With more and more people ordering food from home — a trend that gathered momentum at a time when it was safer to eat at home than in restaurants — the proliferation of so-called “ghost kitchens” is continuing apace. These kitchens focus on takeaway orders and need a layer of technology to keep things running smoothly.

“When COVID began, all restaurants were required to have some relationship with technology in order to survive, but the importance of this relationship has been greatly enhanced by the rise of the omicron variant,” Nabeel Alamgir, co-founder and CEO of Lunchbox, told TechCrunch via email. “This is the most difficult struggle restaurants have ever faced in recent memory.”

Lunchbox spotted an opportunity, raising $20 million in 2020 and then $50 million back in February. In this post, I’m taking a look at the deck the company used to raise its $50 million round and bring on board an impressive cadre of investors.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Lunchbox raised its $50 million Series B with a very tight, 15-slide deck, which the company very kindly shared with us. The entire deck is unabridged, which makes it a particularly amazing deck to learn from. Let’s dive in:

- Cover slide

- Lunchbox is the operating system … — mission slide

- Best Emerging Brands — customer slide

- 3rd party companies are expensive — problem slide

- Building your own ordering system — problem slide

- All in one solution — solution slide

- Result: 3rd party killer — impact slide

- Case Study: Clean Juice — customer deep-dive slide

- Meeting guests where they are — customer journey slide

- Product Led Organization — product road map slide

- An exploding ghost market — market trend slide

- Competitive Positioning — competition overview slide

- Toast vs Lunchbox — competition deep-dive slide

- Future Landscape — market trend slide

- Let’s get cooking — contact slide

Three things to love

This is going to be one of those times when I regret limiting myself to only writing about three things I loved in a pitch deck.

This deck is a master class in how a company can carve out its story and show off how it shows up. Lunchbox successfully explains how it impacts its customers’ lives without rabbit-holing too deep into product features. It capably paints a picture of exactly how it stands out in a fiercely competitive landscape.

The deck also tells us how Lunchbox can see a clear path to an exit without making that explicit. Very well done indeed. Let’s pull up some highlights!

