The public markets give, and the public markets take away. Earlier this morning, enterprise cloud storage and productivity company Box got into a more public spat with some of its shareholders upset with its performance and management decisions. But while Box endures the more difficult chapters of being a public company, other companies are racing to join the ranks of the listed concerns of the world.

If it feels like IPO news slowed for a few weeks at the start of the second quarter, your gut is correct. Investors previously told The Exchange that the first, third and fourth quarters of 2021 would be hot periods for public debuts, but that Q2 would be slower. Their argument revolved around reporting cadences and how long it takes for certain periods of accounting work to be completed.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

So we weren’t surprised when the second quarter’s IPO cycle began to feel a bit soft compared to the rapid-fire first quarter. And, as we’ve all heard in recent days, the great SPAC rush is slowing.

But that hasn’t stopped a number of firms from defying expectations and going public all the same. Online hosting and website builder Squarespace has not only filed but filled in its public filing with notes on its anticipated direct listing. We have to talk about its choice to list directly in light of new financial information we have concerning its recent performance.

But there’s more: Expensify filed to go public yesterday, albeit privately. And the SmartRent SPAC combination, though now slightly dated, is also worth a moment of our time.

But there’s more: Expensify filed to go public yesterday, albeit privately. And the SmartRent SPAC combination, though now slightly dated, is also worth a moment of our time.

The final element in the current IPO landscape is the recent Darktrace IPO in the United Kingdom, which, after that market had a rough start to its tech IPO calendar, is now seeing better results. So, let’s discuss IPOs to fully understand where we stand today in the realm of unicorn liquidity.

Squarespace’s direct listing

When The Exchange first dug into Squarespace’s IPO filing, we did our best to parse its full-year results because we lacked its quarterly details. This leaves us with two things to chew on: Why is Squarespace pursuing a direct listing over another listing technique, and what can its current and more granular operating results tell us about the choice?

On the first count, if Squarespace is direct listing, we can presume that it doesn’t need more cash to operate. So, how much cash does the company have on hand? A good chunk of change: $183.3 million.

But just having cash is meaningless if you are burning it. So, does Squarespace have positive operating cash flow? It does! The company has lots of positive operating cash flow, and it also reported its unlevered free cash flow, which it defines as “cash flow from operating activities less cash paid for capital expenditures increased by cash paid for interest expense net of the associated tax benefit.” Cool. The company generated $51.8 million of the stuff in Q1 2021.

That was down slightly from the year-ago period, but it’s large enough to help us understand why a direct listing for Squarespace is possible — the company has lots of cash and generates lots of cash.

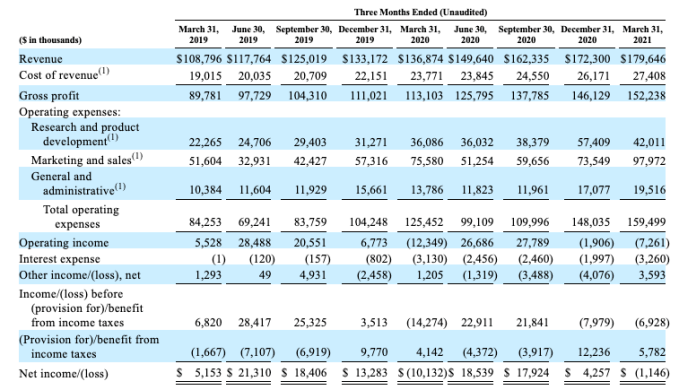

Now let’s peek at its quarter-by-quarter data from its preceding few years, along with its Q1 2021 results as well:

There are two things to note from the data: First, Squarespace’s successive-quarterly revenue growth is rather good. Even the onset of COVID-19 did not halt its quarterly revenue additions, though its Q1 2020 was somewhat lackluster in sequential-growth terms compared to other periods. After that lull, the company’s growth picked back up nicely.

Secondly, we can see that after GAAP net income in all of 2019, and during two quarters of 2020 in which its marketing costs were depressed — saving the company around $20 million a quarter — it slipped back into GAAP losses in more recent quarters. That’s because it amped its marketing costs by around $20 million per quarter from $59.7 million in Q3 2020 to $98.0 million in Q1 2021.

