The SPAC parade continues in this shortened week with news that community social network Nextdoor will go public via a blank-check company. The unicorn will merge with Khosla Ventures Acquisition Co. II, taking itself public and raising capital at the same time.

Per the former startup, the transaction with the Khosla-affiliated SPAC will generate gross proceeds of around $686 million, inclusive of a $270 million private investment in public equity, or PIPE, which is being funded by a collection of capital pools, some prior Nextdoor investors (including Tiger), Nextdoor CEO Sarah Friar and Khosla Ventures itself.

Notably, Khosla is not a listed investor in the company per Crunchbase or PitchBook, indicating that even SPACs formed by venture capital firms can hunt for deals outside their parent’s portfolio.

Per a Nextdoor release, the transaction will value the company at a “pro forma equity [valuation] of approximately $4.3 billion.” That’s a great price for the firm that was most recently valued at $2.17 billion in a late 2019-era Series H worth $170 million, per PitchBook data. Those funds were invested at a flat $2 billion pre-money valuation.

So, what will public investors get the chance to buy into at the new, higher price? To answer that we’ll have to turn to the company’s SPAC investor deck.

Our general observations are that while Nextdoor’s SPAC deck does have some regular annoyances, it offers a clear-eyed look at the company’s financial performance both in historical terms and in terms of what it might accomplish in the future. Our usual mockery of SPAC charts mostly doesn’t apply. Let’s begin.

Nextdoor’s SPAC pitch

We’ll proceed through the deck in its original slide order to better understand the company’s argument for its value today, as well as its future worth.

The company kicks off with a note that it has 27 million weekly active users (neighbors, in its own parlance), and claims users in around one in three U.S. households. The argument, then, is that Nextdoor has scale.

A few slides later, Nextdoor details its mission: “To cultivate a kinder world where everyone has a neighborhood they can rely on.” While accounts like @BestOfNextdoor might make this mission statement as coherent as ExxonMobil saying that its core purpose was, say, atmospheric carbon reduction, we have to take it seriously. The company wants to bring people together. It can’t control what they do from there, as we’ve all seen. But the fact that rude people on Nextdoor is a meme stems from the same scale that the company was just crowing about.

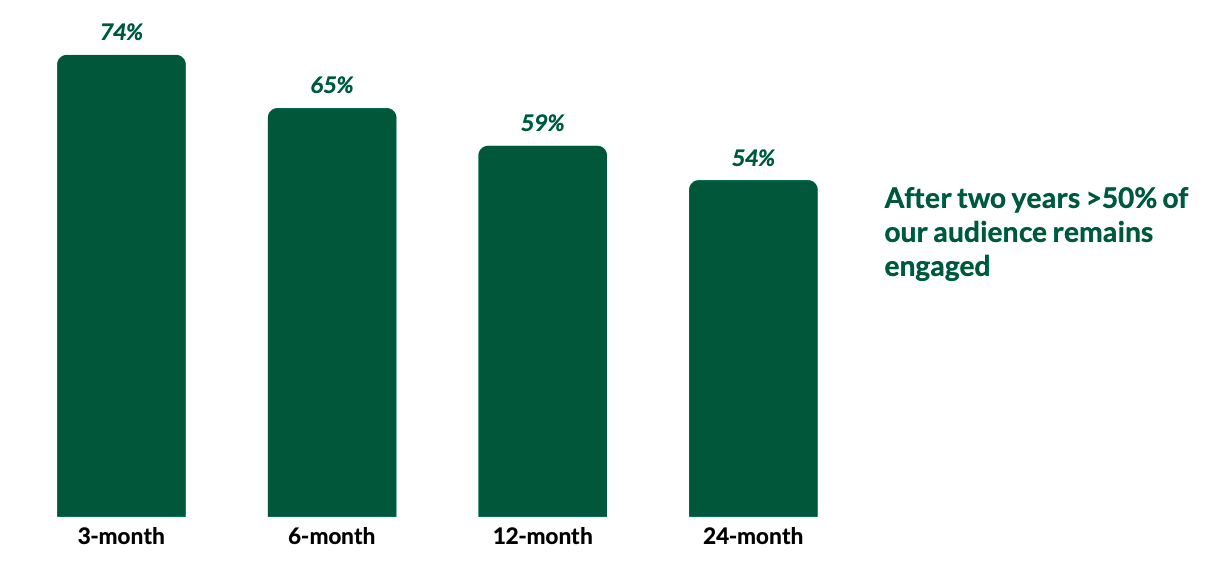

Underscoring its active user counts are Nextdoor’s retention figures. Here’s how it describes that metric:

These are monthly active users, mind, not weekly active, the figure that the company cited up top. So, the metrics are looser here. And the company is counting users as active if they have “started a session or opened a content email over the trailing 30 days.” How conservative is that metric? We’ll leave that for you to decide.

