Another week, another unicorn IPO. This time, Sprinklr is taking on the public markets.

The New York-based software company works in what it describes as the customer experience market. After attracting over $400 million in capital while private, its impending debut will not only provide key returns to a host of venture capitalists but also more evidence that New York’s startup scene has reached maturity. (More evidence here.)

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Sprinklr last raised a $200 million round at a $2.7 billion valuation in September 2020. That round, as TechCrunch reported, also included a host of secondary shares and $150 million in convertible notes. Inclusive of the latter instrument, Sprinklr’s total capital raised to date soars above the $500 million mark.

Temasek Holdings, Battery Ventures, ICONIQ Capital, Intel Capital and others have plugged funds into Sprinklr during its startup days.

Temasek Holdings, Battery Ventures, ICONIQ Capital, Intel Capital and others have plugged funds into Sprinklr during its startup days.

Sure, Robinhood didn’t file last week as many folks hoped, but the Sprinklr IPO ensures that we’ll have more than just SPACs to chat about in the coming days. But one thing at a time. Let’s discuss what Sprinklr does for a living.

Sprinklr’s business

Sprinklr’s IPO filing and corporate website suffer from a slight case of corporate speak, so we have some work to do this morning to determine what the company does. Here’s what the company says about itself in its filing:

Sprinklr empowers the world’s largest and most loved brands to make their customers happier.

We do this with a new category of enterprise software — Unified Customer Experience Management, or Unified-CXM — that enables every customer-facing function across the front office, from Customer Care to Marketing, to collaborate across internal silos, communicate across digital channels, and leverage a complete suite of modern capabilities to deliver better, more human customer experiences at scale — all on one unified, AI-powered platform.

Not very clear, yeah? Don’t worry, I’ve got you. Here’s what the company actually does:

- Content marketing software: Sprinklr sells content marketing software designed to help companies produce more content more quickly, keep tabs of digital assets and track performance.

- Social media management software: What Sprinklr is perhaps best known for, the company provides social media management software that helps brands manage content across multiple platforms.

- AI-powered software to connect and parse data: Sitting in between its other work, Sprinklr is building out a machine intelligence engine to connect its various products and help companies come up with what it calls “actionable insights.”

So it’s marketing and comms software, with some machine learning built in. Simple enough.

Digging in a little bit more, Sprinklr has a pretty strong enterprise focus. Of its claimed 1,179 customers, 69 generated $1 million or more in revenue for the company over the last 12 months. The company notes that its generated top line “represented approximately 47% of our subscription revenue for” the period.

That’s all well and good, but how did the company perform in aggregate over recent quarters and years? Let’s find out.

Sprinklr’s results

In its fiscal years ending January 31, 2020, and 2021, Sprinklr generated revenues of $324.3 million and $386.9 million. That’s 19% growth between the two 12-month periods. More recently, in its quarters ending April 30, 2020, and 2021, Sprinklr posted revenues of $93 million and $111 million, also up 19% year over year.

Over both fiscal years and most recent fiscal quarter time frames, Sprinklr lost more money. From net income of negative $39.1 million to negative $41.2 million in its fiscal years ending January 31, 2020, and 2021, to $11.2 million and $14.7 million in its quarters ending April 30, 2020, and 2021, its deficits rose.

However, if we lean on the company’s preferred metric of non-GAAP operating income, then Sprinklr’s losses fell. In its most recent fiscal year Sprinklr’s non-GAAP operating income came to $16.9 million, and the company recorded a diminished $1.7 million loss in its most recent fiscal quarter.

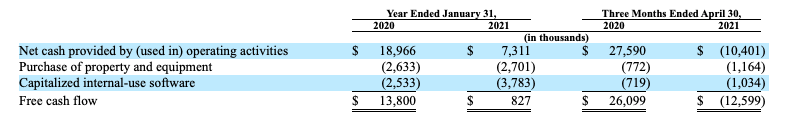

While the company’s adjusted profits should make its somewhat modest growth rate more palatable to investors, Sprinklr’s cash flow paints a somewhat uneven picture.

Sprinklr swung to both operating cash flow and free cash flow negativity in its most recent period. That’s not the sort of trend you want to post on the way to going public.

But don’t fret that the company is going to run out of cash. As it noted in its S-1 filing:

As of April 30, 2021, we had $84.2 million of cash and cash equivalents, which consisted primarily of bank deposits and money market funds and $191 million of highly liquid marketable securities.

That’s north of a quarter-billion in cash, effectively.

So Sprinklr is not going public because it needs the money. It doesn’t. Instead, we can read its IPO timing as just that: a timing of the markets. With American stocks back near record highs, it could be a propitious moment to list for software companies that lack impressive top-line expansion results.

More when we get pricing information.

Comment