The IPO market is gearing up for a hot close to the second quarter and a hotter Q3.

That’s The Exchange’s takeaway from recent IPO filings from Monday.com (enterprise planning and communications) and a number of SPAC-led combinations from Bird (scooter sharing), Bright Machines (AI-powered microfactories) and others. Looking ahead, Squarespace (site design and hosting) will direct list this week, while Oatly (pressed grain juice) and Procore (construction tech) will price and complete traditional IPOs in the next few days.

Late last week, Marqeta (card issuing and payments tech) filed as well, and just this morning, Flywire (global payments) set a price range for its own debut. The two fintechs are our targets today, though we’ll take them in sequential posts.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Public equities have seen some price declines in recent sessions, and there’s been observable multiples-compression afoot among both tech stocks and shares more generally. But many companies are betting that it remains a fertile moment to list. A slow drift downward in the value of technology revenue, in other words, is not stopping what could be an enthusiastic exit market from here to the end of the year.

Forget the larger market for now. Let’s narrow our focus to Marqeta, long a darling of the fintech market though less well known than some companies in its sector due to its infrastructure nature.

Forget the larger market for now. Let’s narrow our focus to Marqeta, long a darling of the fintech market though less well known than some companies in its sector due to its infrastructure nature.

If you are not familiar with Marqeta, it powers the payment card tech behind products that you use, like Square, a key customer and driver of the unicorn’s growth. Marqeta exhibits a number of fascinating fintech characteristics (majority revenue from interchange, a rabidly competitive market) that make it very interesting to unspool.

Throw in the fact that the company’s business strengths (rapid revenue growth, for example) are tied to its key weaknesses (customer revenue concentration, to pick one), and the picture that emerges from the Marqeta filing is both varied and super fun.

First, let’s briefly discuss what the company does. Then we’ll dig deep into its operating results. Let’s go!

What does Marqeta do?

Unlike most companies that file to go public, Marqeta is actually able to describe what it does with a minimum of bullshit. From its S-1 filing: “Marqeta provides a single, global, cloud-based, open API Platform for modern card issuing and transaction processing.”

The model attracted around $527 million in private capital from investors like Spark Capital, Goldman Sachs and CommerzVentures, and a number of investments from strategic investors, per PitchBook, at a most recent valuation of around $4.3 billion, according to the same source. Marqeta, then, has managed to raise north of a half-billion dollars for its product vision.

The company has what it describes as three “primary capabilities,” namely issuing, processing and applications. They concern the creation and management of both physical and virtual cards, the processing of payments, and software that helps customers manage fraud, handle compliance and more.

In business-model terms, Marqeta employs what it calls a “usage-based model [that is] based on processing volume.” That shakes out to interchange revenues, mostly. The company also generates top line from what it describes as “processing services, including monthly platform access, ATM fees, fraud monitoring, and tokenization services.”

On the customer front, Square is the key entity, though Marqeta also stresses deals with DoorDash, Instacart, Klarna and others in its IPO filing.

Got all that? Good. Now let’s look at how all that work converted to numerical results.

Is Marqeta a good business?

Yep. But there are some caveats to consider.

Marqeta has rapidly scaled its revenues from $143.3 million in 2019 revenue to $290.3 million in 2020, a gain of 103%. And more recently, from $48.4 million in Q1 2020 to $108 million in Q2 2021, a gain of around 123%.

Rapid, accelerating revenue growth? Check.

Marqeta has cut its losses over time from a net loss of $58.2 million in 2019 to a net loss of $47.7 million in 2020, a decline of 18%. And more recently, from $14.5 million in Q1 2020 to $12.8 million in Q1 2021, a decline of around 12%.

Falling losses and a path to profitability? Check.

Perhaps more importantly for public-market investors, Marqeta has reduced its adjusted EBITDA losses from $34 million in 2019 to $15.4 million in 2020; and more recently from $10.4 million in Q1 2020 to positive adjusted EBITDA in Q1 2021 of $1.6 million.

Fake profits to pump up the numerically loose public markets? Check.

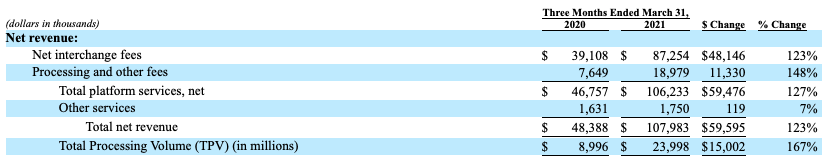

What’s driving the revenue growth that has led to falling net losses and a flip into adjusted EBITDA positivity? Here’s a table showing the company’s revenue category breakdown and resulting changes in percentage terms, comparing the first quarter of last year with the first quarter of this year:

Hot damn, right? Both revenue categories denoted were up more than 100% in the first quarter. That’s pretty freaking bonkers, to be honest. And just to throw in one more bit of good news, Marqeta started generating positive operating cash flow in 2020 and had free cash flow positivity to report in Q2 2021.

In short, the company’s two key revenue sources are both growing like a weed, adjusted profits have arrived, and GAAP losses are falling. It’s a solid package.

What’s the other side of the coin? A few things:

- The rate at which Marqeta converts total processing volume (TPV) to revenue is falling. From 5.4% in Q1 2020 to 4.5% in Q1 2021, in fact.

- The company’s growth is highly dependent on Square’s growth. From the company’s filing, Marqeta’s Square dependence is striking: “For the years ended December 31, 2019 and 2020, we generated 60% and 70% of our net revenue from our largest Customer, Square. For the three months ended March 31, 2020 and 2021, we generated 66% and 73%, respectively, of our net revenue from Square.” Square’s growth, then, has been a key driver of Marqeta’s growth.

- Marqeta depends heavily on a single banking partner. From its S-1 filing, the following should be kept in mind: “A significant portion of our payment transactions are settled through one Issuing Bank, Sutton Bank. For the years ended December 31, 2019 and 2020 and the three months ended March 31, 2020 and 2021, approximately 97%, 96%, 95%, and 94%, respectively, of TPV was settled through Sutton Bank.” That’s risky.

- The company has dual-class shares, which could limit shareholder input into company plans, operations, hiring and compensation. Also, The Exchange hates dual-class shares.

If some of those concerns sound like nit-picks to you, bear in mind that defending take-rates is key for any business that deals in volume; customer concentration risk is real and matters, just ask Twilio and Affirm; banks fail; and dual-class shares have a way of keeping certain equities out of the major indices. So, our gripes are not hokum.

How investors will weigh those key concerns against the company’s stellar recent financial performance is not yet clear. We’ll know a hell of a lot more when we get a first IPO price range for Marqeta.

Comment