data indicates. Fidelity, Bain Capital Ventures, Highland Capital Partners, Kleiner Perkins, TCV and others invested in the company during its private life. Let’s see how it has performed.

While private, Rent the Runway raised hundreds of millions of dollars in equity funding and the odd debt round. The company’s most recent major investment was a $125 million Series F announced in March 2019. The company was valued at a flat $1.0 billion after that transaction, Crunchbase data indicates. Fidelity, Bain Capital Ventures, Highland Capital Partners, Kleiner Perkins, TCV and others invested in the company during its private life. Let’s see how it has performed.

Rent the Runway’s IPO filing

You are likely familiar with the Rent the Runway model: It buys expensive clothing aimed at women, renting the pieces out to subscribers and customers for a fraction of their retail price. The idea is that customers want a more varied wardrobe and want to wear items that they would not be able to afford on their own. Customers can subscribe to the company’s service or rent individual items piecemeal.

By lucky happenstance, your servant got his first real tour of the Rent the Runway product a few days ago, so I am moderately read-up on how it works in practice. Rent the Runway has a truly epic selection of items, and frankly shopping for designer items at rental prices is good fun.

But is it a good business? It’s a little hard to say, but I am not leaning toward yes.

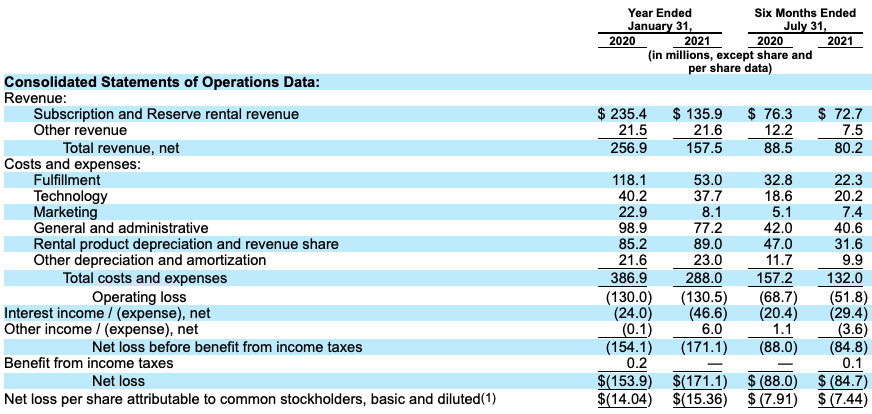

COVID-19 was not kind to Rent the Runway. This makes sense. Clothes are for wearing places, and the pandemic kept most of us at home. Naturally, then, revenues at the company declined during its fiscal 2020, a 12-month period that ended January 31, 2021:

I doubt that anyone expected the company to grow during 2020 thanks to COVID, so let’s zoom in a bit on Rent the Runway’s more recent results.

Here we can see a revenue decline yet again, from $88.5 million to $80.2 million during the six months concluding July 31 in 2020 and 2021, respectively. Costs also fell during the period, from $157.2 million to $132.0 million, which helped the company lose slightly less money in that time frame. Note the company’s high interest expenses, which impact its net income and will come back into our conversation shortly.

Eagle-eyed readers will note that the company doesn’t break out its gross profit in the above calculations. That might surprise us a little.

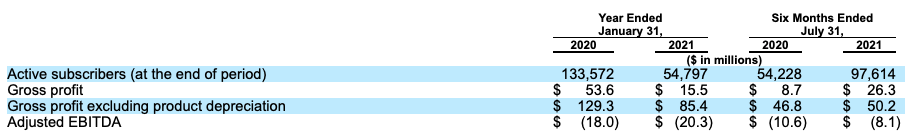

The reason that the company doesn’t, by our read, is that its GAAP-friendly gross margin calculations are not really what it wants you to focus on. Rent the Runway calculates gross margins in two ways. The first, and the one we care about, is inclusive of rental product depreciation. The second is not. And, surprise surprise, the latter makes the company look much better:

The gap between gross profit and gross profit excluding the cost of clothing depreciation is huge.

Rent the Runway notes “purchases of rental product” in its investing cash flow, and depreciation of those items in its operating cash flows. For example, in the company’s fiscal 2019 (the 12 months concluding January 31, 2020), Rent the Runway spent $117.7 million on clothing purchases, and noted “$76.1 million [worth] of rental product depreciation and write-off expenses.” As the numbers indicate, it’s expensive to buy lots of high-end clothing, and there is material wear and tear from renting the items out to folks who wear them out in the world.

All this is to say that when we consider Rent the Runway’s aggregate profitability, we aren’t really in a mood to discount depreciation costs, as they are essentially the result of investing cash flow; or, more precisely, they are how the company’s clothing purchases show up in its operating results. They matter.

From here things get a bit more grim. The company is heavily indebted, with some $381.8 million worth of long-term debt. That pile of promises is expensive, harming Rent the Runway’s overall operating profile. Sure, debt is not a sin in the abstract, but at a company with profitability issues, carrying that sort of debt load is not ideal.

Closing our coverage of the company’s operating results on a high note, Rent the Runway’s July 31, 2021, quarter was its best in revenue terms since its April 30, 2020, period. And the company’s $15.0 million worth of “rental product depreciation and revenue share” was its lowest on record for any single-quarter period we have data for. Sadly, the company still lost $42.4 million on a net basis during the three-month period.

What’s it worth?

I have precisely and exactly zero idea how to value the company. The company’s growth profile may depend heavily on how quickly the world returns to travel, in-person work and socializing. Its profitability will depend heavily on its ability to make clothes last longer and acquire them for less. And the company’s debts are worrisome.

Where Rent the Runway sets its first IPO price range will prove illustrative regarding market sentiment. Just keep in mind that at a $1 billion valuation, the company is worth 5.4x its current annual run rate, as set by its most recent quarterly revenue result ($46.7 million). How high or low that metric feels to you will help you come to an opinion when the company does set a price for its debut.

Comment