Did you miss IPOs? I sure did. They could be coming back after a summer lull.

Warby Parker, a D2C glasses company backed by over a half-billion dollars of private capital, filed to go public yesterday. For investors like General Catalyst, Tiger Global and Durable Capital Partners, it’s an important debut. Having taken on equity capital since at least 2011, investors have been waiting a long time for Warby to float.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

And there’s quite a lot to like about the company, the first parse of its IPO filing reveals. There are some less attractive elements to its business worth discussing, and we need to examine how COVID-19 impacted the company’s 2020 performance.

Warby last raised known private capital in August 2020, a $120 million Series G that valued the company at just over $3 billion on a post-money basis. D1 Capital Partners led that transaction, which included both Durable Capital and Baillie Gifford.

For D2C startups, the Warby IPO is something of a do-over. The Casper IPO from early 2020 is now a cautionary tale for companies employing the business model; The company reduced its IPO range, priced at $12 per share and today trades for just over $5.

For D2C startups, the Warby IPO is something of a do-over. The Casper IPO from early 2020 is now a cautionary tale for companies employing the business model; The company reduced its IPO range, priced at $12 per share and today trades for just over $5.

But there’s more to Warby Parker’s IPO than just the D2C category. It’s a public benefit corporation, which it says in its filing means that it is “focused on positively impacting all stakeholders” as opposed to merely shareholders. And the company has a charitable bent to its efforts through a foundation and donation model of giving away eyewear when customers purchase their own set. Warby also has a hybrid sales model, leaning on both IRL and digital retail channels. There’s lots to dig into.

So let’s parse Warby’s growth history, its profitability progress over time and how the company is blending IRL shopping with digital channels. We’ll close by examining just how the company was priced last year, taking a guess at what it might be worth in today’s public markets.

Inside Warby Parker’s historical growth

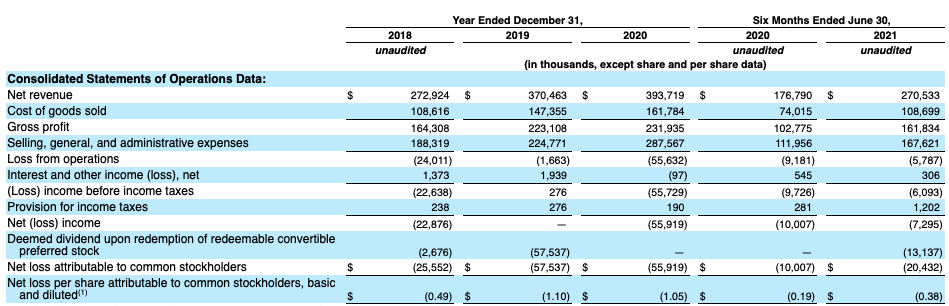

Looking at Warby’s full-year results for 2020 is not inspiring. The company grew well from 2018 to 2019, expanding from $272.9 million in revenue to $370.5 million in revenue, or around 36%. That’s not an astounding pace of growth, but it’s more than respectable for a company of Warby’s age and size.

Then in 2020 the company only managed to eke out 6% growth to $393.7 million in top line. What happened to slow the company’s growth rate from Just Fine to Not Fine At All? COVID, it appears.

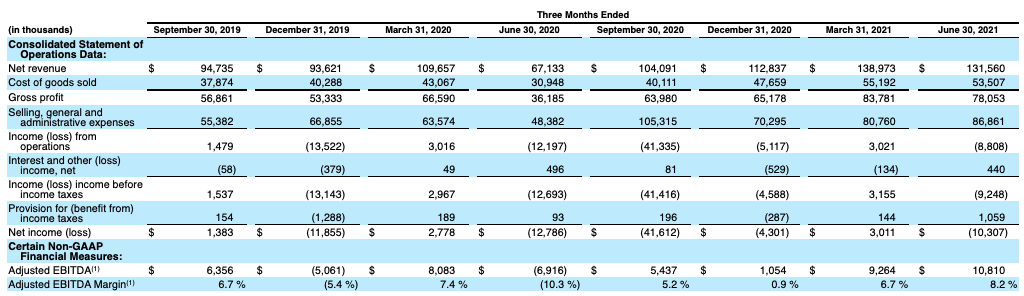

Observe the company’s quarterly results, via its S-1 filing:

Don’t worry about the wall of numbers. Just track the top line (revenue) against time. As we can quickly see, Warby had a pretty weak Q2 2020, the period ending June 30 of last year. The company did manage to reduce SG&A costs during that quarter, which saved it from posting even deeper losses. But having such a lackluster quarter meant that 2020 was essentially a lost year at the company in aggregate growth terms.

