Welcome back to The Exchange. Today we’re doing something fun with crypto.

Sure, we could write more about how insurtech valuations are under fresh pressure after Hippo’s Q2 earnings report — we spoke to the company’s president yesterday; more to come — or the latest stock market movements in China. There are big rounds worth considering as well. Roblox reported earnings this week. And Monday.com’s earnings pushed its shares sharply higher yesterday. There’s lots of interesting news to chew on.

But instead of all that, we’re digging back into crypto. Why? Because there are some rather bullish trends that indicate the world of blockchain is maturing and creating a raft of winning players

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Writing about crypto is always a little risky. Cybersecurity folks will complain that we’re abusing the phrase crypto, despite the fact that language always evolves. And Bitcoin maximalists aren’t going to find much below that underscores their core thesis that every coin not mentioned in Satoshi’s whitepaper is, in fact, a scam. Save your tweets, please.

But if you care more generally about the larger global cryptoeconomy, it’s time to imbibe some good news. Our goal is to highlight a few recent trends and then talk a little about what we might see coming from startups.

Encouraging news from your local distributed ledger

The Exchange finds rising NFT volumes bullish, and we have a new thesis for what the value proposition is for such digital assets. The rising tide of mega-rounds for crypto exchanges belies not only the worldwide demand for access to crypto, but also sets the stage for a global cohort of stable, well-funded and trustworthy on-ramps to the crypto world — and, of course, more exchanges imply lower fees over time.

Non-exchange crypto fees are also bullish. And then there’s a wrinkle to the stablecoin game and what sort of economics things like USDC may command in time. We have notes from an interview with Circle to help us there.

NFTs and the concept of joy

I don’t think anyone actually understands what the metaverse is. But the possibility that, in time, unique assets on particular chains — NFTs — will have a part to play in larger digital worlds seems like a reasonable conjecture. One can easily imagine life, as we all become Increasingly Online, leaning on human desires for scarcity as a method of showing status. NFTs will help meet that demand in certain digital ecosystems. Games, probably, though what we consider a game will also evolve as VR becomes more mainstream.

But that future is not here yet. So, what value are NFTs providing today that makes them potentially worthwhile? Joy.

You can’t use a ruler to find out just how much joy a person has, or an object currently engenders. But it seems clear that the folks busy trading NFT apes and rocks and horses and even shoes are having an absolute blast. And that’s enough, it turns out, to power a simply enormous trading volume.

Joy is derived in a few ways: the thrill of collecting, the acquiring of what are currently rare assets, and the successful status-seeking among NFT fans, I suppose. And if you observe the following chart, clipped from a one-year search of data presented by NonFungible, tracking NFT sales volume over time, you will see evidence of the price people are willing to pay for a slice of digitally derived joy:

Impressive, yeah?

NFTs feel bullish because their current use cases are modest, but market interest is high. Provided that anticipated future use cases bear out, the NFT world could continue to impress. That means more trading volume for Ethereum and more folks buying into the cryptoeconomy over time.

Selling crypto picks and shovels

Extending our previous look into investors pouring capital into crypto trading platforms the world around, we have a new name to add to the mix: Bitpanda.

The company raised $263 million, it announced this week, at a new $4.1 billion valuation. Per TechCrunch reporting, the company offers investing in more than merely crypto assets, but given its name, it’s not hard to surmise what Bitpanda is mostly about. And coming off the heels of big rounds for other crypto trading platforms FTX, FalconX, Pintu and CoinDCX, it’s more evidence that there are going to be a number of winning platforms helping consumers get their hands on some ether or whatever else strikes their fancy. Our take? Bullish.

Moving forward, we should see more and more overlap between the markets served by the various crypto investing platforms; Bitpanda has geographic expansion in its roadmap, for example. More market overlap will mean more competition, and, therefore, falling fees. Coinbase likes to say that it is not competing on fees today, a position it can take thanks to a solid technological position in the market. But that advantage should shrink, and price competition should heat up. That’s bullish.

Proof of value

Fitting neatly into our previous two points, present-day crypto activity — driven in part by NFTs, and often facilitated by venture-backed exchanges — is generating material fees income. Per CryptoFees, the Ethereum blockchain has averaged more than $20 million in daily fees over the past week, the leading tally. Other places of active fee generation include Uniswap, Aave and Sushiswap. Bitcoin ranks seventh.

High fees are bad, though, right? Kinda. But they are also an indication of the value that users of blockchains and blockchain-based tech are seeing from those technologies; you don’t pay fees unless the activity you need to pay the fee to execute is worth it. And given the amount of fees generated, there’s lots of value out there to buy and sell.

Again, bullish.

The stablecoin revenue bomb

The Exchange spoke with Circle the other day about its efforts to pursue a commercial banking license in the United States. We’ll have more on the matter in the weekend newsletter. For today, however, I want to highlight Circle’s S-4 filing from the other day.

Here’s the key bit:

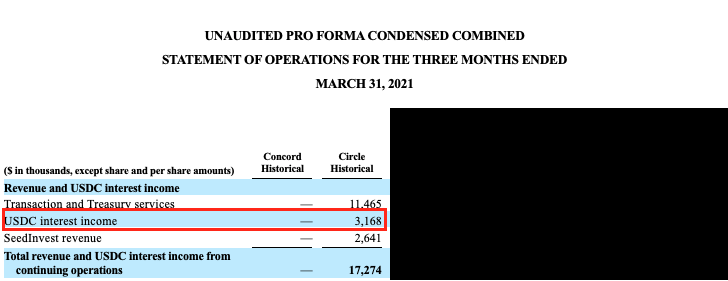

Check out that USDC interest income line.

Here’s how the company describes the revenue result:

As the sole minting issuer of USDC, we expect to generate meaningful economic benefits directly from the growth of USDC as a digital asset. We earn interest income on the U.S. dollar-denominated assets held in the reserves that back USDC. This activity is subject to bank supervisory and money transmission standards where Circle is regulated, as well as a series of more conservative reserve and asset management standards established in collaboration with Centre.

As a part of our partnership with Coinbase, interest income earned on USDC is subject to a revenue share agreement. We record all USDC interest income on a gross basis before the impact of the sharing of income with Coinbase.

Generating around $1 million a month in income from USDC-backing reserves is not a lot of money. But it’s going to go up for two reasons: More USDC issuing over time, and rising interest rates. That means that Circle is sitting on top of a project that could greatly expand its revenues over time.

More specifically, as the price of money rises, holding huge reserves that keep a stablecoin, well, stable, will be an increasingly lucrative activity. So there’s yet another business model in crypto that makes lots of fiat sense. Given that our lives are 100% fiat, we find that to be rather bullish.

What about startups?

One doesn’t have to be a cryptohead to glean from the above that there are large problem spaces for crypto-focused startups to work on. And that’s excepting the more exotic crypto activities that could become more impactful in the future, like decentralized autonomous organizations, or DAOs.

The takeaway from our read of today’s cryptomarket is that there are increasing use cases for the technology space that generate material revenues in the traditional sense, which should help keep the venture tap turned on. Bullish!

Comment