Andrés Dancausa

There’s a disconnect between reality and the added value investors are promising entrepreneurs. Three in five founders who were promised added value by their VCs felt duped by their negative experience.

While this feels like a letdown by investors, in reality, it shows fault on both sides. Due diligence isn’t a one-way street, and founders must do their homework to make sure they’re not jumping into deals with VCs who are only paying lip service to their value-add.

Entrepreneurs are increasingly demanding more than a blank check: They want mentorship, product understanding and emotional support, as well as industry connections and expertise. If VCs can’t bring that value, founders now have plenty of other funding routes to choose from, like crowdfunding, angel syndicates, tokenization and SPACs.

To stay competitive, VCs have to at least advertise that they have more than deep pockets. But what if it stops there? Founders have to know exactly what they’re looking for in a VC, which means looking past the front page and vetting their investors.

The ideal investor for modern startups is an operator VC — someone who was a founder or operator at a company before becoming an investor. But even then, ticking boxes isn’t enough to ensure the investor won’t come with their own challenges, like being too hands-on or less strategically minded.

Looking into an investor’s past, reputation and connections isn’t about finding the perfect VC, it’s about knowing what shaking certain hands will entail — and either being ready for it or walking away. There is no single solution to this issue, but here are my recommendations to founders seeking a successful investor relationship in 2021.

Have a guiding framework

No founder-investor relationship can survive misalignment. Because you share responsibility on so many processes, both parties have to be on the same page. So before you even start fundraising, nail down the expectations you need your future investor to meet. What do you need the most? What does your dream investor look like?

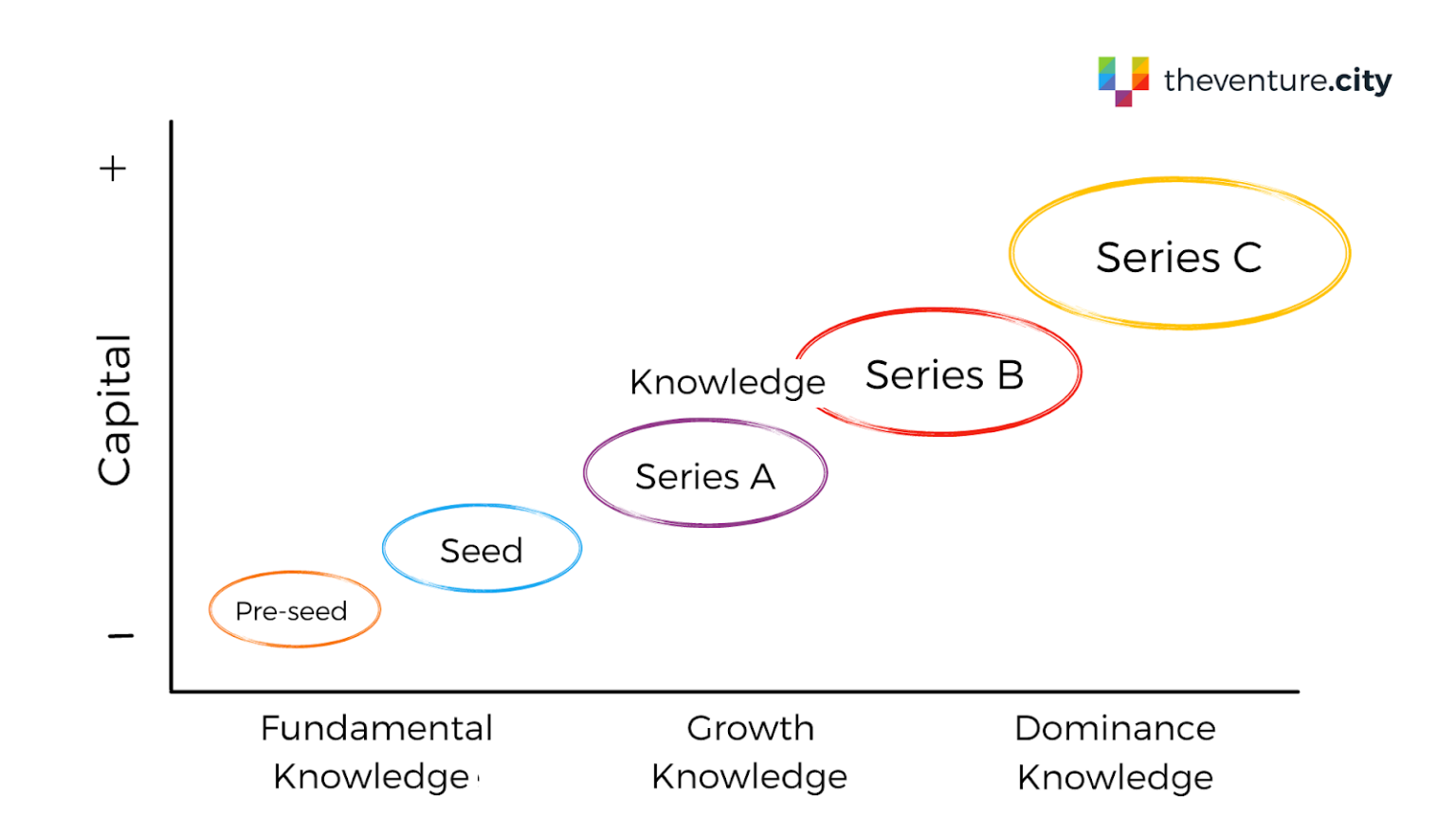

Another way to think about it would be how much operator value you need, versus how much capital you’re looking for. When considering value, think about how hands-on you want them to be, their industry experience and their connections. For example, a pre-seed startup should focus on finding investors that will provide operational support, not just capital. In fact, that is where most of the value will come from.