The company’s argument for its value continues in the following slide, with Nextdoor noting that users become more active as more people use the service in a neighborhood. This feels obvious, though it is nice, we suppose, to see the company codify our expectations in data.

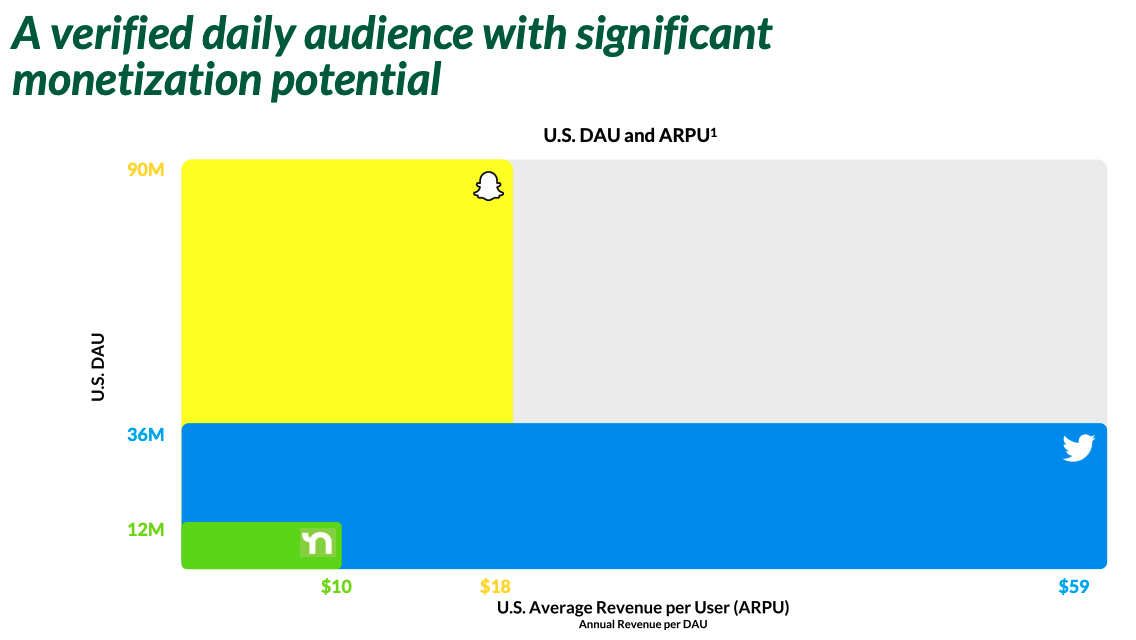

Nextdoor then argues that its user base is distinct from that of other social networks and that its users are about as active as those on Twitter, albeit less active than on the major U.S. social networks (Facebook, Snap, Instagram).

Why go through the exercise of sorting Nextdoor into a cabal of social networks? Well, here’s why:

The argument here is that the company has lots of room to grow on the monetization front as it expands its user base. Snap shows that the company can generate more average revenue per user (ARPU) over time, and Twitter shows that a larger user base may help with that hunt.