Illustrate the impact

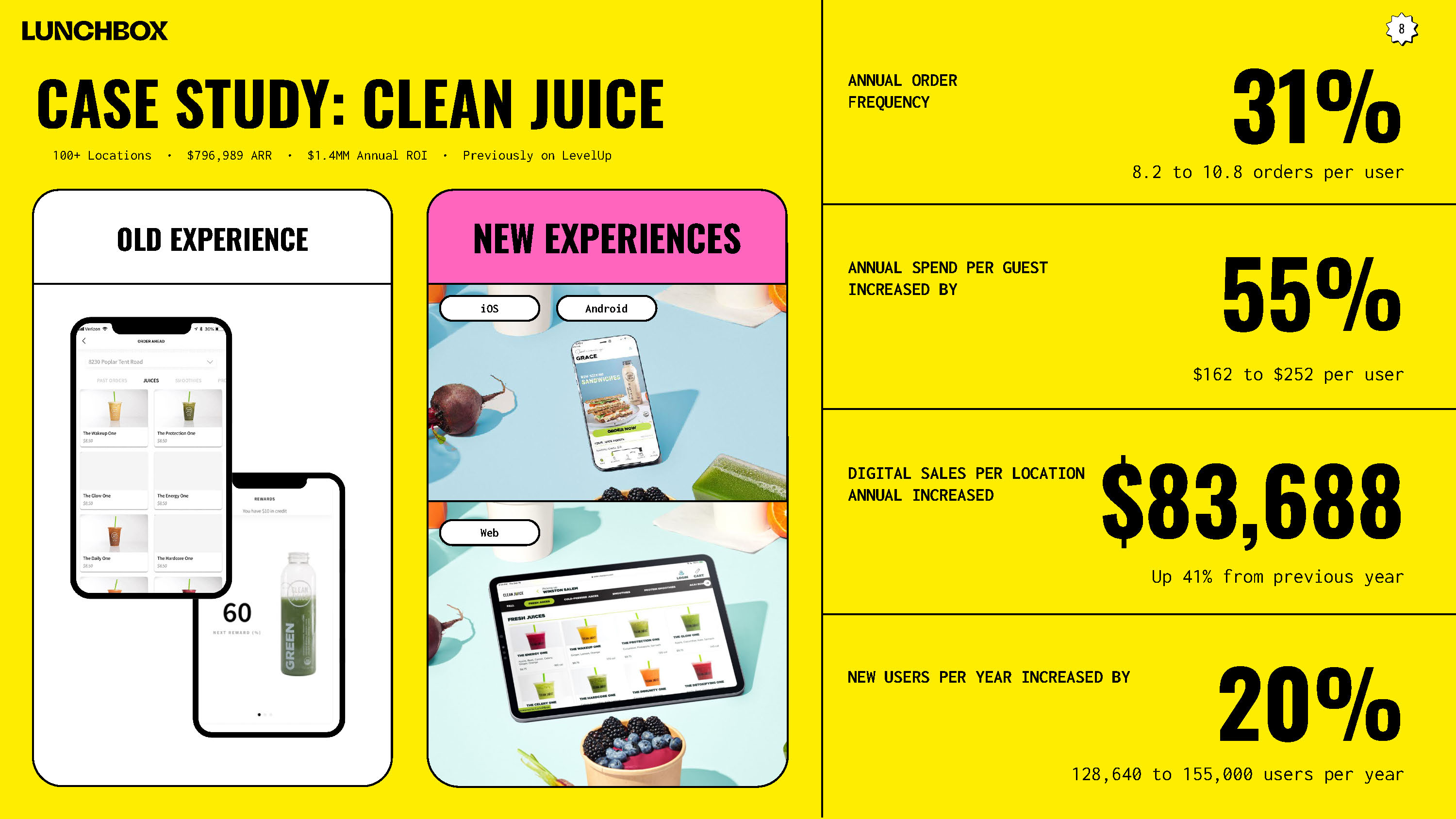

About halfway through the pitch, Lunchbox plays a card — or a slide, if you will — that really rams home its raison d’etre. The slide tells the story of how Lunchbox is helping a customer — juice bar Clean Juice.

Click “order now” on the Clean Juice site, and you’re taken to a beautiful, white-labeled version of Lunchbox, where you have the option to choose an outlet close to you and place an order. That’s one layer of this slide — you’d best believe that any investor worth their salt would try to place an order from Clean Juice to see the product in action.

Case in point: As I write this teardown, I’m saddened that the nearest Clean Juice outlet is too far away to deliver to my house. If Lunchbox is clever, they’d note that I submitted my address and would feed that back to Clean Juice to tell them that perhaps there’s interest in an outlet in Oakland, California.

The other layer showcases the impact Lunchbox has had on Clean Juice with hard facts, figures and numbers — the manner of storytelling investors appreciate most.

A 31% increase in order frequency, a 55% increase in annual spend per user and a 41% increase in digital sales per outlet, plus a 20% bump in new users year over year? Those are incredible numbers for any business and would certainly be enough to make me lean in and pay attention if I were running a chain of food stores. More importantly, if Lunchbox is able to draw a clear parallel between the tools and services it provides and the sharp uptick in traffic its customers see, it’s going to have some incredible sales collateral.

To me, the best part about this slide is that it doesn’t go too deep into exactly how it accomplishes these numbers. No doubt that’ll be a topic for conversation later in the pitch process. As an investor, all I need to know right now is that the product works, that the customers find real value in it and that they are willing to pay for it.

These numbers tell that story in a powerful way.

Why now? This is why now!

The best slides rarely whisper; they shout.

My goodness, slide 11 is a shouty slide. Let me be clear: There’s no way I would have designed this slide like this. It’s three different slides masquerading as one — it tackles macroeconomic market trends (70% of restaurants have used a ghost kitchen, and 69% said they are planning to open more), the moat/defensibility of the product (“patented product”) and gives us the raw numbers.

The last bit is my favorite. In the top right corner, the company hides the most impressive stat in the entire deck in muted colors, almost shyly telling us that it’s on an incredible growth trajectory. It grew 541% from 2020 to 2021 and another 365% from 2021 to 2022 to almost $15 million in annual recurring revenue (ARR).

If I were pitching this company to investors, these numbers would be on the second slide in the deck, and I’d be shouting about it very loudly indeed: We found a repeatable business model, and we are raising $50 million to lean heavily on the gas.

It is against this context that I love this slide so much. It isn’t how I would have done things, but any investor reading this would lean in and start paying close attention. It’s a mic drop, a humble brag, a “Hey, we have something defensible in an exploding market, and we are hanging on tight as this rocket ship vanishes into the stratosphere.”

What this slide tells me is that Lunchbox would have to try not to be wildly successful. And that, ladies, gentlemen and everyone who doesn’t identify as either, is how you pitch a Series B round — explain how your success is inevitable.

Does it have to be the truth? Absolutely; you can’t lie. But what you can do is tell your company’s story in a powerful way and let that be the opening salvo for discussion between you and your investors.

