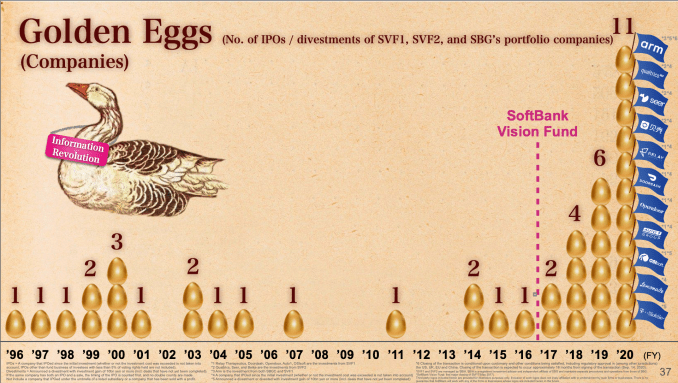

SoftBank had some good data to report overnight with its third-quarter earnings, which covers the last quarter of 2020 through December 31. The company’s first Vision Fund reported large gains driven by DoorDash, where the company’s $680 million investment blew up to just shy of $9 billion — a 13.2x return in SoftBank’s math. While not the first exit from the fund nor the first high-returning exit SoftBank has had, it is the first exit that meaningfully shakes up the prognosis for the Vision Fund’s returns.

Now seems as good a time as any to ask a question we first started pondering when SoftBank launched the Vision Fund way back in 2017: What does a return profile look like at such a late stage of investment?

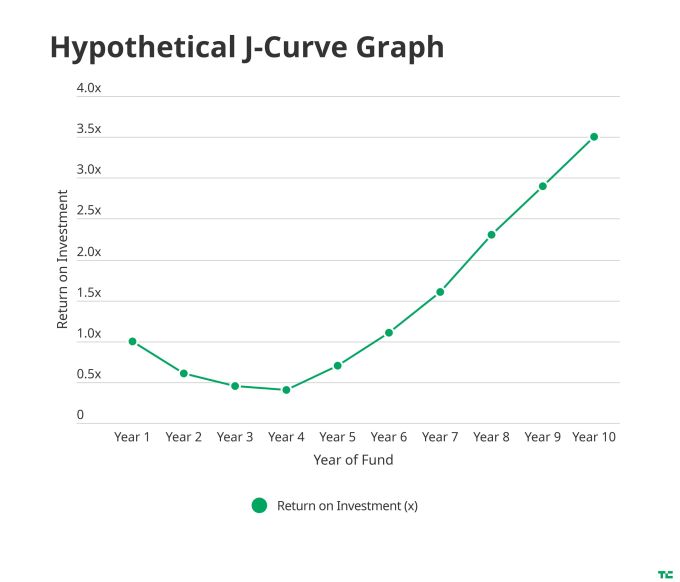

Early-stage venture capital has a return profile dubbed the “J-curve.” Given a cohort of startups in a venture portfolio, the failures of that cohort tend to materialize quite quickly. Those startups can’t raise money, and thus, they run out of runway and either die or are sold off. That means that the losses from those investments are recognized by investors right away. Meanwhile, the successful startups keep growing and raising venture capital, but funds won’t realize their gains for potentially a decade or more. Thus, the J-curve describes the early years of a fund where the losses are visible but the future gains have not yet materialized.

The Vision Fund pioneered a much more muscular form of traditional mezzanine (pre-IPO) capital, where it would barge into a company’s cap table with big dollars and high valuations with the dream that these companies would go big. While not true of all of the Vision Fund’s investments, many of these startups were quite mature with serious revenues where the alternative to mezzanine capital was an IPO.

That brought up an interesting fund construction question: The sort of immediate failures that create the J-curve for early-stage investors shouldn’t presumably exist at later stages, where startups are less-risky investments. Sure, some startups may grow more slowly than other companies and exit for a middling return, but few startups should actually fail entirely.

So what does the SoftBank data look like today and what can it tell us about late-stage fund performance?

SoftBank Vision Fund I made a total of 92 investments from summer of 2017 to mid-2020, of which 10 have fully exited, and eight are now traded on the public markets. According to SoftBank, 25 of its Fund I portfolio companies received another venture capital round in calendar year 2020 as well, giving the firm some upticks in its fair-market valuation.

