At long last, the Monday.com crew dropped an F-1 filing to go public in the United States. TechCrunch has long known that the company, which sells corporate productivity and communications software, has scaled north of $100 million in annual recurring revenue (ARR).

The countdown to its IPO filing — an F-1, because the company is based in Israel, rather than the S-1s filed by domestic companies — has been ticking for several quarters, so seeing Monday.com drop the document on this Monday morning was just good fun.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The Exchange has been riffling through the document since it came out, and we’ve picked up on a few things to explore. We’ll start by looking at the company’s revenue growth on a historical basis to see if it has accelerated in recent quarters thanks to the pandemic. Then, we’ll turn to profitability, cash burn, share-based compensation expenses and product vision.

We’ll wrap at the end with a summary of what we’ve learned and also make sure to check out the company’s marketing spend, because I’m sure you’ve seen its digital ads.

We’ll wrap at the end with a summary of what we’ve learned and also make sure to check out the company’s marketing spend, because I’m sure you’ve seen its digital ads.

It’s a lot to chew through, so no more dilly-dallying. Into the numbers!

As always, we’re starting with revenue growth because it’s still the single most important thing about any venture-backed company.

Revenue adds are accelerating

This is great news for the startup, its employees and its investors. From 2019 to 2020, Monday.com grew its revenues from $78.1 million to $161.1 million, or 106%.

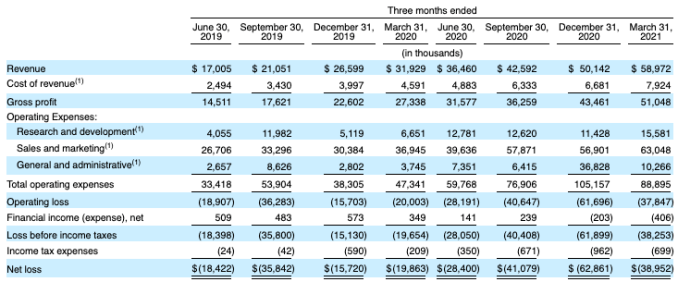

From Q1 2020 to Q1 2021, the company’s revenues grew from $31.9 million to $59 million. That’s about 85% growth. So, by what measure do we mean that the company’s revenue growth is accelerating? Its sequential-quarter revenue growth is picking up. Observe the following:

From Q2 2019 to Q3 2019, the company added around $4 million in revenue. From Q2 2020 to Q3 2020, that number was $6.1 million. More recently, the company’s revenue added $7.6 million from Q3 2020 to Q4 2020, which accelerated to $8.8 million from the final quarter of 2020 to the first quarter of 2021. Of course, from an ever-larger base, the company’s growth rate may decline. But the super clean and obvious expanding sequential revenue gains at the company are solid.

The fact that it added so much top line in recent quarters also helps explain why Monday.com is going public now. Sure, the markets are still near record highs and the pandemic is fading, but just look at that consistent growth! It’s investor catnip.

Losses, “losses,” and free cash flow

Of the $39 million that Monday.com lost in the first quarter of this year, around $14.5 million came from stock-based compensation costs. So, the company’s SBC-adjusted net losses were more modest.

Notably, the company does not share adjusted metrics that we often see from startups of its ilk, namely EBITDA and adjusted EBITDA, increasingly fancy ways of gutting costs to make a company look more profitable than it actually is. Good. It’s nice to see a tech startup treat itself mostly like an adult.

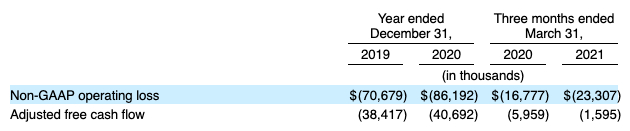

But we are left to merely parse its cash flow numbers. They are as follows:

To dig in, what the hell is non-GAAP operating loss? Essentially, it’s the company’s operating loss inclusive of all costs, minus share-based compensation. That’s reasonable-ish. And as we can see, it does not translate neatly into adjusted free cash flows.

In this case, adjusted free cash flows are “net cash used in operating activities less cash used for purchases of property and equipment and capitalized software development costs, plus non-recurring expenditures such as capital expenditures from the purchases of property and equipment associated with the build-out of our corporate headquarters.” Adjusted free cash flow, then, is free cash flow with a freebie stapled to it in that Monday.com is discounting the cost of building out an office.

You can vet that as you will. But what does matter is that the company reached nearly breakeven status on the metric in its most recent quarter. That’s good!

We can see two things from this deluge of numbers: First, that when using formal American accounting rules, Monday.com is pretty damn unprofitable, thanks in part to share-based compensation expenses. However, when it comes to real cash burn, the company’s deficits have been somewhere between just fine and pretty good for a high-growth software company.

What about product?

As you would expect, the Monday.com feature that you are most aware of — status updates — is not the full picture of what the company does. Let’s take a moment to dig into what the company is building and has planned.

Monday.com calls its service “Work OS,” which is interesting. Operating systems have to be flexible platforms that can be used to do all sorts of things while including myriad integrations to other systems. Does the company’s product live up to that?

Here’s a dramatic retelling of the Work OS story from Monday.com’s F-1 filing, using all sorts of excisions for length and rearranging. Additions are in brackets:

We call our platform “Work OS.” [It] consists of modular building blocks that are simple enough for anyone to use. [It] is a no-code and low-code framework. [Work OS] allow[s] our customers to create their own software applications and work management tools.

[As a company we] recently expanded the scope of our building blocks by extending our platform to external developers through a low-code framework and an apps marketplace [that] allow[s] customers, partners and external developers to easily create their own building blocks and apps.”

Cool. That’s actually enough for me to not hate the Work OS tagline. And, apparently, it’s working. With more than 120,000 customers and a net dollar retention rate “for customers with more than 10 users” of “119% and 121% for the three months ended March 31, 2020 and 2021, respectively,” Monday.com’s product plan is trucking along just fine.

Normally IPO filings are full of useless dreck and overwrought verbiage. In this case, I don’t hate the writing, and I don’t feel like the company is fibbing under an obfuscating haze of bullshit buzzwords. That or I need more coffee.

Bonus: Ad spend?

It’s fair to say that Monday.com has done some advertising. Whenever I am using YouTube on a machine without ad-blocking tech, I run into the company’s peppy adverts. You may have as well. There have been so many Monday.com ads that people are tweeting stuff like this in relation to its IPO filing.

So, does the company really spend a lot on marketing? Yep. Tons: $191.4 million in 2020, for example, up from $118.5 million in 2019. As Monday.com had revenues of $161.1 million in 2020, that’s a lot. Sales and marketing costs were still higher than revenue in the company’s most recent quarter, the first of 2021. I guess this is how YouTube helped Alphabet hit its numbers.

Summing up

What have we learned? Thanks for asking, here’s a rundown:

- Monday.com’s sequential revenue-adds are impressive, even if the company’s year-over-year growth rate slowed modestly in Q1 2021 versus calendar 2020.

- The company is deeply unprofitable, but on an adjusted free cash flow basis is not nearly as bleak as you might expect given its net loss figures.

- Monday.com’s shared profitability picture is less adjusted than what most companies of its ilk produce, so we get to treat it mostly as a grown-up business. In aggregate, Monday.com has been sufficiently efficient, though we have to peer through its GAAP numbers to see that side of its business.

- The company’s product vision is pretty interesting, and we’ll add here that if the no-code world continues to grow as it has, Monday.com could be in a good place to capitalize on increasing demand.

- And, yes, all those Monday.com ads you have seen were expensive.

We’re excited about this particular debut. More when we get an initial price range.

Comment