Shiran Shalev

More posts from Shiran Shalev

If money is the ultimate commodity, how can fintechs — which sell money, move money or sell insurance against monetary loss — build products that remain differentiated and create lasting value over time?

And why are so many software companies — which already boast highly differentiated offerings and serve huge markets— moving to offer financial services embedded within their products?

A new and attractive hybrid category of company is emerging at the intersection of software and financial services, creating buzz in the investment and entrepreneurial communities, as we discussed at our “Fintech: The Endgame” virtual conference and accompanying report this week.

These specialized companies — in some cases, software companies that also process payments and hold funds on behalf of their customers, and in others, financial-first companies that integrate workflow and features more reminiscent of software companies — combine some of the best attributes of both categories.

From software, they design for strong user engagement linked to helpful, intuitive products that drive retention over the long term. From financials, they draw on the ability to earn revenues indexed to the growth of a customer’s business.

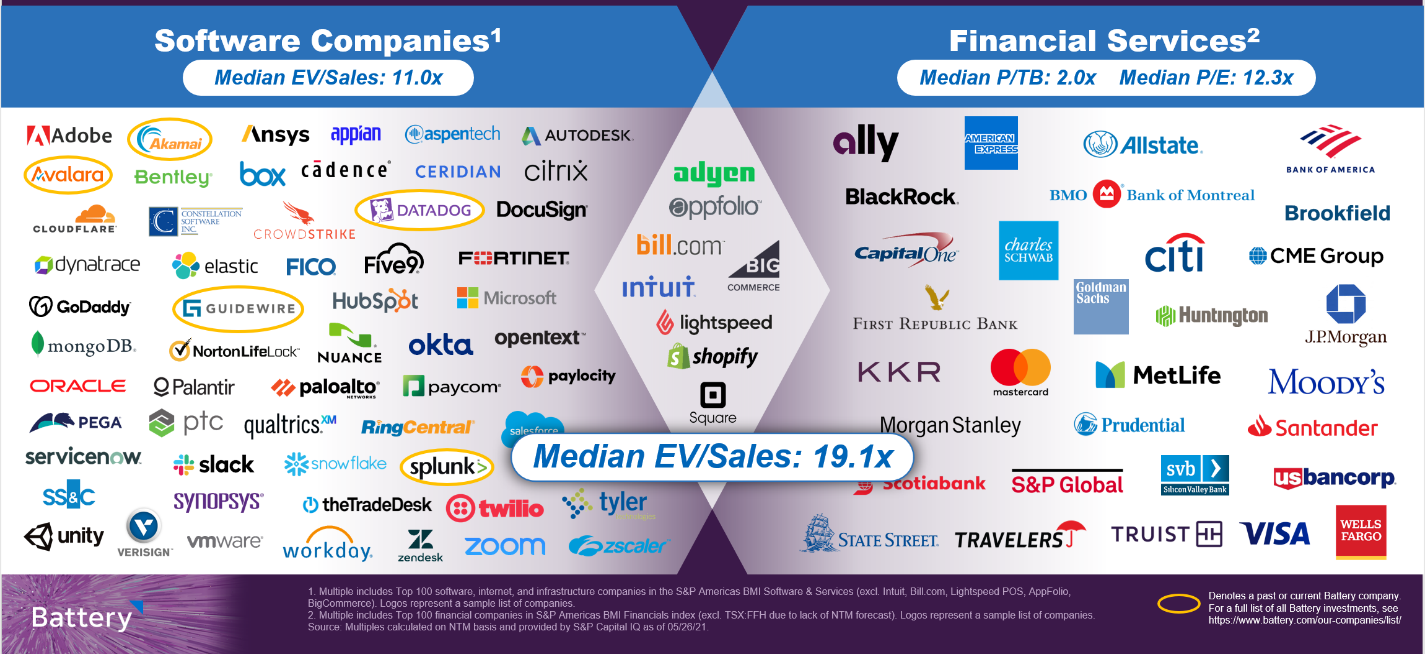

The powerful combination of these two models is rapidly driving both public and private market value as investors grant these “super” companies premium valuations — in the public sphere, nearly twice the median multiple of pure software companies, according to a Battery analysis.

The near-perfect example of this phenomenon is Shopify, the company that made its name selling software to help business owners launch and manage online stores. Despite achieving notable scale with this original SaaS product, Shopify today makes twice as much revenue from payments as it does from software by enabling those business owners to accept credit card payments and acting as its own payment processor.

The combination of a software solution indexed to e-commerce growth, combined with a profitable payments stream growing even faster than its software revenues, has investors granting Shopify a 31x multiple on its forward revenues, according to CapIQ data as of May 26.

How should we value these fintech companies, anyway?

