The Coinbase S-1 is out! And hot damn, did the company have a good fourth quarter.

TechCrunch has a first look at the company’s headline numbers. But in case you’ve been busy, the key things to understand are that Coinbase was an impressive company in 2019 with more than a half-billion in revenue and a modest net loss. In 2020, the company grew sharply to more than $1.2 billion in revenue, providing it with lots of net income.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

The company’s Q4 2020 was about as big as its entire 2019 in revenue terms, albeit much more profitable because the sum was concentrated in a single quarter instead of spread out over four.

However, beyond the top-level numbers are a host of details to explore. I want to dig more deeply into Coinbase’s user numbers, its asset mix, its growing subscription incomes, its competitive landscape and who owns what in the company. At the end, we’ll riff on a chart that discusses the correlation between crypto assets and the stock market, just for fun.

Sound good? You can read along in the S-1 here if you want, and I will provide page numbers as we go.

Inside Coinbase’s direct listing

To make things simpler, we’ll frame our digging in the form of questions, starting with: How many users did Coinbase need to generate its huge 2020 revenue gains?

The answer: not as many as I expected. In 2019, Coinbase generated $533.7 million from what it describes as 1 million “Monthly Transacting Users” (page 14). That works out to $533.7 in revenue per MTU for the year.

In 2020, Coinbase generated $1.28 billion in revenue off of 2.8 million MTUs, which works out to around $457 apiece during the year. That’s a bit lower, but not terribly so. And given that the company’s transaction margins ranged in the mid-80s percent during much of 2020, each Coinbase active trader was still quite valuable, even at a lower revenue point.

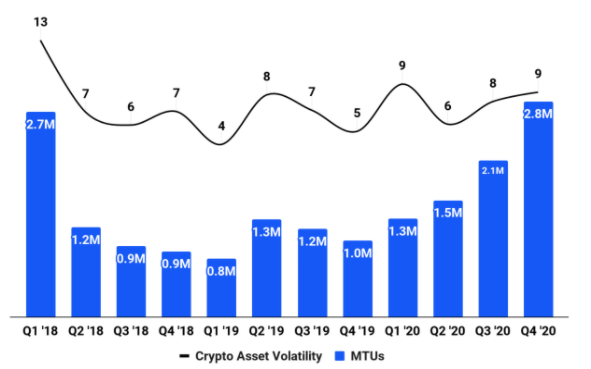

As we noted in our first look at the company’s economics, Coinbase’s metrics are highly variable. Its MTU figure is no exception. Observe the following chart from its S-1 filing (page 95):

Coinbase’s Q1 2018 was nearly as popular in MTU terms as its final quarter of 2020. And from that point in time, the company’s MTUs fell 70 percent to its Q1 2019 nadir. That’s a lot of variance.

The company itself notes in its filing that “MTUs have historically been correlated with both the price of Bitcoin and Crypto Asset Volatility,” though the company does point out that it expects such correlations to diminish over time.

The answer to our question is that it only takes a few million MTUs for Coinbase to be a huge business. But the other side of that point is that Coinbase has shown twice in two years (2018, 2019) that the number of traders on its platform can decline.

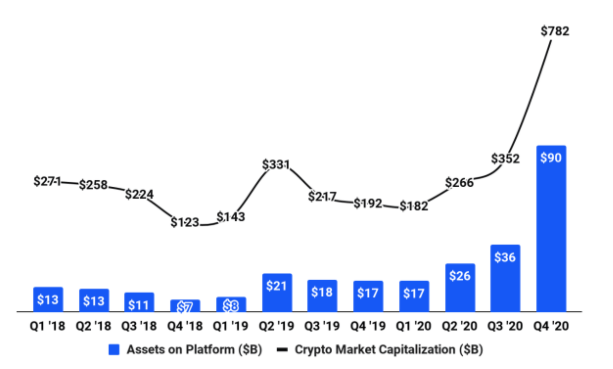

What assets do Coinbase users hold? This is a question that I am sure many of you crypto enthusiasts have. But first, what does the Coinbase user asset base look like? Like this, historically (page 96):

Holy shit, right? The chart shows two things. First, the rapid appreciation of cryptocurrencies overall, which you can spy in the upward kick of the black line. And then the blue bars show how the assets on Coinbase’s platform grew from $17 billion at the start of 2020 to $90 billion by year’s end.

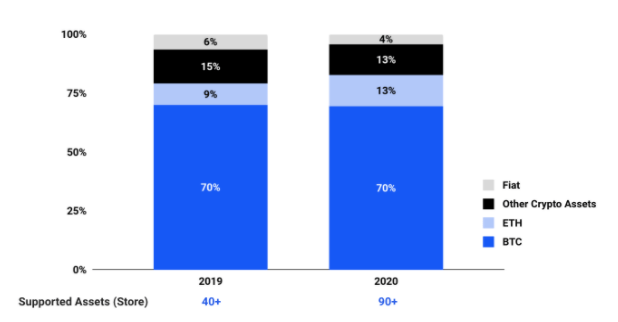

Now, what are they? Here you go (page 97):

Admit it, that’s a little boring!

But the chart does show that even as Coinbase more than doubled its supported assets, bitcoin’s dominance held. And fiat currency lost 2 percent, or a third of its share of Coinbase assets, during 2020. Which I find oddly funny for a reason I can’t quite place.

