At this point, if you aren’t going public via a direct listing, traditional IPO or SPAC, are you even a growthy business?

Every CEO I talk to at a startup that’s doing more than Series B-level revenue tells me that SPACs are circling, hungry for a deal so they won’t have to return collected capital to their original backers. There’s an old joke: If all you have is a hammer, everything looks like a nail. Except this time, if all you have is a blank-check company, every erstwhile startup looks like a public company in waiting.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Enter WeWork. Yes, the company famous for torching a mountain of cash that would rival the Ever Given in sheer bulk is going public via a SPAC. This morning we’re going through its investor presentation, asking ourselves questions like, “Is this as nasty a business as it was a few years ago?” and “Why, oh God, why do we have to talk about WeWork again?”

But that’s not all. Axios, the rare media startup that appeared positioned for a good run, could merge with The Athletic and go public via a SPAC. At least per WSJ reporting.

It’s possible to summon arguments in favor of the deal. The Athletic has what Axios lacks and vice versa, so perhaps combining the former’s subscription base with the newsletter-and-ads prowess of the latter would make for an attractive company. Maybe.

It’s possible to summon arguments in favor of the deal. The Athletic has what Axios lacks and vice versa, so perhaps combining the former’s subscription base with the newsletter-and-ads prowess of the latter would make for an attractive company. Maybe.

But the main gist of this morning is that private investors in companies of all stripes are trying to get their money out while it’s still possible. That’s why we’ve seen eleventy-seven lidar and electric-vehicle SPACs. These aren’t usually companies that are ready to go public; they’re companies with investors that are ready to cash out.

The same momentum applies to the WeWork deal and the possible Axios combo-and-SPAC, I reckon.

Today, greed isn’t really good, to quote an old movie. It’s been good for so long among the tech-and-money class that quoting a film about a corrupt financier is too boring to warrant even warmed-over ennui. Instead, greed is god, and we’re all watching its ascension.

Now let’s digest the latest sacrifices.

WeWork

First, is WeWork a recovered company that has shown an ability to grow while losing less money? Not really.

Second, is WeWork still flexing its future as a hybrid space-and-software-and-services business? Yep.

Third, does its accounting setup as visible in its SPAC investor presentation contain more complexity than feels warranted, making it hard to kinda grok just what is going on at the former venture darling? Of course!

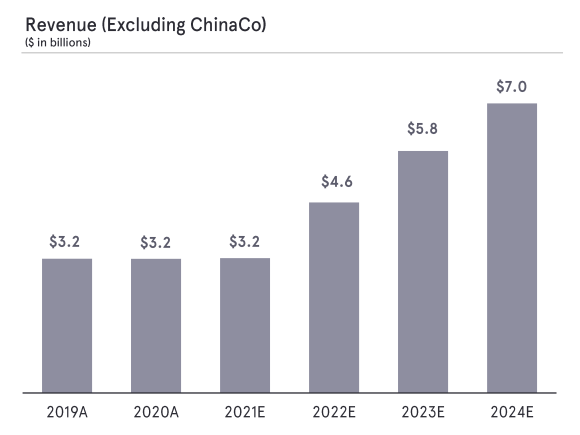

Starting from the bottom of the deck, where the real numbers are (page 46, if you’re reading along), we quickly learn that WeWork had flat revenues in 2020, compared to 2019. In 2020, WeWork generated $3.21 billion in top line (excluding its Chinese operations), losing $3.22 billion over the same period. That’s a net margin of -100%, mind. In 2019, the numbers were similarly dismal, with WeWork posting $3.23 billion in top line against a net loss of $3.50 billion. That’s a net margin of -108%.

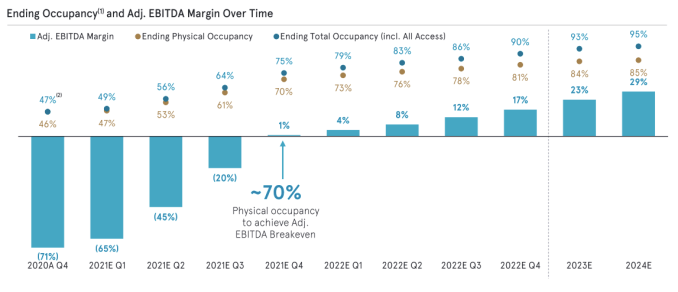

Surely WeWork isn’t going public via a SPAC on the back of those numbers, right? What does it expect for 2021? Revenues of $3.25 billion and adjusted EBITDA of -$922 million. As far as we can tell, the company doesn’t provide GAAP estimates for future profits. But we do know that WeWork’s adjusted EBITDA loss was $1.75 billion in 2020, so the company is anticipating an improvement in its economics this year.