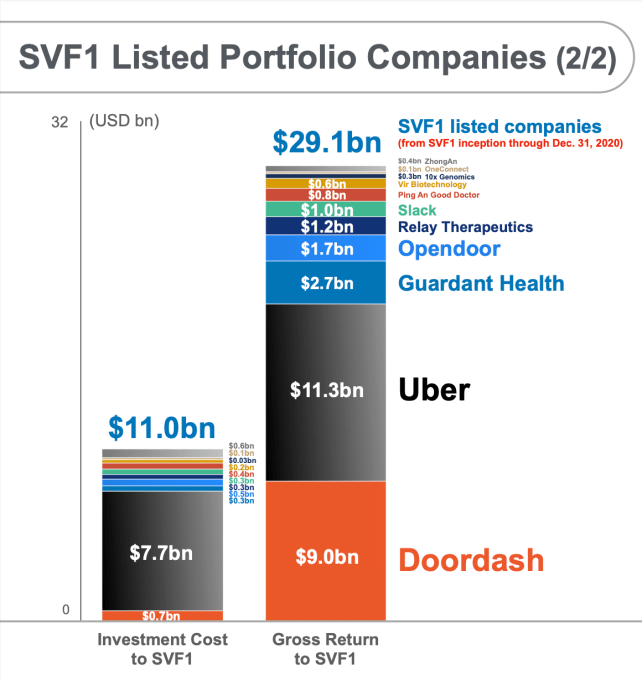

Among those publicly traded companies, which include OneConnect, ZhongAn Insurance, Guardant Health, Relay Therapeutics, Vir Biotechnology, DoorDash, Opendoor and Uber, SoftBank’s total invested capital was $9.7 billion and the current valuation for this set of companies is $24.8 billion, for a multiple of 2.56x. Uber drives that return with a value of $11.3 billion, followed by DoorDash at $9 billion.

The fund has also fully exited 10 investments, including public listings of Slack, Ping An Good Doctor and 10x Genomics. These three investments received total investment of $765 million from SoftBank and they had a final exited value of $2.2 billion, for a multiple of 2.86x.

But then, there are the other seven fully exited investments from Vision Fund I that are not individually listed in its latest earnings report. Those seven investments had total invested capital of $6.3 billion and a realized gross return of $8.5 billion, for a return of 1.35x.

Altogether then, that’s 18 companies out of 92, with an aggregate investment of $16.8 billion and a return of $35.5 billion for a blended multiple of 2.11x. Not included in these figures are partial exits of companies not listed as investments, which total a $1.1 billion investment and a sale price of $2.7 billion.

Let’s head back to our J-curve discussion — how is SoftBank performing? On its own merits without any comparisons to competitors or investment benchmarks, the fund is actually doing quite decent right now. There is something of a J-curve apparently at the Vision Fund stage of investing, given that it has had to exit seven investments for roughly its original invested capital. Nonetheless, its other recent exits have more than compensated for those relatively lukewarm returns, particularly if we take into account the company’s quick turnaround on these investments of roughly 2-3 years.

That performance among its exited companies is certainly better than industry benchmarks. The S&P 500 has gained 61% since mid-2017 when the Vision Fund first started investing, while the more tech-oriented Nasdaq index gained 128% in that same timeframe. Against other late-stage investors, it is a bit harder to judge SoftBank’s performance given the lack of data (most funds are private, while SoftBank reports pretty much everything as a public company).

The big caveat of course is that as a traditional VC fund, these are gross returns and not net of carried interest, the performance incentives for its VC partners. So while the fund so far has had exits that have performed better than the market benchmarks, we don’t have a clear sense of whether that is still true net of fees.

That caveat aside, there are two points of concern here for the Vision Fund’s future performance, one small and one large.

First and as I mentioned earlier, SoftBank noted that its Vision Fund I portfolio companies received 26 follow-on rounds in calendar year 2020. One of those was in TikTok-owner ByteDance, one of those was for DoorDash (which is now public), and two of those rounds were for Zuoyebang.

That number feels surprisingly low. Even if you take out the company’s 10 fully exited investments, that leaves 82 companies vying for growth and presumably more funding or exits. Only 25 companies got follow-on rounds in 2020, or roughly 30%. Given the frenetic pace of venture capital these days, raising a round every two years or even every year is hardly unheard of. So it is a bit surprising to see so few of SoftBank’s companies get follow-on capital.

There’s a larger point though that is harder to judge today. Does SoftBank have an “inverted” J-curve problem? Unlike in early-stage venture capital where the worst startups tend to fail faster than the best startups can succeed, will we actually see the inverse of this pattern in SoftBank’s portfolio, where the best companies are the ones that succeed before the middling companies find some sort of landing spot?

Among SoftBank’s 74 unexited companies, the company invested $66.6 billion and they collectively have a fair market value today of $65.2 billion. That flat valuation is partly due to the lack of follow-on rounds, which is how these numbers typically get driven higher over time as new investors buy in at higher prices. But even if you include the 25 companies that received follow-on investments in 2020, the number remains flat.

The big open question then is how many high-flying winners are waiting to be discovered in SoftBank’s portfolio that haven’t already been so successful that they have exited?

The most caustic light to look at the Vision Fund is simply its overall simple performance. LPs (including SoftBank itself) invested $98.6 billion into the fund in 2017, and today that fund is worth $104.9 billion for a multiple of 1.06x after 3.5 years. For SoftBank to make the Vision Fund a defining fund of its era in terms of performance, it really, really needs to find another dozen or two major winners among its ranks, and soon. 20% of the Vision Fund’s portfolio companies have already exited, and it literally can’t afford an inverted J-curve.

Eighteen months ago, I argued that SoftBank believed that there was a J-curve in venture even at the late stage, and despite disasters like WeWork, the company’s ambition would pan out over the coming years as startups skyrocketed in growth. I still believe that — but the data is starting to trickle in, and it’s getting a bit harder to believe without some serious evidence to the contrary.

Comment