Better.com, a venture-backed digital mortgage lender, announced this morning that it will combine with a SPAC, taking itself public in the second half of 2021. The unicorn’s news comes as the American IPO market is showing signs of fresh life after a modest April.

The Better.com deal comes just over a month after it sold $500 million of its existing shares to SoftBank at a valuation of $6 billion. At the time, TechCrunch described the deal as “further proof” that unsexy industries were able to secure attractive valuations despite their relative lack of pizzazz.

The SoftBank secondary round was hardly Better’s only recent mega-deal; the company raised a $200 million round at a $4 billion valuation in November 2020.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

But the company’s SPAC combination will affix an even higher price than its April round managed, providing the Kleiner-Perkins-backed Better with what it describes as a “post-money equity value of approximately $7.7 billion.”

SoftBank is doubling down on Better, putting together a $1.5 billion private investment in the deal’s public equity, or PIPE, in effect repricing its own preceding investment. For the Japanese telecom and investing powerhouse, making successive bets in companies at ever-higher prices is essentially gospel. So, don’t read too much into the commitment.

As with all SPAC combinations, we have a pile of new data from the company that is going public as part of the transaction. So, this morning, we’re getting our hands dirty.

Our goals are simple: We want to understand whether Better is a weak business, an acceptably strong business or a great business. To get there, we’ll have to start by digging into how the company functions. From there, we’ll discuss its valuation stacked against its trailing metrics. We’ll also take a look at its growth expectations and bring in the recent Compass IPO, a company that focuses on a different part of the mortgage market, to see if we can get a better handle on Better’s new valuation.

Ready? The deck is here. Let’s have some fun.

What’s Better.com?

If you have heard of Better but really had no idea what it does before this morning, welcome to the club. Mortgage tech is like pre-kindergarten applications — it applies to a very specific set of folks at a very particular moment. And they care a lot about it. But the rest of us aren’t really aware of its existence.

For the rest of us: Better is an online mortgage lender that aims to offer lower-than-standard fees to consumers looking for credit to help them buy a house. As the company explains on its website, it generates income by selling loans that it helps generate. Per its investor deck, Better also derives top line from selling insurance products.

Better, then, earns revenue by selling consumer debt and charging them for home and title insurance. Simple enough.

Powering Better is technology that does a few key things for its business. The unicorn claims that its “competitive advantage” comes from its tech products reducing consumer loan prices by surfacing and matching them to lots of different “products,” rapidly.

And Better claims that its tech helps it upsell customers with insurance products, helping to diversify its revenue streams over time. More on that in a moment.

The company has also built something called “Tinman,” which it told investors is “the world’s first supervised learning network for consumer finance.” Essentially, Tinman is a software method of executing tasks that allow Better to reduce human inputs in its process, cutting down on errors and saving itself money on a per-transaction basis.

Savings that it can pass on if it chooses, allowing it to offer lower-priced debt and thus attract customers while still making points on the total deal by later selling those loans. As you can imagine, Better has a flywheel graphic in its deck, arguing that more data helps it improve its technology, which helps it offer lower-cost loans to consumers, which, in turn, drives more folks to its service and thus more data.

It’s a standard argument.

Finally, in product terms, Better has plans for more financial add-ons to its core mortgage business. These include other types of home loans (“home services” and home improvement-focused debt) in the second half of this year; a “financial network” offering other forms of credit (“personal, auto, student [and] credit cards”); and more insurance products in the second half of 2022. Keep in mind these coming projects when we discuss Better’s projections.

How does Better convert all of that into historical revenues? A great question. Let’s find out.

Is it a good business?