Taking a more positive angle on the company’s historical results, we can see that Warby managed to grow across the next three quarters, effectively doubling in size from Q2 2020 to Q2 2021. For investors who might be looking to buy IPO shares in companies with growth stories, the last few quarters at Warby have been pretty strong.

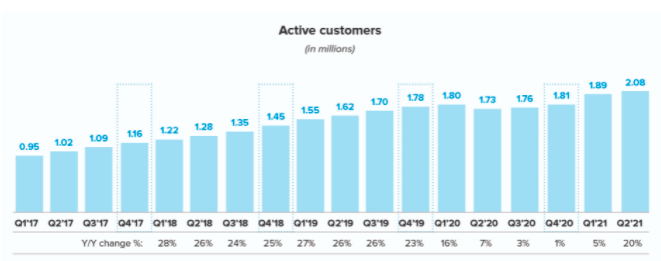

Another way to view the company’s COVID hit is to track its “active customers” metric. This is the number of customers who have “made at least one purchase in the preceding 12-month period.” Here’s that chart:

I apologize for the quality of the image, but it’s also poor in the S-1 filing itself. There’s only so much we can do.

More importantly, in the second quarter of 2020 we can see that after endless quarters of sequential growth, Warby’s rolling 12-month unique customer count fell. That means that the company’s ability to add new customers during the period was dramatically constrained. Which makes sense — getting one’s eyes checked for new glasses was difficult at the time, and going outside was discouraged, impacting Warby’s physical stores — and explains the slack revenue numbers from the period.

But it’s not all bad news. A lackluster Q2 2020 and a strong start to 2021 gave the eyeglasses company a strong comparative performance to tout in its IPO filing:

From the first half of 2020 to the first half of 2021, Warby grew by just over 53%. Sure, that includes the dim second quarter of 2020, but the comparison still looks rather nice. The company also tacked on around 2 percentage points to its gross margins across the two half-year periods, wrapping H1 2021 with gross margins of just under 60%.

For a non-software company, that’s pretty good. So, we have growth and reasonable revenue quality. How do the pair of financial attributes convert into profits?

Profitability

Because 2020 was not a good year for growth at Warby Parker, it was also not a good year for the company to demonstrate that as it grew, it would lose less money. Convincing investors that a growth-focused company is reducing its losses is known as showing a path to profitability. In 2020, Warby merely showed that it could lose a very modest amount less on the back of slim top-line expansion. Not great.

But the first half of 2021 is looking a bit better, with Warby’s growth reducing its net loss from $10 million in H1 2020 to $7.3 million in the most recent two quarters. That’s not amazing implied operating leverage, but it isn’t awful either. Warby is losing less money as it scales in recent quarters, and it will want to be priced as such.

In adjusted profitability terms, let’s pull some numbers. Via the company’s S-1 filing, adjusted EBITDA was as follows:

- 2018: $8.6 million.

- 2019: $21.9 million.

- 2020: $7.7 million.

- 2020 H1: $1.2 million.

- 2021 H1: $20.1 million.

The COVID-impacted 2020 period remains a bit of a blot on Warby’s growth history, but the company’s H1 2021 adjusted profitability gains — the company is on track for record adjusted profit this year — returning growth and improving gross margins could prove to be an attractive package when it prices. Of course, we’d prefer unadjusted profits, but this is 2021 and we need to adjust our standards accordingly.

Now that we’ve digested the big, raw numbers, let’s dig into some Warby-specific questions to better get our minds around how the company operates today.

