Inflation may or may not prove transitory when it comes to consumer prices, but startup valuations are definitely rising — and noticeably so — in recent quarters.

That’s the obvious takeaway from a recent PitchBook report digging into valuation data from a host of startup funding events in the United States. While the data covers the U.S. startup market, the general trends included are likely global, given that the same venture rush that has pushed record capital into startups in the U.S. is also occurring in markets like India, Latin America, Europe and Africa.

The rapidly appreciating startup price chart is interesting, and we’ll unpack it. But the data also implies a high bar for future IPOs to not only preserve startup equity valuations at their point of exit, but exceed their private-market prices. A changing regulatory environment regarding antitrust could limit large future deals, leaving a host of startups with rich price tags and only one real path to liquidity.

That situation should be familiar: It’s the unicorn traffic jam that we’ve covered for years, in which the global startup markets create far more startups worth $1 billion and up than the public markets have historically accepted across the transom.

Let’s talk about some big numbers.

Startup valuations: Up, and going upper

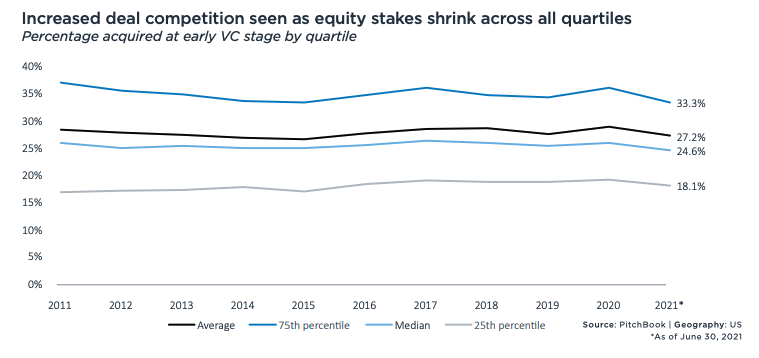

To summarize what PitchBook published: Round sizes are going up as valuations go up, and with the latter rising faster than the former, we’re not seeing investors get more ownership despite them having to spend more for deal access.

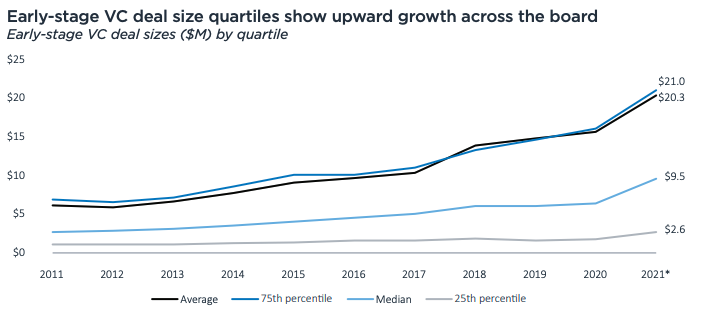

In the early-stage market, deal sizes are rising as follows:

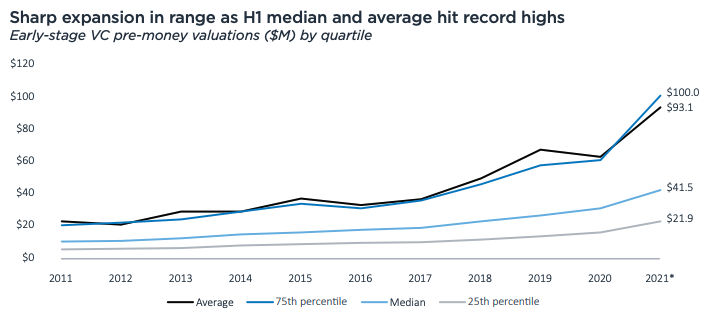

Prices are going up as well, as the following chart shows:

Which leads to the following decline in equity take rates:

Those charts belie somewhat how quickly venture capital is changing. For example, in 2020, the median early-stage value created between rounds was $16 million (or a 54% relative velocity, if you prefer). In 2021 thus far, it’s $39.4 million (120% relative velocity). And that 2020 figure was a prior record. It just got smashed.

