Now out of office, news regarding former President Donald Trump has been rather lacking from TechCrunch’s pages. He’s back.

News broke yesterday that Trump Media & Technology Group, a concern formed to take on a host of major technology and media companies, plans to go public via a merger with a SPAC. The blank-check company in question, Digital World Acquisition Corp., recently raised $287.5 million.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The merger of Trump Media & Technology Group — TMTG from here on out — and Digital World will sport “an initial enterprise value of $875 Million,” with the potential for another $825 million in capital “depending on the performance of the stock price post-business combination.”

Per the release disclosing the transaction, “Trump Media & Technology Group’s growth plans initially will be funded by DWAC’s cash in trust[.]”

The former president has apparently decided that funding the company that bears his name would be too expensive, so he’s leveraging a SPAC to underwrite the effort.

Regardless of how we feel about that, we have to take this news item seriously. Because when the name of the company says “Media & Technology,” it apparently means it. An overview of the TMTG company shows huge aspirations — if limited evidence of actual progress. A quarter-billion dollars will certainly help.

First, some notes on the money in the deal. And then an overview of what TMTG wants to build.

Are we being punished?

Yes. Clearly.

Back to work: Digital World Acquisition Corp. priced at $10 per share, as is standard with blank-check companies. The company has two classes of shares listed, including units ($DWACU), inclusive of a Class A share and half one a warrant, and Class A themselves ($DWAC).

Both rose sharply on the news of the combination. In pre-market trading, units of Digital World are up some 66% to $16.86, while Class A shares are a more modest 48% to $14.79.

Assuming no redemptions — a huge assumption in today’s era of rising SPAC redemptions — TMTG will have around $293 million from the blank-check company with which to build. But build what?

The Exchange was unable to find a traditional SPAC investor deck with revenue forecasts and the like as of the time of writing, but we do have a presentation from TMTG itself, which is illustrative. Let’s explore.

Is this real life? Is this just fantasy?

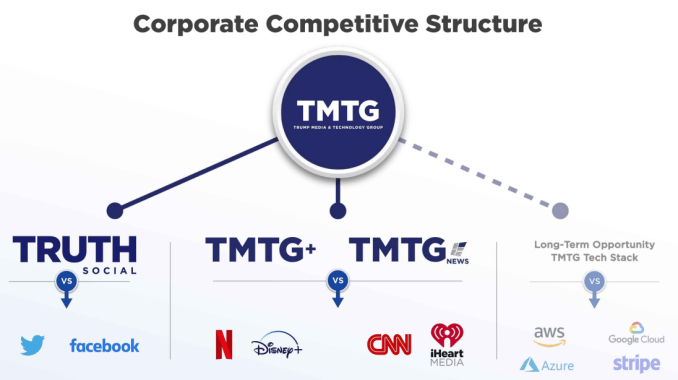

The business targets of TMTG are pretty clear: Major social media platforms like Twitter and Facebook, and major technology companies like Amazon, Microsoft, Google and Stripe. The group also has plans to take on major content streaming firms like Netflix and Disney, and major news orgs like CNN, along with audio-focused groups like iHeartRadio.

From the company’s own presentation:

In a blinding flash of humility, TMTG allows that taking on public cloud and fintech infrastructure giants is more a “long-term” goal, not something it intends to get busy on right away.

But what does appear to be in the offing is a social network (Truth Social), a streaming service (TMTG+) and a news org (TMTG News).

All of which it has big hopes for. The following graphic is not a joke that we whipped up. It is the entirety of page 12 of the investor presentation:

Cool.

More granularly, Truth Social appears to be some sort of Twitter knockoff. Per the company, this is what it is setting out to build:

An earlier image in the deck shows images of the application, replete with — I shit you not — lorem ipsum text. From provided screenshots, then, Truth Social appears to be unfinished. I signed up, but was not immediately invited to join. Some folks appear to have gotten in through another method.

TMTG is asking folks to pre-save the application on the iOS app store, which you can view here. The social service has a number of rules associated with it, including the following prohibitions:

- “use [of] the Site to advertise or offer to sell goods and services.”

- actions that “harass, annoy, intimidate, or threaten any of our employees or agents engaged in providing any portion of the Site to you.”

- using the service to “disparage, tarnish, or otherwise harm, in our opinion, us and/or the Site.”

The Truth Social network also reserves the right to “DENY ACCESS TO AND USE OF THE SITE (INCLUDING BLOCKING CERTAIN EMAIL AND/OR IP ADDRESSES), TO ANY PERSON FOR ANY REASON OR FOR NO REASON.” So don’t piss off the mods, or you are out, it appears. (Yes, it is ironic that Trump is lending his name to a project that is a response to his being kicked off of Twitter and Facebook that reserves that same right with regards to others.)

Moving along: TMTG+ will be an “on-demand streaming service that will provide news, big-tent entertainment, exciting documentaries, sports programming, and more.” The deck goes on to argue that the “American public is seeking ‘non-woke’ entertainment, and TMTG+ will provide content for all to enjoy.”

I personally cannot wait to see a knockoff ESPN clone make bigoted jokes to appease the non-woke crowd. Hell, maybe they can even crack a few jokes about female refs in the NFL and note that women’s sports aren’t as well-viewed as men’s? That would be swell. What a treat!

Details are light on what the TMTG News product will be, as are details concerning precisely how TMTG intends to take on AWS, Azure, Google Cloud and Stripe in time. But, hey, with nearly $300 million, perhaps there’s a chance that some fraction of what this SPAC-led combination intends to build actually launches?

I am doing my best to hold back an ocean of snark this morning, but I cannot imagine a more 2021 news story than the former U.S. president leveraging a blank-check company to fund a project that he won’t bankroll himself in an effort to take on trillions and trillions in dollars worth of American corporate might, just because they have annoyed him.

It’s not nearly enough money. Ten times the money wouldn’t be enough. To underscore just how underpowered TMTG is, Twitter’s operating costs in Q3 2021 were $1.16 billion. Facebook’s Q2 2021 saw operating costs — exclusive of revenue expenses — of more than $10 billion. Throw in the money that Netflix, Disney and CNN spent in their most recent quarters alone, and you start to get a feeling that a little under $300 million once is not going to be enough to unseat them all.

A few questions remain:

- How hard does the SPAC get hit with redemptions, and how far does that deplete the potential TMTG cash position post-combination?

- Who gets the “potential additional earnout of $825 Million in additional shares”?

If the answer to question two is Trump himself, I will not be surprised, but I will be incensed.

Set your bets, everyone, regarding how well this overall effort will perform. Personally, I expect it to underperform Air America and Gettr, but that’s me.

If and when the social network does let us in, we’ll report live from the frontlines of Truth. Gird thyself.

Comment