As last week came to a close, NerdWallet filed to go public. Given the late hour, our S-1 dive had to wait until today.

The NerdWallet IPO comes at an interesting time. The company provides financial product recommendations to both consumers and SMBs, meaning that it dabbles in the same market that fintech startups play in. And because NerdWallet is essentially a weaponized content play, we get to talk about the value of the written word.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

NerdWallet is pursuing a traditional IPO, meaning that it will raise primary capital in its public debut. Per its filing, the company intends to “use approximately $29.0 million of the net proceeds we receive from this offering to repay all outstanding principal amounts and accrued interest under certain promissory notes.” The rest will go to running and growing the company, or what lawyers like to call “general corporate purposes, including working capital, operating expenses and capital expenditures.”

The NerdWallet IPO is a liquidity event for several investing groups, including Institutional Venture Partners (IVP), which owns 17.5% of Class A stock ahead of the company’s public offering, RRE Ventures (6.5% of pre-IPO shares) and iGlobe Partners (6.0%). (Crunchbase has more regarding the company’s private fundraising history here.)

The NerdWallet IPO is a liquidity event for several investing groups, including Institutional Venture Partners (IVP), which owns 17.5% of Class A stock ahead of the company’s public offering, RRE Ventures (6.5% of pre-IPO shares) and iGlobe Partners (6.0%). (Crunchbase has more regarding the company’s private fundraising history here.)

We want to know how COVID-19 impacted NerdWallet’s growth, how quickly it is expanding revenues in 2021, its historical profitability and recent trends thereof and how the company manages to stay trustworthy, a question that we’ll address through the lens of editorial independence. Sound good? Let’s have some fun.

COVID-19 and NerdWallet

The pandemic was not kind to NerdWallet, but because the firm had variable costs it could constrain, wasn’t disastrous to its overall business.

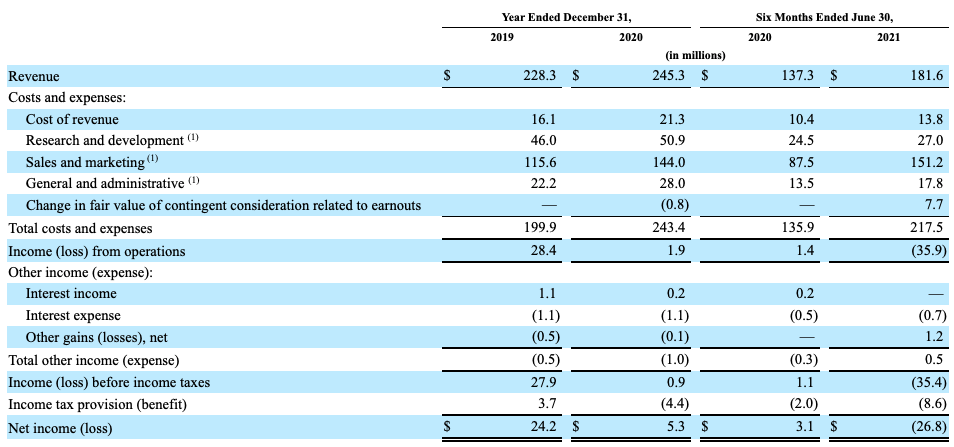

NerdWallet generated $228.3 million in revenues in 2019, a figure that rose only modestly to $245.3 million in 2020. For a venture-backed company, posting growth of around 7.5% can be lethal. At that pace of growth, who’d want to back a startup?

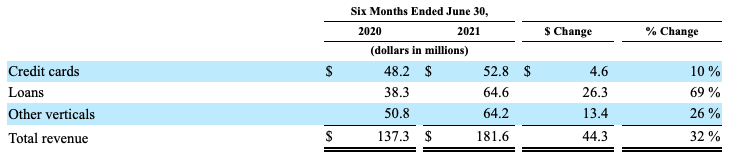

More recently, growth has sped back up, with NerdWallet posting $137.3 million in H1 2020 revenues, a figure that expanded to $181.6 in the first half of 2021. The latter figure represents growth of just over 32%, a much healthier number than what the company recorded in 2020.

The pandemic is partially to blame for NerdWallet’s slack 2020 growth. Here’s the company discussing what COVID-19 did to certain lines of its business:

Our credit cards revenue decreased 30% for the year ended December 31, 2020 compared to the same period in 2019, primarily due to lower approval rates in the market due to economic uncertainty resulting from the pandemic and tighter underwriting criteria. Our credit cards revenue increased 10% for the six months ended June 30, 2021 compared to the same period in 2020, primarily driven by increased activity amid recovery from the economic impacts of the COVID-19 pandemic and higher pricing with our financial services partners.

As you can imagine, credit card revenues are pretty important for the company’s overall results. But before we get into the revenue mix, let’s talk business models for a moment.

How do you trust it?

Given built-in bias in much financial advice — fees are a reason why some advisers love to push annuities, for example — you might not trust much of what you read when it comes to recommended money-related products. That lack of trust is the gap that NerdWallet hopes to exploit by offering trustworthy advice.

How does it manage that? By having, in its own words, an “Independent, Unbiased Editorial Team.”

How is that part of its business situated inside of NerdWallet? After saying that one of its “fundamental values is to build our business by making decisions based upon the best interests of our users,” and that it has “forgone, and we may in the future continue to forgo, certain expansion or short-term revenue opportunities that we do not believe are in the best interests of our platform and our users,” even at the expense of short-term results, the company argues that it publishes “editorial content on topics that do not generate revenue for us” and that its “editorial team maintains editorial independence from our business teams.”

That setup allows NerdWallet to publish content on its core market — consumer and SMB financial products — from a neutral viewpoint.

