Board tensions at Hinge Health, a San Francisco-based digital health unicorn, have caused Bessemer Venture Partners to switch up its board director seat, replacing the original investor at the chair with a different one. Hinge Health co-founder and CEO Daniel Perez says BVP’s original board seat went to the partner who led the his company’s Series C round. The investor was recused from the board because they did not notify Perez of a new investment that the founder sees as competitive with Hinge — New York-based Clearing.

The scenario alarmed Perez, who has requested that the investor go unnamed, given the confidential information to which his board of directors is privy. The partner that left Hinge Health’s board has not taken a board seat at Clearing.

Perez wouldn’t comment on Bessemer directly, but when asked more generally about the increasing competitive bets made in the industry, he cautioned VCs and founders alike to pay more attention to the challenge. “You don’t develop a great reputation with entrepreneurs if you invest in competitive situations, particularly without giving them a heads up.” Adds Perez, “Some investors have a strong moral compass, some do not.”

A spokesperson from Bessemer declined to comment on the event because the firm does not “publicly discuss the mechanics of private Board dynamics.”

There hasn’t been a complete break between Bessemer and Hinge Health, a now six-year-old company that was valued at $3 billion during its last round of funding in January. Initially describing the situation as a firing, Perez said that the company “separated ways” with the original partner. In lieu of that, Elliott Robinson, a growth equity partner with Bessemer, was upgraded from board observer to the newest board director at Hinge Health. The switch enables Bessemer to maintain visibility into its investment, while at the same time, letting Hinge Health make a statement to the firm and future investors about how it views transparency.

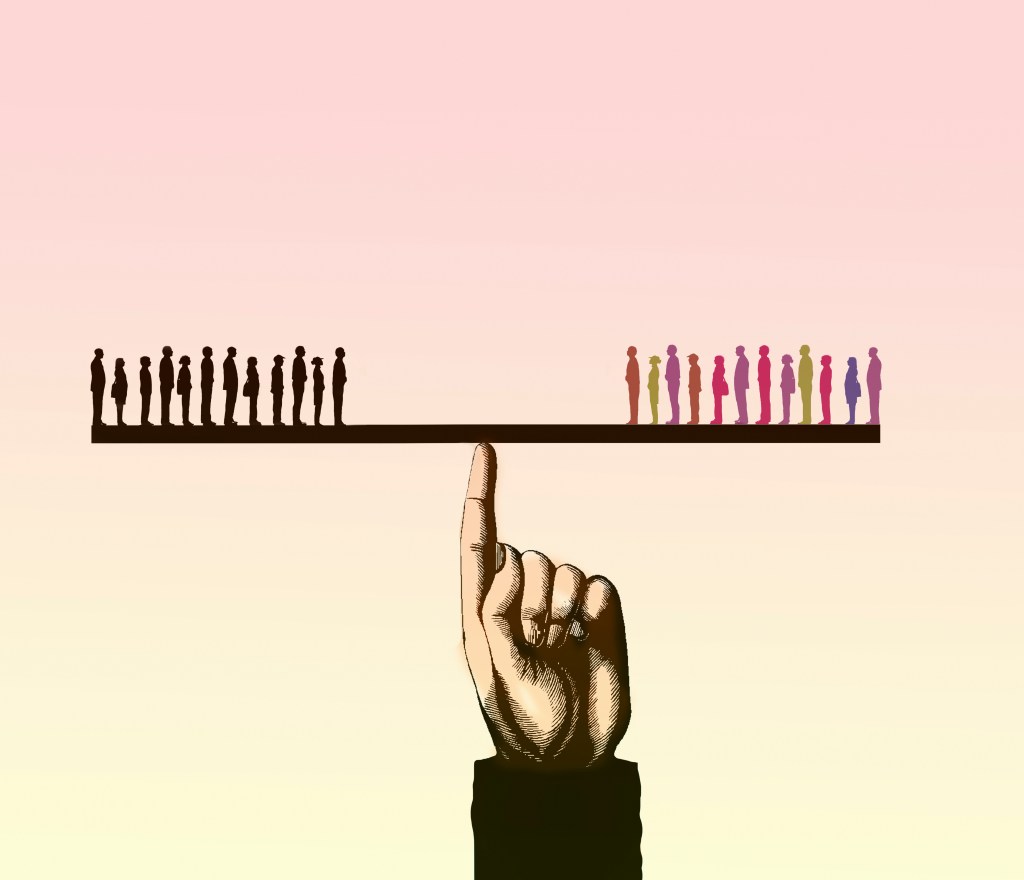

The tiff points to the increasingly nuanced tension around competition between startups, as deal velocity and volume reach all-time highs. While founders expect certain standards of conduct from investors, including that they notify them of investments in directly competitive startups, investors may be feeling more pressure to make faster decisions that clash with the founders they’ve already backed, while having different definitions of competition from their portfolios.

