Brian Rothenberg

More posts from Brian Rothenberg

The “health” of a startup’s growth can be a strong predictor of how large and valuable it can become. Our generation’s most valuable startups have all sustained a high rate of user/revenue growth over an extended period of time. As such, founders, employees and investors are all trying to figure out if their startup can achieve sustainable growth to create a large and enduring business over time.

Simply looking at top-line growth tells you relatively little. Two startups that are currently growing users or revenue 300% every year can each have different long-term prospects. It’s almost like looking at two people of the same age, height and weight, and projecting the same quality of life and longevity for both — there are many more factors that can help you make better predictions. Startups are similar, and it’s important to dig deeper into the health of a startup’s early growth and work to build the right foundation from an early stage.

Prior to becoming a VC at Defy, I founded two companies and was Eventbrite’s VP of growth for over six years from startup through IPO. Working across all stages from founding through to public company and advising many other startups along the way, I’ve landed on five critical factors for healthy and sustained growth that can be the difference between a startup failing, getting to a modest exit or building a valuable and enduring billion-dollar company.

Healthy engagement and retention are key

At its core, any successful product or service delivers more value to the user/customer than it costs to use (money or time). To see if your product is delivering true value, ask if it is achieving strong user engagement and customer retention. My friend and growth guru Casey Winters captures this well: “Product-market fit is retention that allows for sustained growth.”

Consumer startups can evaluate this via through cohort-based retention analysis of how frequently customers use the service, and how long they are retained for. SaaS businesses should be talking with customers often to gauge their happiness while also looking at logo retention as well as gross and net revenue retention — ideally, the business should show early signs of being a net-negative churn business, wherein revenue from existing customers actually grows over time, even after accounting for churned customers.

Many people incorrectly think “startup growth = customer acquisition.” In reality, retention is the most fundamental aspect underlying sustainable growth.

Customer obsession creates “pull” from the market

Customer obsession, plus organic pull from the market, are indicators of early product-market fit and signals of future growth potential.

Here are a couple ways to measure this:

See if a healthy percentage of the business is growing without paid spend, generally through word of mouth or some other form of virality. If your business is seeing more than 50% organic growth at a fast rate (200% to 300%+ year over year), you’re solving people’s needs well enough that they’re now sharing with others and creating a positive viral effect.

Customer happiness is another key metric. When talking with a startup’s customers, my ears perk up when I consistently hear superlative praise such as, “I don’t know what I did before [product X]; now I don’t think I could live without it.”

Beyond conversations with customers, here are a few ways to help quantify this:

- Survey your customers by asking: “How disappointed would you be if [product X] were no longer available for you to use?” My friend Sean Ellis popularized this, and found that >40% was the “magic” number that seemed to indicate strong product-market fit and word of mouth virality.

- When asked, “How likely are you to recommend [product X] to a friend or colleague?”, a substantial portion of customers rate the product a nine or 10 (these are “promoters”) and very few rate the business a six or below (these are “detractors” in the NPS system). Several studies have shown that long-term category leaders are also leaders in terms of NPS. This can be a good early indicator that a product is delivering substantial customer value, which in turn drives word of mouth.

- When I was at TaskRabbit, during the core onboarding flow, we used to ask every new consumer where they first heard about TaskRabbit. A healthy percentage selected “From a friend, family, or colleague.” This was helpful in validating that there were happy customers telling other future customers, and triangulating on a quantifiable metric around our word of mouth.

Distribution advantage that fuels organic growth

The strongest businesses I’ve worked on have all had proprietary growth loops or built-in distribution advantages. I urge every entrepreneur to ask: “What is our business or team’s unfair advantage in growing our customer base?” It’s critical to identify and leverage a product’s built-in strengths first.

To reference a product I know well, Eventbrite built a number of proprietary growth loops early on. Events are inherently social, so Eventbrite designed its platform with virality at its core. As David Sacks said, “Making your company go viral requires more than just the right story: You must thoughtfully build your business from the bottom up and design plenty of opportunities for virality.”

