There are a number of ways to take a private company public: You can pursue a traditional IPO, sell a chunk of shares at a set price and start trading. You can direct list and merely start to trade. You can host a hybrid auction-offering, like what Unity did.

Hell, Google showed us back in the day that a reverse-Dutch auction is possible, after which no one else deigned to try it.

And then there’s the blank-check method: Instead of taking your company private, some rich people list a pile of hungry money instead and then go hunting for a private company to merge with. If you consent, the money bucket and your actual company merge, renaming themselves after your operating entity. This is a SPAC-led debut.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

And it’s what we’re discussing today, because there are a few upstarts going public via special purpose acquisition companies (SPACs, or blank-check companies) worth checking out.

One deals with bitcoin, and one is a huge consumer-facing fintech that has a stadium named after itself. In the case of Bakkt, the cryptocurrency-powering entity, a SPAC made some sense at first blush. SoFi, on the surface, seemed less obvious. (Bakkt is owned by Intercontinental Exchange, an exchange-focused, public company. It has raised money from Microsoft as well.)

One deals with bitcoin, and one is a huge consumer-facing fintech that has a stadium named after itself. In the case of Bakkt, the cryptocurrency-powering entity, a SPAC made some sense at first blush. SoFi, on the surface, seemed less obvious. (Bakkt is owned by Intercontinental Exchange, an exchange-focused, public company. It has raised money from Microsoft as well.)

This morning I want to dig through the two offerings’ investor presentations to see what we can learn. After viewing the Opendoor-SPAC presentation, I had a few questions heading into the new deals. The first was whether SPACs were going to be used again to lift potentially promising companies that lacked obvious, near-term growth stories to the public markets. If so, perhaps SPACs would wind up helping get more total companies public, which would not be a bad thing.

Especially given how many unicorns the private markets are birthing ahead of the public market’s ability to IPO them all; maybe SPACs would help close the liquidity gap?

So, does that very modest hypothesis fit with Bakkt and SoFi? And what can Bakkt tell us about Coinbase’s impending IPO and SoFi about the state of consumer fintech? Let’s find out.

SPAC me baby one more time

We’ll start with Bakkt. You can read its release, including all the messy details of a SPAC-led combination here. The piece you need to know is that the resulting, combined company will have an enterprise value of around $2.1 billion and more than $500 million in cash after all elements of the deal are closed.

So the market should soon have a publicly traded, cryptocurrency-focused business that is loaded with cash. Fun!

Next we want to know how healthy Bakkt is as a business, which brings us to its investor presentation, which you can read here. The presentation stresses that Bakkt is backed by major companies, a plus for public investors who might still be skittish about bitcoin. It also stresses that Bakkt will handle a host of digital tokens instead of just cryptocurrencies.

Bakkt’s point that airline miles and other nonmonetary rewards are related to decentralized cryptocurrencies in that they are digital tokens is worth considering. Bakkt views the breadth of its supported asset classes as both an advantage over its competitors, and something that it is expanding. Equities trading is coming soon, which will allow users to view even more of their digitally held assets in one place.

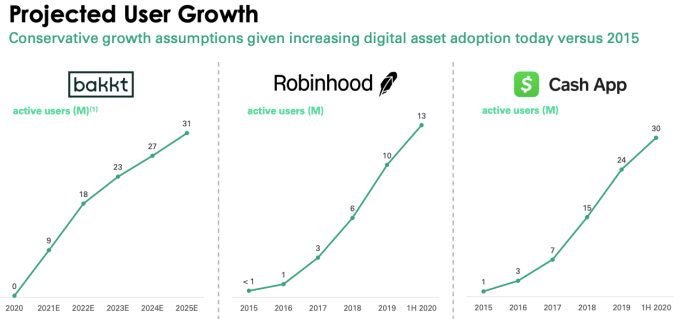

Then we get to the results section of the presentation, which includes what I think is the most egregious chart of all time:

Observe how competitors are denoted with actual data, while Bakkt bests them all with projections. Oof. So when it comes to what we can learn today from Bakkt about the impending Coinbase IPO I think that the answer is “not much.” Oh well.

