Robotic process automation platform UiPath added its name to the list of companies pursuing public-market offerings this morning with the release of its S-1 filing. The document details a quickly growing software company with sharply improving profitability performance. The company also flipped from cash burn to cash generation on both an operating and free-cash-flow basis in its most recent fiscal year.

Companies that produce robotic process automation (RPA) software help enterprises reduce labor costs and errors. Instead of having a human perform repetitive tasks like data entry, processing credit card applications and scheduling cable installation appointments, RPA tools employ software bots instead.

The phrase that matters most when digesting this IPO filing is operating leverage, what Investopedia defines as “the degree to which a firm or project can increase operating income by increasing revenue.” In simpler terms, we can think of operating leverage as how quickly a company can boost profitability by growing its revenue.

The greater a company’s operating leverage, the more profitable it becomes as it grows its top line; in contrast, companies that see their profitability profile erode as their revenue scales have poor operating leverage.

Among early-stage companies in growth mode, losing money is not a sin — after all, startups raise capital to deploy it, often making their near-term financial results a bit wonky from a traditionalist perspective. But for later-stage companies, the ability to demonstrate operating leverage is a great way to indicate future profitability, or at least future cash-flow generation.

So, the UiPath S-1 filing is at once an interesting picture of a company growing quickly while reducing its deficits rapidly, and a look at what a high-growth company can do to show investors that it will, at some point, generate unadjusted net income.

There are caveats, however: UiPath had some particular cost declines in its most recent fiscal year that make its profitability picture a bit rosier than it otherwise might have proven, thanks to the COVID-19 pandemic. This morning, now that we’ve looked at the big numbers, let’s dig in a bit deeper and learn whether UiPath is as strong in operating leverage terms as a casual observer of its filing might guess.

Then we’ll dig into four other things that stuck out from its IPO filing. Into the data!

Operating leverage, cost control and COVID-19

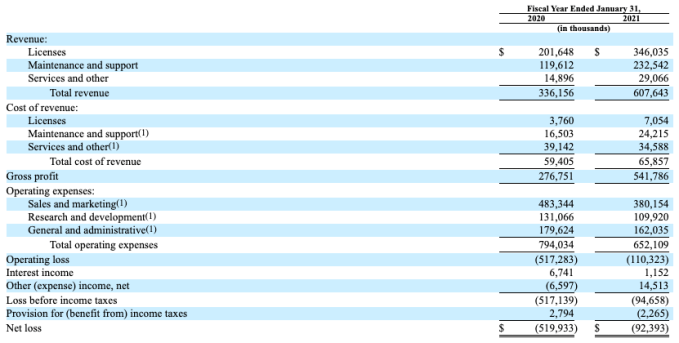

To avoid forcing you to flip between the filing and this piece, here’s UiPath’s income statement for its fiscal years that roughly correlate to calendar 2019 and calendar 2020:

From top-down, it’s clear UiPath is growing rapidly. We can see that its gross profit grew more quickly than its overall revenue in its most recent 12-month period. As you can imagine, that combination led to rising gross margins at the company, from 82% in its fiscal year ending January 31, 2020, to 89% in its next fiscal year.

That’s super good, frankly; given that UiPath has a number of business lines, including a services effort that doubled in size during its most recent 12 months of operations, you might expect its blended gross margins to fade. They did not.

But it’s the following section, the company’s cost profile, that leads us to our first real takeaway from the UiPath S-1:

UiPath’s operating leverage looks good, even if COVID helped

Every operating expense category at the company fell from the preceding fiscal year to its most recent. That’s an impressive result, and one that is key when it comes to understanding where UiPath’s recent operating leverage came from. But how the declines came to be is just as important to understand.

The largest decline in operating costs came from sales and marketing spend, which fell by around $100 million during its last fiscal year. Here’s how the company explained the drop, with emphasis by TechCrunch:

In addition to travel and entertainment, trade show expenses also decreased in fiscal year 2021, related to the COVID-19 pandemic. We currently expect trade show expenses to resume in the second half of fiscal year 2022, although the timing is uncertain and related to the trend of the pandemic. We plan to increase our investment in sales and marketing over the foreseeable future as we continue to hire additional personnel and invest in sales and marketing programs. However, we expect that our sales and marketing expense will decrease as a percentage of our total revenue over the long term[.]

So, COVID cut travel, entertainment and trade show costs. That makes sense.