Defining competition

Hinge Health is a digital health startup in the musculoskeletal (MSK) space that sells its care to insurers, self-insured employers and health plans. Clearing, meanwhile, brands itself as a solution to chronic pain, which is a symptom of underlying MSK conditions. The latter is going direct-to-consumer with its service, ignoring insurance carriers altogether. The venn diagram of the two companies thus overlaps vaguely, but looks different both from a product and go to market strategy.

Certainly, Clearing CEO Avi Dorfman, previously the co-founder of Compass, does not consider the two direct competitors. Asked by TechCrunch about potential overlap for a recent piece on personalized healthcare in TechCrunch, Dorfman pointed to Bessemer’s stake in both companies as evidence that the two are taking very different tacks and targeting different end customers.

Of course, early-stage companies can evolve quickly, and even if the two aren’t competing squarely today, Hinge and Clearing have enough in common — Clearing is “competitively spirited,” says Perez — that Perez was surprised that Bessemer wouldn’t at least broach the conversation about Clearing with him.

“I think the best practice is that the investor asks the existing company how they feel about the conflict, and if they think it’ll be competitive,” says Perez via email. “Baseline, you always have to have a conversation. I’ve had 3-4 of those conversations with investors, and we understand the parameters, is there meaningful conflict, and how to ensure confidential information isn’t shared.”

No doubt plenty of founders might agree. To protect themselves, venture firms never include language in the term sheets that promises they’ll never invest in competing companies, but there has traditionally been a tacit understanding between founders and the investors who back them that the investor will avoid backing a similar company at all costs.

Andreessen Horowitz somewhat famously missed out on owning more of Instagram after also investing in a company that later veered into Instagram’s business and deciding that it needed to pick one or the other. As Marc Andreessen told TechCrunch at the time, in 2010: “This kind of stuff happens all the time. Entrepreneurs are like heat-seeking-missiles; they gravitate towards good opportunities . . . It’s less of a choice against Kevin [Systrom] and Instagram as it was we were just very excited about working with Dalton [Caldwell],” who co-founded the now-defunct Instagram rival and is today a partner with Y Combinator.

More recently, Sequoia gave away its $21 million stake in a payments company, Finix, after resolving that its early-stage investment in the company competed too directly with Stripe, among its most valuable portfolio companies.

As more and more deals get funded and faster, the possibility for competitive overlap is growing – along with the scenarios that can be considered conflicting in the first place. What happens when a startup pivots into a different market than the one that it sold its investors on, and is suddenly competitive with a portfolio company? Can a Sequoia India partner back a company that is directly competing with a Sequoia India company? Is it okay for there to be competing investments within the same firm as long as different partners are sitting on the board? While founders may deserve transparency, there has to be some sort of reasonable boundaries on what they consider competitive, as well as an understanding that not all firms make promises to avoid conflicts.

Legitimizing unspoken rules

Tania Shah, a startup lawyer and the founder of The Know Legal, often works with founders who are raising seed rounds and has to educate them on the “unspoken rule” of obligations around confidentiality and loyalty. Essentially, she explains the obligations of a passive investor versus a board member who has more access to confidential information along with voting power. Part of what she teaches is that VCs tend not to sign NDAs — even while she pushes her clients to ask for these — so founders need to be as certain as possible that they are taking money from the right sources.

“I think the role of attorneys right now is also to be teachers,” says Shah.

In the meantime, there is no shortage of horror stories. Nabeel Alamgir, CEO and founder of Lunchbox, for example, struggled to raise his first institutional check for his restaurant tech startup. He eventually found an investor who had connections to restaurants in New York City who Alamgir wanted to land, so Alamgir shared everything about Lunchbox, from its financials to its product integration road map and go-to-market strategy. The investor eventually ghosted Alamgir. Within four months, claims Alamgir, that same investor’s portfolio company launched a product that directly mimicked Lunchbox.

In February, a similar situation appeared to play out when insurtech company Sure claimed that venture firm IA Capital Group, its Series A investor, had used privileged information to launch a similar company called Boost. (IA Capital told TC at the time that the firm didn’t realize there was a potential conflict until Boost was “already well underway.” Sure has since filed a related lawsuit against Boost.)

This insurtech alleges its venture backer founded and funded a copycat: a founder’s ‘nightmare’

Hinge Health’s Perez say that this conversation around competing interests and conflict has grown in the past year in his conversations with investors. After all, VCs have ballooning funds to invest and LP expectations to meet – and it may become impractical at some point for these same investors to fully back away from compelling bets in booming industries.

“I’ve gone through a bunch of business cycles, and so I’m seeing this business cycle where there’s a lot of deal flow,” Perez said. In his case, “We’re not going to carve out a whole field of medicine and say that you can’t play at all in this field,” But at minimum, he says, VCs and their founders have to communicate as clearly as possible about what’s happening out there right now. Says Perez, “You have to have a conversation.”

Updated July 1, 2021 to add additional context to Perez’s comments.

Comment