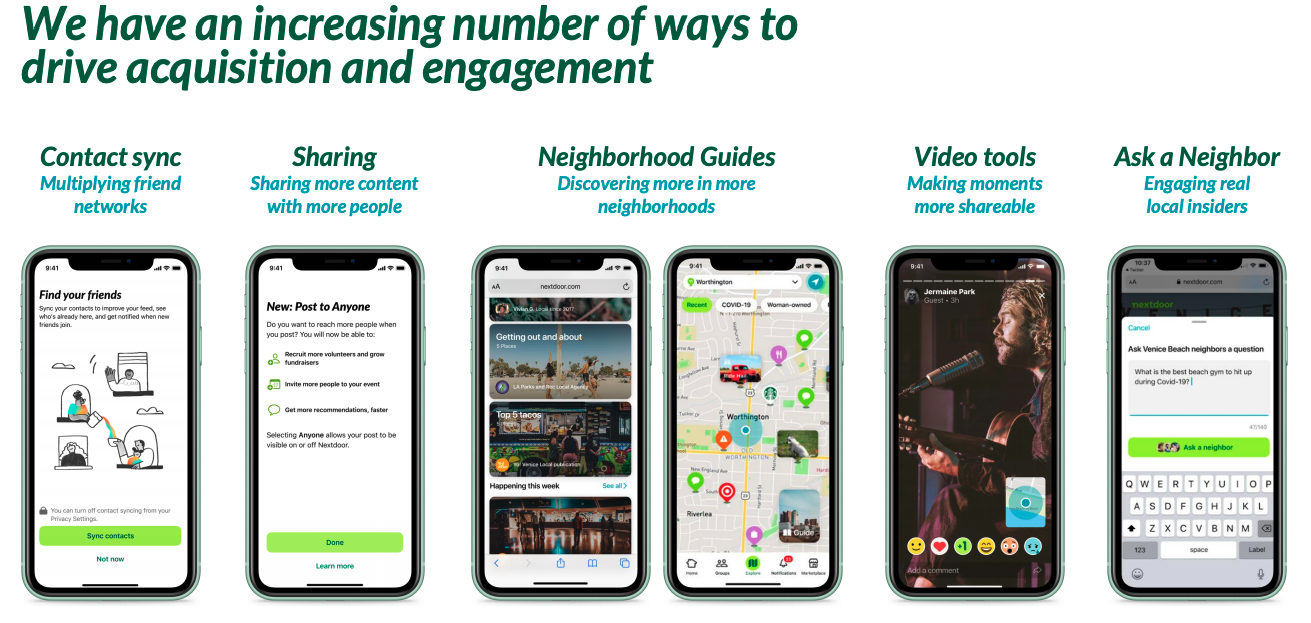

How does Nextdoor expect to manage to grow its user base so that it can reap the rewards it just detailed? The next slide supplies its argument:

The first two bits — contact sync and sharing — feel like table stakes. Things get slightly more interesting with guides, video and Q&A features. But, again, nothing here is revolutionary.

In the following slide, Nextdoor draws a picture of a world in which folks follow more than one neighborhood, perhaps where they live and where they work. That could help boost engagement, but how many people want to get involved in the networks of multiple locations is not clear.

Regardless, Nextdoor estimates that it can “4.5x [its] reach just by reaching global penetration in line with our more mature U.S. neighborhoods.” This is an interesting point. The company currently claims 45 million households as users, of which 37 million are in the United States, and 8 million are international. The company reckons that it can add 158 million households by pushing to 65% penetration among international and domestic markets it already serves. The company also claims another 109 million households are available from “future opportunities in existing markets.”

So far, Nextdoor has argued that it’s big, that its users are sticky, that some of those users are unique to its platform, that it can better monetize those users over time, and that it has room to expand its user base.

If the company can add more users to its platform, it may have a more general audience, but its general pitch is that it has done a good job reaching the scale that it has, and that if you like what it has managed so far, it will do much more of the same over time.

After a discussion of its leadership team, we get to the money side of things.

Is it a good business?

Let’s find out! Here’s Nextdoor’s high-level monetization pitch to investors:

In more human language, the company is saying that its service is unique, that its users are sticky, that its product gets better with more usage, that it has several ways to make more money from each user, that some of those methods are obvious and could be easy to attack, and that it has not yet reached its full potential in revenue from international markets.

