Continuing our global look into the torrid pace of venture capital investment in the second quarter, today we turn to Canada. While many markets have posted impressive results, like the United States setting the pace for new all-time records in dollars invested into startups, Canada’s numbers stand out.

The country, now famous in the startup world for giving birth to Shopify, has already crushed prior yearly records for venture investment thus far in 2021. Indeed, CB Insights data indicates that Canadian startups this year have already raised more than double their 2020 totals.

The same data set indicates that Canada’s venture capital results now rival those of the entire Latin American region, with exits and megadeals coming in roughly on par in the second quarter, and a similar number of total venture capital rounds in the period.

That caught our attention.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The Exchange reached out to a number of venture capitalists to expand our perspective on the Canadian market beyond the data points. Matt Cohen, a Toronto-based investor at Ripple Ventures, told The Exchange that “Canada is in a venture explosion” today, leading to results that are “unprecedented” for the country.

Taking the data and investor notes in aggregate, Canada’s startup industry seems to be benefiting from both domestic and international trends, a wide genre focus and more than one hub. Let’s talk aboot it.

Taking the data and investor notes in aggregate, Canada’s startup industry seems to be benefiting from both domestic and international trends, a wide genre focus and more than one hub. Let’s talk aboot it.

A venture capital blowout

In the first half of 2021, Canadian startups raised $6.3 billion across 414 deals, per CB Insights data. Both numbers compare favorably to Canada’s 2020 results, when 617 deals led to $2.9 billion in total capital raised by Canadian startups. Canada has already bested its previous record in venture dollars invested ($4.3 billion, 2019), and is on pace to beat its all-time deal count as well (720, 2018).

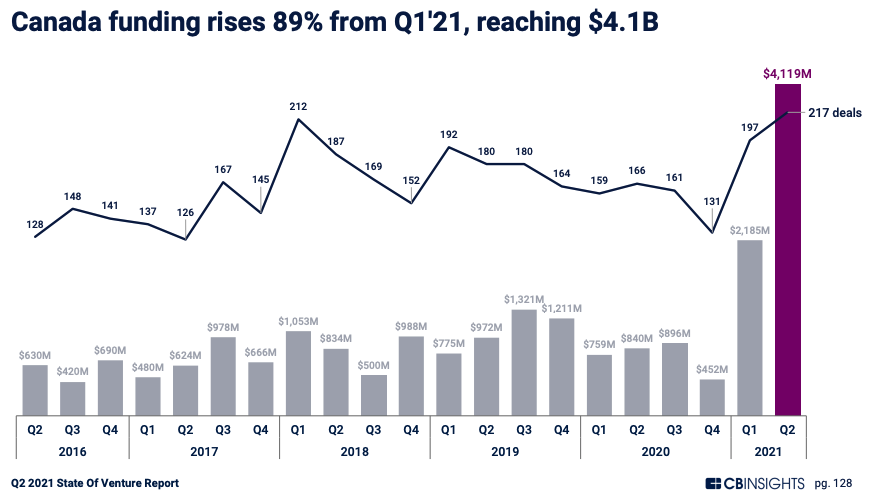

By itself, the second quarter’s outsize results are even more extreme than its H1 2021 results might have led you to expect, amazingly. Observe the following chart from the same data set:

Canadian startups just had their single best quarter ever in both deal volume and dollar volume terms. Furthermore, the country boosted capital raised by nearly 10x from its local minimum in Q4 2020.

Notably, no Canadian startup deal in the quarter was worth more than $500 million; indeed, Trulioo’s $394 million Series D was the largest. From there the list includes $300 million for ApplyBoard’s Series D and Vena’s $242 million Series C. We read that list of results as indicative of an investing landscape in Canada that is not dominated by a handful of companies raising billion-dollar rounds. That’s good news, mind you: The data implies that the Canadian startup market is not being bolstered by one or two standout companies, but rather performing well more generally.

There are still inequalities, of course. Venture capital is an outlier game, one in which investors make the bulk of their returns from a handful of breakout startups. But how Canada got to today’s point of having a host of mega-rounds is somewhat wholesome. They did not appear out of the void, according to Damien Steel, a managing partner at OMERS Ventures and its global head of ventures. He said the “spike” in Canadian venture capital activity has been accelerated by large rounds that were themselves the “result of seeds that were planted over the last three years, particularly in very early-stage businesses.”

To close our quick dig into Canada’s numerical results in the first half of 2021, the country also set what appears to be an all-time high in exits for any six-month period we have data for. Q2 2021’s exit volume dipped slightly from Q1’s result, but the two periods were the first and third best results on record for Canada’s startups, so the modest decline in the June quarter was hardly lethal.

What is driving this torrent of capital and investor enthusiasm? Let’s find out.

What is driving the boom?

Some of the frenetic deal-making that the United States has seen in recent quarters is spilling over into Canada, as U.S. firms logically look elsewhere for less competitive deal flow. As NEA partner Vanessa Larco told TechCrunch, “looking internationally offers … more room for investors to deploy capital.” After all, “the pace of innovation has accelerated and it’s touching all industries and geographies.” Plus, the pandemic contributed to more investors taking notice.

