While waiting for full first-quarter venture capital results for fintech startups to drop, we knew that they were going to be outsized. The Exchange previously explored the pace at which huge venture rounds were invested into the startup niche, noting that by mid-March the fintech market had already recorded a record number of $100 million rounds.

But the largest venture capital rounds are only part of the fintech investing picture, so we were looking forward to getting a deeper look into what happened in the critical startup sector more generally. We’ve now got the data, so today we’re digging in with both hands.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Per a CB Insights compilation of Q1 2021 fintech venture capital data from around the world, the first three months of the year were the most valuable period for fintech investing, ever. Somewhat shockingly, the first quarter beat the infamous second quarter of 2018, when Ant Group raised a $14 billion round, so skewing the category’s longitudinal data that some analyst groups simply discount it for analytical purposes.

It wasn’t necessary this time: The 614 tracked fintech deals in Q1 were worth a total of $22.8 billion, per the report, enough to set an all-time high, Ant Group be damned. Per CB Insights, the quarter’s fintech VC deal volume rose a modest 15% compared to the year-ago quarter, while VC dollar volume in the sector shot 98% higher over the same interval.

The boom in funding was a global affair, as we’ll get into shortly. We’re also going to chat subsectors in the fintech world, parsing where there’s the most venture activity to track, and, critically, where VCs are pushing — or pulling back — their attention and capital.

The boom in funding was a global affair, as we’ll get into shortly. We’re also going to chat subsectors in the fintech world, parsing where there’s the most venture activity to track, and, critically, where VCs are pushing — or pulling back — their attention and capital.

So, where did the fintech venture capital market push the most money in the first quarter, and why? We’ll be chatting data as we go, but The Exchange also enlisted VCs from three continents who have made fintech investments to help provide context: We’ll hear from Jesse Wedler, a partner at CapitalG based in North America; Kola Aina, a general partner at Ventures Platform based in Africa; and Shiyan Koh, a general partner at Hustle Fund based in Asia.

Let’s talk a few key fintech numbers, and then rip into venture results by geography and focus.

Huge checks, myriad exits

While we’re looking beyond the largest checks today to get a more holistic perspective on the state of the fintech venture capital world, we cannot discount them. So, briefly, what matters from the mega-round space, or the funding category of rounds worth nine figures and more? Some 57 were raised by fintech startups around the world in the first quarter, or about 4.5 per week. That number was 30 in Q4 2020, and just 21 in Q1 2020.

The first quarter’s 57 mega-deals were worth a huge 69% of total venture capital in the fintech space during the quarter. Don’t be shocked by that figure; a single mega-round can add up to the value of 50 seed deals pretty easily.

The huge results should also not be a complete surprise, CapitalG’s Wedler told TechCrunch in an email, as “the reality is that fintech has been a hot category for years.” What could be driving the recent acceleration in capital disbursement into financial technology startups? Wedler mused it’s a combination of “the ubiquity of smartphones and the modern internet, the development of modern cloud technology, and advancements in APIs and modular services.”

Don’t expect things to cool, either. The growth-stage investor told The Exchange that “fintech funding seems to occur in waves as innovations open up new business models or customer segments,” adding that the market is “entering a new phase in which we’re seeing significant innovations in legacy infrastructure.” That should take a while, we reckon, and a few dozen billion dollars in private capital to sort out.

Investment totals weren’t the only record-setters in the quarter. Exit data provided by the same report indicates that Q1 2021 set what were at least local maxima in terms of exit volume, both in aggregate terms and when we only count IPOs. There were 67 fintech exits in the quarter, CB Insights data reports, and 11 sector IPOs.

At this point, we have to mention the private equity-cum-venture capital group Tiger Global, which is currently throwing enough capital into the private markets to make us recall the heyday of SoftBank’s first Vision Fund.

Tiger is both symptom and cause in the fintech data we’re discussing today. The group’s participation in a rising number of deals — from just two fintech rounds in Q1 2020 to 16 in Q1 2021 — matters because it can write huge checks. Indeed, 14 of Tiger’s 16 deals in the quarter were mega-rounds.

Driving those rapid-fire bets? We reckon it’s the late-stage exit market. If you are confident in your ability to get a solid exit for a possible portfolio company, you are taking on less risk by funding it. And so you can do so more quickly, at a higher dollar amount.

All told, the fintech venture capital market was so hot at the start of 2021 that in dollar terms it already raised more than half of its 2020 total during just the first three months of the year. Perhaps even more humorously, Q1 2021’s global fintech haul was roughly equivalent to the full-year totals set in 2016 and 2017.

But if there’s one thing we’ve learned about venture capital, it’s that it isn’t always driven by equity and balance. So, where is the money going? Let’s find out.

Geographies

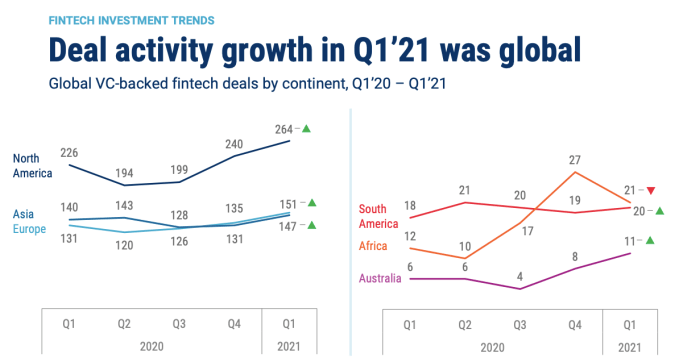

Of all continents where there was fintech startup activity, only Africa saw a sequential decline in quarter-on-quarter deal volume. Though African fintech deals did slip from 27 in Q4 2020 to 21 in Q1 2021, that most recent figure was a near-doubling of what the sector managed in the first quarter of 2020.