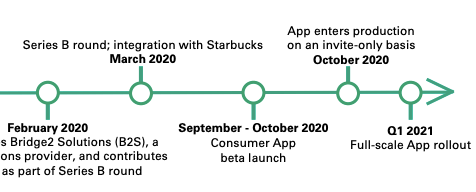

We raise the above chart not merely to gently mock some of its embedded optimism, but also to note how nascent Bakkt’s consumer app really is. Per the company itself, it has yet to really launch:

This leads to the “results” shared being pretty heavy on speculation. Indeed, they are nearly all speculation. Check it out:

I mean, I love the chutzpah.

All the same, this company feels very SPAC-worthy. Not that that is a diss. Instead, Bakkt is less of a sure thing than IPOs try to present themselves as during roadshows. Sure, IPOs no longer have to feature profitable companies, but public investors at least want to see a history of growth, and, often, a path to profitability.

Bakkt is not quite there. What about SoFi?

SoFi’s deal will see it merge with Social Capital Hedosophia V, one of Chamath’s SPACs. You can read the combination announcement here and its investor presentation here. And you can find more SoFi operating data here, if you scroll to page 26. Which we will do shortly.

The deal will see SoFi valued at “$8.65 billion post-money” per its own calculations, after the combination is complete. And SoFi should raise “up to $2.4 billion of gross proceeds” in the deal. So, SoFi should be able to roughly double its last private valuation — set at $4.8 billion during a 2019-era investment — while raising lots of cash and going public.

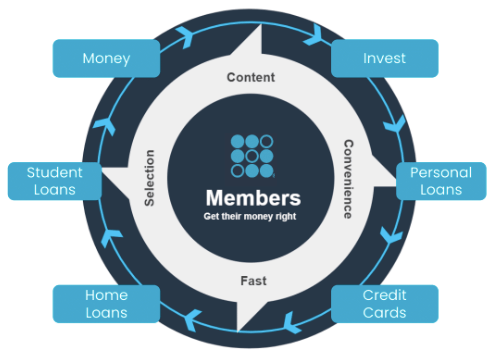

So far it’s hard to whine about any of this, other than it feels needlessly complex. Regardless, SoFi’s business depends on its ability to cross-sell customers from one financial product to another, what it calls “the financial services productivity loop,” of FSPL. If the FSPL works as SoFi thinks it will over time, the company will be able to reduce customer acquisition costs over time and drive more profit.

This concept led to some questionable word-art decisions:

And this ninja star that you bought as a teen from the mall:

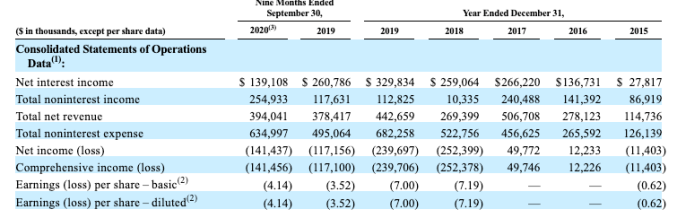

But let’s not get hung up on how the company draws self-portraits. Or even its sunny 2021 and beyond performance estimates. Let’s look at its trailing performance:

You have some questions, I know. Here are a few of mine: Why has the company’s “noninterest” revenue proved so inconsistent over time? Why did the company’s net interest income fall by around half from the first three quarters of 2019 to the first three quarters of 2020? And so on.

Due to the uncertain nature of the company’s performance, I can understand why it is pursuing a SPAC-led debut. Instead of trying to drum up banker support and then general interest in its recent, slow aggregate growth and rising unprofitability, it has found sponsors who really think that it has potential.

So much potential, they are willing to lead its SPAC-combination at twice its last valuation; for investors who got in before that round, the final mark-up here is gravy. And in pursuing a SPAC-led debut, SoFi will raise a trainload of money and get its IPO done at the same time. This bothers me not at all.

But returning to our opening question asking “whether SPACs were going to be used to lift potentially promising companies to the public markets that lacked obvious, near-term growth stories,” it appears that the answer is yes.

Bakkt is hardly a proven business, and despite its blue-chip backing, appears to be banking heavily on huge success for its impending consumer app. In the case of SoFi, it has less-consistent revenue performance than we would have expected and growing net deficits. But each has a growth story to tell, provided that you buy into their market-view antecedents.

Perhaps these companies would have merely stayed private sans SPACs. If that’s true, two cheers for blank-check companies?

With 5 new unicorns in first week of 2021, are we in for a stampede this year?

Comment