Before even talking about how investors should value these hybrid companies, it’s worth making the point that in both private and public markets, fintechs have been notoriously hard to value, fomenting controversy and debate in the investment community.

On the one hand, fintech businesses come with certain advantages over traditional software companies. By way of example: If you’re choosing customer-service software, you’d likely compare a number of platforms and try to understand their specific capabilities, as well as how they integrate with existing systems and how they’re priced. Then, you’d make a decision.

But if you’re in the market for a loan, the situation would be very different: If one provider could offer competitive terms and a quick close, it would likely get the business. This dynamic has enabled many fintechs, particularly those with a knack for digital marketing and data-driven, real-time underwriting, to grow revenues at least as fast or even faster than best-in-class software companies.

That being said, there’s still a good argument for why pure software companies trade at a premium to pure financials. In terms of margins, a software company will typically keep 60%-90% of its revenue, while with financials — taking a lender as an example — these margins then need to account for the interest expense of capital, fraud and credit losses.

Further, while software companies can, with some help from their friendly cloud providers, theoretically serve an infinite number of customers, financial companies are constrained by their respective balance sheets and capital bases — a limitation we’ve recently seen extend from lenders and insurance companies to include even stock brokerage Robinhood at the height of the GameStop saga.

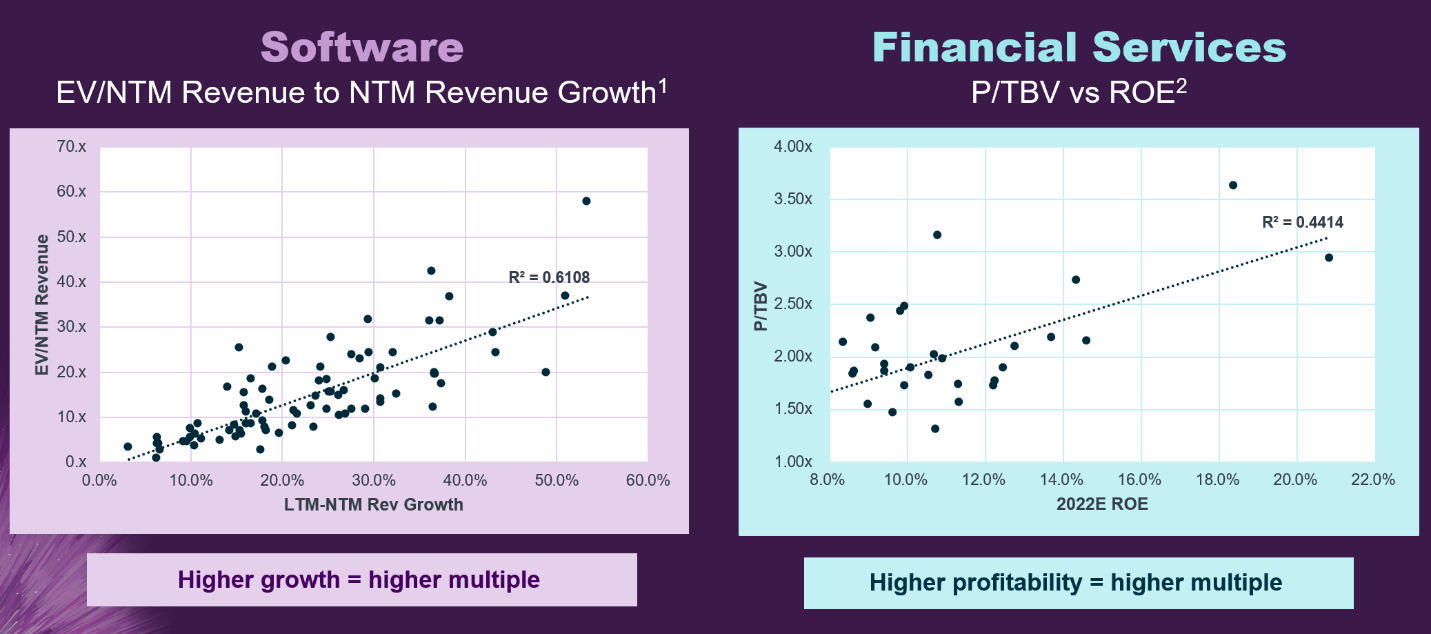

It’s fair to say that when you’re selling money, it’s easy to grow quickly — but growth is not the only important metric. Public markets often correlate valuation to growth in the case of software companies, and valuation to profitability in the case of balance-sheet-heavy financials, like banks. So how should fintech companies incorporating aspects of both models be valued?

Software + finance = BFFs

Part of the reason tech companies receive such high valuations in the first place is because they can tap massive markets independent of geography. Plus, they have high barriers to the competition challenging them and scale their revenues over a relatively fixed cost base, creating highly profitable margins — and value — over time.

