News that China’s government may force domestic tutoring-focused companies to go nonprofit is taking a huge bite out of the value of several technology companies. Bloomberg notes that the value of companies like New Oriental Education & Technology Group and TAL Education are tumbling in light of the news, which would constitute merely the latest salvo against tech companies in the autocratic country.

New Oriental’s Hong Kong-listed shares fell 44.22% in after-hours trading after the nonprofit news broke, while NYSE-shares of TAL are off an even sharper 51.75% in pre-market trading. With Yahoo Finance listing a roughly $13.8 billion market cap for TAL ahead of its impending declines at the market open, billions of equity value are about to get deleted. The list goes on: China Online Education Group is off 39.97% in after-hours trading, for example.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

A new decision by China’s government to exert more control over a sector of its domestic economy should not surprise. And we shouldn’t be shocked that online tutoring is in the country’s targets; today’s news is a follow-up to prior regulatory action in the sector from earlier in the year.

As China has become synonymous with edtech startups in recent years, the news impacts more than just public companies. The expected rules change may also hit a host of private, venture-backed companies.

As China has become synonymous with edtech startups in recent years, the news impacts more than just public companies. The expected rules change may also hit a host of private, venture-backed companies.

For example, what will happen to Yuanfudao? The company was valued at $15.5 billion last year, offering what TechCrunch described as “live tutoring, an online Q&A arm and a math-problem-checking arm.” Will the company see its wings clipped?

Or how about Zuoyebang, which raised $1.6 billion in a single round last year? TechCrunch wrote that Zuoyebang offers “online courses, live lessons and homework help for kindergarten to 12th grade students.” Is it in trouble as well?

All this comes on the same day that shares in Zomato began to float, with the Indian online food delivery company seeing its shares close up nearly 65% in their first day’s trading. TechCrunch has viewed the Zomato IPO as a possible bellwether for the larger Indian startup market, and the results augur well for other growth-focused, loss-making unicorns in the country.

As far as the technology business rivalry between India and China exists, the contrast in their news today is worth chewing on.

Add in the Chinese government’s recent axing of the Ant Group IPO, how it has handled Didi’s debut in the United States, and a broader crackdown on tech companies — fintech, edtech, it’s a list at this point — and I am wondering just how much room will be left in the future for China-based startups to pursue the sort of growth that lured so very much capital to the country in recent years.

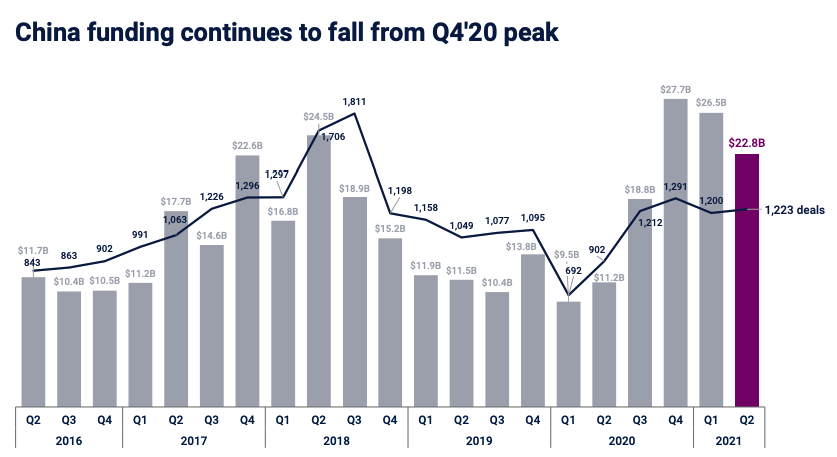

Not that venture capital activity is slowing down too much in the country. Chinese startups set a record for invested capital in Q4 2020, according to CB Insights data. Since then, venture activity has cooled in both dollar, and deal terms, albeit slightly. Here’s the chart:

You can read the data in a few ways. You could say, for example, that Q2 2021 Chinese venture capital results were down from Q2 2018 levels, but that seems somewhat unfair. Perhaps a better way to grok the data is in comparative-percentage terms. Let’s compare H1 2018 and H1 2021 Chinese venture capital investment to what the United States managed in the same periods, leaning on the same dataset. You’ll see why:

- China/U.S. venture capital percentage H1 2018: 75.4%

- China/U.S. venture capital percentage H1 2021: 35.5%

I think that that is the bigger story in the above data set, not merely that Chinese venture investment has fallen in the last few quarters on a sequential basis; China’s place as a challenger for the top spot in the global venture capital game has concluded, and even a boom to all-time highs in the country in recent quarters failed to recover lost ground when compared to U.S. results.

We could repeat the experiment with other global startup regions that have seen huge gains in their 2020 and 2021 results compared to their own historical results. China appears to have lost at least some of its luster as an investment location. I have a few guesses as to why.

What we’re really talking about is risk. It’s less risky to invest in a country where local companies can adapt to regulatory changes over time, where government caprice is uncommon, and the larger business climate stable. It’s more risky in countries where those business conditions are inverted, places where regulatory changes can be sudden, and governments can change the rules of business on a dime.

China is more the latter, while America is still more the former.

This is part of the larger China-U.S. technology war that isn’t discussed enough, in my view. There’s lots of argument about which country is leading on AI work, and where global chips will be manufactured in time. But with China clamping down harder and harder on business, and with less and less room for perspectives not coming from the ruling party, how competitive can its local economy prove over time?

I’m exposing my capitalist bias here, but I don’t mind. The recent news out of China indicates that when it comes to control, the Chinese government doesn’t mind wiping out a few dozen billion dollars in market cap here and there. That’s not a great system.

Comment