Which all sounds really good, aside from the fact that the company classifies its “100+ person” editorial group as part of its sales and marketing costs (page F-13 in its S-1, if you want to read more). Ew. I would stick those expenses in the cost of revenue category, but NerdWallet probably doesn’t want to take the gross-margin hit that such a move would entail.

So, the company’s unbiased writing shop winds up finding a home in its S&M line item. Having once run an editorially independent writing team at a for-profit company, that worries me. Sales and marketing folks do not, at their core, have beating journalistic hearts.

Regardless, NerdWallet at least says the right things when it comes to how it drives recommendations. Now we can talk revenue mix.

How does that make money?

Here’s how NerdWallet makes money, in its own language:

The Company generates substantially all its revenue through fees paid by our financial services partners in the form of either revenue per action, revenue per click, revenue per lead, and revenue per funded loan arrangements.

That is precisely what we expected, so there isn’t much to say on the matter. But the revenue that the above paragraph describes varies in genre. Here’s how the company’s mix has changed over time:

There are three main revenue types in play. The first two self-explain, while the third is a bit murkier. Per NerdWallet, growth in “other” was “primarily attributable to higher SMB revenue following our acquisition of Fundera.” Fair enough.

You can see the pandemic in the above numbers, notably, in anemic credit card growth (due to, as noted before, rising credit standards, in part) and surging mortgage incomes as the U.S. housing market went flat bonkers in recent quarters. From this perspective, we can see that NerdWallet can generate lots of revenues in varying market conditions, but that its revenue mix is at the mercy of the larger consumer credit market.

Is it profitable?

So far, we’ve explored historical growth at NerdWallet, how it manages to hold onto its place in the financial advice market, and how the company’s revenue mix has changed over time. Now let’s sum all that up and talk profits.

See if you can spot what perplexed me in the following:

Yes, it is that shocking H1 2021 net loss!

After a long history of profitability, NerdWallet is now running fat deficits. And as you can tell by peeking at its most recent cost structure, sales and marketing costs are skyrocketing at the firm. Naturally, with some slowdown in 2020 marketing compared to what the firm almost certainly had planned due to the onset of the pandemic last year, some of the year-on-year gains are artificial. But still, damn.

Here’s how NerdWallet talks about the situation:

Sales and marketing expenses increased $63.7 million, or 73%, for the six months ended June 30, 2021 compared to the six months ended June 30, 2020. The increase was primarily attributable to increases of $22.0 million in brand marketing expenses and $23.2 million in performance marketing expenses. The increase was also attributable to higher organic and other marketing expenses, including an $11.8 million increase in personnel-related costs due to our efforts to grow and increase our user base, and $3.1 million of amortization expense of intangible assets from our acquisitions of Fundera and KYM in the second half of 2020.

There are two interesting nuggets in that paragraph.

First, that the company is spending heavily on brand marketing, the sort of effort you execute when you want to establish long-term revenue strength over near-term growth. The move implies a long-term perspective on brand value.

The second is where the company is spending on near-term growth. That’s where performance marketing comes into play. Spend is up there as well. And the company boosted spending on “personnel-related costs due to our efforts to grow and increase our user base” by nearly $12 million. I presume that a chunk of that went to expanding its editorial team.

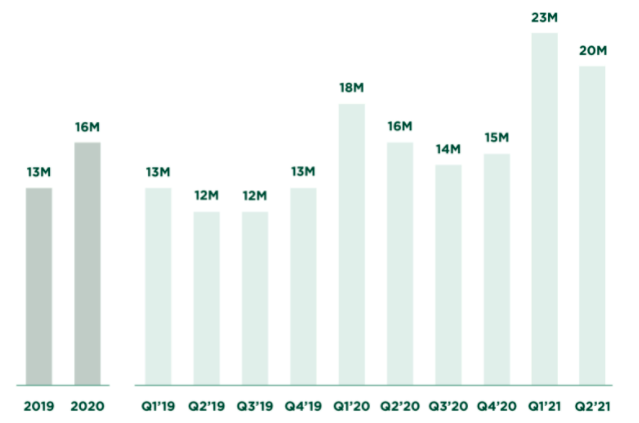

The result of the above is that NerdWallet has posted record traffic numbers. As we observe the following, keep in mind that “approximately 73% of all traffic to NerdWallet came organically through direct or unpaid channels” in the 12 months concluding June 30, 2021:

Results, yeah?

Kinda. The traffic numbers are not converting into users as quickly as you’d expect. NerdWallet closed 2019 with 5.5 million “Registered Users.” That figure rose to 8 million by the end of 2020, a pace of growth that feels strong. But the same figure only grew by 1 million to 9 million by June 30, 2021. That’s less good, in both percentage-growth and gross numerical terms.

All that is to say that the company’s profitability picture has worsened as its spending has gone up. And the category of spending that is rising the most meaningfully is its sales and marketing expenses, which are driven by both long-term investments and more near-term spending. Finally, while the company has posted some encouraging business results, including re-accelerated revenue growth, not all signals from its business are as approbatory. Or, as my editor would like me to say, as good.

Why spend so much?

If you consider that NerdWallet wants to set itself up well for its first few quarters as a public company, the spend makes sense.

But the outcome of that is not only rising net losses, but also a flip to adjusted EBITDA negativity in 2021, and the first negative operating and free cash flow results from the company. After posting positive figures in each category in 2019 and 2020, including H1 2020, each metric went negative in H1 2021.

So, falling profitability but rising revenue growth? This is a very 2021 IPO. But one that does, perhaps a little indirectly, show the value of unbiased writing. And that’s a good thing, I think.*

*Why, yes, this perspective from me is biased.

Comment