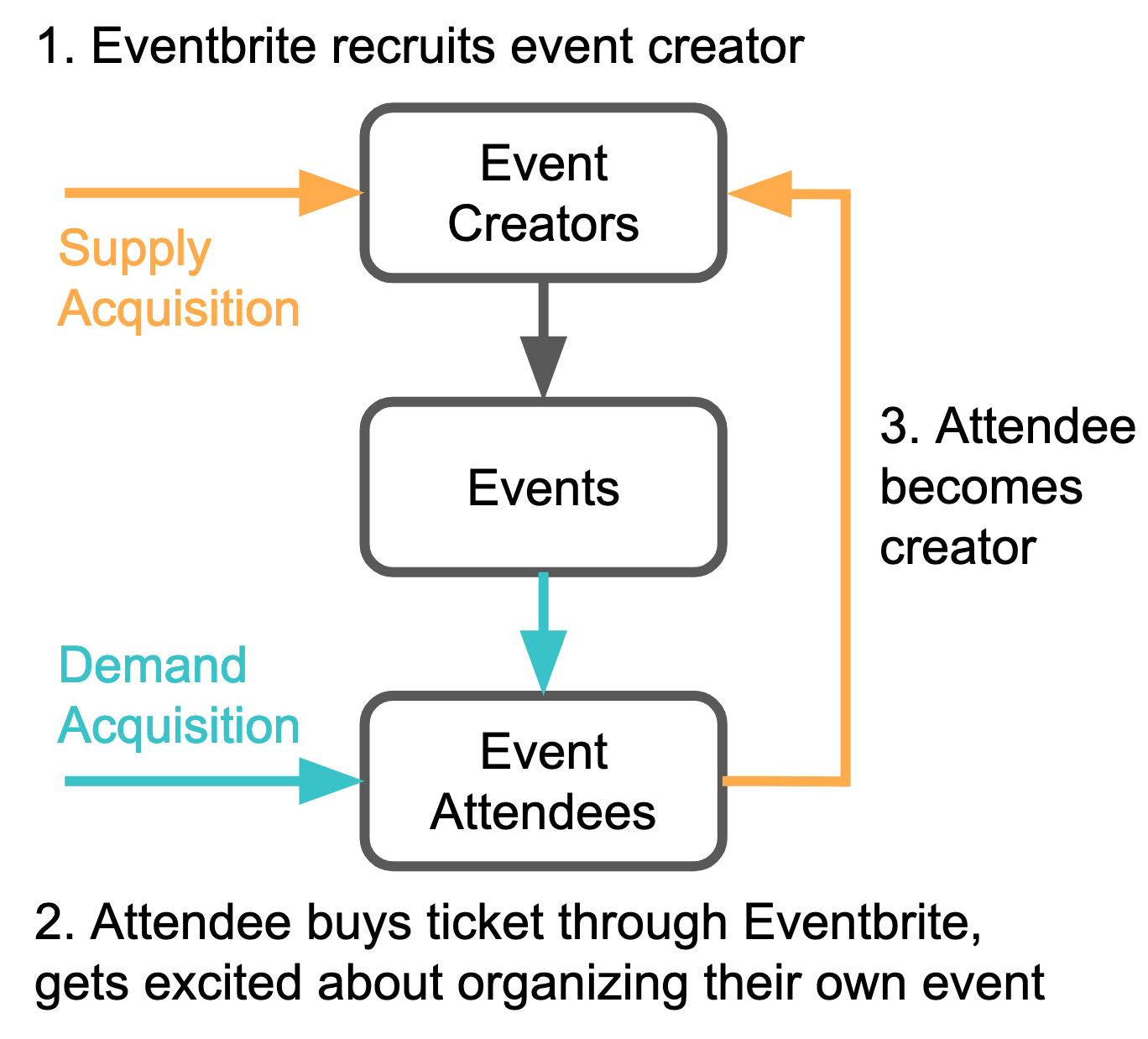

Part of Eventbite’s built-in virality was the attendee-to-organizer loop. People would learn about the platform by first buying a ticket on Eventbrite, and later when they needed to organize their own event, they would convert into an event organizer on the platform. Here’s a visual:

The early growth team at Eventbrite experimented with this key viral loop for almost two years, dramatically improving the attendee-to-organizer conversion rate, which in turn drove substantial organic growth for the business. Years later, this was listed as a key strength in Eventbrite’s IPO prospectus, with around 70% of the company’s awareness driven by this viral loop or word of mouth.

The above is just one example, but Facebook, DocuSign, Uber/Lyft, LinkedIn and many other multibillion dollar companies had some form of early built-in virality. There are many other flavors of this, but this kind of unique growth dynamic is something startup teams should look for in their own businesses, because they can provide massive upside for growth and value creation.

Steering clear of the paid marketing trap

Many startups are using large chunks of their funding on paid marketing. Rather than tacking the more difficult task finding repeatable organic growth levers, some startups instead choose to buy their up-and-to-the-right growth curve. While startups can fool some investors by using paid marketing as the dominant driver of their growth curve, it usually comes back to bite you. For one, it’s really hard to get off the paid marketing drug once you’re on it, and secondly, as a startup gets hooked on paid marketing, a couple things happen:

- Marginal costs tend to increase as each additional user acquired tends to cost more than the previous one.

- Marginal customer value declines. All else equal, customers from paid channels tend to generate less revenue per customer than customers from organic channels. To make matters worse, early customers are likely to be the most valuable, so as you scale, customer lifetime value for newer uses actually tends to decrease.

Combine the two dynamics above, and it can be easy for startups to get upside down on incremental paid acquisition as they scale. Paid marketing can be a useful tool in your toolkit to accelerate an already humming flywheel. Just don’t let it be the only one.

Innovate on distribution, not just product

First time founders are obsessed with product.

Second time founders are obsessed with distribution.

— Justin Kan (@justinkan) November 7, 2018

Great distribution is an absolute requirement in building a category-defining company. Building strong distribution requires iteration, innovation and continuous investment.

Thumbtack is a good example here: From an early stage, the founders were constantly testing new and novel ways to drive distribution, from building one of the earliest automated post-to-Craigslist tools, to deeply investing in and creative testing of SEO. I watched them continuously try new things over a decade, failing at times while winning other times. But in all they were relentless in pushing forward growth and distribution.

There’s a saying that past results predict future success. If founders and their teams have a track record of creatively and tenaciously finding new ways to continue growing, it’s certainly more likely that they will continue to do so throughout their path from startup to enduring company.

Not all startup growth is equal, and there are a few key aspects that make the difference between a startup reaching its full potential or falling short. Ultimately, in my experience, the most compelling growth will be organic, sustainable, uniquely designed into how the core product works, and driven through creative iteration and ongoing tenacity. I hope these key growth attributes are helpful as you evaluate and work to strengthen your own startup, or when choosing your next promising startup to join.

Comment