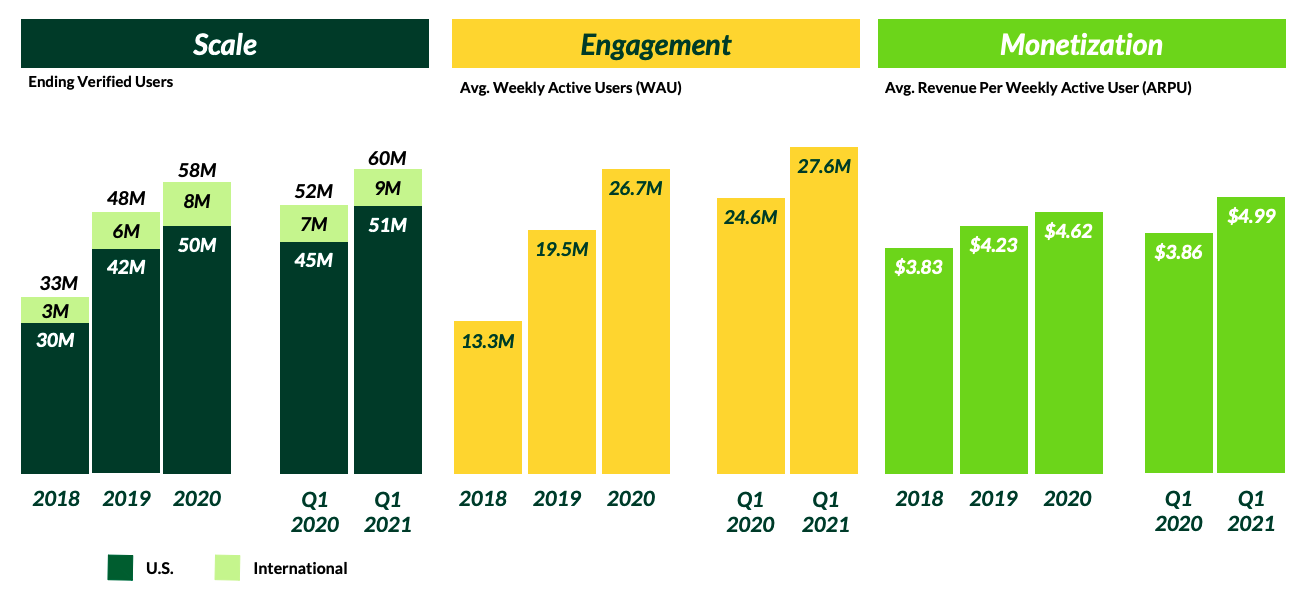

Next! Charts. But not awful charts, like we see from most SPACs. Good charts. Reasonable charts. Breath-of-fresh-air charts.

Here they are:

As you can see, this is all historical data, which means that the information presented is real.

What can we observe? That Nextdoor grew its verified users by 8 million from Q1 2020 to Q1 2021, or around 15%. Over the same period, weekly active users rose by 3 million, or 12%. And that the company added a little over $1 in ARPU over the same time frame, or around 29% from its year-ago Q1 result.

That means that the company has been most successful at boosting ARPU, second-best at adding verified users and least effective at adding engaged users over the past year.