A humble brag plus a competitive overview

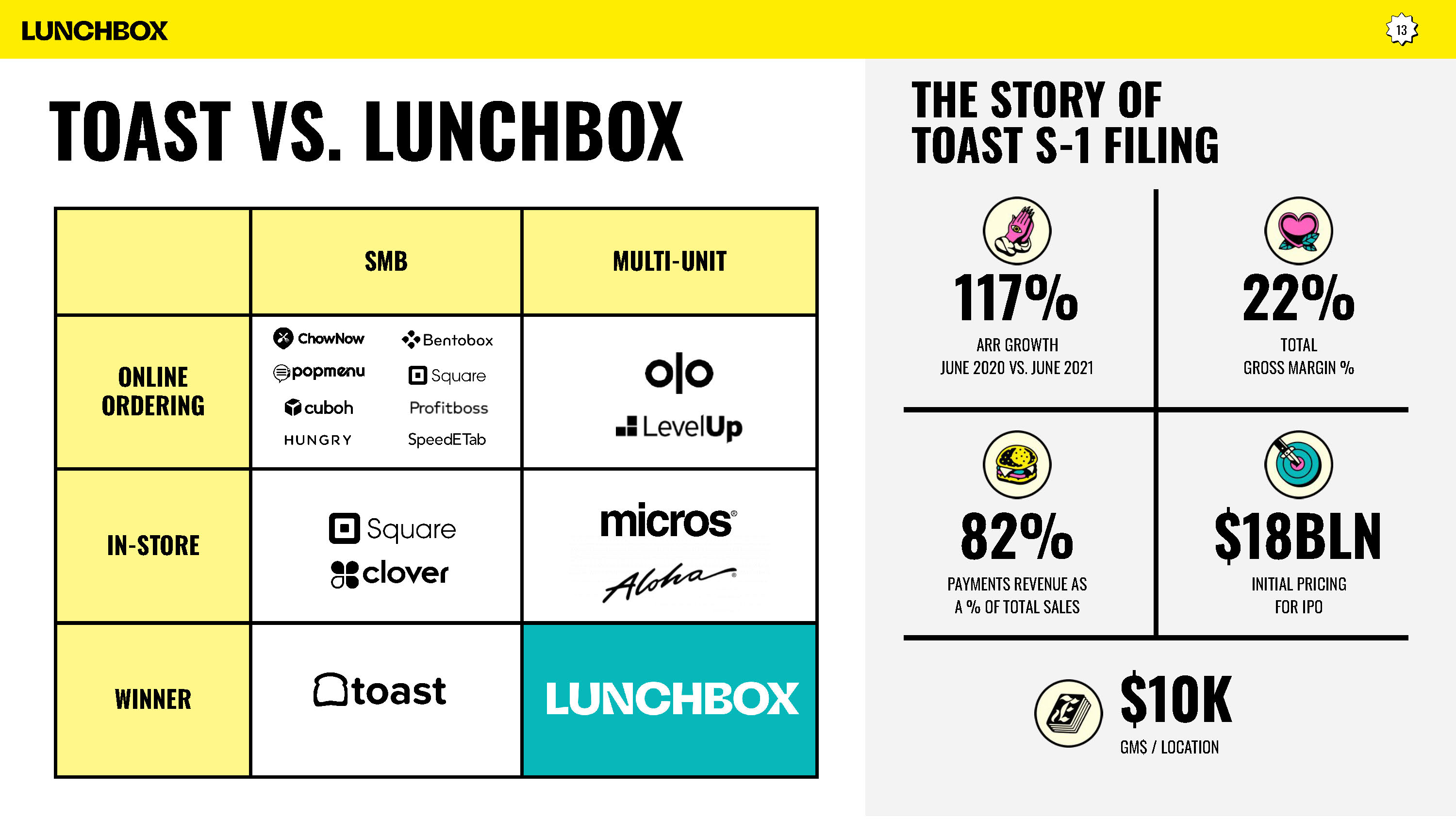

Toast is an interesting competitor for Lunchbox to position itself against, not least because the former recently filed a form S-1 for an IPO and posted a (more recent) 10Q quarterly report.

If you’re not used to reading those, Alex has a fantastic analysis of the company’s S-1, but Lunchbox did a great job at pulling out the salient details vis-a-vis investors taking a closer look.

Knowing that Toast exists and has a current market cap of $8 billion in a market where Lunchbox can argue that it has access to a potentially bigger market is a pretty smooth way of telling this part of the story.