Now, if Squarespace were an enterprise B2B SaaS giant, we’d just say that the company was spending cash to collect long-term, positive net dollar retention with those rising marketing costs. The explanation for the rising spend in Squarespace’s S-1/A filing is a bit different. Here’s the company:

In light of the accelerating trends in the amount of time and money consumers are spending online during the COVID-19 pandemic, we increased our marketing and sales spend over 40% in the year ended December 31, 2020 relative to the year ended December 31, 2019. We viewed this increased spending as a long-term investment in our business that would attract new unique subscriptions. As our revenue increases, we expect our marketing and sales expenses to continue to increase on an absolute dollar basis, but over time we expect our marketing and sales expenses to decrease as a percentage of revenue. We believe that our easy-to-customize and design-first solutions drive consistent cash retention.

Fair enough. Even though Squarespace customers don’t exhibit long-term positive net retention metrics, they do continue to kick off cash on a cohort basis for a long time. So, we can still view its recent marketing costs as investing in future cash flows.

Regardless, the company is growing well, generating lots of cash and has a history of growth that could entice investors. More when we get a reference price for its direct listing and can do some new valuation calculations.

Expensify’s IPO

A bit of background on this one: We were working on a round of interviews with Expensify executives in early March when they stopped talking to us. Now we know why: It was entering a quiet period ahead of filing for IPO. In retrospect, we can’t say we’re surprised to see this 13-year-old expense management company go public. As we pointed out when it joined the $100MM ARR club last November, it was an obvious IPO candidate, thanks to pretty singular metrics.

Which figure to highlight? Maybe its reported “lifetime revenue eclipsing $215 million,” contrasted with its headcount of only 130 employees. Or its revenue growth of 283% between 2018 and 2020 despite COVID-19. But to stay on IPO grounds, let’s pause on the most unusual one: revenue versus capital raised. According to Crunchbase, Expensify raised a total of only $38.2 million, and that doesn’t account for the fact that it actually bought back several of its investors — so the tally is actually even lower.

Still, the path in front of Expensify may not be as open as it used to be when it was only competing against traditional players like SAP Concur and Intuit — or simply against spreadsheets themselves. In the meantime, the market has caught up with bottom-up SaaS, and Expensify now has competitors that are more similar to itself, such as Divvy, which closed a $165 million round at a $1.6 billion valuation in January. Even more recently, Brex made it clear that it intended to eat into Expensify’s territory with the launch of Brex Premium (see our recent interview with Brex CEO Henrique Dubugras.) However, Expensify wasn’t born yesterday and already anticipated some of these moves by launching its own card in 2019.

SmartRent’s SPAC

We are running a little long, so just a few brief words to catch you up on SmartRent. The proptech company is merging with Fifth Wall Acquisition Corp. I in a combination that will sport an equity valuation of $2.2 billion.

To some degree, you can consider SmartRent a competitor with Latch, another company that is going public via a SPAC merger. What you need to know about SmartRent’s debut is that the company is going public early. It was gross-margin negative in 2020, posting a gross profit of -$3 million off $53 million in revenue during the year. But, it expects to generate $15 million in gross profit in 2021 off of $119 million in top line.

Hard to believe? I’ve chatted with Latch a bit about its model, and it appears that the company has a long install cadence for closed deals as construction takes a minute. SmartRent could be the same — the company claims that 80% of its “’21-’22 units are committed” — implying that its revenue growth isn’t a PIPE dream.

You can read the deck here if you want to go deeper. What matters for our purposes today is that the company’s combination was announced during what we’re viewing as an IPO lull, which is notable in terms of timing.

What’s ahead

A lull isn’t a cessation, so we should perhaps be less surprised that we’ve had to compile an IPO roundup to handle all the news. If this is the quiet period, imagine how noisy things will be in Q3 2021.

Hell, we could see names from Egnyte to Databricks file and list later this year. Why not? Everyone has to do it at some point or give up and sell to someone they once thought they were going to beat.

In short, then, strap in. The IPO market should get wild in just a few months’ time.

Comment