So no continent was a slouch, really, in the quarter. The disparity in results, however, is blunt. North America, home to the robust U.S. venture capital scene, saw 264 fintech rounds in the first quarter of 2021. Asia and Europe managed around 300 as a pair, effectively tying in the period at around 150 apiece.

And then South America, Africa and Australia managed around 50 as a trio:

But there’s cause for some optimism regarding discrepant results. According to Nigeria-based Kola Aina from Ventures Platform, his firm has “seen a marked increase in interest from local and international investors” regarding African fintech startups.

Driving that boost, in his estimation, is “the COVID-induced uptick in digital adoption (with fintech being a huge enabler of various digital use cases) as well as confidence built from increased liquidity events (Paystack) and valuation increases like Flutterwave.”

Aina said that the “competition and velocity of capital” for African fintech startups are up. “Founders,” he concluded, will be “ultimately better for it.”

But what about Asia? If North America has been on a multiquarter hot streak, and Africa a somewhat uneven boom in fintech investment, what to make of the critical startup continent? Hustle Fund’s Shiyan Koh told The Exchange that in the Southeast Asian market, at least, “investor appetite for fintech continues to be high particularly as the pipes are still being built in a sense from an open banking perspective.”

What makes the region so attractive for venture investment? Koh said that a combination of a “low percentage of banked population and younger consumers” is helping drive investor interest. She cited a few deals to back up her view, namely the $65 million Series A raised by Ajaib that TechCrunch covered here, and the Endowus deal that TechCrunch mentioned here.

But enough about location. Let’s talk fintech startups grouped by focus.

Sector notes

CB Insights breaks the fintech world into eight distinct categories. Before we dive into several, a note that the data firm counts insurtech as part of fintech. Given that insurtech can be easily divvied up into subcategories itself, we should keep in mind just how broad the fintech market truly is. But let’s not let that slow us down. Let’s see where the money went in the first quarter among fintech’s subniches.

Payments were undoubtedly one of the hottest fintech categories in Q1 2021, and the numbers are impressive, with a 188% increase in deal volume compared to Q4 2020. Sure, there were mega-rounds, but deal count is also up by 50%, going both to B2B and B2C companies. However, in Southeast Asia, B2Cs see much more competition from VCs, Koh told us. The explanation is simple: “Here, consumers lead the way on tech adoption,” she noted.

Digital lending is another vertical that’s trending up — not as much as payments, but showing a clear rebound after a drop in Q4 2020. It also has a lot of potential in emerging markets, for instance, with marketplaces improving credit access from Brazil to India, both for individuals and for businesses.

Meanwhile, crypto is going more mainstream and global. On the first part, Coinbase’s direct listing served as “a strong testament to crypto as an asset class,” Passion Capital partner Eileen Burbidge told us earlier this month. As Wedler noted, Coinbase answered the needs of “consumers [wanting] a simple way to buy and sell coins.” However, in emerging markets, decentralized finance is also an answer to local challenges, which explains why both Aina and Koh are following this trend closely. Aina pointed out DeFi’s potential for “financially underserved markets,” while Koh noted its attractiveness “in countries with more volatile political situations” and highlighted Singapore’s positioning as a crypto hub.

Turning to the wealth management sector, its first quarter was a tale of late-stage mega-rounds. With its investment results counting $5.4 billion worth of global deals, fintech venture dollar volume shot 560% higher compared to what it managed in Q4 2020. But just eight deals were worth 83% of the funding total, so the category is a good example of the larger trend we’ve seen in the venture world for some time.

And then, finally, insurtech. Compared to the standout results from other fintech categories, insurtech’s results were tame. CB Insights reports that “deal activity fell by 5% in the quarter while funding increased 12%.” That’s a bit blah.

What’s going on? Wedler wrote that while he’s bullish on Next Insurance, a Capital G-backed company, “aside from those few standout companies like Next, innovation and growth in the space does feel less accelerated on average than what we’re seeing in some of the other fintech categories.”

Why is that the case? Per the investor, much of the difference “can be attributed to the fact that underwriting risk — the core function of insurance — is incredibly challenging.” But it’s not all bad news. Wedler noted interest in neoinsurance providers targeting “historically challenging populations for the traditional carriers to serve” and startups that are helping insurance incumbents go digital.

And there could be more opportunity for insurtech in markets where there has been historically less capital available. Aina, for example, cited insurtech as an area of fintech that he’s excited about from an African startup perspective.

Conclusion

It’s very likely that private global fintech investment is on pace to set all-time records this year, which means that our regular focus on exits in the space this year will matter. On the heels of the successful Coinbase direct listing, the Robinhood IPO beckons. And after some uneven insurtech public debuts, there is at least the Hippo SPAC combination ahead of us. Each impending fintech exit via the public markets will help investors, private and public alike, value the other companies in the sector.

Let’s see if the venture enthusiasm that is so vividly obvious from the first quarter’s results can translate into continued, strong fintech exit results.

Comment