To me, this slide basically screams, “Hey, we are spooling up for an IPO!” Given the current fundraising size of $50 million, I wouldn’t be surprised if part of the strategy following this round is to hire a team of finance people, a wunch of bankers (yes, a “wunch” is a collective noun for bankers; don’t think too hard about it) and strengthen the operations of the organization to cement a solid growth trajectory.

If Lunchbox manages to do all of those things, an IPO might turn out to be the logical next step. Alternatively, it might spend the cash on hyperscaling its growth, and then raise a Series C to finance the IPO process.

One thing is for certain: This slide is placing a stake in the ground for Lunchbox to gear up for explosive growth — and makes it seem entirely reasonable based on in-market competitor predicates.

In the rest of this teardown, we’ll take a look at three things Lunchbox could have improved or done differently, along with its full pitch deck!

Three things that could be improved

I know I say this every time, but I feel a little goofy offering feedback to Alamgir, the CEO of Lunchbox. If I were him, I’d go, “Hey, Haje, calm down. We raised $50 million; how much money have you raised?” at which point I’d have to look down at the tips of my sandals and mutter, “Not $50 million.”

Impostor syndrome aside, there’s no deck so perfect that it can’t be improved a little bit, so let’s see if we can’t manage to poke a few holes.

A weak start

The deck starts with a series of three slides that I think could be improved. The first slide is the cover, which just says Lunchbox Series B (the one at the top of this article). I think the company chose a strange design language; it is bold, yes, but it really doesn’t work for me. If I had this on my desk, I’d immediately be on my back foot.

The second slide is the company’s mission: “Lunchbox is the operating system for managing your restaurant’s entire consumer experience.” I don’t hate it, but mission statements that speak directly to a customer often fall flat in the context of an investor pitch. The statement says, “your restaurant,” and it’s unlikely that the investor runs a restaurant, which makes me wonder who the founders are talking to.

Then there’s the third slide, embedded above. It’s a wall of logos and a breakdown of chain restaurants and ghost concept kitchens. The problem is that I’m not familiar with half of these brands. I don’t know whether these brands are Lunchbox customers (If they are, great! Put that on the slide!) or if they are just examples of emerging brands (If so, why are they on this slide?). I found it confusing.

I imagine the CEO does a voice-over that puts all this into perspective, but that means this slide doesn’t stand well on its own. If it said something like “Meet our customers” at the top, it would be obvious why these companies are listed here.

Too much going on on each slide

A lot of these slides have one thing in common that leaves me confused — there’s often too much information on each slide. Some slides explore multiple ideas at the same time (the best and worst example of that is slide 13, discussed above), a few have lots of text on them and others are simply unclear in their purpose.