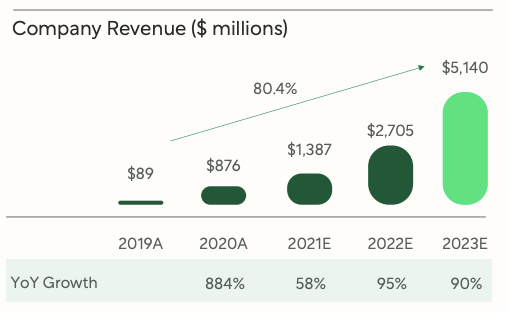

As with many SPAC-combination decks, we have to do a bit of hunting to get the full picture of Better’s business. To start, here are its historical revenue results, along with its projections:

Better benefited from a hot mortgage market in the United States during 2020, which could help explain why the company expects huge revenue growth deceleration this year.

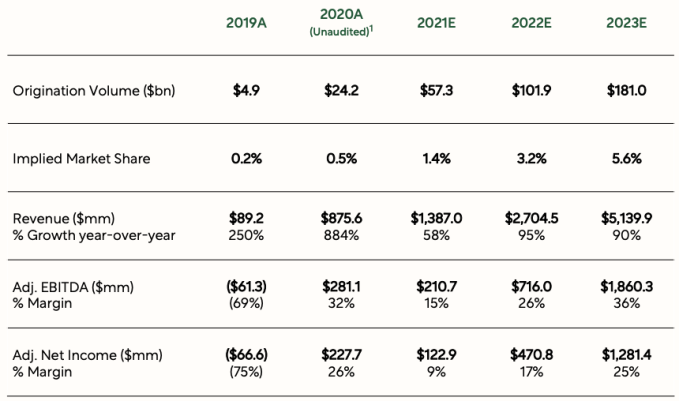

Driving its 2020 revenue growth was a near quintupling of its mortgage origination volume, from $5 billion in 2019 to $24 billion in 2020. Over the same time, Better saw its written insurance coverage grow from $1.2 billion to $9.1 billion.

Here’s how its historical and projected growth look in numerical form:

What sticks out immediately from that mix of numbers is the fact that, at least in adjusted terms, Better roared into the black in 2020. It also doesn’t expect to succumb to adjusted deficits in the future, at least through 2023. That’s pretty neat; not losing money is good. (The company also details its GAAP net income results and projections, which are still positive in 2020 and all future periods.)

However, that its growth rate, adjusted EBITDA margin and gross adjusted EBITDA — along with its adjusted net margin and adjusted net income — are expected to fall this year is less good.

Quickly summing: It’s clear that Better had a great 2020, growing sharply and swinging to profitability. It’s what happens next that will be the public investor’s call to make. If you believe Better’s growth story, it could be an interesting bet. If you don’t, then perhaps its new price won’t prove attractive to your portfolio.

Speaking of which, in valuation terms, Better is targeting a trailing revenue multiple of under 10x. If that feels low, understand that fundamentally Better is not a software company as we generally consider them; it doesn’t merely sell cloud-delivered bits to customers. Instead, Better is selling loans that come from a cyclical market. Recurring revenue this is not.

As with all SPAC decks, Better has a slide showing off how cheap it is at its combination price. Per its own hype, Better considers its enterprise value at around 2.5x its 2022 estimated revenues. Which is better than what it calculates the same ratio from the already-public Rocket Mortgages to be.

However, scroll back up to our first chart to recall precisely how aggressive Better’s 2022 revenue estimates are compared to what it expects for 2021. Those are part of its “we’re actually very cheap” argument.

Can we compare Better to Compass? Not really. Better is a consumer company, while Compass works with agents. Same market, different businesses.

Don’t think that we’re being lazy; they really are different. Compass, per Better’s own telling, has an average revenue per transaction of more than 10x its own. But Compass, again in Better’s telling, has far higher marketing costs and fulfillment expenses. I would compare the two companies’ gross profit results, but because Better doesn’t share its own, we cannot.

We’ll have to wait to see how public investors value the company once it begins to float later this year. But as far as unicorn SPAC deals go, there have been worse ones that we’ve viewed. Any company that posts positive net income along with rapid growth is too material to dismiss.

Comment