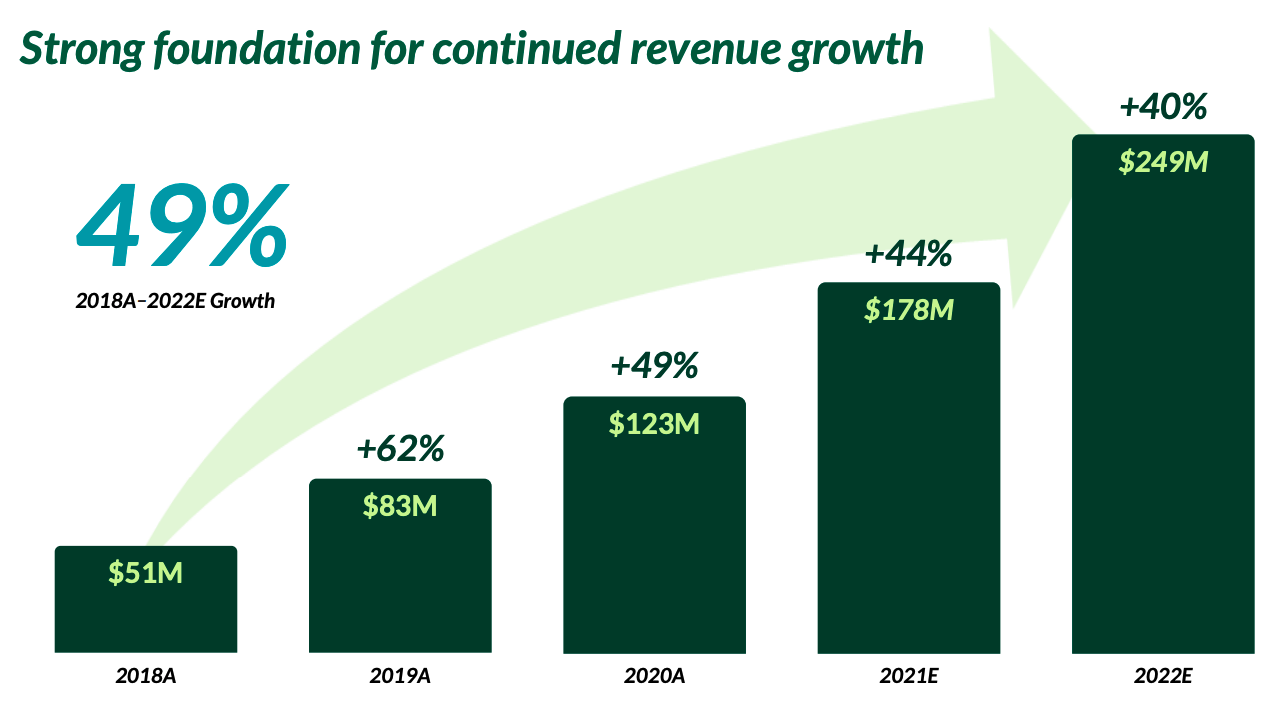

What’s ahead? Here come the projections:

Please ignore the SoftBank-style arrow. Instead, focus on the company’s anticipated revenue growth deceleration. Nextdoor is projecting that its rate of revenue growth will slow; that after falling by 13 percentage points from 62% 2019 to 49% in 2020, it will manage a decline of just 5 percentage points in 2021 and 4 percentage points in 2022. It’s worth noting.

Nextdoor reports on its next slide that its ARPU grew by 31% in the first quarter, a rate of growth that was an acceleration from its Q4 2020 ARPU growth. That’s pretty good because it implies that the company won’t have to add a zillion users to hit its growth projections, provided that ARPU growth can be kept up as it adds more total users.

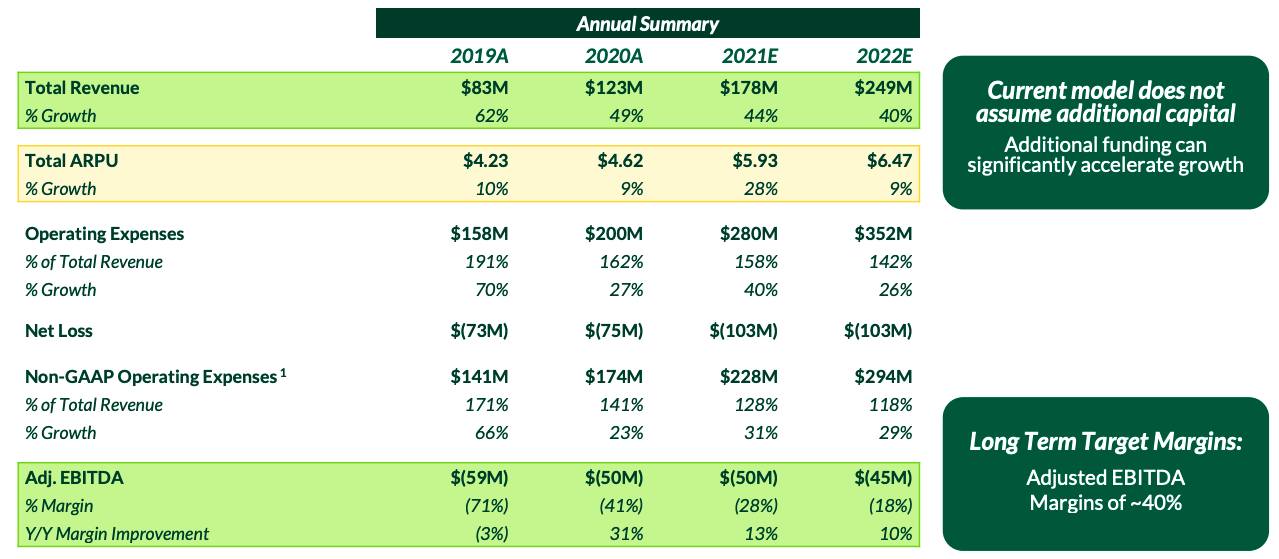

And, my favorite bit, here’s the company’s more serious breakdown of its past and projected performance:

There’s a lot to unpack here. First, that the company’s 2020 ARPU growth was a bit garbage. Given that the ad market took a hit for much of the year, we can discount this somewhat. Nextdoor still managed 49% revenue growth in the year after all, as we noted above. You can’t get too mad at the company because that pace of growth from an at-scale $83 million revenue result in 2019 is impressive.

From there, however, things get a bit rougher. The company doesn’t expect its operating expenses to fall to less than 142% of revenue by 2022. That’s very high, and it implies that the company’s ramp to profitability will take some time. Nextdoor also expects its net losses to rise this year and stay flat in 2022.

