News broke this morning that Revolut, a U.K.-based consumer fintech player, raised a Series E round of funding worth $800 million at a valuation of $33 billion. Those figures are breathtaking not only due to their sheer scale, but also thanks to their radical divergence from Revolut’s preceding funding event.

At times, The Exchange, TechCrunch’s markets-and-startups column, runs into two topics worth exploring in a single day. Today is such a day. You can check out our earlier notes on the buy now, pay later startup market and Apple’s entrance into the BNPL space here. Now, let’s talk about neobanks.

As TechCrunch’s Ingrid Lunden wrote earlier today concerning the news:

This latest Series E is being co-led by Softbank Vision Fund 2 and Tiger Global, who appear to be the only backers in this round. It comes on the heels of rumors earlier this month Revolut was raising big. Revolut last raised about a year ago, when it closed out a Series D at $580 million, but what is stunning is how much its valuation has changed since then, growing 6x (it was $5.5 billion last year).

Stunning indeed.

Lunden also went on to report on the company’s changing financial picture based on Revolut’s recently released 2020 results. In this entry, we’re digging more deeply into those financial results and usage metrics detailed by the fintech megacorn.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The picture that emerges is one of a company with a rapidly improving financial image, albeit with some blank spaces regarding recent customer growth.

Growth and profitability

Let’s start by reprising Revolut’s 2020 results, including usage metrics that it released that were current as of March 31, 2021. Updating our prior listing of Revolut’s financial report card, here’s the rundown:

- 57% revenue growth from £166 million in 2019 to £261 million in 2020.

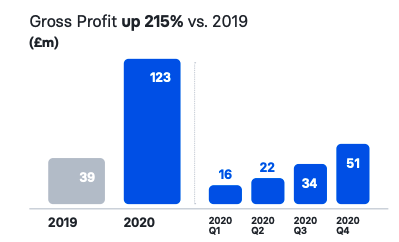

- Gross profit growth of £123 million in 2020, up 215% from 2019.

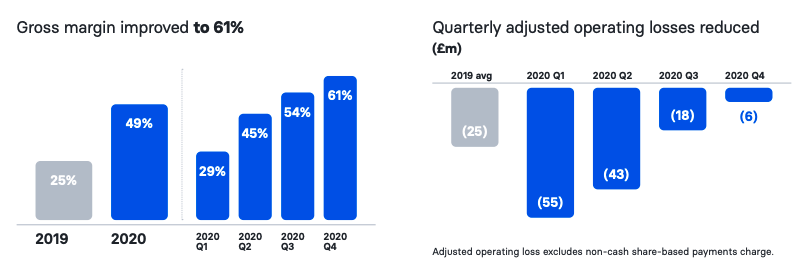

- Gross margin of 49% in 2020, what Revolut described as nearly a doubling.

- 2020 operating loss of £122 million from £98 million in 2019.

- Total loss of £168 million in 2020, up from £107 million in 2019.

- 15 million retail customers (March 31, 2021).

- 150 million monthly transactions (March 31, 2021).

As you can see, the company’s 2020 revenue growth was material. But it was gross margin expansion that proved to be its leading metric. By effectively doubling its gross margins while expanding its revenues, gross profit at Revolut shot up by a staggering 215% last year.

That didn’t help the company avoid stiff, rising losses in the full-year period. Despite a tectonic boost to its gross profit — the portion of its revenues left to cover operating costs — its operating losses still crept up by more than 24% while its total loss expanded by a worse 57%.

Turning to the company’s news today, Revolut reported two usage metrics that we can contrast to its March 31, 2021, data that was released as part of its 2020 financial report:

- That it has “more than 16 million customers” today.

- That it now powers “more than 150 million transactions a month.”

So, Revolut grew from 15 million to 16 million customers from March 31 to today? Not precisely. The 15 million figure was retail customers, a figure that was presented separately from business customers, which totaled 500,000 in March. The company’s new 16-million-customer figure is therefore effectively flat from its prior result. And the company’s 150 million transaction result is also unchanged from March.

This leaves us with two possibilities: Revolut didn’t grow in Q2 2021 in customer terms, or the company managed growth since March and is being coy with its data by not providing similar breakdowns of its customer base, essentially giving us the same metric again, but in an aggregated format.

Because Revolut just multiplied its valuation, it seems that the latter is more likely; private companies are notoriously discreet when it comes to sharing data when they don’t have to. Revolut may have simply wanted to keep its cards close to its chest.

Are we stuck in the dark, then? Not entirely. Something nice that Revolut provided in its 2020 report was a series of quarterly breakdowns regarding its financial performance. These are illustrative.

Here’s the company’s gross profit over time, for example:

Note the rapid appreciation in gross profit, from a run rate of £64 million in Q1 2020 to £204 million in Q4 2020. There was similar appreciation in other metrics when viewed from a quarterly perspective. Here are the company’s gross margins and adjusted losses over time:

The quarterly gross margin chart is fascinating.

Given the company’s reported trajectory from Q2 to Q4 of 2020 — discounting the Q1 to Q2 jump as a one-time, outsized gain — it’s not unreasonable to estimate that Revolut could have posted another 5% boost to its gross margin in Q1 2021, and perhaps another few points in the second quarter. More simply, if Revolut managed to keep up even decelerating growth to its gross margins in H1 2021, the company’s gross margins could have reached the 70% mark by the end of June.

That’s SaaS-level revenue quality, the sort of gross margins that investors covet, possibly helping explain the heft of the new funding round.

The same principle applies to the company’s adjusted losses. From a run-rate of -£220 million in Q1 2020 to -£24 million in Q4 of the same year, Revolut quickly pared losses from terrifying levels when compared to its revenues to a mere dusting of negativity. If the company managed to maintain its 2020 performance on this particular metric, its valuation gain makes more sense; Revolut could easily have tipped into adjusted profitability in either Q1 or Q2 2021, extrapolating from its 2020 quarterly results.

Framing the changes to its business, Revolut announced the first $500 million of its $580 million Series D in February 2020. In that quarter, the company posted 29% gross margins and adjusted losses of £55 million. If the company was worth $5.5 billion at the time, it’s not super stupid to value the company far more richly with massively improved gross margins, profitability and more proven revenue growth.

Precisely how aggressive the company’s new $33 billion valuation is compared to its fundamentals I’ll leave to you. From my chair, we don’t have enough data to say more than that the company’s improving financial results make appreciation in the company’s value reasonable.

Comment