Dana Stalder

Sunday was a big day in fintech: Afterpay has agreed to merge with Square. This agreement sets two of the most admired financial technology companies in recent history on a path to becoming one.

Afterpay and Square have the potential to build one of the world’s most important payments networks. Square has built a very significant merchant payment network, and, via Cash App, a thriving high-growth consumer payment service. However, these two lines of business have historically not been integrated. Together, Square and Afterpay will be able to weave all of these services together into a single integrated experience.

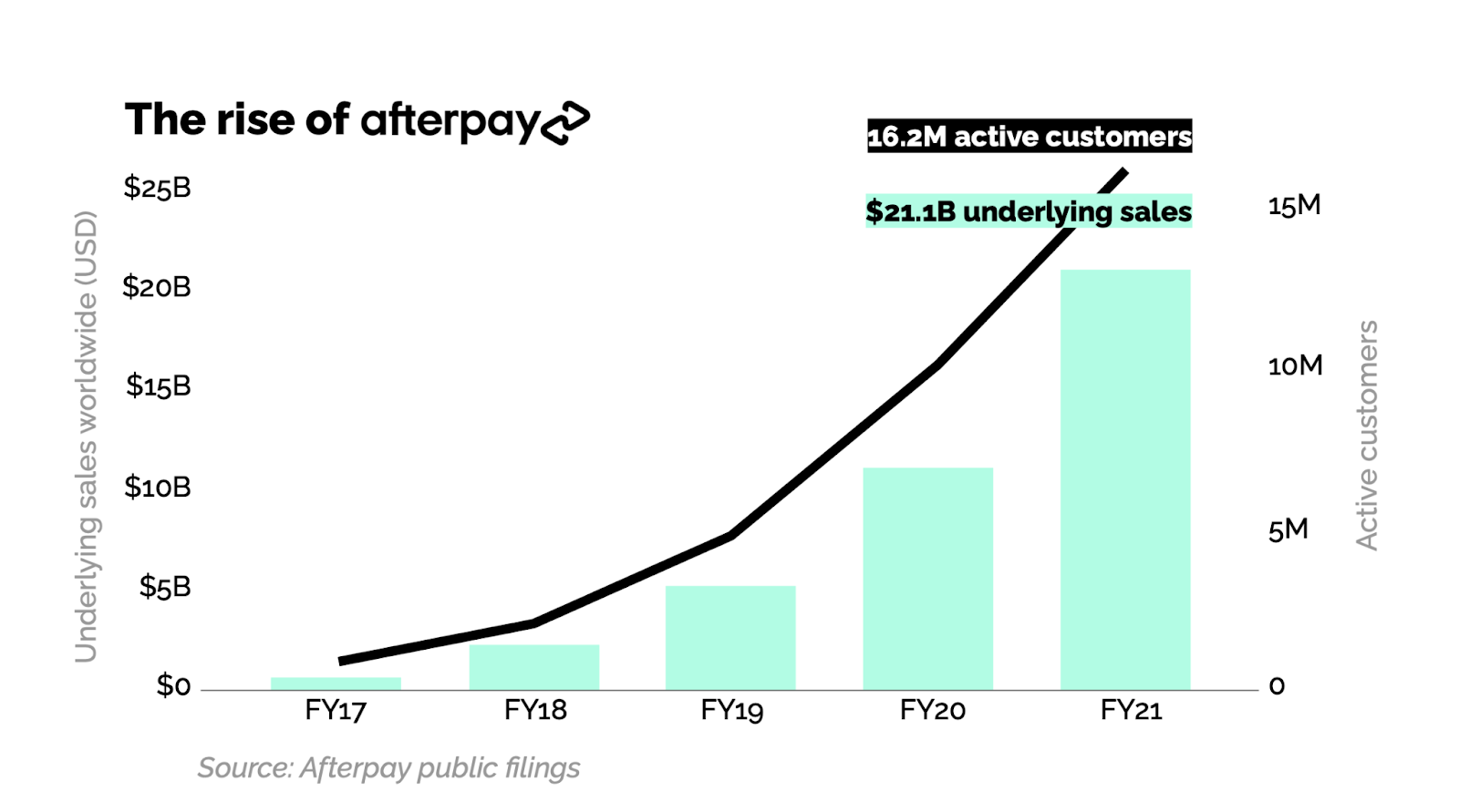

Afterpay and Cash App each have double-digit millions of consumers, and Square’s seller ecosystem and Afterpay’s merchant network both record double-digit billions of payment volume per year. From the offline register and the online checkout flow to sending money in just a few taps, Square and Afterpay will tell a complete story of next-generation economic empowerment.