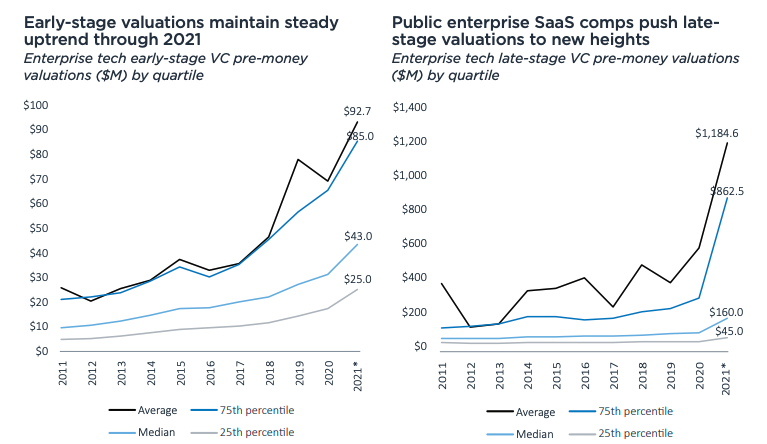

The PitchBook dataset has other superlatives worth noting. Enterprise-focused seed pre-money valuations hit an average of $11 million in the first half of 2021, an all-time high. Early-stage valuations for enterprise-focused startups also hit fresh records — $92.7 million on average, $43 million median — this year after rising consistently since 2011.

And late-stage valuations for enterprise tech startups have gone vertical (chart on the right):

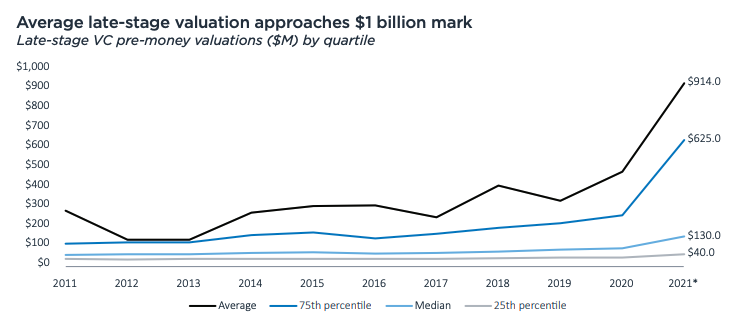

The entire U.S. late-stage venture capital market is having a moment. Despite a 2016-2017 lull in valuation growth, prices for late-stage venture capital rounds have done the following in the first half of 2021:

Before you shout and try to put your wallet in the freezer if you are a VC, or start to refresh your deck if you are a founder, let’s keep in mind that there are some good reasons why valuations are rising.

As a reminder, the software market is proving to be larger than many previously anticipated. In practice, that means that tech companies can grow more quickly and for longer than many had priced into their earlier values. Now that the total addressable market for software — and therefore startup TAM, broadly — is known to be so large, it’s natural that early-stage prices are rising as the present value of those companies’ anticipated future cash flows is going up.

And it’s not just market risk that has declined. Execution risk in the startup space, as many upstart companies focus on software, has also declined. Less startup risk means higher prices, as lots of other types of money can now play in the private markets. More money, more competition for deals, and thus higher prices.

In summary, prices going up for startup equity can make general sense, given a few macro trends that we understand.

But that doesn’t mean that the aggressive price increases for startup deal allocation are entirely reasonable; it just means that they don’t make no sense. You can still comfortably argue that deals are overpriced.

What about exits, though?

Especially if you worry about exit value, or the price at which startups raising all these high-priced deals will be able to give their shareholders liquidity.

Here another macro argument comes into play, namely rising antitrust pressure on the largest tech companies. Over time, that could lower the appetite among large tech companies to buy high-priced startups. If those deals are going to hit regulatory snags, they won’t be as attractive.

That could limit the price that startups can command when selling to larger public tech companies. And it could lower overall deal volume. We’re already seeing that among the Big Five, for example.

That leaves IPOs, and the same issue we’ve long seen from unicorns. There’s little evidence that the strong IPO market in recent quarters can curtail the unicorn backlog. More unicorns are being created than exited, and present-day trends in valuations imply that we’re only going to see more of the same.

So, what fixes the problem? It’s not clear. Perhaps direct listings? En masse? That might help, but given that we’ve only seen a few companies manage the transaction type, and fewer successfully, it’s a stretch.

SPACs are fading. This leaves traditional IPOs as the likely exit path of choice requirement for the rising unicorn horde, a group that should become all the more crowded given this new valuation data. Maybe IPO cadence will accelerate for a few years? That might clear the decks somewhat.

Investors appear to be implicitly betting that the future IPO market will accelerate for a multiyear period at attractive prices. Otherwise, none of what we are seeing regarding the rising price of startups really makes sense.

How to make the math work for today’s sky-high startup valuations

Comment