On the back of flat revenue growth. Buy into WeWork, and you are indicating that you are content to wait until 2022 for growth. And profits, to some degree. WeWork estimates that it will generate positive adjusted EBITDA in 2022 of $458 million. That’s a more than $2 billion swing in adjusted profits in two years! Hmm.

What’s different about 2021 and 2022, compared to 2020, that will improve WeWork’s adjusted profit margins by so much, so quickly? In part, a revenue mix shift. (For more details on that strategy, check out Mary Ann Azevedo’s recent feature on WeWork here).

WeWork expects its “All Access” service — “on-demand pay-as-you-go or monthly subscription that provides access to global network of locations” — to generate revenues of $0 in 2020, and $90 million in 2021 and $215 million in 2022. Presumably, those members are high-margin to the larger WeWork platform because they aren’t tied to a single location.

Marketplace — “high-margin, value add services” per page 21 — revenues are also expected to scale from $37 million in 2020 to $86 million in 2021 and $153 million in 2022. High-margin implies greater gross profit generation per dollar of revenue. So the growth of this category could have material impacts on WeWork’s bottom line.

Finally, the company’s Platform revenue category is also expected to grow in the coming years. This, so far as we can tell from the deck, is the company’s software business. Remember all those companies that WeWork bought? It vomited some of them back out half-chewed, but not all, it appears. And software has good margins.

Add in several hundred million in anticipated 2021 selling, general and administrative (SG&A) costs and you have a business that loses less money over time. In theory. If you want to buy into WeWork at around 3x revenues, or around $9 billion in value, this is the deal for you. And don’t worry, the company really does expect to reach adjusted profitability break-even by the end of this year.

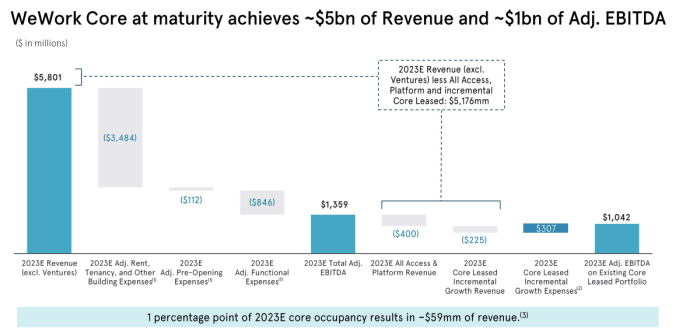

Here’s the chart explaining that, a real piece of non-GAAP art:

Cool.

Anyway, this is round two for WeWork. Let’s see what investors have to say about the company when it begins to trade in a few months.

Axios and The Athletic

We’ll be brief. Axios could merge with The Athletic before going public as a combined unit. Here’s The Wall Street Journal on the plan:

If Axios and the Athletic merge, the combined company may seek to raise money for expansion and acquisitions, according to people familiar with a presentation aimed at potential investors. The long-term plan is to bring additional digital publishers into the fold, especially those with content that consumers are willing to pay for and that can earn a premium from advertisers, the people said.

Oh shit, they are going to try and buy TechCrunch, aren’t they? We just not-died again, and now this? Ugh. The Journal adds later that a SPAC could be in the mix after the two pubs get hitched:

One logical step to raise capital could be going public by merging with a blank-check company, also known as a special purpose acquisition company, the people said. There are also other options under consideration, one of the people said, declining to be more specific.

2021 is the year of the SPAC akin to how 2017 was the year of the ICO. If you have a pulse, someone wants to sell you one.

But let’s not be too cynical. Maybe Axios and The Athletic can combine their local news assets to effectively rebuild local media? Maybe. My hopes are not up. But media deals in the air do feel a bit better than the beheadings we saw this week at Medium and Mel.

Comment