Victor Echevarria

I think it’s important that we explicitly discuss something that every VC instinctively knows: The hype around a given business or category has become a form of bias for investors and founders when vetting ideas to pursue. At any point in time, you can find FOMO-flavored bad business decisions based on false market signals somewhere in tech. It’s human nature for excitement to be contagious, but treating it as a leading factor when considering a new opportunity is not a good idea.

Take the 17th century tulip-mania, when, at one point, Dutch speculators drove tulip futures so high that one bulb of a particularly rare species was valued at more than a fully furnished luxury house1. We can look at this and collectively lampoon anyone who could possibly have bought into that absurd trend.

But that’s the rule with mega-hyped markets. The dot-com apocalypse was inevitable in hindsight. So was the consumer lending bubble that set off the global financial crisis. But major market catastrophes aside, newly hyped sectors in tech seem to pop up, like Moore’s Law clockwork, every year or so.

In the last 15 years, giant bonfires of cash have turned to ash financing companies in hyped up sectors like SoLoMo (I bet many people reading this have never even heard of this trend), clean tech, VR gaming, daily deals, crypto (which spawned flashy undercard entries like PotCoin, BurgerKing’s WhopperCoin, and yes, TrumpCoin), the sharing economy, scooters (in which Bird, Lime, Lyft and Uber competed around little more than the color scheme of the otherwise identical Segway Ninebots), and SPACs (through which the aforementioned white-colored scooter company is going public).

Usually, these bubbles start when a breakout company creates a discontinuity in the market — a technology that changes how we live (Apple’s iPhone), or delivers an exceptional solution to a ubiquitous pain point better and more cost effectively than before (Uber’s ride-sharing). Rational speculators look to apply lessons from these breakouts to identify other massive winners. If a few seem to take off, irrational FOMO takes over.

What does that look like? Here’s an actual example, per data sourced from PitchBook:

- Yelp creates a new way for local businesses to engage their customers.

- It eventually takes off and its growth catches the eye of founders and investors who want to help businesses engage customers in other ways.

- Dodgeball Foursquare launches in 2009, goes viral, and sees its valuation grow from $6 million to $115 million in nine months on the heels of widespread consumer adoption.

- SoLoMo becomes the Next Big Thing; seed and Series A social platform deal valuations jump 30% and capital invested increases by 170% between 2010 and 2011.

- The hype subsides the following year, and valuations crash to below the levels seen before the trend and the capital chasing the sector drops by almost half.

Rinse and repeat with Uber and the sharing economy, which created hype that peaked when we saw not one, not two, but three competing on-demand valet parking apps. Groupon gave rise to Living Social, BuyWithMe, and, in a final supernova of commoditization, aggregators of these companies like Yipit.

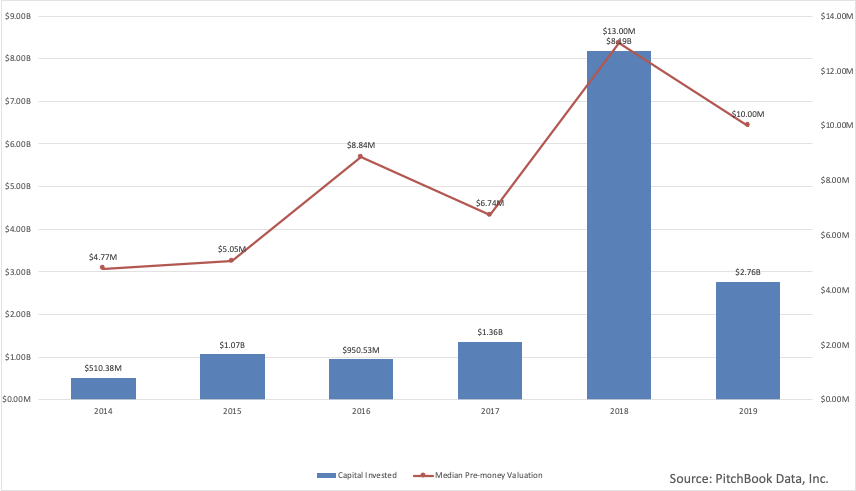

Highlighting a more recent example, this is what seed and Series A investment and valuation activity looks like for blockchain companies over the past several years. The data needs no additional comment.

Chasing hype is human nature for good reason. We can rely on collective excitement to try new restaurants, watch movies, read books and listen to music — decisions with limited downside. The consensus “best” may not always live up to the hype, but it usually works out pretty well, and you didn’t have to do the hard work of researching and sampling yourself.

But with startups, hype easily leads to bad business decisions. Investors and founders skip due diligence because they don’t want to miss out on a perceived money-printing Next Big Thing. And founders fail to think through their ideas because other similar companies riding the trend are seeing incredible paper markups.

Trends are addictive; to remain disciplined and avoid hype is to deny our innate instincts. About two years ago, during the scooter boom, I was smitten with a company that I thought had a compelling edge against the large incumbents. In hindsight, it’s clear that I subconsciously invented those points of differentiation merely because I wanted a piece of the trend. I am all for investing into a trend as long as it’s alongside an entrepreneur’s authentic conviction in a truly differentiated idea.

If you’re a founder or investor chasing an idea, pull off the excitement superhighway for a moment. If you’re chasing a trend, make sure it isn’t just supported by lofty valuations floating in a hurricane of private market activity. I remember seeing gig economy companies that proudly offered in their pitch decks, as proof of inevitable success, the crazy amounts of capital raised by other gig economy companies over short periods of time.

But early-stage paper markups and eventual bankruptcies are more correlated than you’d think. Cool your jets for a moment and try to imagine your company 20+ years from now. Do you truly believe it will be a category-leading, standalone public company serving a massive market? If not, move along. If “tailwinds” represent the majority of your conviction, then question your conviction.

Ultimately, don’t let an imagined future state of regret drive a decision to launch or fund a new venture. Trends present real opportunities, but founders and investors should engage with caution.

1. This is somewhat misleading. As tulip prices started to grow, the Dutch government introduced a mandate that futures contracts be cancelable for a small fee, effectively turning future contract prices into option strike prices. Spot price movements were still volatile though, and plenty of people lost their shirts.

Comment