For most startups, the hardest early challenge is identifying a market and a product to serve it. That wasn’t the case for Nubank CEO David Velez, who understood the massive potential for success if he could break into Latin America’s most valuable economy with even a moderately modern banking offering.

Instead, the challenge was how to rebuild the concept of a bank in a country where banking is widely hated, all while the incumbents heavily entrenched with the state worked to block every move.

Nubank knew its market and geography, and through tenacious fundraising, inventive marketing and product development, and a series of contrarian hires, Velez and his team stripped bare the morass of Brazilian banking to build one of the world’s great fintech companies.

In the first part of this EC-1, I’ll look at how Velez brought his skills and experience to bear on this market, how Nubank was founded in 2013, and how the team brought a Californian rather than Brazilian vibe to their first office on — no joke — California Street, in a neighborhood called Brooklin in the city of São Paulo.

The makings of an entrepreneur

The idea of being his own boss was ingrained in Velez from his earliest days in Colombia, where he grew up in an entrepreneurial family, with a father who owned a button factory. “I heard from my dad over and over again that you need to start your own company,” Velez said.

But years would pass and Velez still had no idea what he wanted to do. To “kill time,” and also to surround himself with entrepreneurial energy, Velez attended Stanford University — partially financed by the sale of some livestock — and then worked as an analyst at Goldman Sachs and Morgan Stanley before switching to venture capital at General Atlantic and Sequoia.

For all his burgeoning investment prowess, Velez had never been an entrepreneur himself, and began questioning his capacity to give founders advice from across the table. “I was just over here saying, ‘Just go do it. Hire faster. Do better. Acquire’,” he recalls. He yearned for the drive and passion he saw in founders. “I would see the spark in [a founder’s] eyes and I didn’t have that in my job.” But Velez still had no idea what kind of business he wanted to start.

