Bright Machines is going public via a SPAC-led combination, it announced this morning. The transaction will see the 3-year-old company merge with SCVX, raising gross cash proceeds of $435 million in the process.

After the transaction is consummated, the startup will sport an anticipated equity valuation of $1.6 billion.

The Bright Machines news indicates that the great SPAC chill was not a deep freeze. And the transaction itself, in conjunction with the previously announced Desktop Metal blank-check deal, implies that there is space in the market for hardware startup liquidity via SPACs. Perhaps that will unlock more late-stage capital for hardware-focused upstarts.

Today we’re first looking at what Bright Machines does, and then the financial details that it shared as part of its news.

What’s Bright Machines?

Bright Machines is trying to solve a hard problem related to industrial automation by creating microfactories. This involves a complex mix of hardware, software and artificial intelligence. While robotics has been around in one form or another since the 1970s, for the most part, it has lacked real intelligence. Bright Machines wants to change that.

The company emerged in 2018 with a $179 million Series A, a hefty amount of cash for a young startup, but the company has a bold vision and such a vision takes extensive funding. What it’s trying to do is completely transform manufacturing using machine learning.

At the time of that funding, the company brought in former Autodesk co-CEO Amar Hanspal as CEO and former Autodesk founder and CEO Carl Bass to sit on the company board of directors. AutoDesk itself has been trying to transform design and manufacturing in recent years, so it was logical to bring these two experienced leaders into the fold.

The startup’s thesis is that instead of having what are essentially “unintelligent” robots, it wants to add computer vision and a heavy dose of sensors to bring a data-driven automation approach to the factory floor. The startup followed that Series A in 2019 with its first product announcement, a software-defined microfactory. As CEO Hanspal explained to TechCrunch at the time of the announcement, it involves a redefined factory tech stack to create microfactories as needed.

What the software-defined microfactory does is package together robotics, computer vision, machine handling and converged systems in a modular way with hardware that you can plug and play, then the software comes in to instruct the factory on what to build and how to build it.

Such an approach takes a ton of cash, which is why this SPAC makes sense. It gives it a massive infusion of capital to build on this vision. As we’ll see shortly, the company’s business is modest today and highly unprofitable. However, as with every company going public via a blank-check company, Bright Machines and its investor think that its business has a rather shiny future.

Inside the numbers

TechCrunch explored the Bright Machines investor deck. You can follow along here.

From a high level, the company has two main business lines: hardware and software/services. The first is called “assembly automation” by the company, and the latter “additional software and services.”

In 2020, Bright Machines had $9 million in hardware incomes and $26 million in software/services revenues. From that combined $35 million in total top line, the company generated negative EBITDA of $40 million. Bright Machines did not share more concrete loss metrics, so we’re stuck with adjusted figures.

While these are not great numbers on their face, it’s early days and the company probably took a hit during the pandemic when it couldn’t do a lot of onsite selling or installation that such a solution likely requires.

Looking ahead to 2021, the company expects its profitability to deteriorate further. From a -115% adjusted profit (EBITDA) margin in 2020, Bright Machines expects to lose 118% of its revenue in adjusted terms. From 2021 on, the company’s forecasts show falling adjusted losses in percentage terms. (The company’s EBITDA loss is expected to rise in gross dollar terms in 2022, though at a lower anticipated resulting margin.)

Bright Machines wants to put AI-driven automation in every factory

This could explain why the company chose the SPAC route. This is a company that has a big vision, but it’s one that is going to require patience on the part of investors.

Driving that theoretical ramp to breakeven status on an adjusted basis is strong revenue expansion in coming years. This is where things get speculative, and therefore very SPAC-y; bear in mind that the SEC is starting to make noise about companies going public in blank-check combinations and their rosy forecasts.

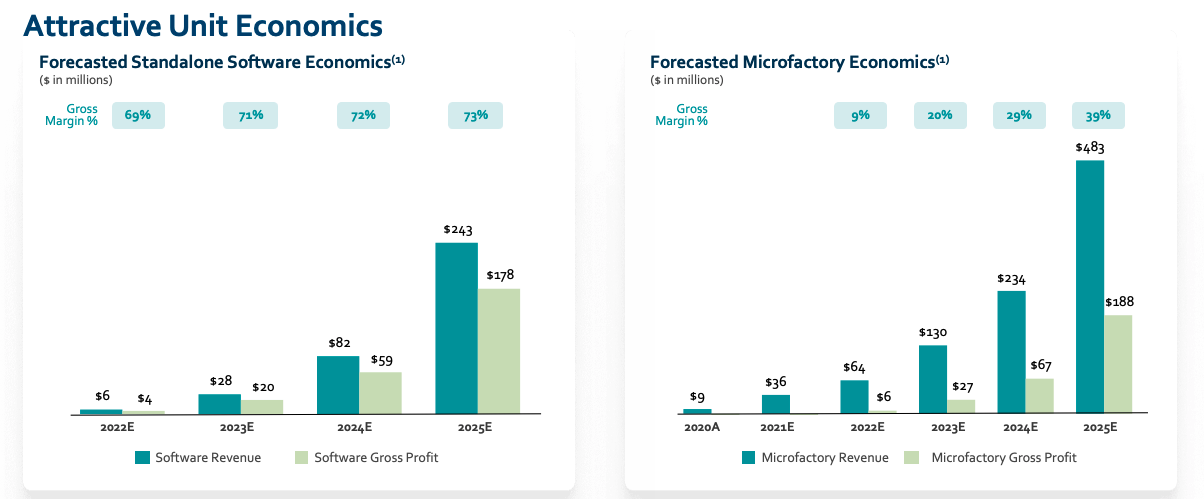

There are two things to understand when it comes to Bright Machines’ anticipated future growth. The first is that its software business is going to start generating “standalone” revenues in 2022. Second, the company’s hardware (microfactory) revenue will scale rapidly but will not generate material positive gross margin until 2023.

It’s worth noting that the company hopes to develop a template approach to manufacturing, and, theoretically at least, over time, the cost of creating these microfactories should go down and profit should go up as they have more of them in place.

So, some standalone software gross profits are coming in 2022, and the microfactory business will start kicking off gross margins greater than 10% in 2023. Here’s what that all looks like in chart form:

In 2023, we can anticipate $158 million of microfactory and standalone software revenues, along with $47 million in gross profit. The company writes later on in its deck that Bright Machines expects a total of $164 million in revenue that year (up 92% from its 2022 projections), and total operating expenses of $106 million, leading to an EBITDA loss of $57 million. You can start to see the potential playing out here with these numbers.

That is a lot of forecasting work to get to a 2023 result that is pretty damn unprofitable. But that’s why SPACs can make sense; Bright Machines is going to raise a huge amount of cash in its public debut. And that cash is precisely what it needs to scale its entire business. So with its new capital, it can get busy building and growing without having to raise — we presume — incremental cash from investors.

Whatever the stock does in the interim it does. But being fully funded through to breakeven or something around there is akin to free cash flow neutrality; it gives a company with a less conventional business model than your typical VC-backed venture time to grow and develop.

A company may pursue a SPAC for good reasons. They are as follows: The ability to go public earlier while raising more than it might be possible from private investors in a single go. This is best for companies with high levels of potential, some technical or market risk, and the possibility of leveraging a huge cash infusion to build out their vision over a multiyear period.

This describes Bright Machines to a T. Beyond that, we have no real view on its core technology or its market read. That’s up to the investors. But the company does seem to be a reasonable candidate for a SPAC transaction.

Enhanced computer vision, sensors raise manufacturing stakes for robots as a service

Bright Machines lands $179M to bring smarter robotics to manufacturing

Comment