As Afterpay’s only institutional venture investor, I wanted to share some perspective on how we got here and what this merger means for the future of consumer finance and the payments industry.

Critical innovations in fintech

Every five to 10 years, the global payments industry undergoes a critical innovation cycle that determines the winners and losers for the next several decades. The last major transition was the shift to NFC-based mobile payments, which I wrote about in 2015. The major mobile OS vendors (Apple and Google) cemented their position in the global payments stack by deftly bridging the needs of the networks (Visa, Mastercard, etc.) and consumers by way of the mobile devices in their pockets.

Afterpay sparked the latest critical innovation cycle. Conceived in a living room in Sydney by a millennial, Nick Molnar, for millennials, Afterpay had a key insight: Millennials don’t like credit.

Millennials came of age during the global mortgage crisis of 2008. As young adults, they watched their friends and family lose their homes by overextending on mortgage debt, bolstering their already lower trust for banks. They also have record levels of student debt. Therefore, it’s no surprise that millennials (and Gen Z right behind them) strongly prefer debit cards over credit cards.

But it’s one thing to recognize the paradigm shift and quite another to do something about it. Nick Molnar and Anthony Eisen did something, ultimately building one of the fastest-growing payments startups in history on their core product: Buy now, pay later … and never any interest.

Afterpay’s product is simple. If you have $100 in your cart and choose to pay with Afterpay, it will charge your bank card (typically a debit card) $25 every two weeks in four installments. No interest, no revolving debt and no fees with on-time payments. For the millennial consumer, this meant they could get the primary benefit of a credit card (the ability to pay later) with their debit card, without the need to worry about all the bad things that come with credit cards — high interest rates and revolving debt.

All upside, no downside. Who could resist? For the early merchants, virtually all of whom relied on millennials as their key growth segment, they got a fair trade: Pay a small fee above payment processing to Afterpay, get significantly higher average order values and conversions to purchase. It was a win-win proposition and, with lots of execution, a new payment network was born.

Imitation is the greatest form of flattery

Afterpay went somewhat unnoticed outside Australia in 2016 and 2017, but once it came to the U.S. in 2018 and built a business there that broke $100 million net revenues in only its second year, it got attention.

Klarna, which had struggled with product-market fit in the U.S., pivoted their business to emulate Afterpay. And Affirm, which had always been about traditional credit — generating a significant portion of their revenue from consumer interest — also noticed and introduced their own BNPL offering. Then came PayPal with “Pay in 4,” and just a few weeks ago, there has been news that Apple is expected to enter the space.

Afterpay created a global phenomenon that has now become a category embraced by mainstream players across the industry — a category that is on track to take a meaningful share of global retail payments over the next 10 years.

