As a general rule, I refuse to worry about how much money bankers make. They have historically done just fine, and I presume will continue to do so. In a similar manner, I don’t worry about how much money venture capitalists earn. Not really. Sure, it’s nice to figure out deal-specific returns here and there, but frankly, I care precisely not at all about any particular VC’s take-home.

But today we have to care a little bit about both, because we need to talk about direct listings, IPOs and how to price private companies. Yes, we’re talking about Amplitude’s recent public-market debut.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

What follows is a dive into the IPO pricing issue and how startups are looking to get around the matter through alternative listing mechanisms. We’ll close with notes from an interview with Amplitude CEO Spenser Skates about the same matter. If you care about the value of private companies and how they are priced, this is for you. If you do not, please read anything else; you are going to be bored out of your socks.

Let’s go!

The problem with IPOs

Earlier this week, we asked if direct listings would be able to solve the IPO pricing issue. Or, more simply: Could direct listings coupled to last-minute private-market fundraising help startups dodge first-day IPO pops?

An IPO pop is what happens when a company prices its initial public offering at a lower price point than where it begins to trade. A little pop is generally considered healthy. A large pop is considered an error.

In more concrete terms, if a company prices at $45 per share in an IPO and kicks off its trading life worth $46, good job. Hell, even $48 would be uncontroversial. But when a company prices at $30 and opens at $45, it doesn’t matter if its shares later come back to Earth. A sin has been committed, at least in the eyes of the company and its private-market backers.

There are two issues with IPO pops that annoy startups and their investors:

- First, they imply that the debuting company could have raised more money, or the same amount of capital, with less dilution. That makes sense.

- Second, private companies and their partial owners (VCs) do not like it when free money is handed out to others, as when bankers price an IPO too low while securing fat allocation in the deal for their own customers; watching bankers that just showed up distribute upside for little work irks founders (reasonable) and venture investors (less reasonable).

The IPO pop issue has become more acute in recent years as some big-ticket public offerings have posted insane first-day results, opening to trade or closing their first day as public companies worth far more than they were expected to be when compared to their formal public-offering price.

One way to dodge an IPO pop is to direct list. In a direct listing, a company simply begins to trade. A reference price is set, but that’s largely a made-up number that folks ignore. It doesn’t matter much. And because the company in question isn’t setting a formal price for itself, it cannot suffer from a mispriced IPO. Huzzah; we’ve solved the problem.

Except we haven’t. IPOs have some good elements to them that everyone can agree on, chief of which is that they raise primary capital. By that we mean the company looking to list its shares in a traditional manner sells stock in the transaction. That’s why it has to set a price; it has to name a number at which it sells primary equity in its IPO.

With a direct listing, you do away with the pricing matter altogether, but it can be a bit baby-with-the-bathwater if a company wants to also raise capital to fund its operations, growth or whatever else. So, unicorns have come up with a neat compromise that appears to be a fix: raise a huge, final private round of capital and then quickly direct list. Doing so decouples pricing the company and it starting to trade.

Amplitude did just that earlier this week. It raised a multipart close Series F at $32.0199 per share a few months back — and then direct listed.

However, there are issues.

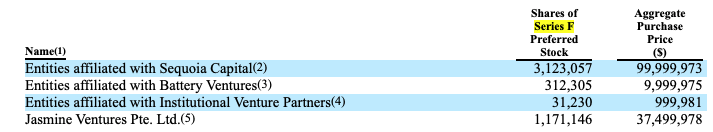

Here’s who bought into the Series F transaction across its various tranches (the table shows “the number of shares of our Series F redeemable convertible preferred stock purchased by [Amplitude] executive officers, directors, holders of more than 5% of [Amplitude’s] capital stock”):

Amplitude wound up setting its direct-listing reference price at $35 per share, or a little under $3 per share more than its final private round’s per-share cost. That’s less than 10%, so the direct listing “pop” — the distance from final private price to reference price — was pretty minimal.

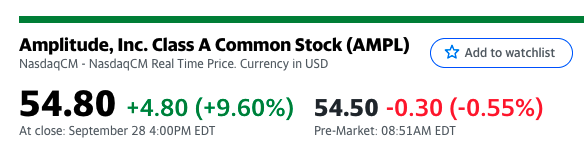

Hooray! Everyone is happy except bankers, right? Well, no. Here’s where Amplitude closed its first day of trading:

Yes, I am both hooting and hollering at this juncture.

It appears that Amplitude’s private backers got away with murder in its final private round, pouring $200 million into the company at around $32 per share in Q2 of this year, when by late Q3 of the same trip ’round the sun the company was worth around $55 per share.

Whoops. The flip of this is that it’s probably less annoying to founders to enrich their long-term backers than it is to enrich hired guns from Goldman. To reiterate: I don’t care much which collection of financial players does better because I don’t worry about comp on either side of the venture-banker divide. But they do.

I have yet to read any tweets from venture capitalists bemoaning the extra dilution that Amplitude took on when its private backers underpriced it out of quite a lot of equity earlier in the year. That would be the same logic that venture players aim at bankers when something similar happens in a more traditional IPO.

So, the dilution argument was always bullshit, and VCs just wanted to protect their own returns — pockets — which is fine; we’re talking capitalism, here. Just spare me the sanctimony in the future, yeah?

Back to Amplitude

By now the Amplitude PR team is wondering why they went through the work of getting me on the phone with their CEO, given that I just spent 1,000 words gently slagging how the company went public. Don’t fret; the Amplitude direct listing is just fine by me because I care more about what the listing says about the market than any particular return element. It’s all good, y’all

But to better understand why Amplitude chose the path that it did, let’s turn to a chat I recently had with the company’s CEO, Spenser Skates. Any executive who arrives at a call in a T-shirt wins my favor, so I frankly like the man.

Talking with Skates about his company’s liquidity event, he was sensitive to the IPO pricing matter, citing the recent Toast IPO as one where value was left on the table. He even had some data to cite on just how mispriced IPOs have proved to be in recent years. Which you’d expect, given that he had some tough calls to make on choosing how his company would list itself; if he didn’t have the numbers in mind, we’d have reason to worry.

Per Skates, he ran an auction for his company’s final private round, discovering that at a price of around $3 billion, there were many takers for Amplitude’s shares. There were none at $5 billion and one at $4 billion. So he went with the middle option.

Very reasonable! But Skates’ offers from private funds were all wrong. The company is worth $7.1 billion today, before the open, per Yahoo Finance.

Skates argued that the best method of going public would be to direct list and raise primary capital, essentially allowing the market to set a price for a company, at which it would then sell equity. But that option isn’t open yet, so he decided to raise and then direct list. Again, that’s pretty reasonable.

But why not direct list and then raise primary capital later at a settled market price? Doing so would allow companies to avoid any sort of pricing mishap. Skates had a very interesting answer, namely that by raising primary and then pursuing a direct listing, he had loads of cash on the books, which made his company appear more than stable.

That’s a darn good point. And to its credit, Amplitude has pretty great numbers, and it is pursuing a vision of the future of the tech market that I pretty much agree with — better digital products through data analysis, everywhere — so I refuse to take sides here.

Raising from private investors and then direct listing doesn’t solve the IPO pricing issue; it merely scoots the upside from one collection of wealthy folks to another. At least until we come up with a truly better way for firms to list.

Comment