The lackluster performance of shares in companies that have combined with special purpose acquisition companies (SPACs) in recent quarters took another hit yesterday when Lordstown Motors reported its first-quarter results.

Lordstown, part of a wave of electric-vehicle companies that raised capital and went public via SPACs, announced lower-than-expected 2021 vehicle production, higher capital expenditures (capex) for the year, and the need to raise more capital. For holders of its equity, the news was a disappointment, as TechCrunch explored after the results dropped.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Shares of Lordstown are down 14% in pre-market trading after falling in after-hours trading yesterday evening.

But there’s more to the Lordstown mess than merely a single bad quarter. What the company reported is somewhat contradicted by its SPAC deck, a document that every startup combining with a blank-check company releases. They are often cheery and full of good news. With just a little capital, the company in question is going to scale rapidly in the coming years, with improving profitability to boot.

Then the deal is sold, capital is raised, entities combine, and the startup in question becomes public, with earnings calls commencing on a quarterly cadence. That’s where the rubber meets the road.

Then the deal is sold, capital is raised, entities combine, and the startup in question becomes public, with earnings calls commencing on a quarterly cadence. That’s where the rubber meets the road.

Lordstown’s earnings mess and the resulting dissonance with its own predictions are notable on their own, but they also point to what could be shifting sentiment regarding SPAC combinations. Returns are lackluster, the SEC is worried about too-rosy forecasts and Congress is looking into the boom.

We’re taking a look into Lordstown’s results this morning, but don’t think that we’re only singling out one company; others fit the bill, and more will in time.

Whoops

Lordstown has been accused by short-sellers of inflating its order book to make it more appealing to investors before its SPAC. The company has pushed back against the allegations. (The SEC is taking a look.) But the short-sellers appear to have the best of the argument so far, judging by Lordstown’s falling worth.

For reference, Lordstown stock was worth as much as $31.80 per share after its SPAC deal. Today, its equity is set to open trading worth just $8.29 apiece.

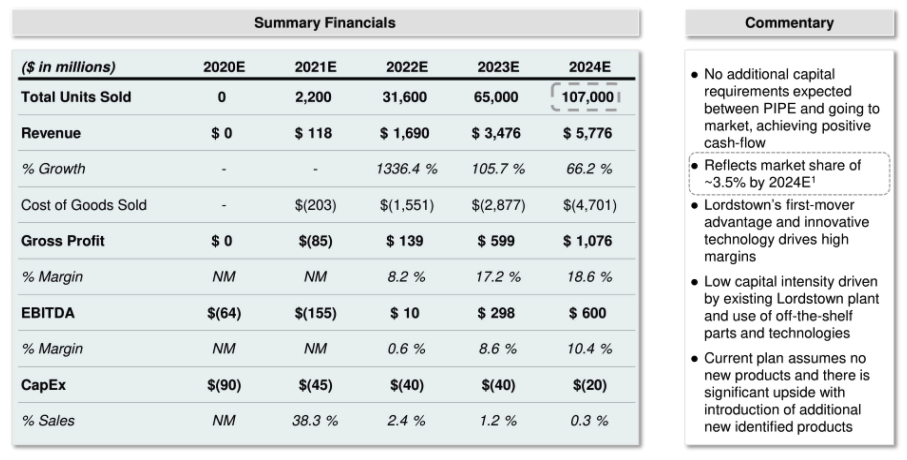

It’s not hard to see why investors have become less enamored with the company. Observe the following chart via its SPAC sales deck from August 2020:

Lordstown expected to sell 2,200 vehicles, generate $118 million in revenue and book capex of $45 million. And as you read in the first bullet point in the right column, “no additional capital” was the pitch to investors; that means no future dilution or debt raises that would force the company into a less-stable financial picture.

And then its earnings arrived. Here’s what Lordstown came up with during Q1 2021 (via TechCrunch reporting and the company’s earnings document):

- 1,000 vehicles sold, a more than 50% decline from promises.

- $53 million in capex during the first quarter of the year, far greater than the $45 million forecast for calendar 2021.

- The company also revised “upward [its] 2021 expectations for operating expenses by $115 million,” creating the need to “raise additional capital to complete our business plans.”

