I was going to wait until after Square reported its Q1 results today to dig into the world of fintech earnings and what they might mean for startups, but something got stuck in my craw that matters more than what Jack’s team may have up its sleeve: How much space is being left in fintech when the major players are growing rapidly in categories where startups are doing their best to make a dent?

This morning, we’ll examine the buy now, pay later (BNPL) market, mostly through the lens of PayPal’s first-quarter results.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

PayPal’s BNPL results are impressive — and not just to your humble servant, but to other fintech watchers as well — which begs the question: Can the platform effect that the PayPals of the world bring to bear suffocate a growing slice of the startup market?

There are obvious issues with the thought. The first being that BNPL-focused Affirm recently went public. And Affirm was, until very recently, a startup and later a unicorn. And then there’s BNPL player AfterPay, which went public a few years back, not to mention Klarna, which could go public sometime soon.

There are obvious issues with the thought. The first being that BNPL-focused Affirm recently went public. And Affirm was, until very recently, a startup and later a unicorn. And then there’s BNPL player AfterPay, which went public a few years back, not to mention Klarna, which could go public sometime soon.

But what we’re watching is PayPal chase a handful of unicorns-and-later BNPL companies. What about the actual startups in the market? Can they hack it? Let’s dig into PayPal’s results, take a peek at what AfterPay’s own can tell us, and then we’ll noodle on the startup question. We’ll come back to all of this after Affirm reports in a few day’s time.

Platforms versus startups

The “kill-zone” concept — that startups should not get too close to what big tech companies do — has never sat well with me. Mostly because it’s not true that small companies cannot take on big ones. And because big companies have a really great history of crappifying their products into vulnerability.

A great example of the first count is Zoom, which took on a host of enterprise-ready, platform-supported video chat services and crushed them by simply being not awful. This brings us to our second point: As big tech companies need to keep finding incremental revenue adds from their existing products, they make them worse to find a marginal top line. The biggest tech shops often trade near-term economic growth for long-term market ownership.

Google is my favorite example of this, turning its search product into something that resembles a digital flea market, littered with cruft and ever-more advertisements to keep its growth pumping. News that Apple is looking to juice its ad revenues by expanding the ad slots in the App Store reminds me of the same issue.

So please do not think that I am overly concerned that big tech companies are impenetrable. They aren’t. Sometimes.

But in the case of PayPal’s BNPL efforts, things feel a bit different. First, the core PayPal product lineup is growing thanks to secular tailwinds — among other reasons — which means that the company doesn’t have to burden it with useless clutter simply to juice it in the near term. And the BNPL market is only so hard to pull off.

I don’t mean that in a cruel way. But given the number of companies that have built market-ready BNPL products, the ability to quickly grade credit risk and offer an installment loan is not impossible to build. Many, many companies have pulled it off around the world.

So, if the product is modestly fungible, wouldn’t platform advantages carry lots of weight? Or more simply, given that BNPL services seem to be pretty much the same all around, wouldn’t PayPal’s ability to leverage its current user base and product lines help it do very, very well in the BNPL market? To the detriment of startups?

I reckon so.

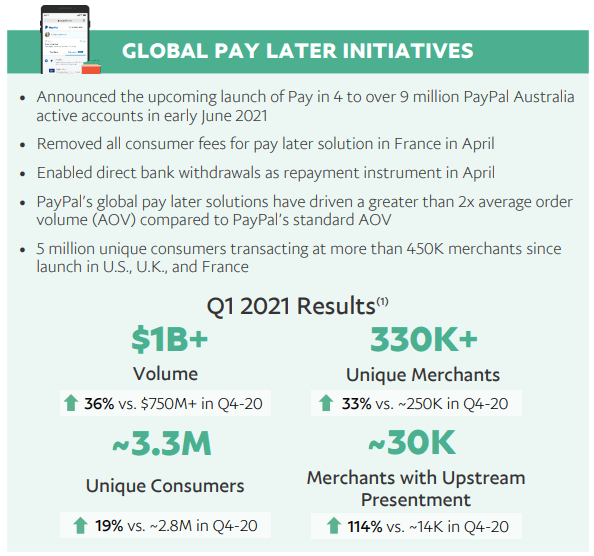

Here’s what PayPal reported in its Q1 earnings:

Sorry for the 1990s-era infographic; it’s what they published.

Bullet point one makes our case about leveraging PayPal’s user base. Bullet point two argues that PayPal’s incumbent status allows it to subsidize some products for segment growth. Bullet point three underscores how big PayPal is, and the scale of resources it can bring to bear on a market. Bullet point five is impressive for a product that launched in September 2020.

The rest of the Q1 results are just that, data points. You can grade them as much as you’d like. Afterpay’s results are perhaps even more impressive, and globally focused. Here’s one taste:

March 2021 exceeded December 2020 and delivered the second highest monthly underlying sales ever recorded, with the U.S. becoming the first region to record more than $1 billion in underlying sales in a single month.

Afterpay is still larger than PayPal’s own BNPL efforts by quite a lot. But PayPal is coming.

Mix in Klarna and Affirm, and we have three leading BNPL-focused companies being chased by a global fintech behemoth. That’s quite a lot of competition that will result in feature wars and pricing challenges. Consumers should do pretty well.

But what about the smaller companies that want to snag their own piece? Tillit is building BNPL for companies; Square will want that market, right? Plentina just raised funds to build BNPL for the Philippines. PayPal already operates there. How long until its BNPL solution arrives? Just one more for flavor: Nelo is building BNPL tech in Mexico, where both PayPal and Square operate.

As the major fintech companies, regardless if they had a business-first birth (Square) or consumer (PayPal), expand their platforms to encompass more and more fintech product categories, we’re seeing something akin to the platform-effect that has, at times, made the largest tech companies hard to disrupt. Not impossible, but hard. The question becomes if there’s a Zoom in the BNPL space that is still small, hungry, and with a brilliant idea that will shake up its core market. If not, we could see the behemoths simply accrete new product categories to themselves, crushing the upstarts targeting a single market, or user niche. Like in the BNPL space.

I wrote about the platform effect back in 2014. By now it’s obvious logic. But we should apply it to more than just the Apples and Microsofts of the world. More when we get Square and Affirm earnings.

Comment