Artem Milinchuk

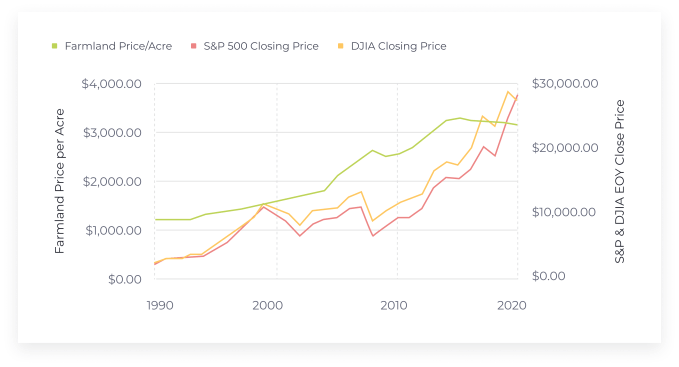

Farmland as an asset class has proven itself to be a stable investment decade after decade. Farmland’s negative correlation with the Dow Jones Industrial Average sits at an eye-popping -43% for a three-year hold period, making it an excellent hedge against market volatility.

The asset has also been a steady appreciator since 1987, when institutional investors began incorporating farmland into their portfolios. Equally, investments into sustainably managed farmland have the potential to transform agriculture from one of the largest sources of greenhouse gas emissions to one of the largest carbon sinks.

However, while farmland is among the oldest investment classes around, the average investor hasn’t had access to farmland the way that billionaires and institutional investors have.

Revolutions in fintech and a host of startups are changing this.

Why farmland?

COVID-19 affected the world in ways we couldn’t have predicted, and the markets were no exception. The S&P 500 plummeted in mid-March and shed 34% of its pre-COVID peak value. But unlike past crises, the index rebounded just a month later.

This doesn’t mean that financial markets have fully recovered, however. We’ve seen plenty of volatility since, both in the form of rallies and losses. This has caused many investors to move some of their portfolio out of equities.

This is where farmland entered the discussion.

A historically stable asset class

Wild stock market fluctuations existed well before COVID-19. The latest era of volatility began in 2018 and continued even as the economy grew prior to the pandemic. Given the unpredictability of the equities market, investors need to counterbalance what’s in store for stocks and funds.

Farmland value has proven itself impervious to Wall Street trends for more than three decades, including during the ’90s recession, dot-com boom and bust, and the subprime mortgage crisis. Should markets stay turbulent as the U.S. and other economies continue to grapple with the pandemic, this trend will continue to play out in the months and years ahead.

Farmland has also held up against inflation remarkably well. The asset is closely aligned to the movement of commodities: When the price of food increases, so does the value of the farms producing it. Historically, the value of U.S. farmland has been about 70% correlated with the CPI. As the country faces stimulus-driven inflation today, it’s likely that farmland will stay just as resilient.

Feeding 9.7 billion

Farmland investing provides more than a history of steady appreciation — it’s also key to the future of the world’s food supply. Population growth has increased, on average, by 1.1% every year. The World Bank predicts that we’ll reach a global population of 9.7 billion by 2050. With more mouths to feed than ever before, farmers will need to increase current output by 70%.

And yet, the amount of farmland in the United States has decreased as a result of climate change and urban development. The country’s latest farmland census demonstrated a loss of 143 million acres between 2012 and 2017, and it’s not likely that we’ll see this trend reverse any time soon. As many American farms struggle to find the financing needed to modernize equipment and transition to more sustainable practices, there’s a significant need for investment dollars in a market where increased demand is all but assured.

The growing scarcity of farmland will also drive up the cost of farmland, making the asset well suited to increase in value over time.

Previous hurdles to farmland investing

While farmland investments can provide passive income and a hedge during just about any economic condition, direct investments into the asset have been largely inaccessible to date.

The agriculture sector is extremely fragmented, with the majority of farms in the U.S. being small and family owned. This fragmentation, along with a lack of familiarity of the investment benefits of farmland, has led most investors to overlook the sector.

Demand for farmland among institutional investors, however, began to take off in the early 2000s, bolstered by the large pension funds and endowments they managed for businesses and universities. While there were fewer than 20 farmland-centric investment funds in 2005, there were 166 funds as of 2020.

Still, steep check sizes and the lack of a transparent marketplace continue to keep farmland out of reach for individual investors. All of this has changed due to new, dynamic fintech startups that have torn down these long-standing barriers.

How fintech removes barriers for individual investors

The JOBS Act, signed in 2012, loosened SEC regulations for small businesses and startups, making it easier for businesses to secure crowdfunding. This also gave investors another way to diversify their portfolios and a host of fintech startups were founded to tap into new markets.

The fintech revolution has made investing more accessible. Retail investors can now buy and sell options and derivatives without the hurdles they would have faced only a few years ago. There are even platforms that empower investors to own collectibles and rare wines. Farmland, which opens up new and distinct opportunities for a broader range of investors, is the latest asset class to ride the fintech wave.

Now, fractional ownership has made farmland investing viable for accredited investors. This investment model makes it easier for you to dial in your allocation while still having a direct ownership stake, rather than shares of an investment fund dedicated to these opportunities. Accredited investors have much more flexibility in how much they want to invest as well.

All this allows more people to take advantage of the hedging properties of farmland in a tech-savvy, cost-effective manner.

Comment