Warby questions

We’ll proceed in bullet points to save you time:

- Is giving away glasses expensive? Probably. The cost of Warby’s “Buy a Pair, Give a Pair program” is included in its SG&A line item. It’s effectively a marketing cost. Digging into its more recent results, Warby wrote in its filing that while its overall SG&A costs as a percentage of revenue fell during the first six months of 2021, “advertising and marketing costs grew in line with net revenue.” Our read of that explanation is that Warby will have a harder time lowering its marketing costs as a fraction of revenue over time due to its charitable donations. Which is fine, to be clear. We merely wanted to flag the data.

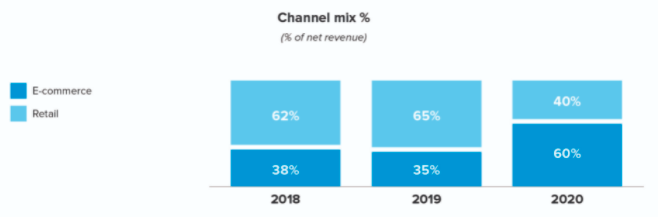

- How important is physical retail to Warby? Very. Warby stores grew from 88 in 2018 to 119 in 2019 to 126 in 2020 to 145 by the end of Q2 2021. Your humble servant actually saw one get put together and opened near where he lives. It looks perfectly nice. But the company’s revenue mix changed sharply last year, impacting its stores’ ability to do their thing. Observe the following chart:

- Physical retail, continued: That’s a revenue mix-shift flip. But if you are bullish on Warby having more stores, you might have reason to be enthused about the company’s future performance. After all, it weathered store shutterings in 2020 while still managing modest growth and adjusted profitability. With more stores now than ever, physical retail fans might have reason to anticipate stronger future growth. Digital retail fans, the opposite.

- What about customer acquisition costs? They are going up. CAC rose at Warby from $26 in 2018 to $27 in 2019 to $40 in 2020. Not bad, right? Especially as we’ll note in a minute, Warby customers are making larger orders over time. But, as it turns out, the company’s CAC numbers are kinda bullshit. Warby defines CAC as “acquisition costs for a given period divided by number of Active Customers during that same period.” Which means that it is counting existing customers in its CAC numbers? Which seems dumb? The company’s real customer acquisition costs are higher.

- Are Warby customers buying more over time? Yep. The company’s average order size rose from $158 in 2018 to $176 in 2019 to $184 in 2020. That’s good news for a company paying more to acquire customers.

- So, what about retention? A good question. Warby has shown a rising percentage of active customers that are returning over time. Returning customers and rising average order size mean that Warby’s rising CAC may pencil out well, though we lack enough data to really make that call.

All told, Warby Parker is a consumer hardware company with two main sales channels, largely attractive economics, falling losses and rising adjusted profitability. You could even argue that it handled the pandemic well, despite COVID-19’s negative impact on its operations. So what’s it worth?

How do you value the company?

EssilorLuxottica is another eyewear brand. Perhaps you’ve heard of them. Happily, they are public, so we can pull some numbers. Here’s EssilorLuxottica’s H1 2021 result set:

- Revenue: €8.8 billion.

- Revenue growth H1 2021: +5.7%.

- Gross margin: 61.4%.

- Net profit: €854 million.

News to me, but EssilorLuxottica is worth $82.5 billion. If we convert the company’s H1 2021 revenue to a full-year run rate, EssilorLuxottica is worth 4.7x revenues. (YCharts lists a 5.0x revenue multiple for the company on a trailing 12-month basis, for reference.)

Turning back to the company in question, Warby is far less profitable, but growing much more quickly with similar gross margins. Given how the market is valuing growth these days, let’s be generous and provide the company with a 50% multiples premium: 7.1x. Warby’s H1 2021 revenues were $270.5 million. Applying our 7.1x multiple, Warby is worth $1.92 billion. That’s $1 billion less than its pre-money valuation set last August. Updated: I made a mistake! I forgot to double the company’s revenue to get an annual run rate figure! Executing that correctly, Warby is on a $541 million run rate, which at a 7.1x multiple works out to a $3.84 billion valuation.

That’s a far more tasty figure than we initially calculated, and implies that the chances of Warby defending its final private valuation are far better than we first guessed. It’s still not a layup, but it went from looking like the stretch of the century to merely moderately aggressive.

Sorry for the error. I hate, hate making mistakes like this and we work pretty dang hard to fact-check our own math. Mistakes happen, but yowza this one hurt.

Comment