A simple tool to visualize this is a matrix where you plot both the value and the capital you want from your investor at different stages of your fundraising journey. This is how we envision the ideal balance between operational value and capital that an investor can offer, but this completely depends on the founder and the company.

Generally speaking, the earlier on you are in the company lifecycle, the more you’ll need expertise rather than capital. But as you progress, the curve normally changes, and you’ll require less support but more capital to facilitate things like international expansion. Of course, this could also be the moment you realize you don’t need VC capital at all. If the traits you need can’t realistically be found in a VC, you have alternative options to fund your business or continue solo.

Understanding how fundraising terms can affect early-stage startups

Set your red lines

In an age when we’re more aware than ever of mental health, burnout and communication issues, the way founders and investors interact has to be done in a way that both agree on. Some investors go beyond their duties and become too involved in the daily workings of a startup. Giving value also means knowing when to step back. As a founder, you want to ensure that there are boundaries in place so your time isn’t being eaten up by meetings and email chains with the VC, or you’ll struggle to see traction.

Due diligence here really involves talking to your potential investors’ network, namely current and former portfolio founders and firm partners. Ask them questions: How involved was the investor in running the company? How frequent were the check-in meetings?

Another important red line you need to set is how much equity or powers you grant investors. Do research into the trajectory of their previous companies. Does this particular investor always get a seat on the board of their portfolio companies? What is their end goal: Do they steer their companies toward quick exits, or are they in for the long run?

Vetting the investor isn’t enough here; you have to determine if the relationship makes sense in the current landscape. Perhaps if you’re already seeing revenue, you can afford to give away more equity. If your market is experiencing a lull, you need an investor who’s patient enough to see you through the next few years.

Look for good communication and trust

Every founder and investor hopes that their relationship will be smooth sailing. However, as with any business, there can and will be challenging times. Whether there’s an unexpected departure at the company, a competitor suddenly overtakes you, revenue drops or the market fit simply isn’t right, you still have to work together. If the idea of dealing with a seriously difficult time with a potential investor scares you, that’s a red flag.

Investors need to show empathy during tough times, and this is quite difficult to predict. Take a close look at the investor’s career, and take note: Previous experience with companies that have done badly can be just as valuable as their success stories. Try and understand how they reacted to the problem and how closely they worked with the founder at the time. Furthermore, if they have experience going through rough patches or failing entirely, they may be more sympathetic to your emotional challenges, as well as pitfalls you should avoid.

Also, look for signs that the investor trusts their founders. Has the investor backed the businesses in their portfolio multiple times? Or have the businesses gone on to raise funds from other investors within their network? Both are signs of a positive relationship.

Direct feedback from other founders is also crucial here. It’s the best way of determining whether a founder can be comfortable looking to their VC for support.

Be suspicious if they haven’t done their due diligence on you

Investors who don’t do their due diligence are a bad omen for both parties. Founders, if a potential investor hasn’t dug into you and your startup before offering you a deal, you should cut loose.

If the investor isn’t truly interested in the inner workings of your team and founders, then they likely can’t identify your main strengths and setbacks — or take you to the next level. Similarly, if the VC doesn’t do a full technical review of your tool, how can they help you scale it into a much bigger product?

Some investors are happy to spread their money around because they know they can take a hit if some of them fail — as long as others thrive. That’s not the kind of investor who will have an intimate relationship with all their companies and give you the close support you need to understand what lies before you. This first stage will paint a picture of what your future relationship will be like.

So when looking into potential VCs, track other companies they’ve been involved in and try to contact the founders to ask about their experience working with the investor. Check their startup failure rate and whether founders in their portfolio have been involved in media scandals or have a shady trajectory.

Make the investor pitch to you

Last but not least, try to make the investor pitch themselves, their mission and their vision for your company to you. Bad investors only want answers to their own questions, and they don’t care about your doubts or queries. The mere fact that an investor is willing to pitch to you means you’ll probably be communicating openly and on the same level in your future relationship.

This isn’t just about getting a sense of whether the investor has the values and mentality you’re seeking. It’s crucial to understand how the investor presents themselves, and therefore how they will sell your company to other potential partners.

The power balance has shifted in the investment world. The “Shark Tank” mentality of VCs selecting which products to trash and which to lead to success is no longer the case. We’ve reached a point where founders with viable products are often oversubscribed with offers and able to choose their investors.

That means VCs have to step up — and founders have to shore up their filtering process to find the best fit.

Comment