But investors out there worried that the company will return to its prior sales-and-marketing spend as a percentage of revenue don’t need to worry much. UiPath spent 144% of its revenue on sales and marketing in its fiscal year ending January 31, 2020. That fell to 62% in its most recent fiscal year. The further that that figure declines, the greater room there is for UiPath to generate GAAP net income.

Adding to our numerical soup, R&D as a percent of revenue fell to 18% of revenue in UiPath’s most recent fiscal year from a year-ago 39%, while G&A costs dropped from 53% to 27% over the same period. Compared to sharp revenue and gross profit expansion, it’s an attractive set of numbers. Directionally, at least.

We should always prefer GAAP net income to merely improving GAAP deficits.

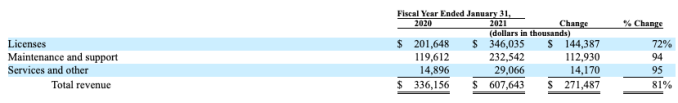

UiPath’s slowest-growing revenue category is software

Moving along, UiPath provided the world with a useful table that breaks down revenue growth across its three categories:

Do note that in gross dollar terms, UiPath’s software incomes (“Licenses”) did grow the most, with a +$144.4 million result in its most recent fiscal year. But in percentage terms, maintenance and services did even better. This is worth flagging in case folks get UiPath’s aggregate revenue picture twisted. Yes, it has large and growing software incomes, but its other efforts are also pretty damn big.

Indeed, maintenance and support revenues grew from 36% of its revenues for the fiscal year ending January 31, 2020, to 38% of its most recent fiscal year. Bad? No. Worth noting? Yes.

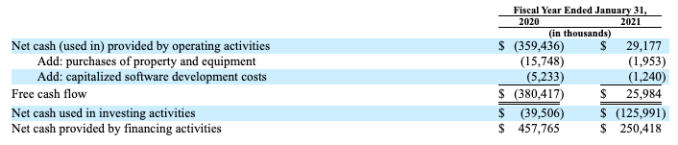

UiPath now self-funds

Given the epic fundraising history that UiPath has recorded, you might imagine that the company is a cash pyre, torching million-dollar bills by the fistful. And it was! Until its most recent year.

Here’s the data:

In case you don’t read these too often, swapping from operating cash burn of $359.4 million to operating cash generation of $29.2 million is insanely good. Yes, we know that the company cut expenses while growing, but hot damn that’s an impressive turnabout.

Even better, when we add in other cash costs, namely capital expenses and the like, UiPath went from consuming a total of $380.4 million in cash during its fiscal year ending January 31, 2020, to generating $26 million in net cash in the next.

For investors who, in theory, value a company on the basis of the present value of its future cash flows, this must be exciting.

UiPath is expensive

Maybe not in a bad way, but wrapping its recent fiscal year with $607.6 million in revenue and a valuation of around $35 billion gives the company a trailing 57x revenue multiple. When we get our hands on the company’s quarterly results in a coming S-1/A filing, we’ll be able to calculate its end of fiscal year run rate and provide a more accurate multiple for the company.

That will bring it down some. But it appears that UiPath is betting on investors not only anticipating strong future growth, but continued operating leverage in coming quarters leading it to not boost its GAAP net losses, or lose the plot in terms of cash generation. As the company will want to best its final private valuation, the road up ahead is steep.

RPA is big business

We knew this to some degree, but I was surprised at some of the statistics that UiPath broke out. Here’s a taste:

As of January 31, 2020, we had 6,009 customers, including 80% of the Fortune 10 and 61% of the Fortune Global 500. As of January 31, 2021, we had 7,968 customers, including 80% of the Fortune 10 and 63% of the Fortune Global 500.

Sure, every company likes to brag up top in their S-1 filings — which is why you should always skip to the numbers first, and then go back and read the PR hype — but those are actually pretty damn good numbers. Toss in the company’s net retention rate and things get interesting.

Here are those numbers:

The power of our land-and-expand strategy is evidenced by our dollar-based net retention rate, which was 153% and 145% as of January 31, 2020 and 2021, respectively.

Mix a strong net-retention rate to a customer base of giants and you can trace long-term growth with even the dullest of pencils.

From this, we can infer that all RPA startups and unicorns are selling into a simply huge space. That’s bullish for more than just UiPath.

Address cybersecurity challenges before rolling out robotic process automation

Comment