Woof.

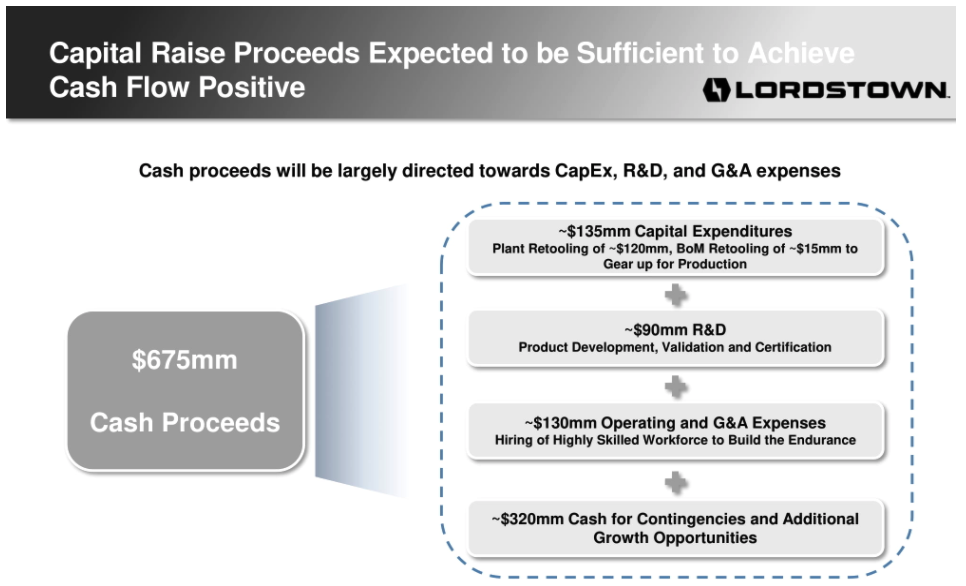

There’s more. Observe the following slide from the same presentation:

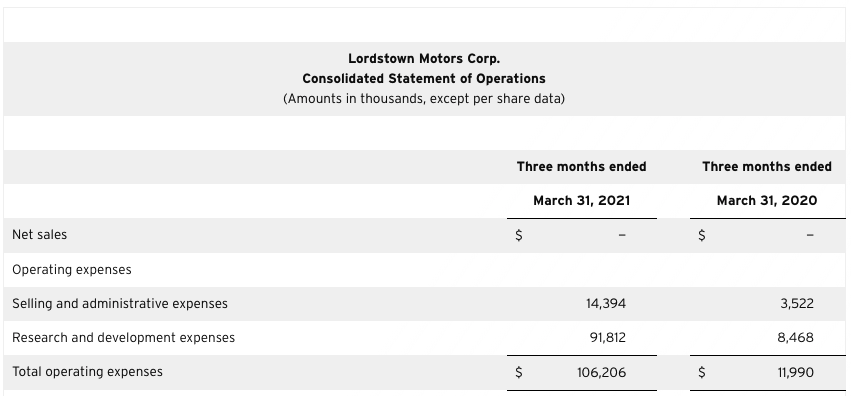

From having enough capital to get to cash flow positivity to needing more capital in just a few quarters? What changed? Well, the above slide says that the company needs to spend around $90 million on R&D. It spent that much in the first quarter of 2021, it turns out.

From its earnings statement:

Yikes.

Look, I am not a securities lawyer, but this is all a bit hard to stomach. I would be pretty annoyed if I had expected the company to do what it said that it was going to do. And then it did not. To the tune of a lot.

Returning to the last slide excerpt we embedded above, the company said that it would have $320 million in what appears to be effectively backup cash. What happened to that? Well, Lordstown expects capex costs this year of “between $250 and $275 million” along with R&D costs of “between $280 and $290 million.” So there it went.

Jesus tap-dancing Christ, that’s a very different picture than the one that the company sold to the market.

Lordstown is not the only SPAC that is going to see some daylight between its pitch and its performance. But it’s a pretty stark reminder that SPAC decks are sales pitches, not promises.

Caveat emptor and all that; I just worry about folks who don’t know better on the buy side and folks who should know better on the sell side.

Comment