In this context, lusting after one neighbor’s startups is only natural, but it’s not just U.S. funds that are venturing into Canada. “We’ve seen money from all over the world flood into Toronto, especially from Asia into the artificial intelligence industry,” Cohen said, pointing out 2017 data on interest from Chinese VC firms. And it’s not just Toronto, either: “International money is flowing in everywhere — Montreal, Ottawa, Toronto and Vancouver are just a few examples,” Steel said.

While the investors we talked to agreed that Canadian founders don’t care much about where the capital they are raising is coming from, they still had some arguments in favor of Canadian money funding Canadian startups. “When the boom turns into a bust, typically foreign sources refocus back into their home jurisdiction,” warned Canadian investor John Ruffolo, who was recently back in the market with a new $500 million fund.

Perhaps more importantly, there is smart Canadian money worth taking. “We appear to be reaching a tipping point here,” Steel said. “Literally thousands of newly wealthy tech operators have been created in Canada in the last few years as a result of the hard work of entrepreneurs, investors and government. These new potential investors create a different environment than existed five to seven years ago, where the majority of angel investors had hugely impressive business credentials, but no real tech experience.”

There’s obviously a Shopify effect at play here. As Steel noted, “Shopify is now investing directly in startups, and current and previous Shopify employees are supporting the ecosystem as angel investors.” This includes women-focused angel collective Backbone Angels and angel fund Ramen Ventures, “all of whom are ex-Shopify team members,” Cohen said.

Shopify has produced a lot of wealth, turning former employees into founders and investors

Perhaps less notoriously, there are other startups having similar ripple effects, Steel said. “While Shopify is probably Canada’s best-known success story, there are also companies like Wattpad and Wave, both of which have also spawned angels, which is exactly what an ecosystem needs to grow and thrive. It’s a real sign of the ecosystem maturing.” And with 15 new unicorns minted in H1 2021, there might be more coming.

Where is the money going?

Venture capital is flowing into the cities in Canada you know best, along with some smaller markets that non-Canadians may be less familiar with. Per Cohen, Vancouver, Toronto and Montreal are “leading the way” in terms of capital raised in the country, with the investor noting that “Calgary, the Prairies and the Maritimes” on the country’s East Coast are “also picking up a lot of momentum, especially after the massive $2.75 billion Verafin exit to Nasdaq last year.”

So if the geographic footprint of investment in Canada is about as broad as the country itself, perhaps the better question is what type of startup is being funded.

Ruffolo told The Exchange that “Canadian deal activity continues to be driven by SaaS companies but the scope of industry segments funded is expanding.”

In Steel’s view, “AI continues to be a dominant area of expertise in Canada, with leading institutions such as MILA and the University of Toronto training the next generation of AI experts.” The investor also added that the country has a “growing cluster of quantum computing” work underway.

Those perspectives match historical Canadian venture capital results. For example, lists of the best-funded startups in Canada through 2020 indicate that three of the four most heavily capitalized startups in the country dealt with AI or enterprise software. But to say that a country is building a lot of AI-powered software products is essentially saying that Canada is taking part in globally hot industries.

But if Canada is competing in sectors that many startup markets around the world are also working to dominate, are its upstart tech companies getting priced like the rest of the market?

The valuation gap is complicated

When we first heard that U.S. firms were betting on Canada, we wondered if they were looking for discounts. So we asked our sources, but “the answer isn’t necessarily black and white,” Steel said, and others agreed. Instead, the picture they painted reminded us of what we heard about in other geographies: a dual market where hot deals just do away with the rules, while other deals follow more predictable standards.

In that context, certain combinations of market size, team experience and product/sales velocity can unlock huge multiples, Cohen said: “For early-stage Canadian startups that are going after global markets in hype industries, they are getting high valuations (i.e., >40x sales). For smaller markets or very Canadian-focused companies, multiples are closer to 10x-15x sales but we are still seeing crazy multiples all over the market.”

Whether this prices Canadian startups at the same level as their U.S. counterparts remains to be seen, but one thing is for sure: Valuations are rising. According to Steel, “five years ago in Canada, the average Series A financing round was $8 million; today the average is $22 million.” Term sheets are also getting more similar on both sides of the border: “We are still seeing the ongoing alignment among Canadian and U.S. deal terms as Canadian startups mature and attract more inbound foreign investment,” a Torys venture financing report noted.

If you are wondering why, maybe it’s just that the world is flat … and that investors are taking notice.

“We are definitely seeing location impact valuation much less than, say, two to three years ago,” Cohen said.

As Ruffolo points out, this puts Canada in an enviable position: “The Canadian market is one such beneficiary as the quality of the opportunities is also viewed very favorably by U.S. capital sources. Not only is the engineering talent in Canada viewed as extremely strong, but proximity, language and culture play a role as well.”

Comment