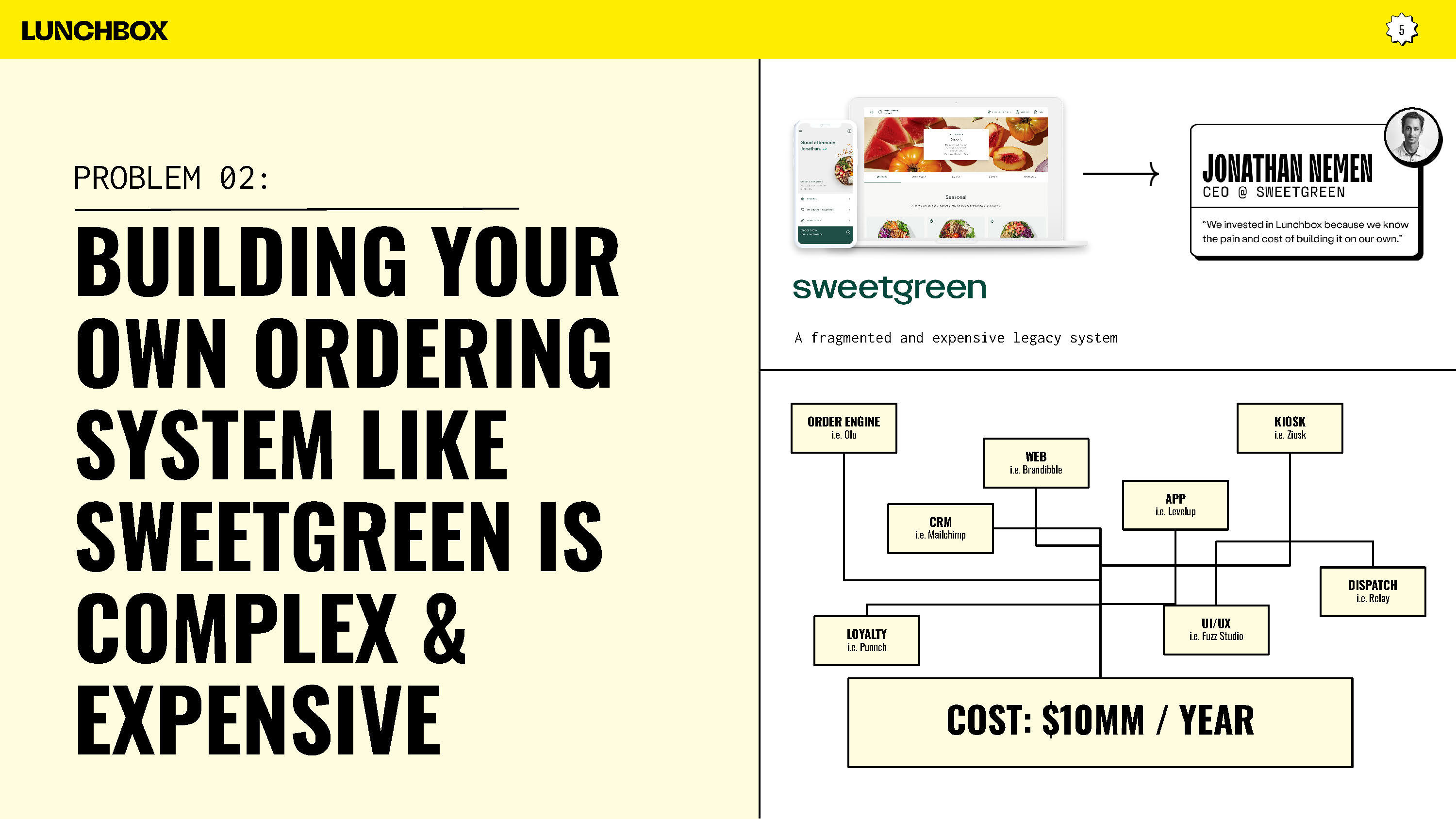

As a general rule, when I coach people, I encourage having only one takeaway per slide. If you’re talking ARR growth, let that be the slide; if you’re explaining your business model, focus on that; if you’re explaining why a customer is happy with you, that’s the whole story.

On this slide, I can 100% imagine how the CEO weaves a narrative. They could start by explaining why Sweetgreen is struggling with its complex home-built ordering system, and how the Lunchbox team spoke with the Sweetgreen CEO to convince them to join Lunchbox instead. They probably used a message along the lines of: “Are you a software development shop or a restaurant chain? And if you’re the latter, wouldn’t you rather focus on opening more restaurants rather than cobbling together a user experience from a half-dozen different components and vendors?”

I get that Lunchbox is proud of having Sweetgreen as a customer and telling the story of one customer’s delight is a great way to capture interest. That said, the spaghetti of how the problem was solved is probably worth a separate slide so you can talk about it in depth.

The quote from the Sweetgreen CEO is a nice touch — if I were an investor, I’d probably pick Jon Nemen as one of the reference calls — but on the whole, it just feels like my eyes are being pulled in many directions at once. That isn’t comfortable and doesn’t help with the “flow” of the story.

Good heavens, that competitive landscape

At the beginning of the pandemic, I had a startup of my own — a virtual events platform that had 40-plus competitors. It was brutal and one of the big stumbling blocks for the company. The question became: How the hell are you going to stand out in a competitive quagmire?

Looking at Lunchbox’s competitive positioning slide (slide 12), I feel a bit of PTSD kicking in, and I suspect Lunchbox will have had similar pushback. There are 43 competitors on this slide, which is a god-awful mess. Lunchbox is doing an elegant sidestep here, which is basically saying that Toast is gobbling up the left-hand side of this chart, and Lunchbox is chomping down on the companies on the right.

I find it extremely hard to read, and it took me embarrassingly long to figure out what I was looking at. Why are they stacked differently? Why is there a pink box? What is the “selling with/selling against Olo” box at the top right? How does this fit in with the product road map and the company’s growth trajectories?

I’m willing to bet a lot of money — not quite $50 million, but still — that Lunchbox has a really good story about what the market is, how it is positioned and where the opportunities open up in the process. This slide doesn’t tell that story in a way that is intuitive to me. The narrative arc’s missing, and I find myself trying hard to understand that part of the story.

A slight redesign — perhaps making the argument that Toast will take 30% of the market, Lunchbox takes 70%, and in five years, Lunchbox buys Toast to take the entire market — would be a cleaner way to tell this story.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice.

Comment