Finally, the company’s adjusted EBITDA results are anticipated to be flat this year — i.e., still -$50 million — and just 10% better in 2022 at -$45 million. That’s north of $10 million a quarter in adjusted losses for the next six quarters, at least. Investors who buy Nextdoor shares are not going to be buying into a company set to quickly turn a profit; they will instead be buying growth.

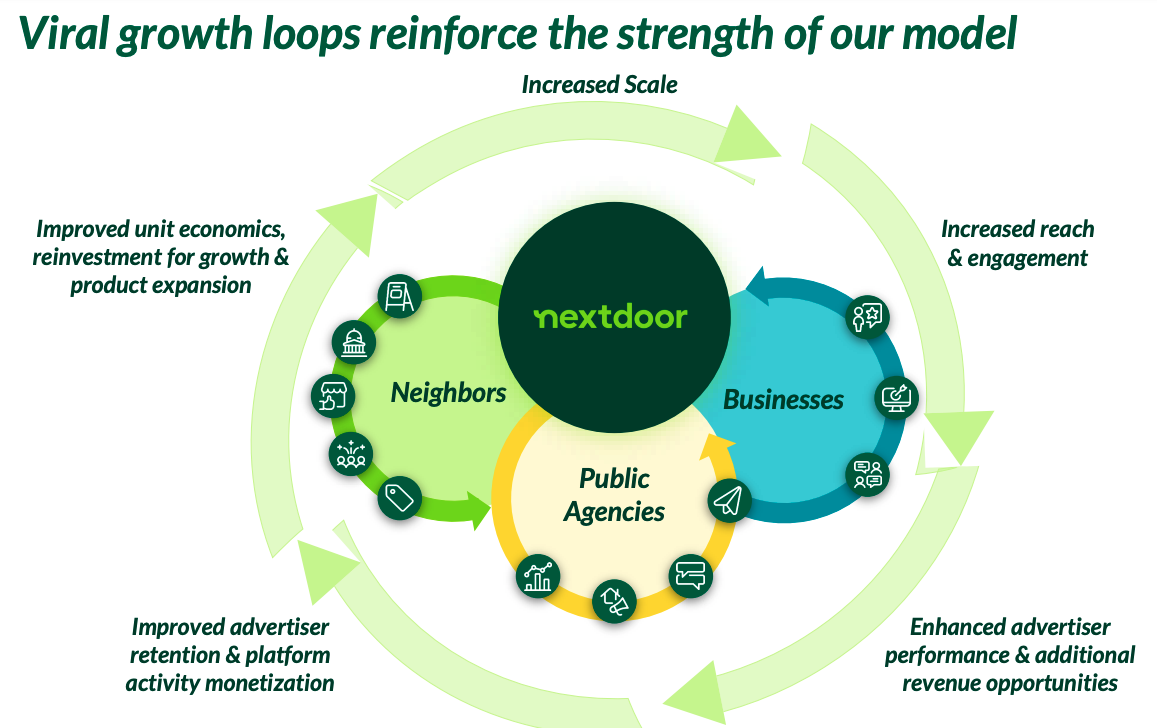

This brings us to the company’s second flywheel slide. It’s a doozy, expanding on the company’s first flywheel slide, which was more granular, but less grand:

That’s the good stuff right there. And no, we didn’t make the arrows appear so oddly disjointed. That’s how they appear in the PDF that the company released.

Regardless, the gist here is that — starting at the upper right — as the company adds users, it can provide a better monetization experience (lower right), which in turn will help Nextdoor better hold onto revenue partners (lower left), which will help it make more money to allow for greater investment and “product expansion” (upper left). And that product work leads the company to have more reach and more engagement, starting the wheel turning yet again.

These slides are somehow mandatory in every deck that we see. It’s not clear why. They never say much other than the obvious, but could be some sort of investor shibboleth, a way of companies telling investors that they are thinking in the same terms as them.

From there on, it’s appendices and other details that I won’t drag you through.

At its core, Nextdoor is arguing that it’s a social network. That’s reasonable. Social networks have proven to be a good business.

But with modest user growth, investors will have to balance their expectations for revenue growth between ARPU expansion and net-user adds. At a valuation of $4.3 billion, Nextdoor has a forward revenue multiple of 24x, or around $156 per weekly active user as of the end of Q1 2021. Place your bets as you see fit.

Comment