Next up: Does Coinbase generate material non-trading software incomes? The answer is no.

Coinbase does generate quickly scaling revenues from its software products. In time, these efforts could help the company better ride out instability among the prices — and therefore trading interest, trading volume and revenue — in crypto assets. Just not yet.

Here are the “subscription and services revenue” category revenue results from Coinbase during 2020 (page 110):

- Q1: $7.1 million

- Q2: $6.5 million

- Q3: $10.8 million

- Q4: $20.7 million

If Coinbase didn’t have a trading business, that sort of growth for this revenue category alone would be enough to pique investor interest. However, compared to its total Q4 2020 revenues of $585.1 million, the category is not incredibly key today. It may become so in time, but Coinbase’s revenue mix is not truly diversified and turns on consumer trading interest in bitcoin and other assets more than anything else.

If Coinbase is doing as well as we now know that it is, a good question to ask is who is Coinbase worried about in terms of competition? I would argue that Coinbase’s key competitor is user apathy when it comes to buying and selling bitcoin, but the company did provide prospective investors with a good rundown of its market competition across several categories (page 148, all emphasis via TechCrunch).

From a general perspective:

However, we do face significant competition from parties ranging from large, established financial incumbents to smaller, early stage financial technology providers and companies native to the cryptoeconomy, such as decentralized exchanges. Further, though we operate in regulated markets, some of our competitors have not or actively do not adhere to the same standards of regulation as we do.

Regarding retail users in particular:

For retail users, we compete with traditional financial technology and brokerage firms like Square, Robinhood, and PayPal, who have recently introduced crypto products and services. These companies have varying business models and focus areas and offer an overlapping, but limited, feature set, which includes buying and selling a subset of the crypto assets supported on our platform. In some cases, users who purchase through these platforms own the economic interest in a given crypto asset, but not the underlying asset itself, and therefore cannot use the asset to interact with the broader cryptoeconomy. We also compete with a number of companies that solely focus on the crypto market and have varying degrees of regulatory adherence, such as Binance.

Well, that’s a diss! Coinbase had one more category of competitor, however, that we should examine:

For institutions, we primarily compete with other crypto-focused companies and a few traditional financial incumbents that offer point or siloed solutions that are limited in scope.

A theme in this S-1 that I am getting as we pick through it is quite a lot of confidence in Coinbase from Coinbase. Not that that is a bad thing per se — it did have a super-hot Q4 2020 — but I do find it slightly amusing that the company can’t stop mocking rivals and complimenting itself in the bit of its filing where it is supposed to warn investors about risk.

Finally, who owns what? It’s a little hard to parse precisely because I need to dig a bit more into the Class B to Class A conversion issue, but here are the investing groups that own 5 percent or more worth of Coinbase stock (page 184):

- Andreessen Horowitz: 29,477,535 Class A and B shares

- Paradigm, firm associated with a Coinbase co-founder: 2,570,459 Class A shares

- Ribbit Capital: 11,995,949 Class B shares

- Tiger Global: 2,624,880 Class A shares

- Union Square Ventures: 13,902,324 Class B shares

Thoughts on the above: a16z will do well because they own the most; however, Andreessen Horowitz also has huge funds to push those returns into, which could mute their impact somewhat. Ribbit Capital did very well and USV did even better, given that it has historically smaller funds than Ribbit and more shares in Coinbase.

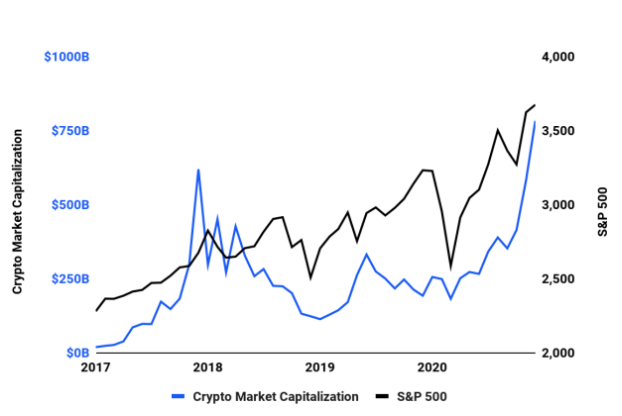

And as I promised at the top, a bonus chart. What is the correlation between crypto prices and the stock market? Here’s the Coinbase chart (page 92):

I am not going to parse that for you. Instead, here’s Coinbase’s own reading:

In the past, crypto markets have not appeared correlated with the broader U.S. equity markets. This trend held true until February 2020, when the U.S. stock market and crypto markets experienced a significant downturn due to the COVID-19 pandemic. Through December 31, 2020, these markets subsequently appeared more correlated as each market recovered.

So, if the stock market drops, we could see the value of cryptocurrencies drop. Which could depress consumer interest in crypto assets and their resulting trading volume. That, in turn, could ding Coinbase’s trading revenues, its biggest income varietal.

In short, if the stock market falls and crypto values stay correlated, Coinbase’s stock could take two hits.

But who are we kidding, investors in today’s public markets aren’t going to worry about that stuff. They are going to see Coinbase’s 2020 growth and throw money at it!

Comment