Any subscriber to the Daily Crunch newsletter is familiar with just how often Indian startups take point in our coverage of emerging technology companies around the world. The country’s prominence has perhaps also risen as the Chinese venture capital market evolves in the face of a changing regulatory environment.

A number of Indian companies have recently gone public or started the IPO process. Those exits have proved more than merely useful for recycling capital into the Indian market; they’re showing global investors of all stages that startups in the country can go from seed to redwood.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The result of a long ramp in venture capital activity since COVID-19-induced lows in early 2020 is an Indian startup market that is going flat-out bonkers. Venture capital data from the country is, even for 2021, surprising.

To get our heads around just what’s going on in the country, The Exchange got ahold of GV Ravishankar, a managing director at Sequoia India, and Kunal Bajaj, head of Capital Network at Blume Ventures.

Just how active is the Indian market today? Ravishankar said that India is “undeniably going through one of the best periods for startups with respect to their ability to raise financing on a continuous basis.”

Just how active is the Indian market today? Ravishankar said that India is “undeniably going through one of the best periods for startups with respect to their ability to raise financing on a continuous basis.”

The VCs helped us understand what’s driving Indian startups to not merely set new records in terms of capital attracted, but accelerate prior gains to totals that we may not see again for some time after the current business supercycle comes to a close.

New records for India’s startup market

When Q3 venture capital data touched down, The Exchange got busy digesting hundreds of data points. Diving into fresh quarterly data is nearly as good as a spanking-new S-1 filing in terms of filling in gaps in our market comprehension.

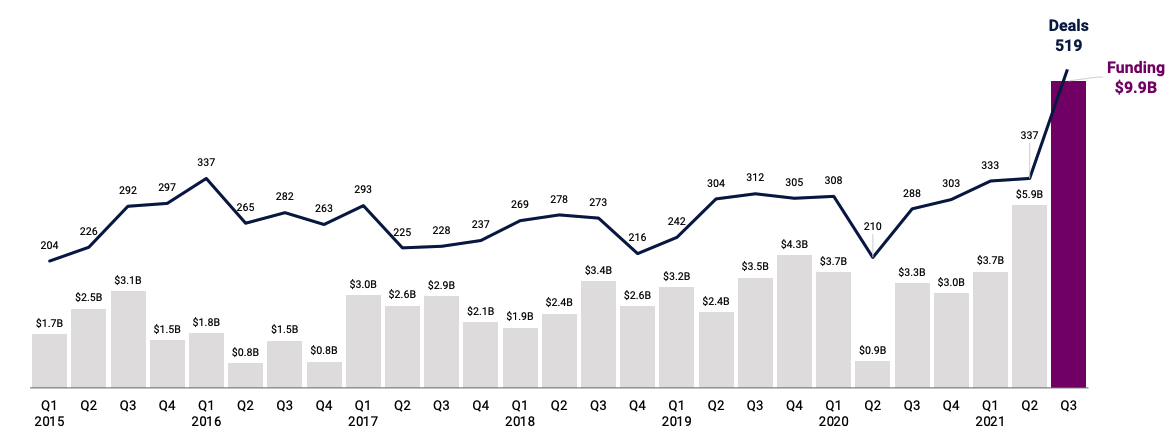

But rare is the chart that makes us actually shout out loud: Wait, what?! Such was the case with CB Insights’ Indian data set concerning quarterly venture totals over time:

-

Image Credits: CB Insights

That hockey-stick-style growth profile is unusual on the heels of a prior all-time record.

To confirm the directional trend in CB Insights data, The Exchange pulled historical data from PitchBook’s data set, which matched its rival’s in directional terms. Indian startup fundraising is accelerating and spent the third quarter in overdrive.

Here’s the data, per the above chart:

- Q1 2021:

- Dollars: $3.7 billion (flat year on year)

- Rounds: 333

- Q2 2021:

- Dollars: $5.9 billion (up 556% year on year)

- Rounds: 337

- Q3 2021:

- Dollars: $9.9 billion (3x, or up 200% year on year)

- Rounds: 519

But data without context is just a spreadsheet, so let’s get into the why.

What’s driving the venture capital explosion

Our two investors detailed a number of factors concerning why today’s Indian startup fundraising market is as hot as it is, not all of which were specific to the country.

Ravishankar noted that there are a number of things driving Indian startups forward, including a macro environment “linked to the increased global liquidity driven by low interest rates.” By now, this argument should be familiar; rock-bottom interest rates are making certain investments unattractive, leading to capital flowing into less traditional and riskier locations, including venture capital funds. In turn, that helps fuel startup investment.

But while India is enjoying a similar macro tailwind as other startup markets, there is a bit more happening in the country that is specific to its own scene that may be helping numbers soar.