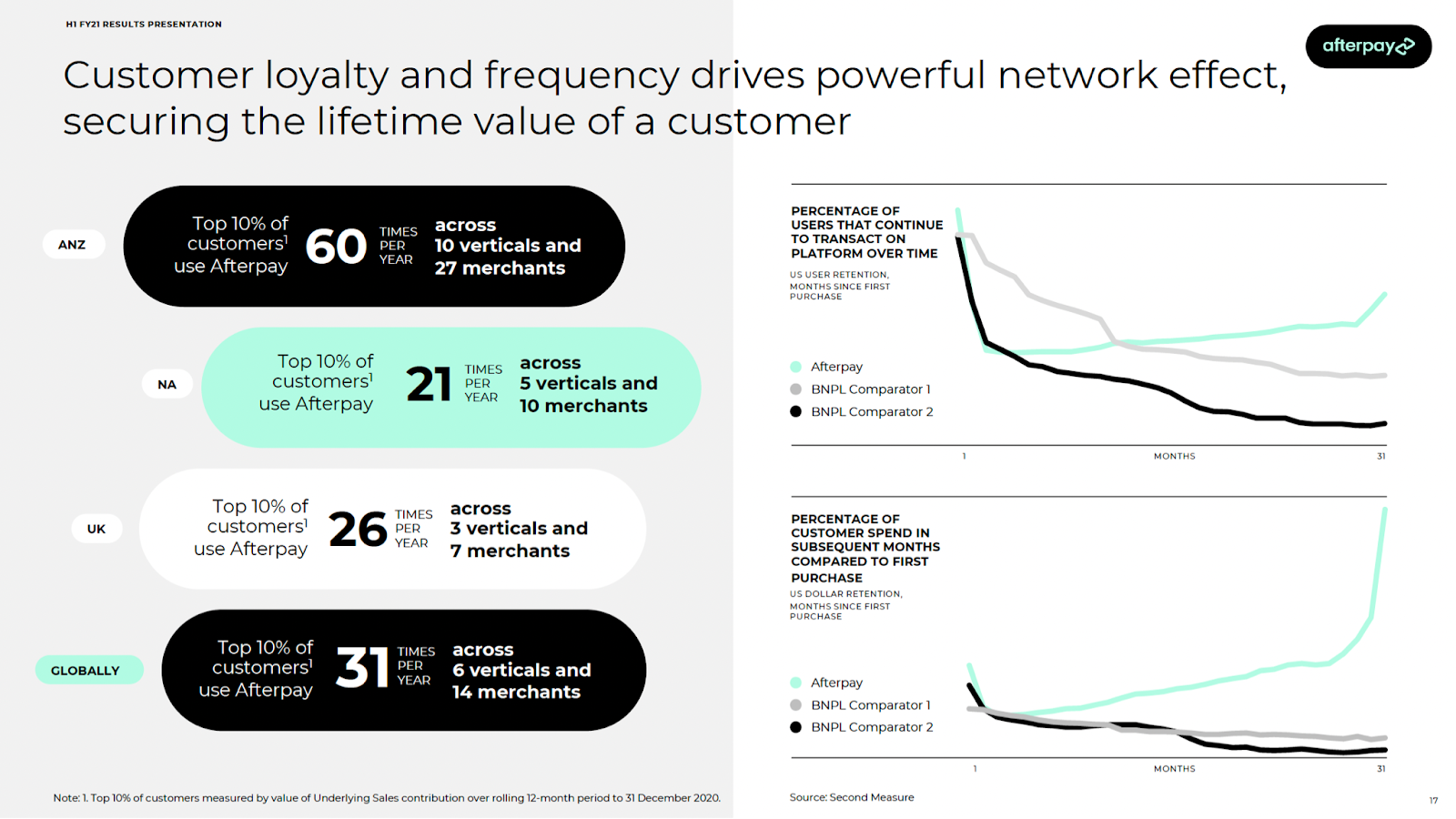

Afterpay stands apart. It has always been the BNPL leader by virtually every measure, and it has done it by staying true to their customers’ needs. The company is great at understanding the millennial and Gen Z consumer. It’s evident in the voice, tone and lifestyle brand you experience as an Afterpay user, and in the merchant network it continues to build strategically. It’s also evident in the simple fact that it doesn’t try to cross-sell users revolving debt products.

Most importantly, it’s evident in the usage metrics relative to competition. This is a product that people love, use and have come to rely on, all with better, fairer terms than were ever available to them than with traditional consumer credit.

Square + Afterpay: The perfect fit

I’ve been building payment companies for over 15 years now, initially in the early days of PayPal and more recently as a venture investor at Matrix Partners. I’ve never seen a combination that has such potential to deliver extraordinary value to consumers and merchants. Even more so than eBay + PayPal.

Beyond the clear product and network complementarity, what’s most exciting to me and my partners is the alignment of values and culture. Square and Afterpay share a vision of a future with more opportunity and fewer economic hurdles for all. As they build toward that future together, I’m confident that this combination is a winner. Square and Afterpay together will become the world’s next generation payment provider.

Why Square is shelling out $29B to snag BNPL player Afterpay

Comment