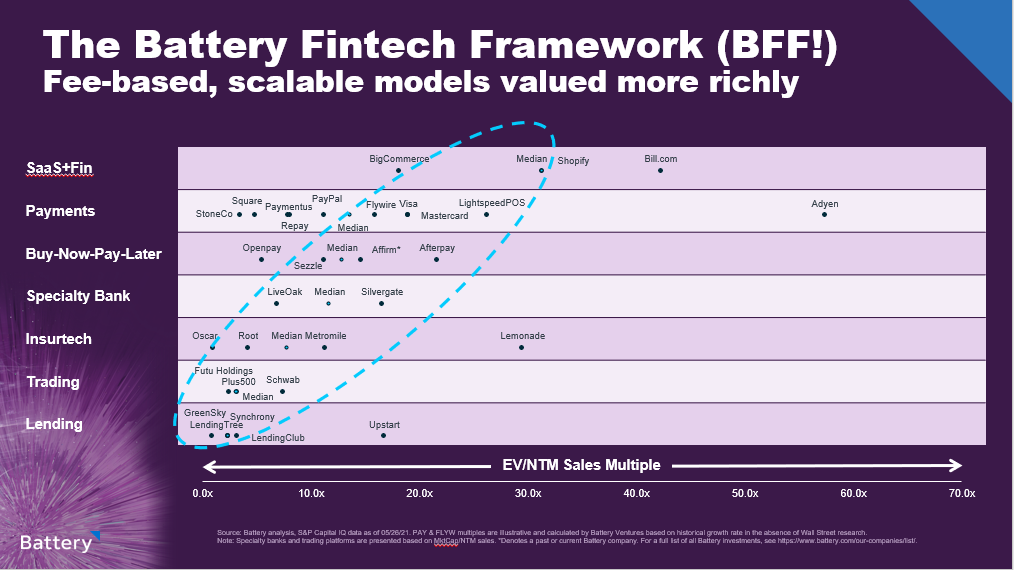

To see how that rationale applies to different types of fintech companies, I’m excited to introduce the Battery Fintech Framework — hopefully a fintech entrepreneur’s “BFF” in understanding how to think about the value of their business model, as well as how a company might be valued by investors.

The BFF classifies different fintech companies into groups based on business model and then compares their median revenue multiples. This comparison yields some interesting conclusions, including:

- At the top of the BFF chart, we see our vaunted hybrid SaaS + financial companies. These companies enjoy the best of both worlds: They collect subscription fees for ongoing use of their service (often with strong customer retention over time) and earn fees for offering financial services to their customers that scale with their customers’ volume.

- In the middle, we see the fintech spectrum. This group ranges from payments companies that collect fees from their customers’ payment volume — essentially the SaaS + financial category, less the subscription fees — to short-duration lenders like the buy-now-pay-laters, or BNPLs, whose short credit exposures are slightly more “fee-like” and require less balance sheet capacity relative to long-duration lenders.

- At the bottom of the BFF, we see the lenders. These companies rely on interest income from loans, are heavily balance-sheet dependent, and typically don’t have a recurring purchase pattern.

The conclusion? The more you can rely on subscription or transaction fees over interest income to generate revenue, and the less balance-sheet capacity your model requires, the higher your valuation.

So what can you, the aspiring fintech entrepreneur, do to bring some of these characteristics to your business and increase value? We can look to both software and traditional financial services companies for inspiration when building a business that stands the test of time.

Own your business process

One of the things software companies figured out long ago is that the more embedded you are in your customers’ people and processes, the harder you are to replace. If we look at the software companies that have stood the test of time — CRM giant Salesforce being a prime example — they are so integral to the functioning of an organization that regardless of how outdated they might look, or how much frustration they might cause to their users, they’re very hard to replace.

There’s a lesson here for fintech: If you think about a traditional bank or an insurance company, their customers treat them as necessary utilities. However, something the very best fintechs do is change this relationship and enable customers to both run their process (for instance, tracking accounts payable/receivables) and take financial action (transferring money), creating the best of both worlds.

Embrace regulation

On the other hand, many software companies getting into financial services stumble because they don’t understand the importance of regulations — something banks and insurance companies deal with in all aspects of their business.

The “move fast and break things” ethos of software doesn’t fly when you’re dealing with multiple regulatory agencies with the power to fine you or even force a freeze on your business until they feel you’ve addressed their concerns (assessed at a typical governmental pace).

The takeaway: Learn to play by the rules or find a partner from financial services to help you.

Fintech is poised to revolutionize financial services, both through reinventing existing products and driving new business models as financial services become more pervasive within other sectors. With the U.S. financial services sector worth an estimated $6.2 trillion, there is an enormous amount of value creation to be had. Just don’t forget your BFF.

Acorns’ SPAC listing depicts a consumer fintech business with a SaaSy revenue mix

Comment