One such factor, per Ravishankar, is the recent IPOs from the country. Calling them “success stories,” the investor cited both the Zomato and Freshworks IPOs as “validat[ing] the fact that there are very large companies that can be, and are being, built from this region.” Other IPOs from Indian tech companies are expected in the coming quarters.

The subtext to Ravishankar’s comment is that IPOs drive startup investor FOMO. Once you realize that a market is not only generating material paper gains, but also strong cash-on-cash returns, you reach for the checkbook.

India also benefits from a youthful population and an improving comparison with China. Bajaj told The Exchange that startup backers from the United States are “looking at India as a large market with 600 million Indians under the age of 25” that has “high potential for tech to solve local problems. He added that India appears more welcoming amid the market’s larger “realization that China is not as friendly a place to do business as earlier” in the current business cycle.

Lots of young people, rising digital penetration and an advantageous contrast to China add up to a potent cocktail of factors leaning in India’s favor.

There’s more. Per Bajaj, high-net-worth individuals in India are also succumbing to FOMO, and “super specialized” investors focused on specific tranches of the startup journey are helping push the nation’s startups along.

Finally, startup founders are recycling in the Indian startup ecosystem. Bajaj wrote that Indian founders of today are “ever more experienced,” “worldly” and “more ambitious,” adding that they have a “wider range of soft and hard skills” than in previous periods in India’s startup history.

From early-stage to growth stage

You don’t have to look further than TechCrunch for news of giant funding rounds going to growth-stage Indian tech companies — $100 million for Open and $250 million for CarDekho in the last day or so — with checks coming both from domestic and from foreign funds. Add in the upcoming IPOs and that makes for very active late-stage deal-making.

However, India’s record Q3 numbers aren’t simply due to mega-rounds: Early-stage deals account for the majority of deal volume. According to CB Insights, this share grew from 71% in 2020 to 75% this year to date.

Indeed, “early-stage funding has accelerated [at] a pace that’s rarely been seen before,” Ravishankar told TechCrunch. Bajaj confirmed this trend, explaining that “angel and pre-seed stage companies garner the most interest from private investors as the amounts involved are small.”

According to Ravishankar, this makes for evenly distributed deal-making, as “all stages are seeing significant interest.” However, Bajaj disagreed, insisting on a point he made last quarter: “In our estimation,” he said, “funding at the Series B and C stages remains a gap within the ecosystem that needs to be addressed.”

Resulting changes

While early-stage deals are by definition smaller, they may also account for a larger share of dollar volume than they used to, not just because of their quantity, but also of their growing size. “The more predictable and secular trend is an increase in the median deal sizes for early-stage pre-Series A and Series A investments,” Bajaj said.

It’s never easy to say which one came first, the chicken or the egg — but one thing is clear: This round size inflation is happening at the same time as cost increases. Per Bajaj, “larger amounts of capital [are] required to scale as wage inflation and inflation in marketing costs kick in.”

This isn’t specific to India, but it’s even more pronounced as more seasoned founders understand what’s at stake. What we are hearing is that finding product-market fit (PMF) is increasingly commoditized and, up to a certain degree, so is finding early traction and scaling abilities. In this context, what matters is shifting, Bajaj noted.

“Once PMF is established and companies begin to see inklings of traction, the typical concerns from investors revolve around [go-to-market efficacy] and whether these companies can truly scale to unicorn outcomes,” he said.

On the scaling front, both sources agreed that it starts mattering again once it’s about proving a company’s ability to dominate its market. In Ravishankar’s words, “scale is a competitive advantage beyond a stage,” and this has consequences because “many companies are now taking the inorganic route to growth and using the abundance of capital to do more M&As.”

Again, this is common to many markets, especially emerging ones where mega-rounds are happening, but what’s perhaps more interesting is what’s happening with go-to-market efficacy.

“Whether it is product-led growth, community-led, customer-led or what have you,” Bajaj said, “modern go-to-market playbooks have caused a fundamental shift in the software-as-a-service market by creating 10x+ as many buying/retention signals. Accordingly, super specialized GTM strategies are now the norm, not the exception.”

This has arguably “expanded the addressable market for these companies and given investors significantly more comfort on their ability to scale both within India and overseas.”

What’s next

Despite the Series B and C crunch, there’s plenty of evidence that India’s latest venture capital results are not the high-water mark of this startup era. Bajaj told The Exchange that while it’s “hard to call the crest of a wave,” it is his view that “this is only the beginning.”

If that winds up being the case, Europe, India and Latin America should run an interesting race in the coming years to determine which is the true rival to the historical dominance of the U.S. startup ecosystem.

Comment