Informatica filed to go public late last week, some six years after it was taken private by two private equity teams for $5.3 billion. The data-focused company used its passage through the private markets to execute a move to the cloud, work that came to a head in early 2021, when Informatica announced its dive into the lakehouse market, where Databricks plays today.

We’ll explore the company’s IPO filing to figure out just how strong of a cloud business it has managed to build and how winsome its overall economic profile appears. While the company has yet to set an initial IPO price range giving us an indicator of where it might be valued, there are media reports of a valuation as high as $10 billion.

A number that big demands exploration. Let’s get into the numbers.

Inside Informatica’s business

Turning back the clock to 2015, the final Informatica earnings release that we could find from its last run at being a public company is dated April 22, 2015. That was just days after the company’s takeover was announced, so the timing makes sense.

At the time, Informatica reported revenues of $250.5 million, up 3% from its year-ago comp. That revenue growth number was more than anemic but did contain an interesting seed of good news, namely that “subscription revenues” at the company were up 47% on a year-over-year basis. Sure, every company wants you to focus more on its growth business than its overall performance, but the subscription result was pretty strong, even if it was from a modest base figure ($21.3 million).

And in that final period — the quarter ended March 31, 2015 — Informatica generated $32.2 million in operating income and $21.6 million worth of net income. At the time it went private, Informatica was profitable and slow growing, albeit with a new business arm that was putting up pretty notable revenue expansion.

What happened over the last half-decade or so?

Here’s the Informatica income statement from its S-1:

Yes, that is a wall of numbers.

Starting at the top, looking just at subscription incomes, we can see that Informatica really did manage to expand that part of its business while private, to $302.5 million in 2018 from just over $20 million back in Q1 2015 (or a run rate of more than $80 million). In 2019, the company managed to grow subscription revenues to $471.7 million, a gain of 56% from the year prior. That’s a pretty freaking solid result at the scale that Informatica had already reached.

Then growth downshifted. In 2020, subscription incomes at Informatica grew just 26%, a dramatic slowdown. More recently, comparing the first half of 2021 to the same period of 2020, growth slipped further, to 25%. That’s not bad, but not great either, especially given what the company managed back in 2019.

To some degree, a slowdown in subscriptions appears to be revenue transference between perpetual license customers and Informatica’s newer — cloud — business. The company expects perpetual to go to effectively zero (“[w]e expect revenue from perpetual licenses to be less than 5% of total revenues going forward”), so the handoff is not surprising. But now that the company’s perpetual incomes are a dusting of revenues when compared to its subscription business, perhaps growth will remain more muted than what the company saw earlier in its cloud transition.

Which brings us to the company today. Informatica flipped to a 5% operating margin in H1 2021, compared to a -2% result in the same period of 2020. In dollar terms, Informatica’s operations went from losing $15.8 million in the first two quarters of 2020 to generating $32.5 million of profit during the same period of this year.

Sadly, the company is still unprofitable on a net basis, though decreasingly so. After posting a net loss of $167.7 million in 2018, Informatica lost $183.2 million in 2019 and $167.9 million in 2020. However, despite losing $102.8 million in H1 2020, Informatica lost a far smaller $36.3 million in H1 2021. That’s better!

What should we make of the divergence in Informatica’s operating and net profitability? The yawning gap between operating incomes and net losses at the company is driven by interest expenses, which come out to 11% or 12% of revenues, historically.

Put simply, the company is heavily, heavily indebted. Which is a change. The company had effectively zero debt before it went private, again looking at its final earnings report before the transaction.

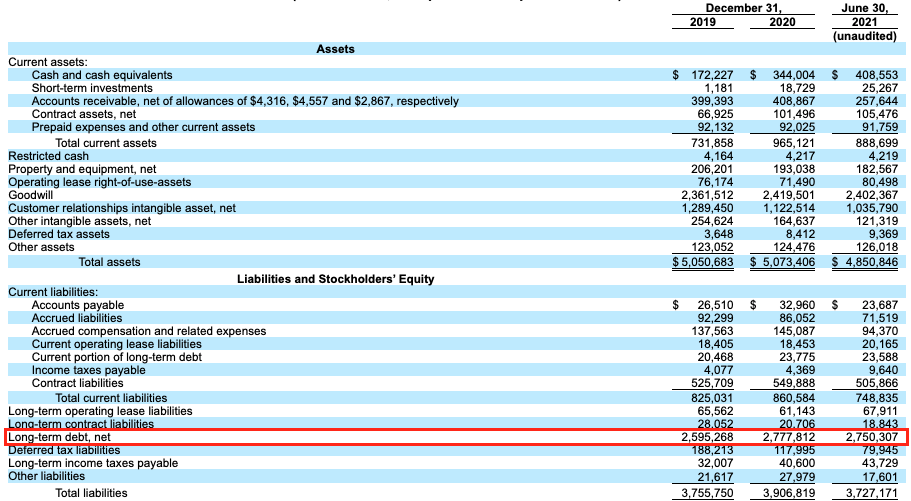

Today? Here’s the damage (observe the red rectangle):

Holy shit.

Notably, the company has generated positive operating cash flow in every major time period that we have data for, including 2018, 2019, 2020 and the first half of 2021. Our presumption is that the company took out huge debts to transfer value to its owners, which is a somewhat shitty thing to do to a company, frankly.

Regardless, the debt is where the company’s pretty good operating results turn to somewhat yucky net results.

So, what’s it worth?

Informatica today is around half software revenue and half services revenue. The former is growing while the latter is not, at least in the first half of 2021. In combined form, Informatica grew 9% from H1 2020 to H1 2021. At the rumored $10 billion price tag, the company would be worth 7.4x its current annual run rate (H1 2021 revenues multiplied by two).

We can’t discount the company’s services revenues and just focus on its software incomes, as Informatica’s services are actually margin-accretive, so it’s hard to figure out how to value the company. But if investors can get to a point where they consider that the company’s subscription revenues are set for long-term growth, a 7x multiple doesn’t seem too wild. Certainly, the financial groups that took it private are going to at least make some money in the IPO, in addition to whatever they managed to extract during its tour as a private company.

More when we get a price range.

Comment