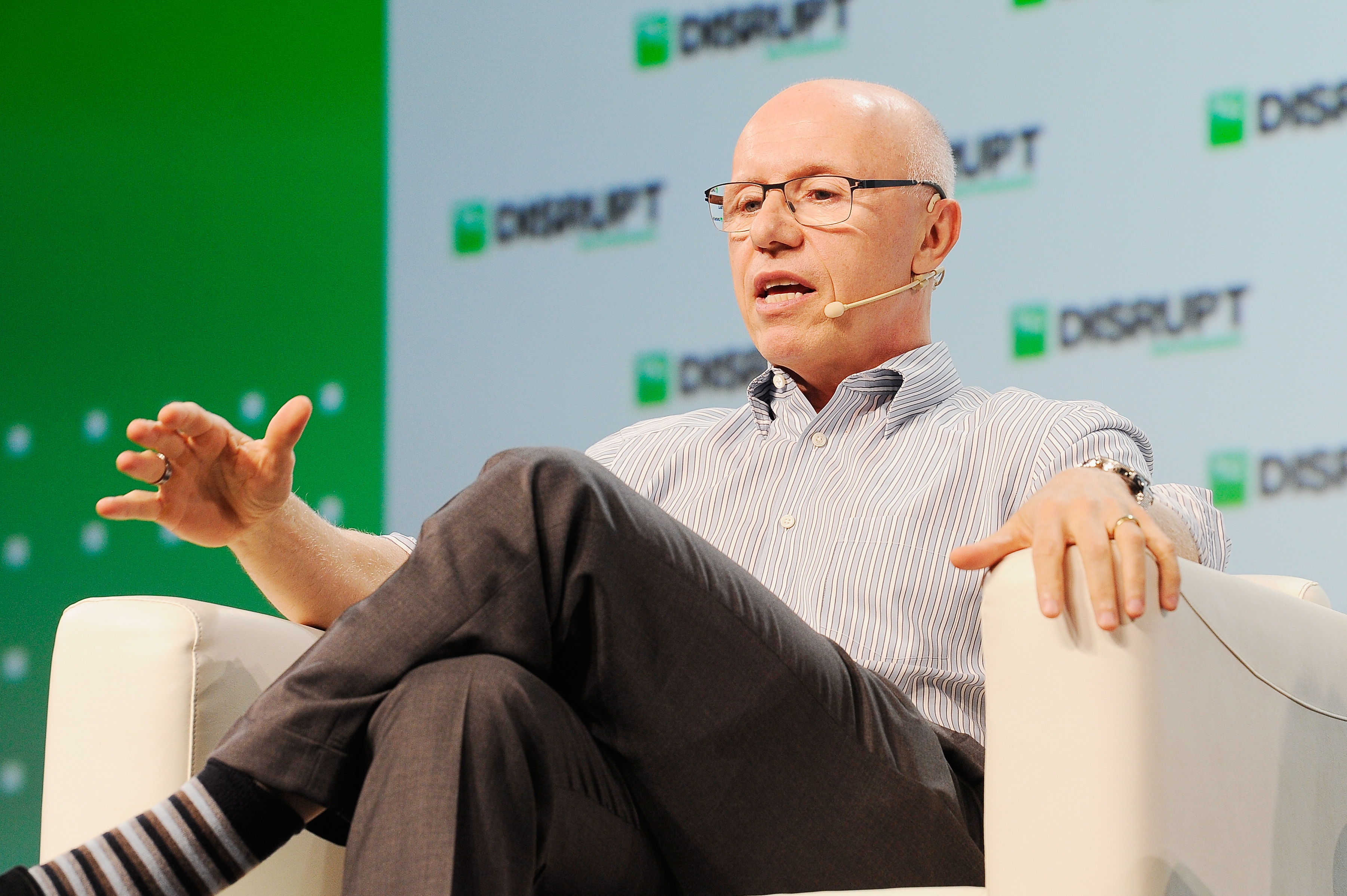

His break came when Sequoia, which had sent him down to Brazil to scout for deals, pulled the plug on its operations in the country. “We started to notice that Brazil had a lot of look-a-like companies, and that didn’t really inspire us,” said Doug Leone, global managing partner of the firm.

Velez saw this halt as an opportunity to introspect and figure out what the hell he wanted to do with his life. Given what he’s doing today, it’s no surprise that he was looking for a challenge. He remembers asking himself, “What’s the hardest thing I can imagine myself doing?” The answer was a shortlist that included: building an asset management firm in Colombia, doing something in edtech or healthcare, and revolutionizing the banking system in Brazil.

The first made some sense, as he could combine his experience in Colombia with his knowledge of finance, while edtech and healthcare are always open to new startups given their scale and opportunity. However, the prospect of revolutionizing banking felt out of place — for one, he didn’t speak Portuguese, didn’t know much about banking and knew little of Brazil’s financial systems.

Despite those barriers to entry, being an outsider would also prove to be a benefit, as it allowed Velez to see opportunities where others with more experience saw only barriers to innovation.

Since he hadn’t been brought up in the system, he didn’t respect it. As someone who had spent most of his adult life in the United States, Velez had been spoiled by the general ease of banking. So when he tried to open a bank account in Brazil, he experienced firsthand the frustration, the challenges, the time-suck, and the peculiar feeling that even though you’re the customer, you feel like they are doing you a favor.

He remembers having a terrible banking experience in São Paulo, the financial capital of Latin America. Most people new to São Paulo are often caught off guard by its modernity and the first-rate luxuries available. Staying at a top-notch hotel in São Paulo more closely resembles the custom-catered customer service one would experience in Asia than in the U.S., for example.

But when it comes to banking, all that good service and care is nowhere to be seen. Velez recalls walking into a bank and being patted down on suspicion of having a gun, because a laptop in his backpack set off alarms. He says he felt like a “hostage,” because a better banking experience just wasn’t available and he was going to have to settle for this one.

Well, he didn’t settle.

A country primed for a financial revolution

With about 213 million people, Brazil is the most populous country in Latin America. Traditionally, the banking industry has been dominated by five major banks: Itaú Unibanco, Banco do Brasil, Bradesco, Santander and Caixa Econômica Federal. Despite the industry’s profitability, these five banks are present in only about 80% of Brazilian municipalities, and just under a third of Brazil’s population remains entirely unbanked, according to a World Bank analysis.

Yet, the country’s financial system is far more advanced than international headlines indicate. Brazil’s Central Bank is nimble as a result of the economy’s volatility: Inflation and exchange rates can rapidly fluctuate. Typically, an ACH bank transfer in the U.S. will take several days to process, but that’s never been the case in Brazil — bank transfers, though laced with fees, are fast. If money transfers took days, by the time the recipient received the money, the currency could be a completely different value.

“If you look at the core, the Central Bank of Brazil is very robust, modern, reliable and competent. It’s actually very different from other bureaucracies in Brazil, which are known for being slow,” said Edward Wible, co-founder and now former CTO of Nubank. “Nine of 10 bankers will complain that it’s too fast. I’m not going to lie, there have been moments where it’s been too fast.”

And it’s gotten even faster. In 2020, Brazil’s central bank launched “Pix,” a state-owned instant payments system similar to Zelle in the U.S. It doesn’t require a credit card or a debit card, and transfers are free of charge for individuals.

Yet, entering the market is terribly difficult. Brazil has long been a country that prides itself on local goods and investors, so much so that imported clothes and cars carry taxes as high as 40%. The government is just as protective when it comes to banking. The Brazilian constitution restricts foreigners from investing in or building a Brazilian bank, requiring a decree from the Brazilian president, a highly fraught request.

Velez would have his decree within four years of launching Nubank.

“It was David and his PowerPoint, and we invested in the PowerPoint”

“There are people you come across in life that within the first hour of meeting with them, you know you want to work with them,” said Leone, who had recruited Velez to Sequoia right out of grad school at Stanford.

In addition to being in the Sequoia family, Velez was also friendly with Kaszek Ventures, the largest venture capital fund in Latin America by dollars raised. The leaders of Kaszek are former executives of Mercado Libre, the leading e-commerce marketplace in Latin America, and brought operational experience in the region along with their checkbook.

Between these two contacts, Velez raised a $2 million seed round for Nubank in July 2013. “He didn’t even have co-founders at the time. The chances of success were very small, because he was going after a big opportunity. It was David and his PowerPoint, and we invested in the PowerPoint,” said Nicolas Szekasy, co-founder and CEO of Kaszek, and former CFO of Mercado Libre.

With the seed money in the bank, Velez turned to finding his co-founders. He had decided that one of these would need to be a CTO, and he would also need someone who spoke Portuguese and knew the ins and outs of the Brazilian banking system. The candidate pool was narrow since potential co-founders would have to already live in São Paulo or be willing to relocate — this wasn’t a remote-ready project back in 2013.

The search proved to be exhaustive and exhausting. “Every time I met a CTO with experience, they would ask me what’s the salary you’re going to pay me for this?” said Velez. To his dismay, candidates often looked at the position as just a job, and most also didn’t believe the company would succeed.

Velez recalls meeting about 50 possible CTOs before hiring Wible. “When I talked to Ed, he was all in very fast; he didn’t need to get paid, and he was OK with just getting equity. And he really believed in what we were doing, so I went for cultural fit over CV,” Velez said. “It was a bet on commitment, cultural fit and alignment.”

An American engineer with an undergraduate degree in computer science from Princeton, Wible had largely worked in private equity until 2013. He had been living in London, but when Velez reached out to him, he had taken a sabbatical and was sailing in Indonesia. The two were acquainted when Wible asked Velez to look over the concept of a startup he was interested in building.

“David looked at my pilot project, and very quickly told me that it wasn’t going to work, and he said, ‘Stop that, come with me to Brazil and let’s start a bank.’ It’s exactly what I was looking for because I wanted to work on something that was really mine,” Wible said.

Yet, he was anything but the experienced technical engineer one might expect to lead a complex and highly regulated business like a bank. Leone over at Sequoia questioned Velez’s choice and was so wary at the time that he asked one of Sequoia’s engineering leads to keep an eye on Wible’s work, especially regarding any architectural decisions he made.

Eventually, he changed his assessment. “Every single time, he made the right decision,” Leone says, impressed with Wible’s prowess. He now credits Velez’s “contrarian hires,” as one of the crucial decisions that put Nubank on the fast lane to unicorn status. “They are hires I’m not sure I would have made,” Leone said.

More engineering and one critical hire

One can surmise from hires like Wible that Velez was determined that his company wouldn’t be just another copy, like the ones Sequoia had been disappointed by. “From the beginning, we decided the model was going to be more like a Silicon Valley company than a Brazilian company,” Velez says.

Leone also pushed Velez to think broadly: “When he came to us, [Velez] said, ‘I want to start a credit card company,’ and we said, ‘No, don’t start a credit card company, start a technology company that offers a credit card.’”

But to get started, Velez needed engineers to build the product and people with banking experience in Brazil to drive the business. One of Nubank’s first 10 hires, Vitor Olivier, could do both.

When he was approached to join Nubank, Olivier was working at BTG Pactual, arguably the most elite investment bank in Brazil. When Velez explained the concept for Nubank, Olivier thought, “I heard two things, ‘Wow, I [currently] have a career where I know I’ll succeed — I just got to keep my head down and keep going.’ I had a lot of clarity.” Or, he could join Nubank and take an immense risk in exchange for potential rewards that could be exponential. “It’s like having a road ahead that’s super clear, but it’s going the wrong way, so instead I chose the trail that I’d have to clean up as I went,” he says.

“I left banking to make a fifth of my salary, and back then, about $5,000 in equity,” he remembers. “Financially, it didn’t really make sense, so I really had to believe that it was really going to work, and that it would be big.”

Olivier, now VP of operations and platforms at Nubank, remembers leaving one of the fanciest buildings in São Paulo to work at a tiny, rented house that would serve as the company’s first office.

Wible lived rent-free upstairs, and Velez started bringing on more people until the house was bursting at the seams with 30 employees and just one bathroom, all working to bring the company’s first product to market in eight months.

To get started, Velez initially asked Olivier to code, as despite having a financial background, he had a bachelor’s degree in computer science from Duke University and had some base knowledge to work from. Between Olivier, Wible and a handful of other engineers, the race was on to launch their first product.

Velez still had a challenge ahead: Finding the person who could unlock the Brazilian market for Nubank. That person would turn out to be Cristina Junquiera, a Brazilian engineer by training who had spent most of her career in business and most recently as the credit card portfolio manager at Itaúcard.

Junquiera joined Nubank as a co-founder because she was tired of “helping rich people get richer,” and as we’ll see in part 2 of this EC-1, she would go on to spearhead Nubank’s push into Brazil, hellbent on making her new company’s CX as amazing as Disney World itself.

Nubank EC-1 Table of Contents

- Introduction

- Part 1: Origin story

- Part 2: Co-founder dynamics

- Part 3: Launching and scaling

- Part 4: Market expansion and future

Also check out other EC-1s on Extra Crunch.

Comment